Bitcoin Trends – W2 April 2025

Bitcoin is weathering a macroeconomic storm – whales are returning to accumulation despite global trade tensions.

TL;DR:

Despite a drop in U.S. consumer confidence and the escalation of the trade war with China, Bitcoin has risen, demonstrating a correlation with gold’s record highs. Bitcoin remains resilient amid deteriorating U.S. consumer sentiment, a weakening dollar, and rising bond yields. Major investors continue to accumulate coins, signaling long‑term optimism even as retail activity weakens.

Macro Economy for the Last Week

Priority: High

1. U.S. Consumer Confidence Falls

Confidence Level:

The University of Michigan’s Consumer Sentiment Index dropped by 11% to 50.8 in April, significantly below market expectations (54.5) and marking the lowest level since June 2022.Expectations:

The expectations sub‑index hit its lowest level since May 1980, while one‑year ahead inflation expectations climbed to 6.7% – the highest rate since 1981.Context:

Escalating trade tensions and uncertainty over international tariffs are weighing on consumer sentiment.

2. U.S. Stock Market Index

Friday's Trading Results:

S&P 500 rose by 1.81%,

Nasdaq added 1.89%,

Dow Jones increased by 618 points.

Weekly Performance:

Over the week, the S&P 500 increased by 5.7%, Nasdaq by 7.3%, and Dow nearly 5%, marking the best weekly performance in over a year, driven by a historic mid‑week rally.Optimism Factors:

Hopes for a potential trade agreement between the U.S. and China persist despite escalating tariff measures (Trump raised tariffs to 145%, and China responded with a 125% duty).Earnings Season:

Early banking sector data was mixed – Wells Fargo shares fell by 1%, while Morgan Stanley and JPMorgan showed gains (1.4% and 4% respectively after recording record revenues).

3. U.S. Dollar

Dollar Index:

The index fell by over 1% to 99.2 on Friday, reaching its lowest level in nearly three years.Weakening Factors:

Capital outflows from U.S. assets, escalating trade tensions, and growing concerns about economic repercussions for the U.S.Tariff Measures:

China plans to raise tariffs on American imports to 125% (up from 84%) in response to Washington’s decision to raise tariffs on Chinese goods to 145%.

The U.S. continues to impose a 10% tariff on imports from most countries and a 25% duty on steel, aluminum, and automobiles.

Weekly Performance:

Over the week, the dollar weakened by 2%, marking its largest weekly decline since November 2022.

4. U.S. 10‑Year Treasury Bond Yield

Movement:

The yield on 10‑year U.S. Treasury bonds increased by approximately 10 basis points and reached over 4.49% on Friday – the highest level since mid‑February.Outlook:

Forecasts suggest the yield could increase by over 50 basis points, marking the sharpest weekly jump since September 2019.Factors:

The intensification of bond selling indicates a decline in investor confidence in U.S. government debt as a safe asset amid growing trade tensions and concerns about a recession and high inflation.Context:

The situation is further exacerbated by a sharp drop in consumer confidence and rising inflation expectations.

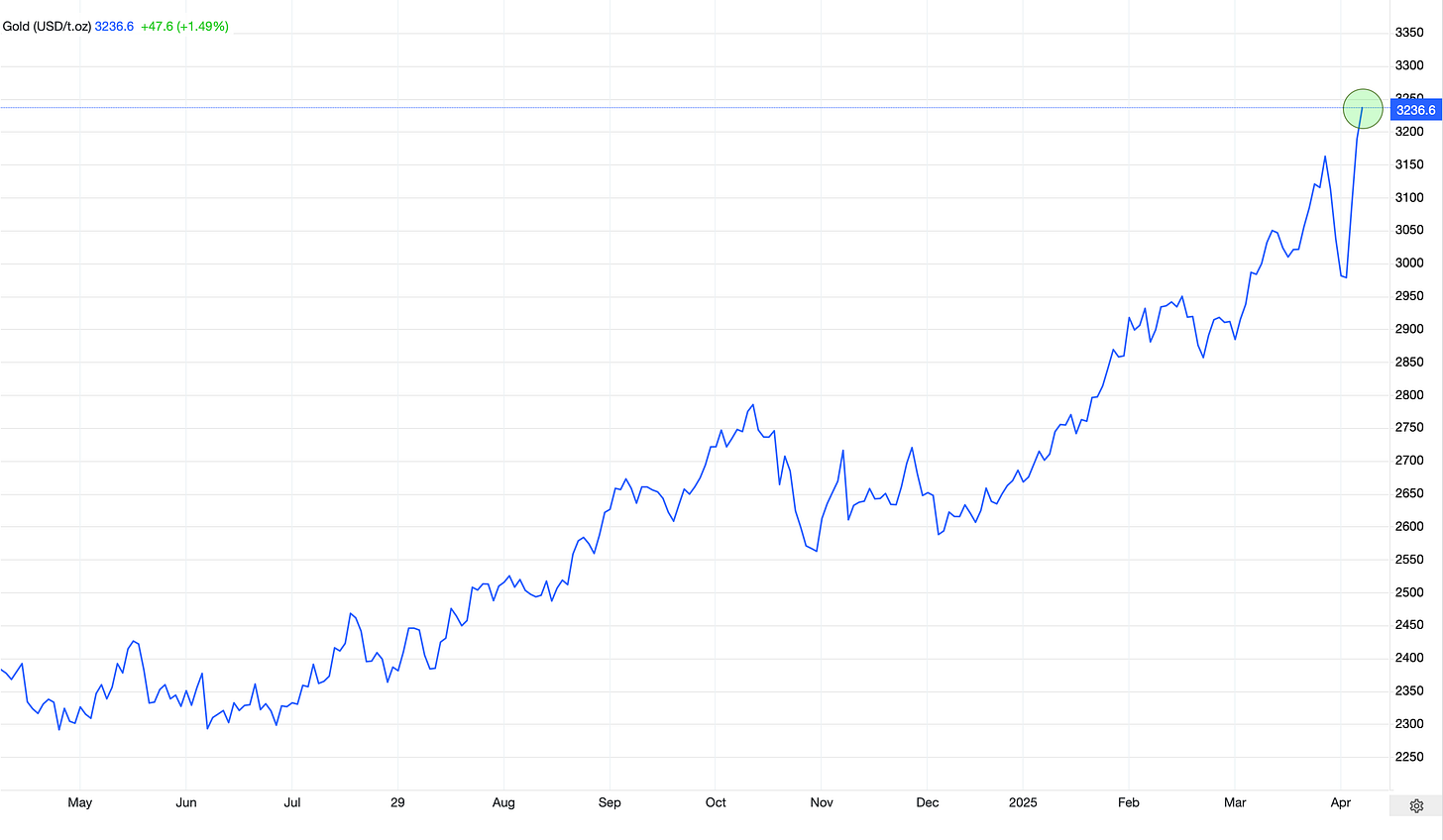

5. Gold Continues to Set Records

Record Growth:

Gold continued its rise, surpassing $3,236 per ounce on Friday, setting a new record.Growth Factors:

A weakening U.S. dollar and growing demand for safe‑haven assets amid the further escalation of the trade war between the U.S. and China have driven prices higher.Tariff Measures:

China raised its tariffs on American imports to 125% as of April 12 and stated it would ignore further U.S. countermeasures despite the White House raising tariffs to 145%. These measures affect nearly $700 billion worth of goods exchanged between the two largest economies, reducing the appeal of riskier assets.Monetary Policy:

Despite the absence of signals from the Fed indicating intervention to limit the rise in long‑term yields, additional signs of disinflation in the March Consumer Price Index report bolstered arguments for rate cuts this year, further strengthening gold.

Priority: Medium

6. Upcoming Events (Week Ahead – April 14)

Next week, global markets will remain highly sensitive to trade shifts as investors continue to monitor the escalation of tariff measures and their impact on the economy, particularly in the U.S. In uncertainty, the earnings season is expected to pick up steam: major companies such as Goldman Sachs, Bank of America, Citigroup, Johnson & Johnson, Abbott Laboratories, American Express, Blackstone, UnitedHealth Group, and Netflix will release their results, offering insights into business prospects. Key macro data include retail sales reports (projected growth of 1.3% for March), industrial production figures (expected to decline by 0.3%), and housing market indicators. In Europe, attention will focus on the European Central Bank meeting on April 17, where the market expects another rate cut, as well as key indicators from the U.K. (CPI and labor market data) and Germany’s ZEW Economic Sentiment Index. In Asia and Australia, investors will be watching for Q1 GDP data from China, trade figures, and inflation readings from Japan and India. Additionally, several central banks (the ECB, Bank of Canada, the Central Bank of Turkey, and the Bank of Korea) are scheduled to announce their decisions, which will affect global liquidity and market sentiment.

Conclusions on the Impact of Macroeconomics on Bitcoin

Decline in Consumer Confidence:

A sharp drop in the consumer confidence index indicates growing pessimism, reducing demand for risky assets, including Bitcoin.Stock Market Optimism:

Despite macroeconomic challenges, the historic rally in U.S. equities may temporarily support the market for risky assets, although this optimism remains fragile.Weakening of the Dollar:

The fall in the Dollar Index signifies a reallocation of capital, which in the long run could benefit alternative assets, including cryptocurrencies.Rising Government Bond Yields:

The sharp increase in government bond yields reflects declining investor sentiment, potentially exerting short‑term pressure on Bitcoin.Support from Gold:

Record levels in gold indicate increased demand for safe‑haven assets, which in a climate of global trade tensions could indirectly dampen interest in riskier assets such as BTC.Overall Summary:

Under current conditions characterized by trade tensions, economic uncertainty, and mixed market signals, Bitcoin demonstrates relative resilience yet remains subject to short‑term fluctuations. Investor sentiment will hinge on further monetary policy signals and economic data, which could either support or weaken demand for risky assets.Key News of the Past Week

Priority: High

Cboe Launches FTSE Bitcoin Index Futures

Conclusion:

The launch of a new cash‑settled product, linked to VanEck’s XBTF ETF, demonstrates the market’s push to expand Bitcoin‑based derivative instruments. The product is awaiting regulatory approval, underscoring its importance from a regulatory standpoint and its potential for institutional investors.Ripple Acquires Broker Hidden Road for $1.25 Billion

Conclusion:

The deal is aimed at boosting institutional services, integrating RLUSD, and expanding XRP Ledger adoption. This strategic acquisition helps Ripple strengthen its competitive position and improve infrastructure for serving large clients.BlackRock Chooses Anchorage Digital for Its $44 Billion Spot Bitcoin ETF

Conclusion:

Switching to a new custodian underscores the growing demand for institutional crypto products and confirms BlackRock’s commitment to expanding its Bitcoin‑focused ETFs, which could positively impact capital inflows and market development.SEC to Hold a Roundtable (April 12) with Coinbase, Uniswap, and Cumberland

Conclusion:

The roundtable indicates serious discussions about specific cryptocurrency trading rules and industry proposals. This event could lead to clearer regulatory approaches and increased transparency in the digital asset sector.Saylor's Strategy Reports $5.91 Billion in Unrealized Bitcoin Losses and Suspends BTC Purchases

Conclusion:

The report on significant unrealized losses highlights the impact of the market sell‑off on Bitcoin accumulation strategies. The suspension of purchases reflects a cautious approach to further investments amid market volatility.Galaxy Digital Receives SEC Approval for U.S. Listing and Plans Nasdaq Debut under “GLXY” (Following Shareholder Vote on May 9)

Conclusion:

The listing approval is a significant step toward enhancing liquidity and expanding investment opportunities in Galaxy Digital, reflecting growing regulatory acceptance of cryptocurrency companies.

Priority: Moderate

ARK's Cathie Wood Buys Over 83K Coinbase Shares Worth $13 Million

Conclusion:

This deal demonstrates institutional investors’ confidence in Coinbase’s potential despite the stock market downturn. However, the purchase volume indicates a cautious approach and an expectation of further market stabilization.Hong Kong Allows Licensed Platforms and ETFs to Offer Cryptocurrency Staking

Conclusion:

The new regulatory initiative supports the development of the crypto market in Hong Kong, bolstering the city’s ambitions to become a global crypto hub. This expands opportunities for regional investors and positively influences the innovative development of staking products.

Conclusions

This week has seen moderate activity in both product innovation and regulatory spaces. The launch of new Bitcoin‑based derivatives, corporate deals from Ripple and BlackRock, and the SEC roundtable underscore the continued evolution of interest in the cryptocurrency sector. Moreover, strategic moves such as Galaxy Digital’s listing approval highlight the growing integration of crypto companies into traditional financial structures.

However, Saylor's Strategy report on unrealized losses and the suspension of BTC purchases demonstrates that significant volatility and market uncertainty persist.

Macro Analysis of Bitcoin Trading Week

1. Analysis of the BTC/USD Pair

Current Price: ~$84.6K

Local Low: $74.4K

Local High: $86K

Trend

Despite a challenging macroeconomic environment, Bitcoin - as with gold, has shown solid growth. We will discuss the factors that pressured buying later in this report, but the main takeaway is that Bitcoin appears strong.

Conclusions

Key Resistance: $86K

Local Support: $81.8K

Strong Base Support: $74.4K (still relevant in the context of the previous corrective move)

2. Options Analysis

Max Pain Price: $82 000

Expiration Date: April 18, 2025

Market Structure:

Call Options Dominance:

Overall, call options volumes (green bars) remain concentrated in the upper price range, starting at $90 000 and extending up to $100 000–$105 000. However, there is a slight decrease in open interest around $110 000 compared to the previous week, which may indicate a reduction in the most aggressively bullish expectations.Put Options:

The majority of put options (red bars) remain concentrated in the $70 000–$80 000 range. There is also a slight uptick in volumes around $75 000, indicating increased interest in downside protection at that level. Nevertheless, the $82 000 level is perceived as an area of relative equilibrium.

Comparison with the Previous Week

Max Pain Change:

Compared to last week, Max Pain has shifted from $86 000 to $82 000, indicating a change in the balance of options traders’ interests toward lower prices. This may reflect the market’s adaptation to a more moderate risk sentiment.Volume Dynamics:

Options trading volumes remain moderate, without any sharp spikes.

Forecast

Short-Term Consolidation:

Given the drop in Max Pain to $82 000 and sustained relative volatility, price is likely to remain in the $80 000–$86 000 range, potentially holding until the April 18 expiration.Potential Upside:

Persistent call option volumes above $90 000 suggest bullish sentiment among some traders. If the price breaks above the local resistance at $86K and trading volumes increase, a swift surge to $88 000–$90 000 is possible.Downside Risks:

A break below the key support around $80 000 could lead to a deeper pullback toward the $75 000 zone, where increased put option buying is concentrated. If negative factors intensify, the downward trend may continue toward $70 000.Max Pain Stabilization:

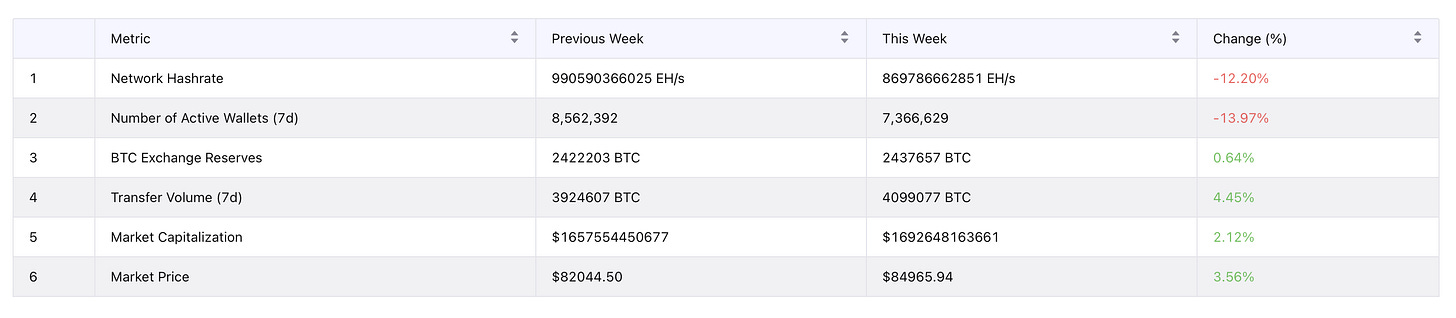

The new Max Pain level of $82 000 reflects the current equilibrium between options sellers and buyers.Bitcoin Market Data Analysis

1. Number of Active Wallets (7d):

Previous Week: 8,562,392

Current Week: 7,366,629

Change: 🔴 -13.97%

Comment:

The significant drop in active wallets indicates a decline in retail activity. This is due to some market participants shifting into a wait‑and‑hold mode (HODL) for long‑term retention.

2. Network Hashrate:

Previous Week: 990,590,366,025 EH/s

Current Week: 869,786,662,851 EH/s

Change: 🔴 -12.20%

Comment:

The decline in hashrate may suggest temporary shutdowns of some mining equipment. Nonetheless, the overall level remains sufficiently high, indicating continued miner interest in Bitcoin.

3. BTC Reserves on Exchanges:

Previous Week: 2,422,203 BTC

Current Week: 2,437,657 BTC

Change: 🟢 +0.64%

Comment:

A slight increase in BTC reserves on exchanges may indicate that some holders are moving funds for potential sales or exchange operations. However, the growth remains insignificant.

4. Transaction Volume (7d):

Previous Week: 3,924,607 BTC

Current Week: 4,099,077 BTC

Change: 🟢 +4.45%

Comment:

The rise in overall transaction volume, coupled with lower small‑wallet activity, suggests that larger players (institutional investors or “whales”) are making significant transfers.

5. Market Capitalization:

Previous Week: $1,657,554,450,677

Current Week: $1,692,648,163,661

Change: 🟢 +2.12%

Comment:

A moderate increase in market capitalization indicates a neutral-to‑positive market sentiment.

6. Market Price:

Previous Week: $82,044

Current Week: $84,965

Change: 🟢 +3.56%

Comment:

The price increase is related to the renewed interest of major holders returning to the market. With retail activity declining, the influence of large transactions on price movements becomes more pronounced.

Conclusions:

Decline in Retail Activity:

The significant reduction in active wallets confirms that small investors have largely adopted a wait‑and‑see approach.Short‑Term Decline in Hashrate:

Despite the downturn, mining remains competitive, the drop may be due to external factors or temporary disruptions.Activity of Major Players:

The increase in overall transaction volume and price suggests the participation of major players ready to execute significant transactions.

The market continues to show signs of consolidation and sustained interest from major participants despite weakening retail activity and negative macroeconomic factors.

On‑Chain Metrics

Bitcoin Whale Position Change – 90‑Day (Quarterly View)

Today's report focuses on major players and their behavior. The first metric covers the quarterly changes in the supply held by major holders (wallets with more than 1,000 BTC), and based on the chart, several key phases in whale behavior over the past few years can be identified:

Peak Accumulation (around 5.68 million BTC) at a price level of ~$60k

As the price approached its historical highs ($60k–$64k), major players actively accumulated BTC, raising their aggregate balance to 5.68 million coins.

The peak supply level among whales (5.68 million BTC) serves as an indicator: when major players reach their maximum accumulation, it signals a potential onset of an “overbought” phase.

Largest Distribution in the Last 5 Years: –420K BTC

After surpassing the $60k+ level, major holders began a large‑scale distribution, reducing their total balance to 5.26 million BTC.

The sale of 420K BTC represents the largest dump among whales in the last 5 years. Such sales indicate that major investors are taking profits, believing that the market has become “overheated.”

Transition from Distribution to Accumulation

Starting at the $88K level, the supply among major players stopped declining and began to gradually increase (as shown by the orange line).

This reversal in whale behavior indicates a shift from a distribution phase to accumulation.

The growth in supply among major holders signals renewed optimism and expectations for long‑term price appreciation.

What Can Be Noted at the Current Stage?

Overall Sentiment Among Major Players:

The resumption of accumulation suggests that whales see growth potential.Trading Volumes and Volatility:

After a period of significant distribution, the market is undergoing a “cleaning” phase of excess positions. Rising volatility (as the local bottom is reached) prompts whales to buy and average down their positions at attractive prices.

Long‑Term Picture

Large sell‑offs at high levels ($60k+) followed by gradual accumulation near the lows represent a classic pattern among major participants.

If the current buying wave persists and whale supply continues to grow, this will confirm that major holders are gearing up for the next bullish impulse.

Conclusion

The current increase in supply among large wallets indicates a new phase of accumulation following a massive dump at levels between $60K and $100K.

Bitcoin: STH Whale Balance

From November 2024 to April 2025, there has been a clear trend of buying by major STHs. During this period, the aggregate balance grew from 249K BTC to 1,425M BTC, meaning new players acquired a total of 1,176K BTC. This figure is particularly significant given that after reaching an all‑time high, part of the market was in a “cooling” phase while a weak macro backdrop was pushing Bitcoin’s price lower.

Short‑Term Holder Whale participants, who are more sensitive to market conditions, continue to show growth despite existing macroeconomic risks and a falling price. Essentially, the high interest of major holders in Bitcoin creates a “demand cushion” capable of supporting the price even amid negative news.

Bitcoin: STH Realized Price

Realized Price for new whales is the average price of all coins based on the cost at which they were acquired (or at the time of their last movement). If the average “Realized Price” of the new whales is around $89.9K and the current market price is below this level, they are in the unrealized loss zone. However, as the previous metric indicates, this cohort continues to actively buy despite the absence of “paper profits.”

Sentiment may remain weak, but real demand is driven not by hype, but by long‑term prospects. Although many STH whales are aggressive participants acting on speculative expectations, the current situation indicates that STHs are in an accumulation phase.

Conclusion

Despite a challenging macroeconomic backdrop (a plunge in U.S. consumer confidence to its lowest since 2022, rising inflation expectations, and heightened trade tensions between the U.S. and China), Bitcoin grew by 3.56% to reach $84,965. The SMA‑365D at $76K continues to act as resistance.

Retail investor activity has declined, as evidenced by a 13.97% drop in active wallets and a 12.20% decrease in network hashrate. However, transaction volume has increased, possibly pointing to major market players at work. Options analysis shows a shift in Max Pain from $86,000 to $82,000, indicating a change in the balance of interests toward lower prices, even though the dominance of call options in the upper price range suggests that bullish expectations persist among some traders.

The analysis of whale behavior indicates a new accumulation phase following a massive dump at levels between $60K and $100K. Major holders (wallets with more than 1,000 BTC) have begun building positions from the $88K level. In particular, Short‑Term Holder Whales are very active, with their balance growing from 249K BTC to 1,425K BTC from November 2024 to April 2025, despite their average purchase price ($89.9K) being higher than the current market price -indicating their long‑term optimism regarding Bitcoin’s prospects.

Forecast

I have temporarily removed the “target price” and “projected returns” from the forecast as they tend to mislead many investors reading this report. Please share your thoughts on this in the comments.

Investment Recommendation: 🟢 OUTPERFORM (Accumulate)

For more details on the rating, please refer to this link:

https://adlerinsight.com/Adler_Insight_Rating.pdfGood luck in the upcoming trading week!

AAJDisclaimer:

This material has been prepared solely for informational purposes and does not constitute an offer, recommendation, or solicitation to buy or sell any securities, digital assets, or other financial instruments. The information presented in this report is considered reliable, however, its accuracy or completeness is not guaranteed. Past performance is not indicative of future results. Any investment decisions are made by the investor independently, taking into account personal financial circumstances and, if necessary, after consultation with a qualified professional. The author and affiliated parties may hold positions in the assets mentioned in this report. The author and publisher accept no responsibility for any direct or indirect losses arising from the use of this information.

Risks:

High volatility may lead to sharp fluctuations in value, adversely affecting investors' portfolios. Significant price swings may reduce the attractiveness of BTC to institutional investors, especially in the derivatives segment (futures, options). Potential tightening of regulatory requirements by governments and central banks may restrict access to BTC markets and reduce liquidity. Issues with custodial services, centralized exchanges, and hacking incidents could undermine confidence in the asset and negatively impact liquidity.