TL;DR:

Bitcoin is showing resilience against the backdrop of a traditional market crash triggered by escalating trade tensions between the US and China. Despite a decline in retail investor activity, institutional interest is growing, evidenced by large purchases by Strategy and Tether. Price consolidation in the $81.6K–$88.7K range may continue in the short term. Risks include global macroeconomic instability, yet the expected Fed rate cuts and institutional accumulation may provide support in the medium term.

Macroeconomics for the Past Week

Priority: High

1. Wall Street Plunge Amid Trade War Escalation

Market Crash: US stocks plunged sharply

S&P 500 and Nasdaq lost over 5.5%,

Dow Jones dropped by more than 2200 points,

Europe’s STOXX 600 fell 5%.

Reason: China’s retaliatory measures on American tariffs - a 34% duty on all US imports following a 54% tariff imposed by the Trump administration.

Stock Market: Nasdaq entered a “bear market” zone.

Context: Markets were gripped by fears of a global trade war and recession.

2. US Labor Market: Contrast Between Rising Unemployment and Job Growth

Unemployment Rate: Increased to 4.2% in March - above expectations (4.1%) and the highest since November.

Employment: The economy added 228K jobs, the best figure in 3 months, significantly above the 135K forecast.

Growth Sectors:

Healthcare: +54K

Social Assistance: +24K

Transportation and Warehousing: +23K

Retail: +24K

Other: The number of unemployed rose by 31K to 7.08 million. Labor force participation rate increased to 62.5%.

3. US 10-Year Treasury Yield Fell to a 6-Month Low

New Yield: Dropped to 3.89% (-16 bps), amid trade war escalation.

Reasons: Heightened uncertainty due to tariffs, expectations of a more accommodative Fed policy.

Rate Expectations: The market has priced in a 100 bps rate cut by year-end (versus 75 bps previously).

Priority: Medium

4. US Business Activity Indicators: Mixed Picture

ISM Services: Fell to 50.8 - the weakest growth in 9 months, with especially weak employment (46.2 vs. 53.9).

S&P Global Composite PMI: Rose to 53.5 - a 3-month high. Steady growth in services, despite a decline in manufacturing.

Comment: Respondents cited rising costs, increased uncertainty, but also stable business growth.

5. Rising Unemployment and Benefit Claims

Continuing Claims: Rose to 1.903M - the highest since November 2021.

Initial Claims: Fell to 219K, below the forecast.

Trend: Difficulties in returning to the labor market are growing despite the overall job recovery.

6. US Trade Balance

Deficit: Decreased to $122.7B in February from a record $130.7B in January.

Exports: Up 2.9%, especially in non-monetary gold and autos.

Imports: Remain near record levels - $401.1B.

Conclusions on Macroeconomic Impact on Bitcoin

Trade War Increases Risks and Volatility:

The escalation of the US-China conflict triggered a crash in global stock markets and a massive sell-off of risk assets. Even traditional safe havens-gold and silver-came under pressure:Silver fell by over 12% in a week,

Gold declined by 2.5%, retreating from record highs due to margin calls.

Against this backdrop, bitcoin remains relatively stable, staying within a low-volatility range. This could indicate a temporary decrease in BTC’s sensitivity to global macro triggers.

Discrepancies in Labor Market Data:

Job growth coupled with rising unemployment creates an ambiguous macro backdrop. This imbalance complicates interpretation of the economic state and may cause indecision among crypto market participants.Falling Treasury Yields and Rate Cut Expectations:

The drop in UST yields and revised Fed rate cut forecasts could theoretically support BTC, especially for investors seeking alternative instruments. However, heightened geopolitical and economic risks impede the full realization of this scenario.Indicators of a Slowdown in Services:

The sharp drop in non-manufacturing employment (ISM) could signal an approaching economic cooldown. BTC is often seen as a speculative asset and could be under pressure during such a phase.Overall Result:

Bitcoin is showing relative resilience amid a broad sell-off in traditional markets and falling prices for safe haven assets. However, escalating geopolitical and economic uncertainties driven by the trade war, rising unemployment, and signs of a slowdown in the services sector create a complex and tense macro environment. In these conditions, appetite for risk assets remains limited. Potential expectations for Fed rate cuts could support BTC in the medium term, but in the short term, the market will remain under pressure due to investors’ overall risk-off sentiment.

Upcoming Events

Next week, investors will focus on the aftermath of the trade war, especially regarding the impact of new tariffs on inflation. Key US releases include March inflation data (CPI and PPI), which will show how much tariff pressure is translating into consumer and producer prices. The FOMC meeting minutes will also be important-markets are looking for signals about the future trajectory of interest rates and the Fed’s stance on fiscal and trade policy.

Important News of the Past Week

Priority: High

SEC on Stablecoin Status

Conclusion: The SEC’s regulatory statement clarifying that USDT and USDC are not securities and do not require registration at issuance or redemption removes some uncertainty for issuers and investors, potentially fostering further stablecoin development.

Outflow from Spot Bitcoin ETFs

Conclusion: A substantial outflow of $99.86M indicates market volatility due to macroeconomic news and tariff measures, requiring institutional investors to closely monitor market dynamics.

HR 1919 Bill Against CBDC

Conclusion: Passage of the bill by the US House of Representatives aimed at blocking a Federal Reserve digital currency over privacy concerns reflects the political struggle surrounding central bank digital currencies and may affect future policy in this area.

GameStop Raises $1.5B via Convertible Bonds

Conclusion: The successful raising of significant capital to purchase Bitcoin demonstrates the company’s confidence in accumulating digital assets despite cautious investor sentiment.

Tether Activity

Conclusion: Tether’s large 8,888 BTC purchase for $735M, increasing its reserves to 92.6K BTC, underscores the company’s intention to strengthen its position as one of the key players in the crypto market.

Strategy Acquires 22,048 BTC

Conclusion: The massive Bitcoin purchase of $1.92B, bringing total holdings to 528,185 BTC, points to an aggressive accumulation strategy and reinforces confidence in the market’s growth prospects.

Trump Family Gaining Control of World Liberty Financial

Conclusion: A 60% stake in WLFI through a new holding company and significant fund inflows from WLFI token sales demonstrate the Trump family’s expanding influence in the crypto-financial sector.

Launch of “American Bitcoin” by Hut 8 and Eric Trump

Conclusion: The initiative to create the world’s largest BTC miner and a strategic reserve with a target capacity exceeding 50 EH/s indicates an intent to massively develop mining and Bitcoin storage infrastructure.

Larry Fink’s Warning from BlackRock

Conclusion: The CEO of BlackRock’s statement suggesting Bitcoin could outperform the dollar as a global reserve reflects the shifting global financial dynamics and the rising role of cryptocurrencies in the global economy.

Priority: Moderate

Bitwise ETF with Call Options Launch

Conclusion: New ETF products for MSTR, COIN, MARA shares designed to generate income from cryptocurrency volatility broaden the range of investment instruments and can attract additional capital flows.

Metaplanet Activity

Conclusion: An additional purchase of 160 BTC for $13.3M brought total holdings to 4,206 BTC, indicating continued accumulation, though on a smaller scale compared to other major buyers.

Binance Operations in Europe

Conclusion: The end of spot USDT trading in Europe in compliance with MiCA requirements demonstrates the platform’s adaptation to regulatory changes, while EEA users retain the ability to trade USDT via perpetual contracts.

Conclusions

This week, the crypto market once again shows a dynamic mix of institutional activity, large-scale Bitcoin purchases, and regulatory developments. Notable moves, such as the sizable buys by Strategy and Tether, underscore the continued aggressive strategy of accumulating digital assets. The SEC’s statement on stablecoins and the anti-CBDC bill highlight active discussions around the legal status of digital assets.

Additionally, the launch of new investment instruments by Bitwise and mining infrastructure expansion initiatives like “American Bitcoin” show market participants adapting to new conditions. Statements by major figures like BlackRock’s Larry Fink emphasize the changing global financial dynamic, where cryptocurrencies are steadily gaining prominence alongside traditional reserve assets.

Weekly Bitcoin Macro Analysis

1. BTC/USD Pair Analysis

Current Price: ~$83.2K

Local Low: $81.6K

Local High: $88.7K

Trend

After a rapid rise to $88.7K, the price corrected and dropped to the local low of $81.8K. Despite widespread sell-offs in traditional markets and falling safe haven asset prices, Bitcoin exhibits notable resilience.

Conclusions

Key Resistance: $88.7K

Local Support: $81.6K

Strong Baseline Support: $76.7K (still relevant in the context of the previous correction)

2. Options Analysis

Max Pain Price: $86,000

Expiration Date: April 11, 2025

Market Structure:

Dominance of Call Options:

There is still a significant volume of Call options (green bars) above $90,000, with the highest concentration around $100,000–$110,000. This points to continued bullish expectations among traders anticipating further price gains.Put Options:

Most Put options (red bars) are concentrated in the $65,000–$80,000 range, with the highest concentration near $65,000–$70,000. This indicates that market participants do not expect the price to drop below $65,000, while the ~$83,000 level is still viewed as a relatively stable zone.

3. Comparison with the Previous Week

Price Change:

The price remains near $83.2K, trading mostly in the $82,000–$84,000 range. No major changes over the week, with volatility remaining low.Max Pain Change:

Compared to the previous period, the Max Pain level remains unchanged at $86,000, indicating stable market expectations after the recent decline from $90,000.Volume Dynamics:

Trading volumes remain relatively low, suggesting market consolidation and the absence of a pronounced short-term trend.

4. Forecast

Short-Term Consolidation:

If current dynamics persist, the price will likely continue to move in a narrow $81.6K–$88.7K range, gravitating toward the Max Pain level of $86,000 closer to the April 11 options expiration.Potential Upside:

The substantial volume of Call options above $90,000 indicates bullish sentiment among some participants. Should trading volumes increase and the price break the upper boundary of consolidation ($88.7K), a quick run toward the $90,000–$95,000 zone is possible.Correction Risks:

The support levels at $81.6K and $76.7K remain key for preventing downward movement. A breach of these levels could lead to a deeper correction down to $70,000–$75,000, where there is a significant concentration of Put options.Stable Max Pain:

The continued Max Pain at $86,000 reflects the current equilibrium point of interest between option sellers and buyers. In the absence of external shocks, the market may “gravitate” toward this price ahead of expiration.Bitcoin Market Data Analysis

1. Number of Active Wallets (7d):

Previous Week: 8,957,237

Current Week: 7,869,290

Change: 🔴 -11.19%

Comment: A significant drop in the number of active wallets may indicate declining retail activity and a shift of some users to a wait-and-see or HODL approach.

2. Network Hashrate:

Previous Week: 797,342,173,889 EH/s

Current Week: 995,025,505,066 EH/s

Change: 🟢 +24.84%

Comment: A substantial rise in hashrate points to increased computational power in mining, possibly reflecting improved profitability or the addition of major new mining pools.

3. BTC Reserves on Exchanges:

Previous Week: 2,040,848 BTC

Current Week: 2,042,203 BTC

Change: 🟢 +0.06%

Comment: A slight increase in exchange reserves indicates cautious replenishment of trading venues.

4. Transfer Volume (7d):

Previous Week: 33,170,786 BTC

Current Week: 36,041,786 BTC

Change: 🟢 +4.53%

Comment: The increase in transfer volume amid fewer active wallets may suggest heightened activity by large investors (institutional or whale accounts) conducting sizable transactions.

5. Market Capitalization:

Previous Week: $169,236,870,577

Current Week: $168,675,445,677

Change: 🔴 -0.33%

Comment: Movements remain within moderate volatility bounds.

6. Market Price:

Previous Week: $92,926.93

Current Week: $93,311.96

Change: 🟢 +0.41%

Comment: Temporary balance between buyers and sellers.

Conclusions:

Decline in Retail Activity: The drop in active wallets suggests some small investors are in a wait-and-see position.

Mining Power Growth: The significant hashrate jump reflects miner confidence and potential increased competition for rewards.

Relative Market Stability: Minor changes in market cap and price indicate continued consolidation around current levels.

Large Player Activity: Higher overall transfer volume may indicate large block trades often linked to institutional moves or whale strategies.

Overall, the market continues to exhibit signs of consolidation, while large players remain interested in Bitcoin despite minor price corrections and lower retail engagement.

On-Chain Metrics

Bitcoin: Percent Supply In Profit

The current “Percent Supply in Profit” metric has dropped to 77% and is approaching the historically typical level of 75%. This indicates that some investors who bought BTC in recent months at higher prices are “underwater,” which in turn could lead to increased volatility. However, as noted, amid declines in stock markets and even gold, Bitcoin remains notably resilient-even though 20% of holders are in unrealized losses.

Bitcoin: ETF Historical Bitcoin Holdings Trend (Aggregated)

Following the February outflow, when aggregated Bitcoin holdings in ETFs started to decline, the last three weeks have seen relative stabilization. This suggests that large institutional investors, having reduced positions in February, are now holding their remaining assets. Such stabilization indicates a reduction in selling pressure from ETF market participants.

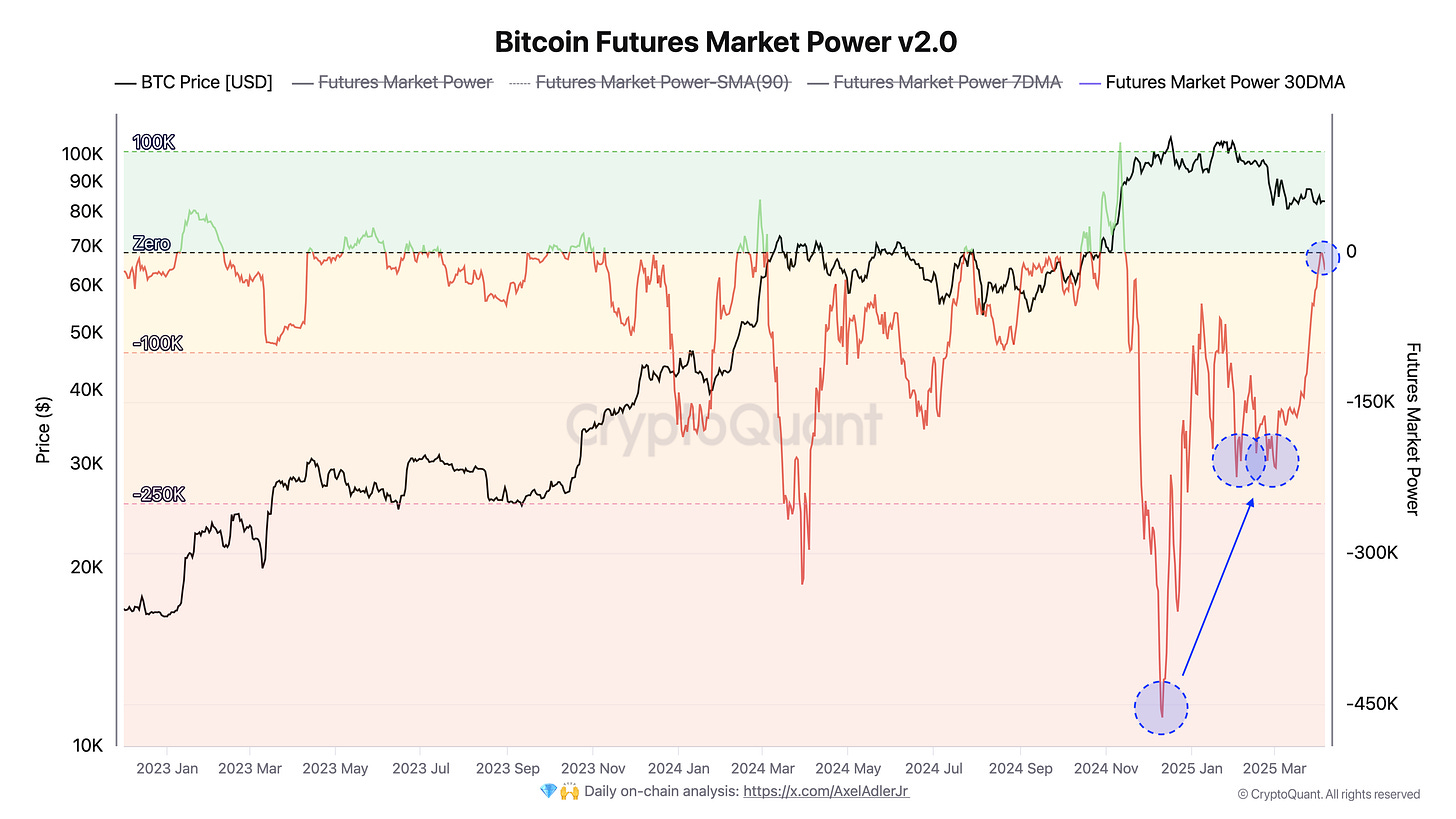

Bitcoin Futures Market Power v2.0

The futures market is seeing a weakening of the “bearish” pressure that intensified in November 2024 when the price hit the ~$90K range. This easing of bearish sentiment in the futures market is accompanied by a move toward a more neutral or even bullish tilt. However, given the current macroeconomic situation, one should expect neutral sentiment.

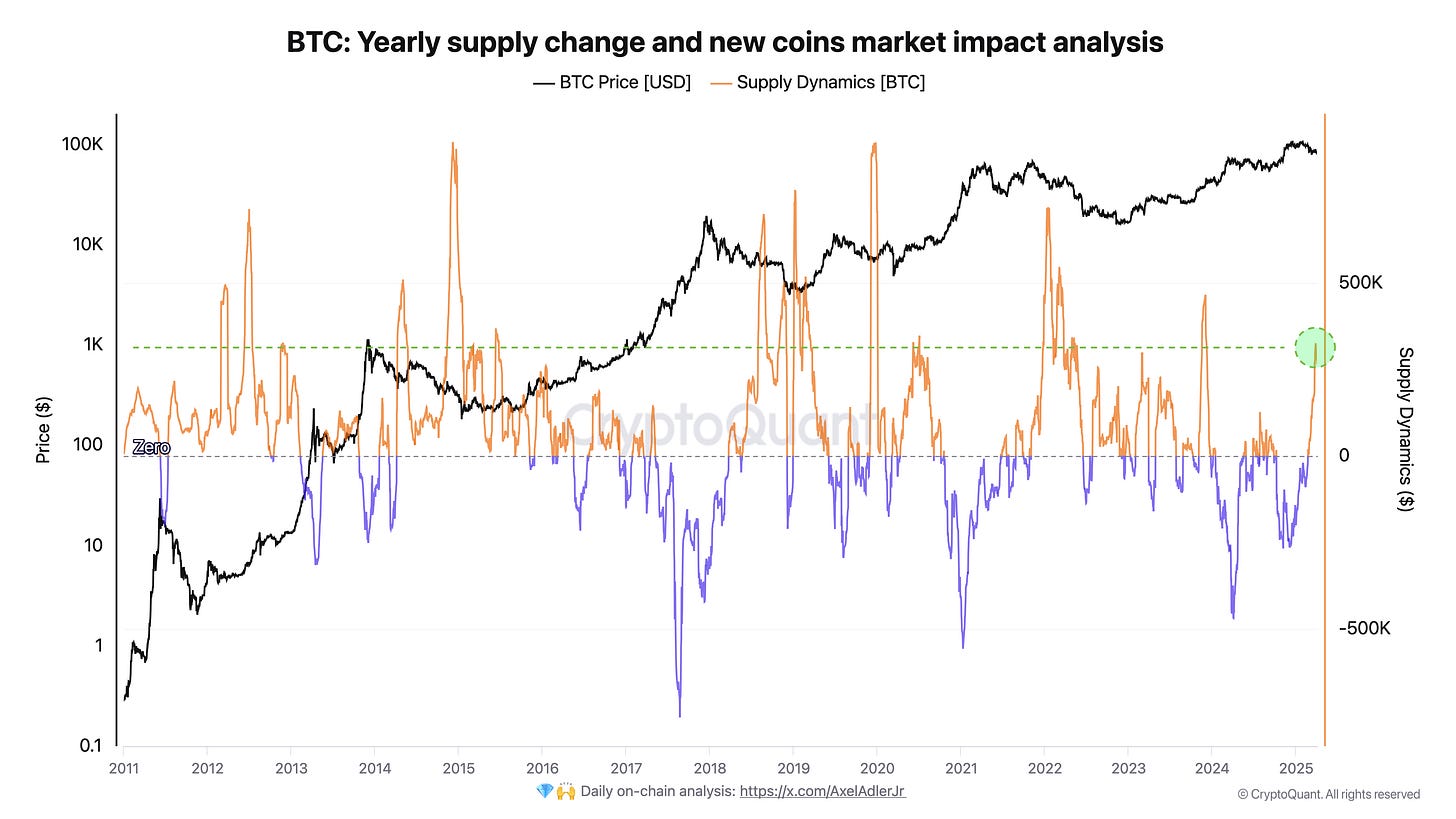

Bitcoin: Yearly Supply Change and New Coins Market Impact Analysis

The final metric in today’s report is Supply Dynamics - a positive reading indicates that the number of new coins exceeds the yearly change in active coins, which may suggest increased demand or Bitcoin accumulation in the market.

Conclusion

The past week showed that Bitcoin remains relatively stable despite a deep sell-off in traditional markets and even precious metals. While volatility in the digital asset sector has declined, rising macroeconomic risks-primarily linked to the US-China trade war-continue to pressure investor sentiment. In this environment, BTC is reinforcing its status as an alternative asset, maintaining moderate demand among institutional investors, as evidenced by steady ETF fund volumes.

Nevertheless, signs of decreasing retail activity-reflected in fewer active wallets-indicate potential caution or a wait-and-see stance among smaller investors. At the same time, the sharp increase in large-player activity, including major BTC purchases by companies like Strategy and Tether, underscores institutional interest in Bitcoin as a long-term hedging and accumulation vehicle.

Short-term forecasts suggest continued price consolidation within the $81.6K to $88.7K range, with a Max Pain level at $86K serving as a benchmark for the April 11 options expiration. In the medium term, if macroeconomic uncertainty and expectations of Fed rate cuts prevail, Bitcoin could be supported by some capital shifting from traditional markets. However, the risk of sharp corrections remains due to investors’ overall tendency to reduce risk.

Forecast

Target Price: $95,000 (90-day period)

Projected Total Return: +14%

Investment Recommendations: 🟣 HOLD (Neutral)More details on the rating can be found at this link:

https://adlerinsight.com/Adler_Insight_Rating.pdfGood luck in the upcoming trading week!

AAJDisclaimer:

This material has been prepared solely for informational purposes and does not constitute an offer, recommendation, or solicitation to buy or sell any securities, digital assets, or other financial instruments. The information presented in this report is considered reliable, however, its accuracy or completeness is not guaranteed. Past performance is not indicative of future results. Any investment decisions are made by the investor independently, taking into account personal financial circumstances and, if necessary, after consultation with a qualified professional. The author and affiliated parties may hold positions in the assets mentioned in this report. The author and publisher accept no responsibility for any direct or indirect losses arising from the use of this information.

Risks:

High volatility may lead to sharp fluctuations in value, adversely affecting investors' portfolios. Significant price swings may reduce the attractiveness of BTC to institutional investors, especially in the derivatives segment (futures, options). Potential tightening of regulatory requirements by governments and central banks may restrict access to BTC markets and reduce liquidity. Issues with custodial services, centralized exchanges, and hacking incidents could undermine confidence in the asset and negatively impact liquidity.