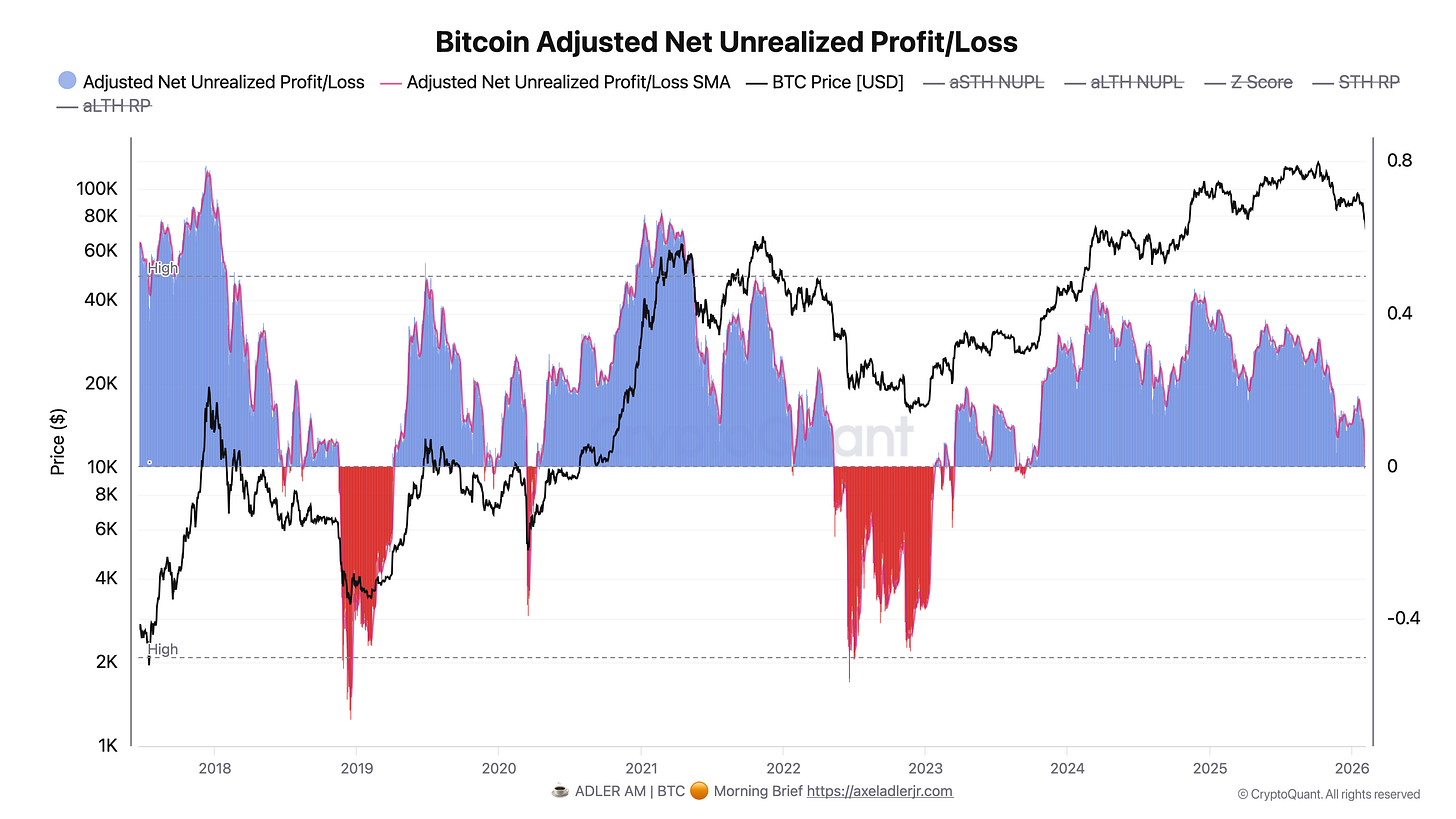

aNUPL Framework (Cohort Adjusted)

SQL of the Week 014

What is it

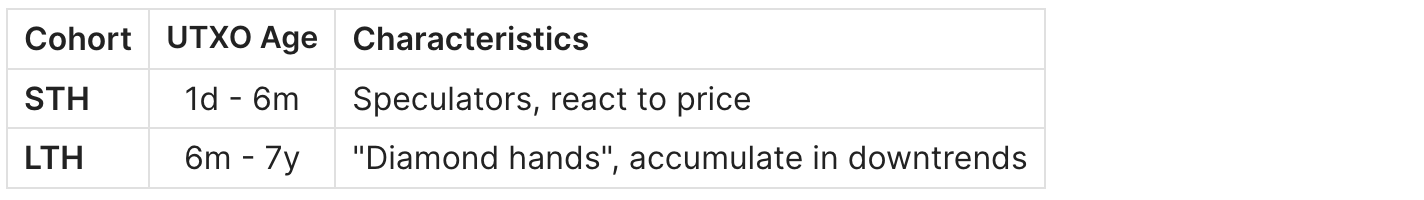

aNUPL (Adjusted NUPL) is an extension of the classic NUPL that separates the analysis into Short-Term Holders (STH) and Long-Term Holders (LTH) cohorts.

While regular NUPL shows the sentiment of the entire network, aNUPL allows you to see where exactly profit or loss is concentrated - among speculators or long-term investors.

Key property: Divergence between aSTH NUPL and aLTH NUPL often precedes major market moves.

Why cohort separation matters

Problem with regular NUPL: The aggregated metric hides internal dynamics. When STH is at a loss while LTH is in profit - this is a completely different regime than when both cohorts are in profit.

Formulas

Keep reading with a 7-day free trial

Subscribe to Adler Insight 💎 Premium to keep reading this post and get 7 days of free access to the full post archives.