Bitcoin Trends – W3 April 2025

Bitcoin under pressure: Dollar at a minimum, institutional investors increase positions, market prepares for breakthrough above $90K.

TL;DR:

Over the past week, the US dollar fell to a three-year low amid tariff concerns and political pressure on the Fed. Reduced tension in US trade negotiations with Japan and Italy is stabilizing global markets, creating favorable conditions for cryptocurrency growth. Institutional investors are actively increasing their BTC positions, confirming long-term market optimism. Bitcoin is in a consolidation phase, with narrowing volatility and price stabilization indicating an imminent upward breakthrough targeting the $90K level and beyond.

Macroeconomics over the past week

Priority: High

US dollar rate at a three-year low

Conclusion: The dollar is under pressure due to low liquidity on Friday and growing concerns about the economic consequences of tariffs. USD decline supports risky assets and commodity currencies, with trend stability depending on further trade negotiations.

US trade negotiations with Japan and Italy, statements about tariff reductions

Conclusion: The negotiations have given the market hope for easing trade tensions. Trump's statement about possibly abandoning further tariff increases and even reducing them creates a positive background for global stocks and may stabilize the dollar rate.

Trump's criticism of the Fed and Powell

Conclusion: Accusations of excessive slowness in lowering rates and public threats of resignation increase political pressure on the regulator. This raises uncertainty regarding the timing and scale of future easing policies.

Powell's statements about monitoring tariff impacts

Conclusion: The Fed demonstrates caution, stating the need to assess the effect of tariffs on the economy before making decisions. Such a tone keeps markets in a state of expectation and may delay any action on rates.

US unemployment benefit claims decreased to a two-month low

Conclusion: Improvement in the labor market supports consumer demand and creates additional arguments for maintaining the current level of interest rates.

Priority: Moderate

Low trading activity due to Good Friday

Conclusion: Holiday closure of most world platforms led to temporary lull and reduced trading volumes, but fundamental dynamics remained unchanged.

Week ahead: key reports and data

Conclusion: Earnings reports from Alphabet, Tesla, Boeing, Intel, IBM, Merck, and P&G, and flash PMI data (US, Eurozone, Japan) will serve as indicators of trade risks' impact on the corporate sector and economy. Durable goods orders and existing home sales figures will help assess the current state of consumer and business demand.

Conclusions

This week, the dollar continued to experience pressure amid tariff concerns and low liquidity, but negotiations with key partners and signals about easing trade tensions had a stabilizing effect. Political pressure on the Fed and its chairman's statements maintain a high level of uncertainty in monetary policy. At the same time, strong labor market data support the current interest rate level. In the coming week, key drivers will remain corporate reports and economic indicators, which will show how trade uncertainty affects growth and inflation.

Important news of the past week

Priority: High

Oregon Attorney General plans to sue Coinbase for unregistered securities

Conclusion: The repetition of a case terminated by the SEC emphasizes continuing legal risks at the state level and a threat to the operations of the largest crypto exchange.

Adoption of SB 1373 on cryptocurrency reserve in Arizona

Conclusion: The House Committee approved the bill, bringing the state closer to creating an official BTC reserve and setting a legislative precedent for other jurisdictions.

Securitize acquires MG Stover fund division ($38 billion)

Conclusion: The merger makes Securitize a leader in digital asset fund administration, strengthening institutional infrastructure and large investor confidence.

MicroStrategy buys additional 3,459 BTC for $285.8 million (total 531,644 BTC)

Conclusion: The bitcoin accumulation strategy continues, confirming long-term optimism, but simultaneously increasing the company's exposure to market volatility.

Visa joins Paxos' USDG stablecoin consortium

Conclusion: The first TradFi company joining the USDG group signals the expansion of stablecoin use in payments and increased trust in digital currencies.

JPMorgan launches 24/7 blockchain payments in pounds sterling via Kinexys

Conclusion: The expansion of GBP payment capabilities and integration of SwapAgent and Trafigura services from LSEG demonstrate deep integration of traditional finance with blockchain technologies.

Priority: Moderate

HashKey Capital launches Asia's first XRP Tracker Fund

Conclusion: The institutional fund sponsored by Ripple creates new XRP investment opportunities in the Asian market and expands the range of joint products.

A16z invests $55 million in LayerZero tokens with three-year lockup

Conclusion: The investment in the cross-chain messaging protocol reflects venture capital confidence in the development of inter-network infrastructure for digital assets.

Metaplanet adds 319 BTC for $26.3 million (total 4,525 BTC)

Conclusion: The company strengthens its position as the largest public BTC holder in Asia, continuing to aim for 10,000 BTC by the end of 2025.

Spar supermarket in Zug (Switzerland) begins accepting BTC via Lightning

Conclusion: The expansion of bitcoin acceptance in retail stimulates the use of the Lightning network and popularizes cryptocurrencies in everyday payments.

Conclusions

Current macroeconomic events open a favorable window for bitcoin growth in the short term. The US dollar's decline to a three-year low and softening rhetoric on tariff wars create a favorable environment for risk assets, including cryptocurrencies. Simultaneously, institutional adoption continues to strengthen – significant BTC acquisitions by MicroStrategy (3,459 BTC), Visa joining the USDG stablecoin consortium, JPMorgan's launch of 24/7 blockchain payments, and the advancement of cryptocurrency reserve legislation in Arizona signal bitcoin's growing integration into the financial system. Political pressure on the Fed may accelerate rate cuts, which is traditionally favorable for crypto assets. Persistent legal risks, as in the case of the planned lawsuit against Coinbase in Oregon, are unlikely to significantly impact the market, although the emergence of such a lawsuit amid a general easing of pressure on crypto assets under the Trump administration looks at least strange.

Bitcoin Trading Week Macro Analysis

1. BTC/USD Pair Analysis

Current price: ~$84.5K

Local minimum: $84K

Local maximum: $86K

Trend

After bouncing from $74.4K at the beginning of last week, bitcoin entered a sideways consolidation phase in the $84K-86K range. Volumes are significantly decreasing, which is characteristic of accumulation before the next impulse. Bears were unable to break through the $84K support, preventing the price from retreating deeper.

Conclusions

Key resistance: $86.5K - a sustained breakthrough with increased volumes will open the path above $90K.

Local support: $84K - maintaining this level preserves a bullish mood in the short-term horizon.

Strong base support: $74.4K - still the main level for major corrections and a point for long-term strategy revision.

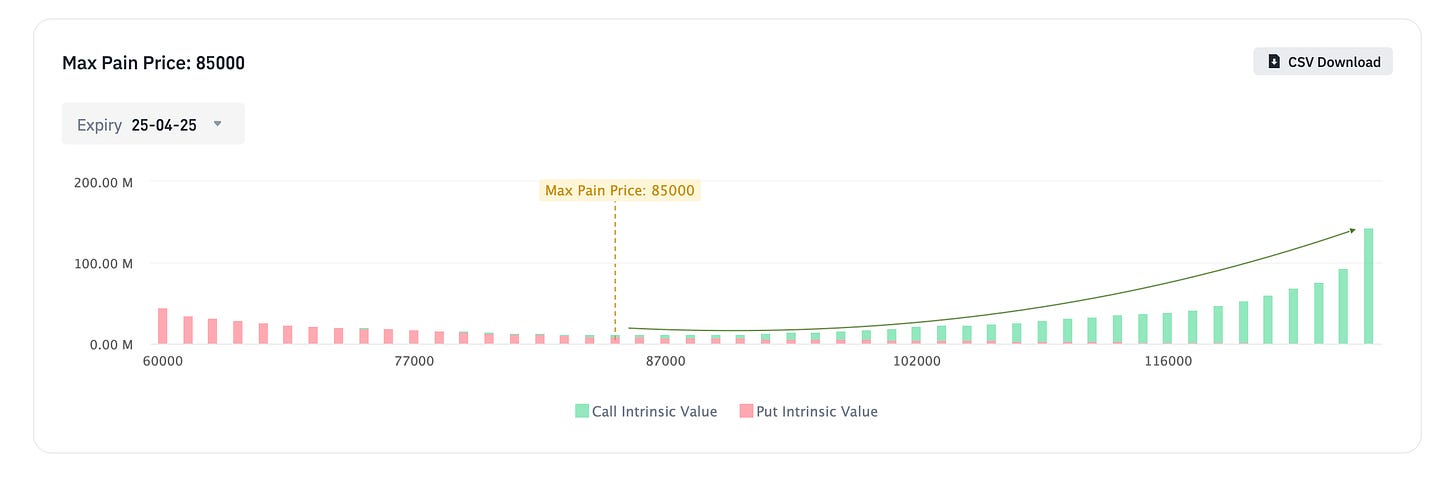

2. Options Analysis

Max Pain Price: $85,000

Expiration date: April 25, 2025

Market Structure

Predominance of Call options:

Green bars are still concentrated at high strikes: active interest in the $100,000-$120,000 range and even higher. Compared to last week, there's an increase in volumes at $105,000-$115,000 strikes, indicating strengthening bullish bets in this range.Put options:

The main mass of red bars remains in the $60,000-$75,000 zone, with volumes at the $75,000 strike slightly decreasing, while at $80,000 they continue to hold at a moderate level. This indicates a shift in interest towards more aggressive protection at lower levels.

Comparative Analysis with Previous Week

Max Pain Change:

The Max Pain level increased from $82,000 to $85,000, reflecting a shift in the balance of options traders' interests in favor of higher prices - bulls are preparing the ground for continued growth.Volume Dynamics:

Trading volumes for Calls at strikes above $100,000 have noticeably increased, while activity in Puts at $75,000-$80,000 has slightly weakened. The total volume of options exposure remains consistently high, without sharp spikes, which is characteristic of accumulation before expiration.

Forecast

Possible Growth:

Strengthening Call option volumes above $90,000 and maintaining support at $84,000 will open the path to testing $88,000-$90,000. A breakthrough of the upper consolidation boundary on high volumes will signal the continuation of the bull rally.Correction Risks:

Breaking support at $84,000 with increased Put volumes could lead to a quick descent to $80,000, where protective positions are concentrated.

Bitcoin Market Data Analysis

1. Transfer Volume (7d):

Previous week: 4,371,000 BTC

Current week: 3,537,362 BTC

Change: 🔴 −19.07%

Comment: Substantial decrease in transfer volume indicates reduced speculative activity and a transition of participants to coin holding mode.

2. Number of Active Wallets (7d):

Previous week: 8,149,351

Current week: 7,657,303

Change: 🔴 −6.04%

Comment: Reduction in active wallets indicates decreased transaction activity, leading to reduced market supply.

3. Network Hashrate:

Previous week: 869,786,662,851 EH/s

Current week: 851,516,036,903 EH/s

Change: 🔴 −2.10%

Comment: The small decrease in hashrate is likely related to scheduled maintenance and difficulty fluctuations, but the overall long-term direction remains upward, indicating network security.

4. Market Price:

Previous week: $84,518.54

Current week: $85,073.18

Change: 🟢 +0.66%

Comment: Insignificant price growth reflects a balanced combination of cautious demand and absence of mass selling.

5. Market Capitalization:

Previous week: $1,692,648,163,661

Current week: $1,687,938,636,883

Change: 🔴 −0.28%

Comment: Mild decline in capitalization is related to small price fluctuations within a narrow range and the capitalization calculation methodology.

6. BTC Reserves on Exchanges:

Previous week: 2,437,657 BTC

Current week: 2,414,414 BTC

Change: 🔴 −0.95%

Comment: BTC outflow from exchanges indicates continued accumulation phase by investors and decreased readiness for short selling.

Conclusions:

Market Consolidation: Significant drop in transfer volume and active wallets speaks to a waiting phase and absence of mass selling.

Stable Security: Slight decrease in hashrate does not affect network reliability.

The market continues to show signs of consolidation and maintained interest from participants.

On-Chain Metrics

BTC: Realized Volatility (1-Week)

Low level of weekly realized volatility (8.4%) indicates market compression: participants are accumulating positions, and trading activity is decreasing to minimal values. Periods of such consolidation precede subsequent movement - with favorable macro environment and maintaining positive news background, current compression is more likely to tend toward a bullish breakthrough than a downward reversal. Upon breaking local resistance (~$86K), we can expect accelerated growth toward $90K.

BTC: Support and Resistance

The main resistance points are concentrated in the range of realized price of the main cohorts of short-term investors in the range of $91K - $95K. A breakthrough above these levels will open the path to tests above $100K, which will be followed by retests of annual maximums. Essentially, if BTC confidently breaks through and closes above $95K, the next target will be the psychological mark of $100K.

BTC: Short-Term Holders SOPR Indicator

When the SOPR SMA-7D of short-term holders is at a level slightly below 1, it means that coins, on average, are sold at the same price at which they were bought or with minimal loss. Simply put, short-term traders are now exiting positions without fixing either profit or loss. Such a "break-even zone" serves as a marker for the completion of the capitulation stage: everyone who wanted to dump the asset at a loss has already done so.

BTC: Realized Loss 7-day Sum

To assess the volume of coins sold close to zero profit, let's look at the metric of the sum of realized losses over the past week. This volume is at the level of $900M. This is the fourth largest capitulation since August 2024. As soon as the price rose to the break-even level, holders began to actively sell. If you return to the Bitcoin Trading Week Macro Analysis chart and see the narrow corridor in which the price has been throughout the trading week, you can assess how easily the market absorbed this capitulation. Such a combination of significant realized losses volume and relative price stability indicates strong demand at these levels. As a result of "cleaning out" weak hands and liquidating positions of break-even sellers, a healthier buyer base has formed. This means that with subsequent attempts to break through the lower corridor boundary, the capitulation volume will likely be lower, and support points stronger. From a technical point of view, such dynamics serves as a positive signal: the market gets rid of excess supply, which will potentially prepare the ground for the next price movement upward.

Conclusion

The macroeconomic environment continues to favor bitcoin: a weak dollar and reduced trade tensions support demand for risk assets. Institutional adoption, expressed in BTC purchases, forms the basis for growth. Low volatility and significant volume of realized losses last week indicate a completing stage of weak market participants' capitulation, which strengthens support and reduces the likelihood of deep corrections in the near future. In the coming week, macroeconomic reports and corporate results will be crucial, capable of determining further dynamics and confirming the market's readiness for an upward impulse.

Forecast

Investment Recommendations: 🟢 OUTPERFORM (Over-Weight)

More details about the rating can be found at this link: https://adlerinsight.com/Adler_Insight_Rating.pdf

Good luck in the upcoming trading week! AAJ

If you use this report in your publications, please include a link with the following parameters.

<a href="https://adlerscryptoinsights.substack.com/p/bitcoin-trends-w3-april-2025"

title="Bitcoin Trends – Week 3 April 2025 By Axel Adler Jr."

target="_blank"

rel="noopener dofollow">

Bitcoin Trends – Week 3 April 2025 By Axel Adler Jr.

</a>

Disclaimer:

This material has been prepared solely for informational purposes and does not constitute an offer, recommendation, or solicitation to buy or sell any securities, digital assets, or other financial instruments. The information presented in this report is considered reliable, however, its accuracy or completeness is not guaranteed. Past performance is not indicative of future results. Any investment decisions are made by the investor independently, taking into account personal financial circumstances and, if necessary, after consultation with a qualified professional. The author and affiliated parties may hold positions in the assets mentioned in this report. The author and publisher accept no responsibility for any direct or indirect losses arising from the use of this information.

Risks:

High volatility may lead to sharp fluctuations in value, adversely affecting investors' portfolios. Significant price swings may reduce the attractiveness of BTC to institutional investors, especially in the derivatives segment (futures, options). Potential tightening of regulatory requirements by governments and central banks may restrict access to BTC markets and reduce liquidity. Issues with custodial services, centralized exchanges, and hacking incidents could undermine confidence in the asset and negatively impact liquidity.