Bitcoin Trends – W1 May 2025

Bitcoin consolidates near $95K, market awaits the Fed decision, rising hashrate and exchange outflows create foundation for breakthrough above.

TL;DR:

Strong hashrate growth, steady BTC outflow from exchanges, and fresh inflows into spot ETFs support the price above $92K, but until the Fed meeting on Wednesday, the market will remain in a $92-98K range. "Dovish" rhetoric will open the path to a quick test of $100K, while "hawkish" could temporarily return the price to the $90-92K zone, where key support is placed.

Macroeconomics over the past week

Priority: High

New non-farm jobs in the US (April 2025): +177,000

Conclusion: The labor market maintains resilience: employment growth exceeded expectations despite tariff uncertainty. Healthcare and transportation sectors led the way, indicating continued expansion in services and logistics.

US durable goods orders (March 2025): +4.3%

Conclusion: Sharp jump in orders before new tariffs take effect indicates "forward" demand from businesses. Particularly strong purchases of transportation equipment may temporarily support the production cycle until the real effect of tariff pressure.

Average hourly wages (April 2025): +0.2% m/m, +3.8% y/y

Conclusion: The pace of earnings growth in the US has slightly slowed and came in below forecasts, indicating weakening pressure on payrolls and possibly beginning to constrain consumer spending.

For next week

Trade negotiations, Fed meetings, and global macroeconomic data

The focus is on the development of US-China negotiations and the Fed's decision on rates. Markets expect the Fed to leave interest rates unchanged amid signs of slowing economic growth. Next week opens the corporate reporting season in the US, as well as central bank meetings in the UK, Brazil, Poland, and Norway. At the same time, key data on inflation, trade, and production in Europe, Asia, and Latin America will be released, creating an additional backdrop for assessing global economic risks.

Conclusions

The US labor market remains flexible and supports consumer demand.

Strong growth in durable goods orders ahead of tariffs indicates business's proactive response.

Slowing wage growth may begin to limit household spending dynamics.

Next week, the preliminary results of trade negotiations and central bank decisions will be decisive, setting the tone for global macro dynamics.

In April, tariff wars became the key driver of economic dynamics: they generated massive uncertainty, restrained consumer and business demand, increased inflation risks, and provoked volatility in global markets. Under these conditions, the IMF is revising forecasts downward, with world GDP for 2025 revised from 3.3% to 2.8%, US: from 2.7% to 1.8%; Eurozone: from 1% to 0.8%. After the March decision to keep rates unchanged and before the IMF data publication, the Fed adhered to a plan for two rate cuts in 2025. However, new IMF forecasts showing significant slowdown in US GDP growth put pressure on the Fed toward more aggressive monetary policy easing.

Stock market over the past week

Priority: High

US stocks extended the record rally for nine sessions in a row

Conclusion: The S&P 500 rose 1.5% on Friday, marking the ninth consecutive gain and the longest streak in two decades. The driver was strong employment data and signals of easing trade tensions between the US and China, strengthening investor confidence.

Dow Jones and Nasdaq strengthened on labor market optimism

Conclusion: The Dow added 563 points, Nasdaq grew by 1.5% after the report on 177,000 jobs created in April, significantly exceeding expectations and confirming the resilience of the American labor market despite tariff uncertainty.

Priority: Moderate

Diversity of corporate results

Apple −3.74% after warning of $900 million in losses due to tariffs.

Amazon −0.12% in response to White House negative statements about Amazon's intention to display the tariff amount next to the total price of goods.

Exxon Mobil +0.4% and Chevron +1.7% after quarterly reports. Conclusion: Divergent stock movements reflect market sensitivity to tariff news and corporate results; support from the energy sector softened index volatility.

Conclusions

Major US indices showed substantial growth for the week, reflecting a high risk appetite amid favorable macroeconomic data. The main focus for the stock market next week will be the Fed's decision and trade negotiations with China. In the current environment, where risk appetite is strengthening (reflected in nine consecutive days of S&P 500 growth), Bitcoin is likely to continue demonstrating bullish dynamics. Institutional and retail investors, feeling support from monetary policy and favorable corporate reports, will seek alternative assets with high returns, which will strengthen capital inflow into cryptocurrency.

Important news from the past week

Priority: High

US Treasury blocks Huione in US markets due to laundering $4 billion, ties to North Korean hackers, and cryptocurrency fraud.

Michael Saylor's strategy files to raise $84 billion through preferred stock sale to finance further bitcoin purchases and acquires 15,355 BTC for $1.42 billion this week, increasing assets to 553,555 BTC.

The Federal Reserve cancels previous cryptocurrency recommendations, ends preliminary approval for banks, and transitions to standard supervision processes.

UK publishes draft cryptocurrency rules for exchanges and stablecoin issuance aimed at stimulating growth and aligning with global regulation.

Priority: Moderate

Kraken launches cryptocurrency derivatives trading for professional investors from the UK through the MTF platform.

Circle receives approval from Abu Dhabi to launch regulated stablecoin services, expand USDC, and join Hub71 digital assets group.

Mastercard officially adds support for stablecoin settlements, partnering with Circle, Paxos, and Nuvei to enable stablecoin payments for merchants.

Priority: Low

Tether reports $1 billion profit for the first quarter, $5.6 billion excess reserves, and $120 billion in US Treasury obligations; USDT supply increased by $7 billion.

Conclusions

The US (Treasury, Fed) and UK are actively strengthening the legal framework and oversight of crypto assets, reducing barriers to industry integration into the traditional financial sector. MicroStrategy's extensive plans to raise $84 billion and subsequent accumulation of 15,355 BTC confirm sustained interest from major players in bitcoin, creating a foundation for further price growth. The launch of Kraken derivatives, USDC licensing in Abu Dhabi, and the implementation of Mastercard stablecoins show the development of tools for professional investors and businesses.

Macro analysis of Bitcoin trading week

1. BTC/USD Pair Analysis

Current price: ~$95.4K

Local minimum: $92.2K

Local maximum: $97.9K

Trend

This week, the price trades in a narrow range of $92.2K-$97.9K: volumes are gradually decreasing, indicating a consolidation phase after the last impulse. Bears' attempts to break through $92K support were unsuccessful, and bulls are not rushing to increase exposure above $97K, suggesting a gathering of strength before the next movement.

Conclusions

Key resistance: $98K – confident breakthrough with increased volumes will lead to a retest of $100K.

Local support: $92K – holding this level will maintain bullish sentiment and avoid correction.

Strong base support: $84K – key level for strategy revision in case of a bounce below the local zone.

2. Options Analysis

Market Structure

Call Options Prevalence:

Green bars are concentrated at $100-$120K strikes, with peak volumes at $115K-$117K levels. This indicates active hedging for growth above the current Max Pain.Put Options:

Red bars dominate at $70K-$85K strikes, with maximum interest in the $70K-$75K range. Put volumes at strikes above $85K continue to decrease, indicating a shift in protective bets to lower ranges.

Comparative Analysis with Previous Week

Max Pain Change:

The Max Pain level rose from $93K to $95K, reflecting a shift in the balance of option players' interests toward higher prices.Volume Dynamics:

Significant volume growth for Calls at strikes above $110K, especially in the $115K-$117K zone. Simultaneously, there's a decrease in Put volumes at $75K-$80K strikes, while volumes in the $70K-$75K range remained stable.

Forecast

Possible Growth:

Maintaining support at $95K and further increasing Call volumes may lead to testing the $98K-$100K zone, and with a confident breakthrough - to the $105K mark.Correction Risks:

Breaking support at $95K while simultaneously increasing Put volumes may return the price to the $90K-$92K range, where the main protection of bears is concentrated.

Bitcoin Network Data Analysis

1. Network Hashrate:

Previous Week: 814,759,948,980 EH/s

This Week: 971,093,401,420 EH/s

Change: 🟢 +19.19%

Comment: Sharp increase in hashrate reflects active deployment of new mining equipment and improved mining economics. This strengthens network security and reduces centralization risks.

2. Number of Active Wallets (7d):

Previous Week: 8,442,270

This Week: 8,245,434

Change: 🔴 −2.33%

Comment: A slight decrease in the number of active wallets may indicate a short-term pause in transactional activity or consolidation of holder positions, but the trend remains stable.

3. BTC Exchange Reserves:

Previous Week: 2,490,612 BTC

This Week: 2,473,597 BTC

Change: 🔴 −0.68%

Comment: Decrease in exchange reserves indicates transfer of coins from exchanges - investors prefer to hold BTC rather than take profit.

4. Transfer Volume (7d):

Previous Week: 4,599,037 BTC

This Week: 4,332,378 BTC

Change: 🔴 −5.80%

Comment: Reduction in transfer volume indicates decreased speculative activity and increased HODL behavior among users, reducing pressure on the market.

5. Market Capitalization:

Previous Week: $1,879,595,545,082

This Week: $1,904,164,793,107

Change: 🟢 +1.31%

Comment: Growth in market capitalization combined with price increases reflects new liquidity inflow and strengthening of BTC's safe-haven function.

6. Market Price:

Previous Week: $94,182.86

This Week: $95,884.89

Change: 🟢 +1.81%

Comment: Moderate price growth indicates continuation of the bullish trend and maintained buying interest at current levels.

Conclusions:

Network strengthening: significant hashrate growth improves blockchain security and reliability.

Supply reduction: BTC outflow from exchanges and decreased transfer volumes create liquidity shortage, supporting the price.

Pause in user activity: slight decrease in the number of active wallets indicates consolidation, but without trend reversal.

Bullish sentiment persists: price and capitalization growth with simultaneous accumulating dynamics on exchanges indicates potential for further rise.

On-chain metrics

Bitcoin Exchange Inflow

The chart shows several key moments reflecting the dynamics of bitcoin (BTC) inflow to exchanges. There's a clear cyclicality in the flow of funds to exchanges - periods of high inflow (red areas, reaching 82K BTC in April 2024 and 72K BTC in late 2024) alternate with periods of moderate inflow (yellow areas, about 30-35K BTC). This cyclicality correlates with BTC price movement - large inflows in a bull market occur during price growth or at local maximums - this indicates profit-taking by holders and distribution of coins to new players.

Over recent months, we've observed stabilization of average inflow at the 30K BTC level while simultaneously price recovery to $95 thousand. This is a positive signal, indicating that the current growth is more organic - it is not accompanied by abnormally high inflow to exchanges, which usually precedes major corrections.

What does this mean for holders?

Despite BTC price being near historical maximums, the current structure of inflows to exchanges looks more favorable compared to previous periods of high activity. The absence of abnormally high inflow values and maintenance of the indicator at about 30K BTC may indicate continuation of the bullish trend in the medium term; current price is perceived by holders as undervalued and consequently there's no selling pressure from investors.

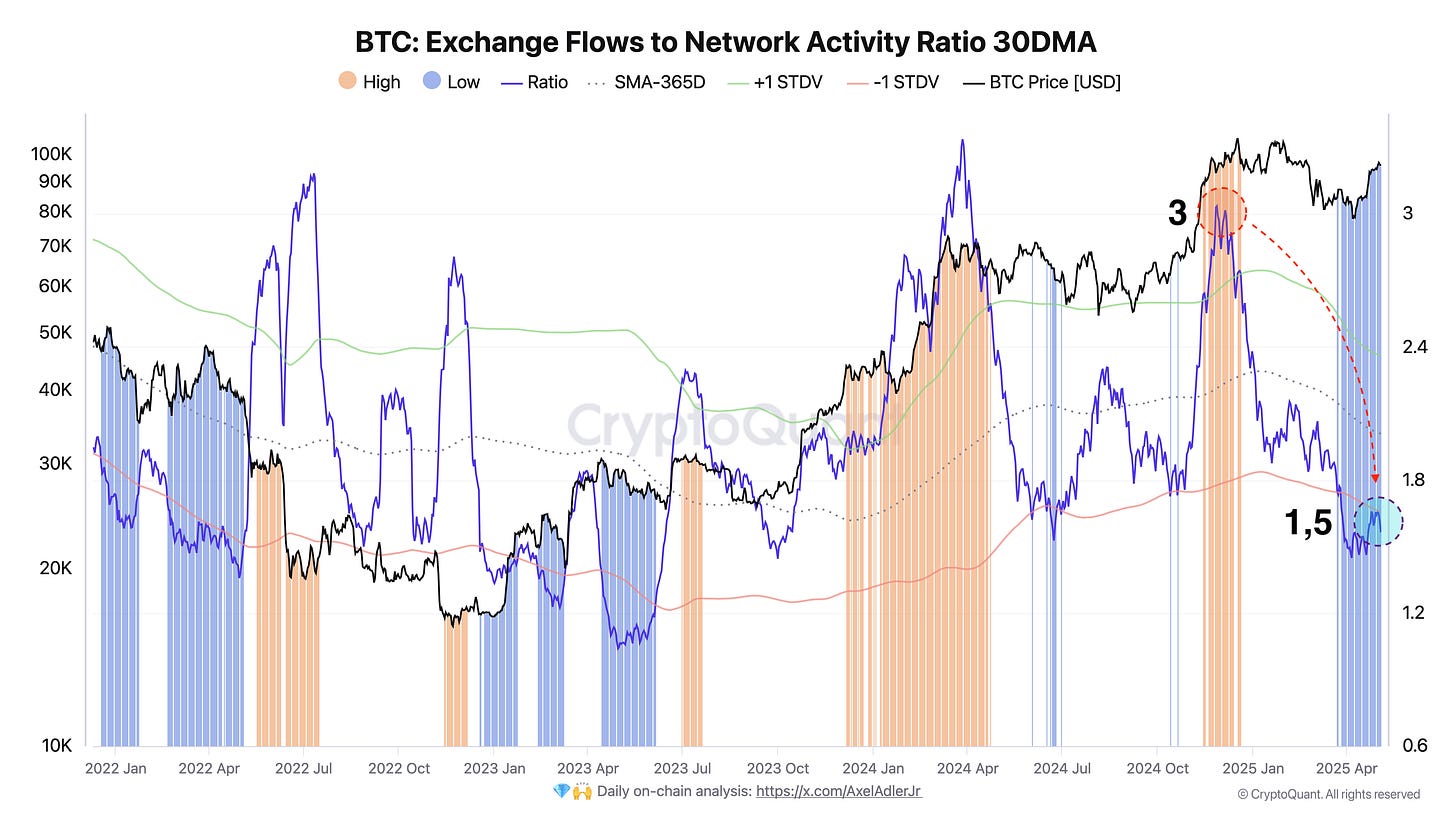

Bitcoin Exchange Flows to Network Activity Ratio

Confirming the decrease in holder sales through exchanges, let's examine the Ratio of network activity to total exchange flow (Inflow + Outflow). The chart shows that after ATH we see a 1.5x decrease in the indicator. This directly confirms the conclusion that current growth is more organic, as we don't observe alarmingly high indicators (orange bars) that were present during previous price peaks.

Essentially, these two metrics indicate reduced selling pressure from holders, enabling HODL mode even with current price growth. All this suggests that holders view current price levels as low and certainly not as exit opportunities.

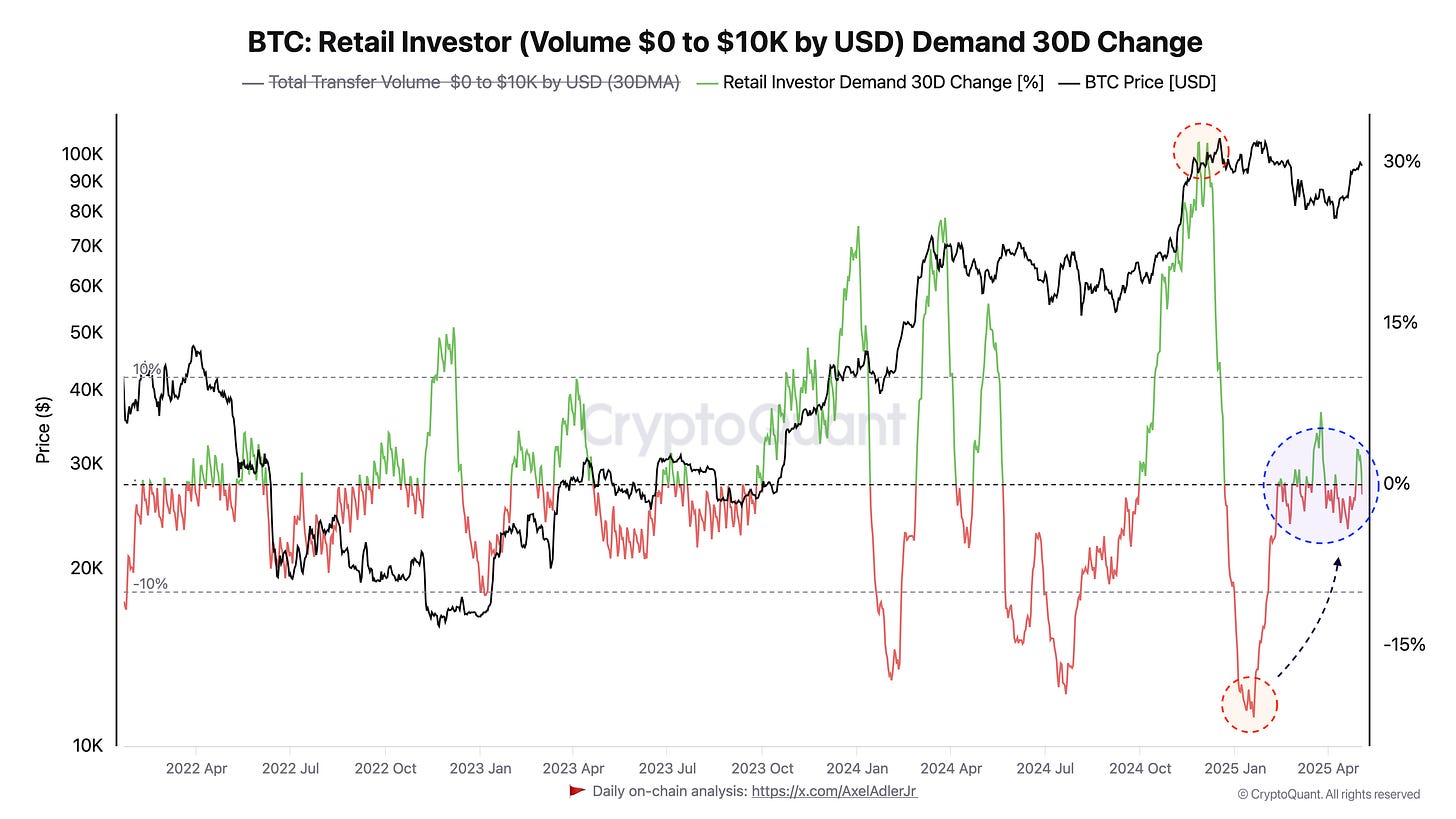

Bitcoin Retail Investor (Volume $0 to $10K by USD) Demand Change

Let's also look at the behavior of retail investors with balances up to $10K. This is actually a very popular metric with 27,452 views on the CryptoQuant website, and I personally like it because it's simple and clear, and as history shows, it well reflects the sentiment of investors who actively follow Bitcoin. In the marked blue area, the 30-day change in retail demand fluctuates around zero. This means that investors with balances up to $10K are in a wait-and-see state.

At peaks above +20%, retail investors showed excessive optimism and sold at local tops. At dips below -15%, the market experienced local capitulation, which coincided with local bottoms.

Key idea:

The neutral level of retail investor demand change around 0% is a favorable background for continued upward movement: as long as retail doesn't return to the euphoria zone, the market remains stable and ready for a new wave of purchases from larger players.

Conclusion

Next week, the main scenario remains sideways trading in the $92-98K range until the Fed meeting on Wednesday: the market has already factored in strong macro data and hashrate growth but prefers a wait-and-see position until the regulator's rhetoric becomes clear. Decreased exchange inflows form a liquidity deficit, supporting the price above $92K, while the dense zone of "call" options at $98-100K keeps buyers from aggressive breakthrough. In such conditions, it's reasonable for investors to maintain base longs.

The key catalyst is the Fed statement: "hawkish" rhetoric and mention of trade risks can return the price to $90-92K, but even in this case, the solid foundation (hashrate growth, reduced exchange reserves, and institutional purchases) will limit correction depth. "Dovish" signal or neutral tone, conversely, will open the path to a quick check of $100K with potential acceleration to $105K. Watch the dynamics of ETF inflows and option Max Pain - their shift above $95K will be early confirmation of the bullish trend continuation.

Forecast

Investment recommendations: 🟢 OUTPERFORM (Accumulate)

For more details about the rating, you can check this link: https://adlerinsight.com/Adler_Insight_Rating.pdf

Good luck in the upcoming trading week!

AAJ

Disclaimer:

This material has been prepared solely for informational purposes and does not constitute an offer, recommendation, or solicitation to buy or sell any securities, digital assets, or other financial instruments. The information presented in this report is considered reliable; however, its accuracy or completeness is not guaranteed. Past performance is not indicative of future results. Any investment decisions are made by the investor independently, taking into account personal financial circumstances and, if necessary, after consultation with a qualified professional. The author and affiliated parties may hold positions in the assets mentioned in this report. The author and publisher accept no responsibility for any direct or indirect losses arising from the use of this information.

Risks:

High volatility may lead to sharp fluctuations in value, adversely affecting investors' portfolios. Significant price swings may reduce the attractiveness of BTC to institutional investors, especially in the derivatives segment (futures, options). Potential tightening of regulatory requirements by governments and central banks may restrict access to BTC markets and reduce liquidity. Issues with custodial services, centralized exchanges, and hacking incidents could undermine confidence in the asset and negatively impact liquidity.