Bitcoin Trends – W2 May 2025

$100K breached: institutional money flows into Bitcoin as the world balances between China's deflation and US tariff chaos

TL;DR:

Central banks diverge in trajectories: BoE cuts rate, Fed waits, China under deflationary pressure. Bitcoin sustainably above $100K for the first time amid ETF inflows and supply deficit, market maintains bullish bias but remains sensitive to tariff news

Macroeconomics for the past week

Priority: High

Bank of England: key rate reduced by 25 bps to 4.25%.

Conclusion: the fourth consecutive reduction reflects increasing risks of growth slowdown under pressure from external tariffs and signals a transition to a softer policy to support the economy.

US Fed: key rate maintained in the range of 5.25–5.50% (unchanged)

Conclusion: for the third consecutive time, the rate remains unchanged, demonstrating that the Committee sees simultaneous risks of accelerating inflation and rising unemployment, preferring a wait-and-see position until new data emerges.

China CPI: –0.1% y/y (April 2025)

Conclusion: the third consecutive month of deflation underscores the effect of trade tensions with the US and weak domestic demand, intensifying pressure on the People's Bank of China for further stimulus.

The agreement between the US and the UK doesn't actually remove key tariff barriers, but merely promises to continue negotiations for a full-fledged treaty. As a result, universal 10% duties and additional 25-27.5% tariffs on steel, aluminum, and automobiles remain in place, with "victories" limited to easing some tariffs on limited export volumes and London's commitment to purchase $10 billion worth of Boeing aircraft. The agreement is characterized as a "deal to make a deal" and emphasizes that high tariffs can still restrain trade and threaten economic growth, with recession not ruled out.

For next week

Over the weekend, investors' attention will be focused on negotiations between Washington and Beijing. Key corporate reports for the week: Alibaba, Applied Materials, Cisco, Deere & Co., JD.com, and Walmart.

Special attention will also be paid to statements from Fed representatives, including Powell. April inflation data on consumer, production, and trade prices will be viewed as the first full month of President Trump's tariff regime.

Conclusions

Bank of England has intensified easing, Fed maintains a wait-and-see position

This creates a multidirectional monetary background in major economies.

Tariff wars remain the main driver of uncertainty

Uncertainty in trade policy continues to constrain both consumer and business demand, impeding confident recovery of the global economy.Deflation in China intensifies expectations for additional stimulus

Remains a risk for global growth.IMF significantly worsened growth forecasts

Global GDP-2025 revised from 3.3% to 2.8%, US forecast reduced from 2.7% to 1.8%, Eurozone — from 1% to 0.8%. This signals a prolonged slowdown and increases recession risks.Pressure on the Fed is intensifying

After the March decision to maintain rates, the Fed planned two cuts in 2025, but lower IMF forecasts create arguments for more aggressive easing.Inflationary risks persist

Rising tariff costs and "tariff markups" from suppliers can sustain price pressure, limiting the space for long-term rate cuts.Central banks stand at a crossroads

Easing from the Bank of England and pressure on the Fed form a divergent background: markets await specifics on the pace of rate cuts and additional measures to support the economy.

A Bank of America survey (April 4-10, 2025) shows a sharp shift of asset managers to cash amid tariff fears: over two months, the cash share grew faster than in any period since April 2020. Simultaneously, positions in global and especially American stocks noticeably decreased. Most respondents expect "stagflation" and rank gold above stocks in terms of returns this year.

Stock market for the past week

Priority: High

Friday results: S&P 500 – 0.1%, Dow Jones – 119 pts, Nasdaq 100 ≈ 0%

Conclusion: closing at the zero mark reflects anticipation of the start of US-China trade negotiations in Geneva and overall caution among investors.

Local optimism against persistent uncertainty

Conclusion: news of a trade agreement with the UK gave a temporary rise, but Trump's proposal to reduce tariffs on Chinese imports to 80% did not remove key questions about the content and results of negotiations with China.

Priority: Moderate

Mixed corporate results

Pinterest + 4.8% after strong advertising revenue forecasts.

Expedia – 7.3% due to disappointing quarterly indicators.

Affirm – 14.5% due to weak forecast for the fourth quarter.

Conclusion: multidirectional reports emphasize continued investor caution amid trade turbulence.

Week Summary

S&P 500 decreased by 0.7%, Nasdaq 100 – 0.6%, Dow Jones – 0.2%.

The market remains in wait-and-see mode: key factors will be the results of US-China negotiations, further tariff announcements, and the start of the corporate reporting season.

Important news of the past week

Priority: High

BTC exceeded $100,000 amid renewed global trade negotiations and major institutional inflows.

Ethereum grew by 20% after the Pectra update — the biggest growth since 2021, as renewed risk sentiment stimulates investor demand.

On May 9, BlackRock's Bitcoin ETF registered an inflow of $356 million, which became a 19-day series and the longest stretch of fund inflows since early 2025.

Coinbase launches 24/7 trading of Bitcoin and Ethereum futures — the first such case on a CFTC-regulated exchange.

Coinbase acquires the Deribit platform for $2.9 billion, expanding its presence in the BTC and ETH options derivatives market.

US banks can now buy and sell cryptocurrency to clients without prior OCC approval.

Priority: Moderate

The GENIUS Act failed at a key Senate vote, slowing down the adoption of stablecoin legislation.

New Hampshire became the first US state to pass a law allowing the treasurer to invest in Bitcoin and some other cryptocurrencies.

Arizona became the second US state to approve a cryptocurrency reserve law and integration of digital assets into the unclaimed property system.

Stripe launches stablecoin financial accounts in 101 countries after acquiring Bridge for $1.1 billion to expand access to global payments.

Strategy (MicroStrategy) acquired another 1,895 BTC for $180 million, bringing its total assets to 555,450 BTC.

Priority: Low

Metaplanet buys 555 BTC for $53.4 million, increasing its reserves to 5,555 BTC.

Conclusions

Surpassing the $100K mark and the 19-day series of inflows into BlackRock's Bitcoin ETF emphasize growing institutional interest in Bitcoin. The launch of 24/7 futures on Coinbase and the acquisition of Deribit for $2.9 billion demonstrate that Coinbase is aggressively expanding in the market through tools for professional traders.

Removing OCC requirements for banks and the adoption of crypto-friendly laws in New Hampshire and Arizona indicate gradual integration of digital assets into the official financial system. Expanding access to stablecoins through Stripe strengthens capabilities for international settlements and stimulates cryptocurrency adoption in the corporate sector.

Bitcoin Trading Week Macroanalysis

1. BTC/USD Pair Analysis

Current price: ~$104K

Local minimum: $93.3K

Local maximum: $104.9K

Trend

This week, the price made a powerful upward impulse: volumes sharply increased when breaking through the $96K–$97K zone, which took BTC out of the consolidation phase, and then clearly formed into a series of green bars up to the $104.9K level. Now there is a slight pause at the upper boundary, indicating a test of demand before the next movement.

Conclusions

Key resistance: $105K – a confident breakthrough on increased volumes could lead to a new rally to $110K.

Local support: $96K – maintaining this level will preserve the bulls' advantage and reduce the risk of a sharp correction.

Strong base support: $90K – a critical zone for long-term positions and a strategy revision point for deep pullbacks.

2. Options Analysis

Market Structure

Prevalence of Call options:

Green columns are concentrated on strikes $100K–$115K, with the largest volume in the $110K–$115K zone (peak around 5M). This indicates active hedging of growth above the Max Pain level.Put options:

Red columns dominate at strikes $75K–$92.5K, with peak interest in the $75K–$80K range (around 11M). Put volumes on strikes $85K–$95K continue to decline, indicating a shift in protective bets to lower ranges.

Comparative Analysis with Previous Week

Max Pain Change:

The Max Pain level increased from $95K to $100K, reflecting a further shift in the balance of interests in favor of higher prices.Volume Dynamics:

Significant growth in Call volumes on strikes above $110K (especially at $112.5K), while Put volumes in the $85K–$95K range continued to decline. At the same time, the largest Put interest remained in the $75K–$80K zone.

Forecast

Possible Growth:

Maintaining support at $100K and increasing Call volumes could lead to testing the $102.5K–$105K zone, and with a confident breakthrough - to the $110K mark.Correction Risks:

Breaking support at $100K while simultaneously increasing Put volumes could return the price to the $95K–$97.5K range, where the main bear defense is concentrated.

Bitcoin Network Data Analysis

1. Network Hashrate:

Previous Week: 971,093,401,420 EH/s

This Week: 888,195,184,226 EH/s

Change: 🔴 −8.54%

Comment: The decrease in hashrate may be related to local equipment shutdowns. This temporarily reduces network security but does not have a critical impact on its functioning.

2. Market Capitalization:

Previous Week: $1,904,164,793,107

This Week: $2,081,491,584,645

Change: 🟢 +9.31%

Comment: The growth in capitalization reflects the inflow of liquidity, strengthening bullish sentiment. This is also confirmed by the steady price increase and interest from institutional investors.

3. BTC Exchange Reserves:

Previous Week: 2,473,597 BTC

This Week: 2,457,252 BTC

Change: 🔴 −0.66%

Comment: Continued outflow of coins from exchanges - signals of long-term accumulation. Market participants prefer to store BTC in their wallets, reducing potential supply pressure on CEXs.

4. Transfer Volume (7d):

Previous Week: 4,595,539 BTC

This Week: 4,538,349 BTC

Change: 🔴 −1.24%

Comment: A slight decrease in transfer volumes may be related to a reduction in short-term speculative activity.

5. Number of Active Wallets (7d):

Previous Week: 8,820,018

This Week: 8,691,452

Change: 🔴 −1.46%

Comment: The decrease in the number of active addresses is in line with the reduction in transfer volumes and may signal an increase in accumulation.

6. Market Price:

Previous Week: $95,713.47

This Week: $103,983.46

Change: 🟢 +8.64%

Comment: A price increase of almost 9% reflects strong buying demand and expectations of further growth.

Conclusions:

Moderate decrease in hashrate: may be a technical or short-term effect without a threat to the network.

Strengthening of the bullish trend: price and capitalization growth confirm the dominance of positive expectations and demand.

Decrease in liquidity: outflow of BTC from exchanges and stabilization of transfers enhance the supply deficit.

Pause in user activity: decrease in the number of active addresses - a sign of consolidation, not a trend reversal.

On-chain metrics

Bitcoin Old Young Supply Cost Basis Model

Since January 2023, when the 🟢 Deep-Value Buy Signal appeared on the chart, the spot price of BTC fell below the entry cost for both "young" and "old" holder cohorts. Simultaneously, the 🟡 Ratio (ratio of young to old) began a confident growth, demonstrating an increased influx of new participants ready to buy bitcoin.

In October 2024, we observed a slowdown phase in Ratio growth: the curve leveled off around 2.8–3.0. Starting from November 2024, Ratio resumed its upward movement and has now reached the level of 3.6. Such growth indicates a sign of continuing intensive accumulation phase and growing interest from new players.

Prospects until autumn 2025

If the current trend continues (dotted green line on the chart), Ratio could grow to ~9 by autumn 2025, which coincides with the peak phase of the previous bull cycle.

Focus on new entries of "young" participants will maintain upward pressure on price, and the subsequent shift in balance in favor of "veterans" will lead to the final distribution phase and to the next point of maximum pullback.

Conclusion: the accumulative dynamics since January 2023 remains strong, the current Ratio growth to 3.6 confirms the continued influx of new buyers. If this trend does not weaken, we will see further acceleration of accumulation up to level 9 by autumn 2025, which historically coincided with the formation of new absolute Bitcoin price maximums.

Bitcoin Short-term Holder (STH) YoY Realized Price

Starting from May 2022, we observe a steady decline in the annual growth of realized price among short-term holders (STH YoY). At the 2021 peak, this indicator reached 470%, then during a long period slowly converged to 164% (early 2024) and further to 146% closer to the end of 2024. Now in May 2025, the YoY growth has fallen to 60%, indicating a decrease in the previous level of aggressive speculative appetite. Professional players, traders, and managers who take a more sober approach to risk have entered the market.

Given the dynamics of this cycle, we can expect further YoY growth in the range of 150%.

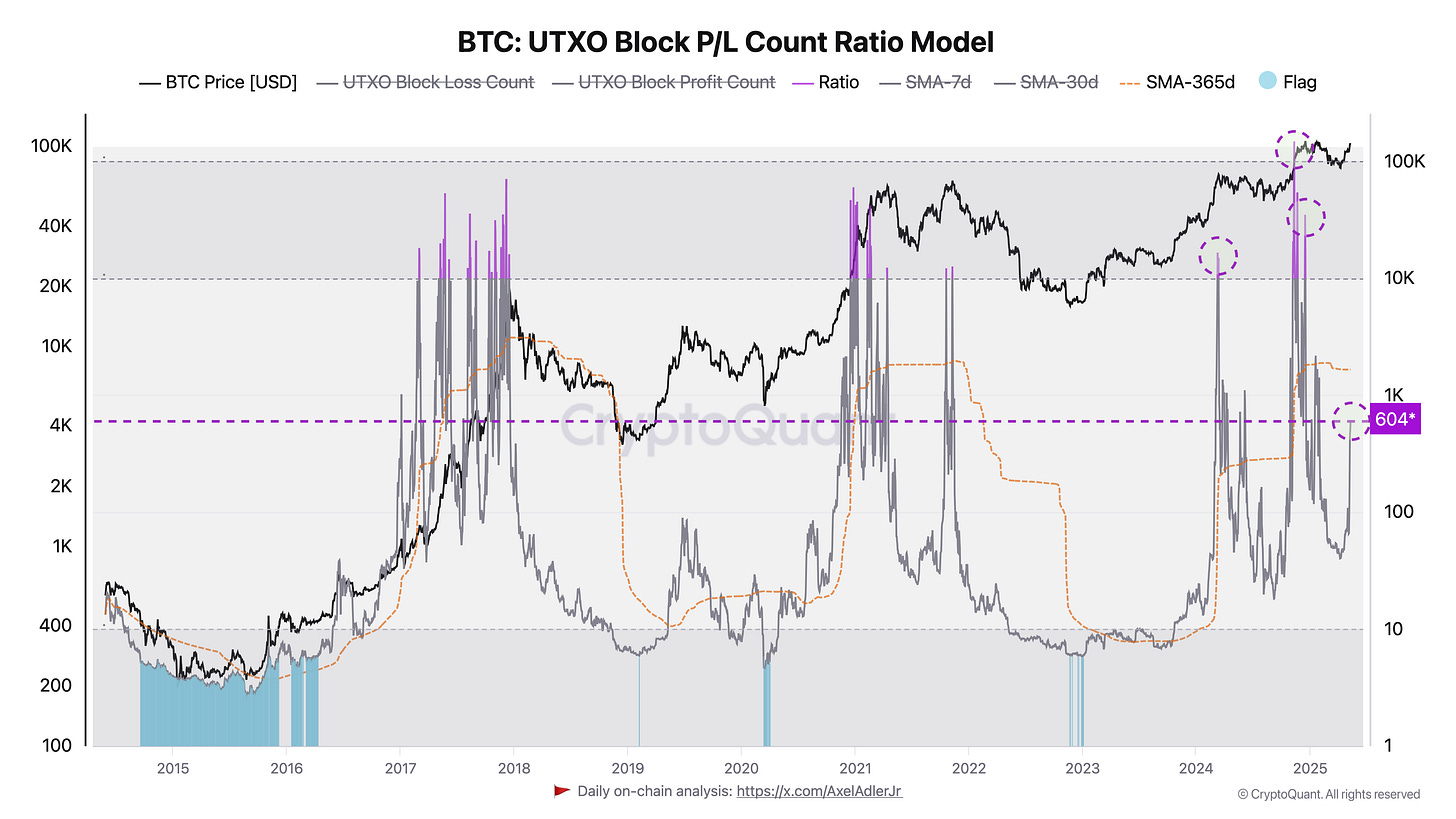

Bitcoin UTXO Block P/L Count Ratio Model

The UTXO Block P/L Count Ratio model calculates the ratio of profit realizing to loss fixing in each block (10 minutes). Extreme Ratio peaks (tens and hundreds of thousands) coincide with phases of mass profit taking at market peaks, while Ratio dips (units–tens) coincide with capitulation points and the best moments for entry.

After the April 2023 minimum (~50), Ratio recovered to the current ~600, reflecting the transition from sell-offs to moderate profit taking. Current metric indicators are below annual averages, corresponding to the middle phase of the macro bull cycle. By analogy with past dynamics, values of 10K will indicate a high risk of sell-offs, and we may see a slowdown in growth and the beginning of a correction phase.

Conclusion.

The Banks of England and China are easing policy against the backdrop of increasing tariff risks, while the Fed maintains a "pause," creating a multi-directional monetary background. Deflation in China and the IMF's downward forecast revision intensify concerns about global growth, increasing the likelihood of deeper stimulus and thereby supporting the search for returns in risk assets.

Against this backdrop, Bitcoin broke above $100K with record institutional ETF inflows. Option positions and on-chain metrics indicate the prevalence of bullish sentiment and an active accumulation phase.

Forecast

Investment recommendations: 🟢 OUTPERFORM (Moderate Buy)

For more details about the rating, you can familiarize yourself with this link: https://adlerinsight.com/Adler_Insight_Rating.pdf

Good luck in the upcoming trading week!

AAJ

Disclaimer:

This material has been prepared solely for informational purposes and does not constitute an offer, recommendation, or solicitation to buy or sell any securities, digital assets, or other financial instruments. The information presented in this report is considered reliable; however, its accuracy or completeness is not guaranteed. Past performance is not indicative of future results. Any investment decisions are made by the investor independently, taking into account personal financial circumstances and, if necessary, after consultation with a qualified professional. The author and affiliated parties may hold positions in the assets mentioned in this report. The author and publisher accept no responsibility for any direct or indirect losses arising from the use of this information.

Risks:

High volatility may lead to sharp fluctuations in value, adversely affecting investors' portfolios. Significant price swings may reduce the attractiveness of BTC to institutional investors, especially in the derivatives segment (futures, options). Potential tightening of regulatory requirements by governments and central banks may restrict access to BTC markets and reduce liquidity. Issues with custodial services, centralized exchanges, and hacking incidents could undermine confidence in the asset and negatively impact liquidity.