Bitcoin Trends – W3 July 2025

Bitcoin consolidates at $118K level: institutional flows, reduced inflows and macro "window" set the stage for testing $125–130K

TL;DR:

Macro background (retail growth, stable labor market, declining inflation expectations) and institutional flows support bullish structure: BTC consolidates below $123K on low inflows and moderate realized profit growth, creating prerequisites for testing $125–130K while holding supports at $115.7K / $110K, key risks - tariff rhetoric and potential large player sales.

Macroeconomics for the past week

Priority: High

US Retail Sales (June 2025): +0.6% m/m

Conclusion: Strongest growth in three months, exceeding forecasts, reflects sustainable consumer demand in key categories (auto, multi-format, construction materials). This will support Q2 GDP and reduce recession risk.

Initial Jobless Claims (July 2025): –7,000 to 221,000

Conclusion: Latest minimum since April confirms labor market strength and reinforces Fed expectations of keeping rates until fall, despite soft inflation signals.

US Import Price Index (June 2025): +0.1% m/m

Conclusion: Growth was below expectations and demonstrates weakening external inflationary pressure, opening window for monetary policy easing.

US Building Permits (June 2025): +0.2% m/m

Conclusion: Exceeding forecast means developers are starting to respond to lower mortgage rates, but regional spread indicates uneven recovery.

US Housing Starts (June 2025): +4.6% m/m

Conclusion: Strong recovery driven by multi-family segment (up to +30.6%) mitigates housing market slowdown and supports related industries.

Priority: Moderate

US Inflation Expectations (UMich, July 2025): 4.4%

Conclusion: Second consecutive decline from 6.6% in May means consumers believe in temporary nature of high prices, creating favorable ground for Fed.

UMich Consumer Confidence Index (July 2025): 61.8

Conclusion: Five-month high supports scenario of continued household spending, however still far from pre-crisis level.

Conclusion and impact on risk assets

Positive retail sales data and labor market stability strengthen risk appetite, supporting stocks and corporate bonds, while moderate external price pressure and declining inflation expectations create additional grounds for welcoming potential Fed easing. In these conditions, bitcoin and other speculative assets may receive additional capital inflow, but short-term corrections are possible amid uncertainty over trade tariffs and external risks.

Stock Market for the past week

Priority: High

S&P 500 and Nasdaq 100 practically unchanged on Friday, Dow –142 pts.

Conclusion: Investors balanced between Trump's statement about raising tariffs on EU and positive economic data: S&P 500 and Nasdaq 100 finished the day at their records, while Dow Jones retreated due to American Express drop (–2.2%).

Weekly index dynamics

Conclusion: S&P 500 gained +0.5%, Nasdaq 100 +1.4%, while Dow Jones finished the week slightly lower, reflecting sustained demand for growth stocks and moderate pressure on traditional "blue chips".

Priority: Moderate

Corporate highlights

Netflix –5.1% despite beating revenue and profit expectations.

Charles Schwab +3% on strong earnings report.

Chevron +1% after completing Hess acquisition ($53 billion).

Ignoring geopolitical shocks

Conclusion: Despite tariff rhetoric pressure, investors focused on corporate results and strong consumer confidence and inflation expectations data (4.4%).

Week summary

S&P 500 +0.5%

Nasdaq 100 +1.4%

Dow Jones –0.1%

US stocks showed moderate growth for the week as positives from corporate profits and consumer sentiment outweighed tariff threats.

Next week

Trade events: final deadline for US–EU negotiations (August 1) and tariff notifications.

Earnings season: quarterly results from Alphabet, Tesla, Verizon, Coca-Cola, T-Mobile and IBM.

Key US data: flash S&P Global PMI, durable goods orders, existing and new home sales.

Monetary decisions: ECB, Bank of Russia and Central Bank of Turkey meetings.

Global indicators: flash PMI for eurozone, Germany, Japan, India, UK and France; GfK consumer confidence (Germany, UK); Ifo index (Germany); UK retail sales; Tokyo CPI; Japan upper house elections.

Important news of the past week

Priority: High

GENIUS Act came into effect - president signed law requiring full dollar backing and annual audits for major stablecoin issuers, becoming first US regulatory act of this type.

Digital asset funds received $3.7 billion inflow for the week, bringing total AUM to record $211 billion thanks to leaders Bitcoin ($2.7 billion) and Ethereum ($990 million).

Ethereum ETF AUM reached 4.95 million ETH after $726 million daily inflow, contributing to ETH growth to $3,400 and reflecting strong institutional demand.

Standard Chartered launched spot BTC and ETH trading for institutions, becoming first global bank to offer access to USD pairs in crypto market.

Jamie Dimon confirmed JPMorgan plans to issue own stablecoin JPMD, reflecting largest US bank's shift toward digital assets.

Priority: Moderate

Bit Digital added 19,683 ETH after raising $67 million, increasing treasury balance to 120,306 ETH.

SharpLink bought 32,892 ETH for $118.8 million, bringing holdings to over 353,000 ETH and strengthening status as largest corporate holder.

Strategy acquired 4,225 BTC for $472.5 million, resulting in reserves growing to 601,550 BTC.

US House passed H.R. 3633 and H.R. 1919, establishing new frameworks for digital assets; bills sent to Senate.

Metaplanet bought another 797 BTC for $94 million, bringing total to 16,352 BTC and securing position in top five largest public holders.

Whale moved 40,191 BTC to Galaxy Digital, likely preparing for $9.6 billion sale after 14 years of inactivity.

Priority: Low

BitMine owns ETH worth over $1 billion, surpassing SharpLink and becoming largest public corporate ether holder.

Peter Thiel-backed groups bought 9.1% of BitMine Immersion, owning $500 million in ETH and recently transitioning to corporate treasury model.

DOJ and CFTC closed Polymarket investigations, concluding probes initiated under previous administration.

Coinbase first reached $100 billion market cap, confirming status as key industry player.

SharpLink Gaming acquired 20,279 ETH for $68 million, bringing reserves to 321,000 ETH and taking second place after Ethereum Foundation.

Conclusions

The week was marked by most important legislative breakthrough - GENIUS Act taking effect, creating first clear US rules for stablecoins. Record inflows into Bitcoin/Ethereum funds and ETFs, as well as Standard Chartered's spot pairs launch and JPMorgan's JPMD plans demonstrate sustained institutional optimism.

Corporate ETH and BTC accumulation - from Bit Digital and SharpLink to Strategy and Metaplanet confirms continuation of digital asset race, while whale actions hint at future volatile events.

Public companies strengthen positions: BitMine and SharpLink Gaming expand ether reserves, while Coinbase crosses $100 billion capitalization threshold. Together these trends indicate approaching new maturity stage where digital assets integrate into traditional finance while maintaining high dynamics and growth potential.

Bitcoin trading week macro analysis

1. BTC/USD pair analysis

Key indicators for the week

Current price: $118.2K

Local high: $123.2K

Local low: $98.2K

Trend

This week BTC demonstrated moderately volatile movement: after confident growth, market formed new local high around $123.2K, then followed short-term decline and consolidation in $115.7K–$120K range, where prices stabilized with declining trading volumes. This indicates profit-taking by some participants and formation of zone below new high for potential further movement.

Most notable growth observed mid-week, where impulsive breakout above $120K was recorded with volume increase.

In second half of week, market entered consolidation phase, with support around $115.7K and resistance at $123.2K.

Volume reduction during sideways movement confirms corrective nature of this section and possible accumulation of strength for new impulse.

Conclusions

Key resistance: $123.2K - its confident break on volume growth can open path to testing new highs: $126K and above.

Local support: $115.7K - maintaining this level strengthens bullish scenario, its break may intensify seller pressure and lead to $110K retest.

Strong base support: $98.2K - critical level for long-term positions. Closing below it would signal medium-term trend change and need for strategy revision.

Overall sentiment: Consolidation phase and moderate volume decline at new highs may precede further upward impulse with large buyer support, however breaking supports $115.7K/$110K increases correction deepening risks.

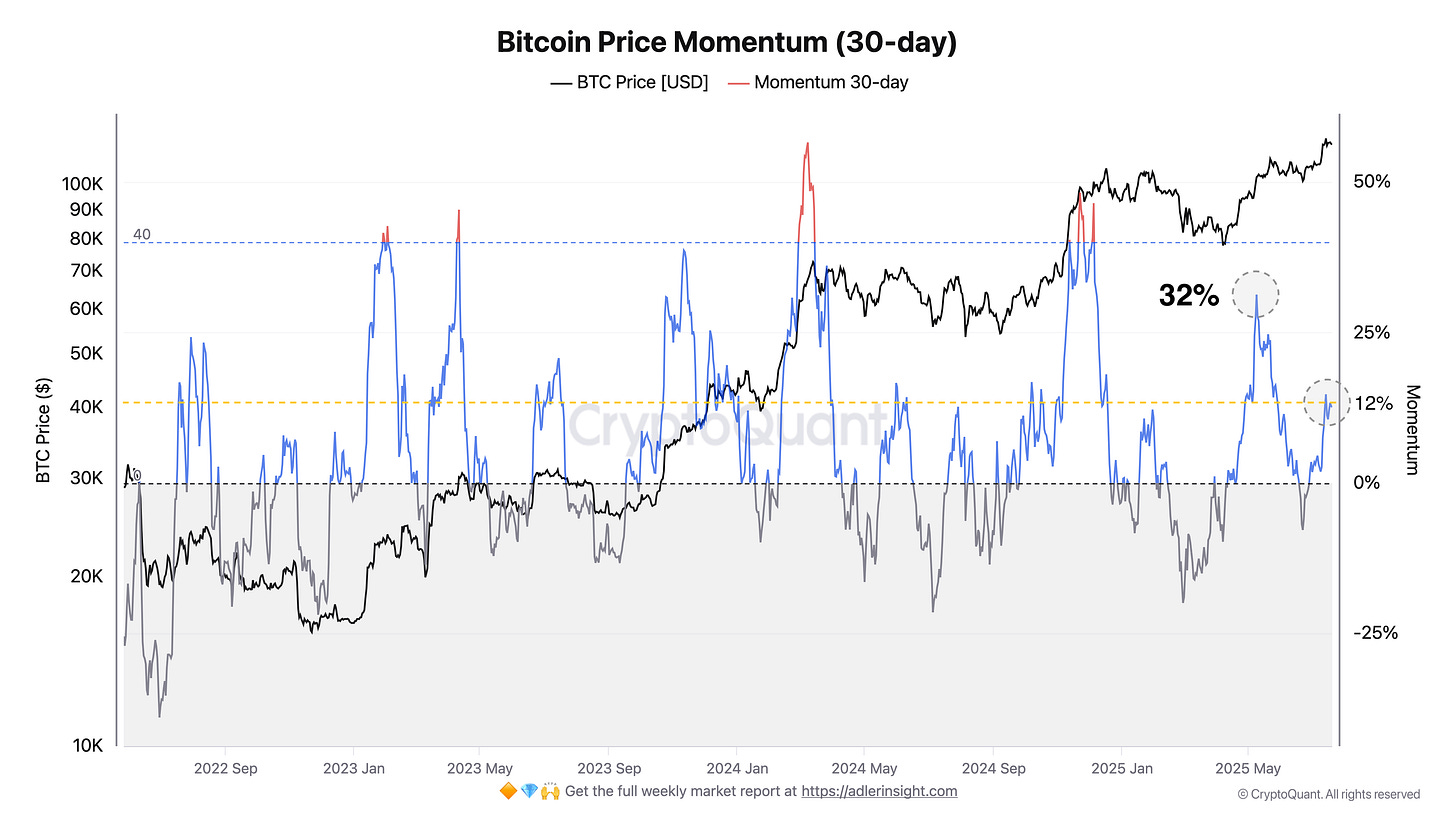

2. Bitcoin Price Momentum (30-day)

This week's analysis

This week 30-day momentum remained at +12% level, confirming preservation of current bullish dynamics without additional acceleration.

Conclusions

Momentum above zero (+12%) continues indicating buyer initiative and overall bullish sentiment.

Lack of momentum growth above 12% may indicate consolidation phase before next movement.

3. Options Analysis

Max Pain Price: $114,000

Expiration date: July 25, 2025

Market structure

Call options dominance (green bars):

Largest Call option volumes concentrated at strikes:$130,000 (≈ 110M)

$135,000 (≈ 125M)

$125,000 (≈ 90M)

$122,500 (≈ 80M)

$120,000 (≈ 70M)

This indicates continued active hedging of growth above new Max Pain.

Put options (red bars):

Main bearish protection lies in deep OTM strikes:$60,000 (≈ 120M)

$65,000 (≈ 100M)

$70,000 (≈ 80M)

$75,000 (≈ 70M)

$80,000 (≈ 60M)

Put volumes consistently decrease toward Max Pain mark and become minimal thereafter.

Comparative analysis with last week

Max Pain change:

Reference level shifted down from $115,000 to $114,000, indicating slight profit-taking at upper strikes.Volume dynamics:

Call: $130,000–$135,000 strikes added +10–15M, middle range $120,000–$125,000 — +5–10M.

Put: huge positions in $60,000–$70,000 zone decreased by –10–20M, and in $75,000–$85,000 range — by –5–10M, indicating weakening bearish protection.

Forecast

Bullish scenario:

Holding price above $114,000 and further Call volume growth may lead to testing $118,000–$120,000 zones, and with confident break - $125,000+.Bearish scenario:

Breaking $114,000 with simultaneous Put volume growth (> 1M) in $110,000–$112,500 area can return price to $108,000–$110,000, where main bearish protection is concentrated.

Bitcoin network data analysis for this week

1. Network Hashrate:

Previous Week: 935,269,743,815 EH/s

This Week: 891,330,896,790 EH/s

Change: 🔴 −4.70%

Comment: Hashrate decline (−4.7%) may be related to scheduled maintenance or capacity redistribution, however overall network security remains at high level.

2. Transfer Volume (7d):

Previous Week: 4,218,732 BTC

This Week: 5,552,202 BTC

Change: 🟢 +31.61%

Comment: Sharp transfer volume growth (+31.6%) indicates activation of large transactions and institutional on-chain activity.

3. Market Capitalization:

Previous Week: $2,336,438,673,540

This Week: $2,345,588,703,054

Change: 🟢 +0.39%

Comment: Small capitalization growth (+0.4%) reflects moderate liquidity inflow and support for current price levels.

4. Market Price:

Previous Week: $118,098.69

This Week: $117,919.76

Change: 🔴 −0.15%

Comment: Price corrected less than 0.2%, demonstrating high stability even with volatile on-chain metrics.

5. BTC Exchange Reserves:

Previous Week: 2,398,855 BTC

This Week: 2,401,209 BTC

Change: 🟢 +0.10%

Comment: Insignificant exchange reserve growth (+0.1%) may indicate short-term profit-taking, but overall long-term accumulation trend remains in force.

6. Number of Active Wallets (7d):

Previous Week: 8,767,754

This Week: 7,783,612

Change: 🔴 −11.22%

Comment: Active address decline (−11.2%) indicates retail position consolidation and reduced speculative activity.

Conclusions

Technical hashrate correction: 4.7% drop is not critical and likely temporary.

Institutional demand supports on-chain activity: +31.6% to transfer volumes with simultaneous wallet number decline.

Price stability: minimal price correction (−0.15%) with moderate capitalization growth (+0.39%) demonstrates balanced buying and selling pressure.

Small reserve increase: +0.1% to exchange balances may indicate short-term participant exit, however long-term accumulation preserved.

Price Analysis

Bitcoin TrendPulse

Since May 2024, bitcoin market has been in clear "aggressive" trend, when both short-term and medium-term dynamics coincide. From TrendPulse calculation query it's evident that 14-day returns consistently remain above zero, while 30-day moving average confidently holds above 200-day. As result, practically every day is marked as "Aggressive Mode" (purple color on TrendPulse chart), indicating simultaneous presence of bullish momentum and sustained uptrend.

Meanwhile, single "moderate" signals (blue bars) appeared in June during light corrections, when short-term momentum temporarily sags but medium-term trend remains positive.

In TrendPulse context, such signal combination means optimal trend-following strategy is now optimal: moderate regime corrections can serve as averaging points, while aggressive phases confirm market readiness to continue growth.

Bitcoin Power of Trend (ADX) 2.0

On Power of Trend (ADX) chart we see that after trend strength fading in mid-June, ADX rose again reaching 43% mark - classic signal of strong trend momentum resumption. At $117K level BullAlert triggered (green mark), indicating fresh bullish reversal and upward wave continuation.

Power of Trend (ADX) construction methodology involves classic calculation of directional indicators (+DI and −DI) and subsequent smoothing through double moving average, after which ADX itself is calculated as 14-day SMA of DX. TrendActive signal (ADX > 25%) defines sustained trend zones, while BullAlert and BearAlert capture first +DI/−DI crossovers at ADX > 25%, indicating bullish or bearish wave resumption. In current cycle ADX rose to 43%, accompanied by BullAlert at $117,000 level - clear confirmation of growing upward momentum.

On-chain metrics

Bitcoin Exchange Inflow

Current Trend line, reflecting smoothed 24-day moving average of daily exchange inflow volume, demonstrates sustained decline - from peaks above 90,000 BTC in March 2024, its value consistently dropped to 82,000 in October, to 40,000 in April 2025 and now stands at 20,000 BTC level. Meanwhile, trend dropped below annual SMA365 (blue dashed line), putting it in "red zone" and signaling that daily exchange arrivals are notably below long-term average.

Such downward trend coincides with phases of reduced player selling and supply pressure softening on market. Since less BTC goes to exchanges, this creates favorable base for further growth and maintaining current levels.

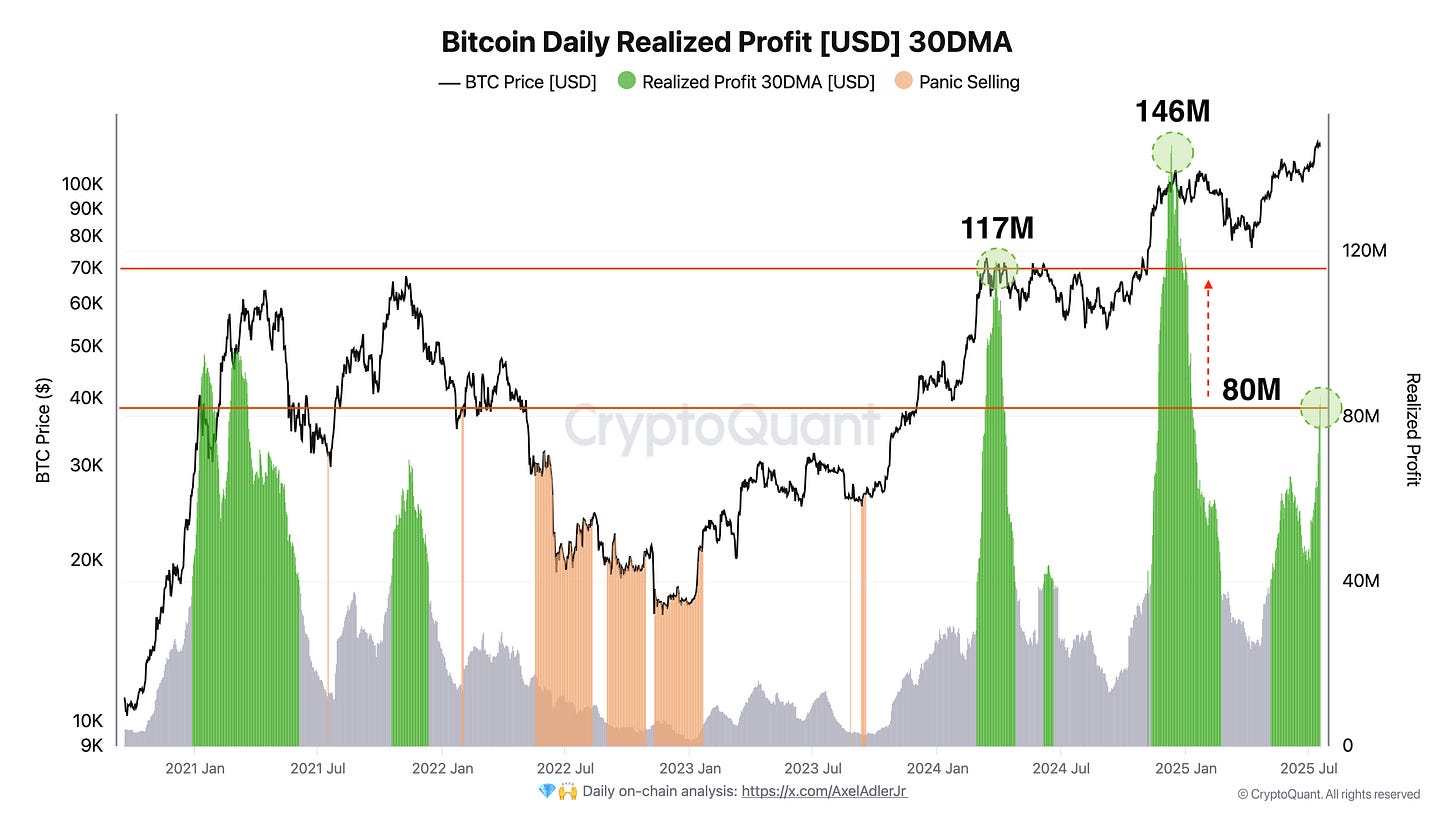

Bitcoin Daily Realized Profit [USD] 30DMA

Daily realized profit metric (30-day moving average) demonstrates clear cyclicality: in March 2024 it jumped to 117 million USD mark, after which price correction of 10–15% from local maximum followed. Even brighter spike was observed in December 2024, when profit grew to record 146 million USD, coinciding with new peak and subsequent sideways movement.

Currently 30DMA realized profit approaches 80 million USD level - notably above average value (~38 million), but still far from year's extremes. This indicates market participants are already more actively taking profits, however selling hasn't reached peak values characteristic of full reversal periods. Price holds above $110K, while moderate profit growth indicates uptrend preservation with smooth position distribution.

Conclusion

Combination of strong US macro data on consumer spending and stable labor market while simultaneously cooling inflation expectations forms rare "golden window" for risk assets: fundamental demand is supported while policy tightening threat decreases. For Bitcoin this manifests in price holding at upper ranges after updating local high, with volatility compression and gradual exchange inflow reduction - classic signature of redistribution phase before potential trend continuation. Option positions shift toward higher Call strikes, while on-chain structure (volume growth with active address decline) hints at institutional nature of current flows. Realized profit increases but remains below historical extremes, indicating incomplete bullish distribution cycle.

Risks concentrate around US–EU tariff agenda and possible large whale selling, locally critical support levels $115.7K / $110K - their stability will preserve $123K break scenario and movement toward $125–130K. Support breaks with exchange reserve growth would shift balance toward deeper correction to $108–110K zone. In base scenario with preserved low inflows and neutral option pressure, consolidation above $116K serves as prelude to new upward range expansion attempt.

Next week forecast

Investment recommendations: 🟢 OUTPERFORM (Moderate Buy)

More details about rating can be found at this link: https://adlerinsight.com/Adler_Insight_Rating.pdf

Good luck in the upcoming trading week!

AAJ

Disclaimer:

This material has been prepared solely for informational purposes and does not constitute an offer, recommendation, or solicitation to buy or sell any securities, digital assets, or other financial instruments. The information presented in this report is considered reliable; however, its accuracy or completeness is not guaranteed. Past performance is not indicative of future results. Any investment decisions are made by the investor independently, taking into account personal financial circumstances and, if necessary, after consultation with a qualified professional. The author and affiliated parties may hold positions in the assets mentioned in this report. The author and publisher accept no responsibility for any direct or indirect losses arising from the use of this information.

Risks:

High volatility may lead to sharp fluctuations in value, adversely affecting investors' portfolios. Significant price swings may reduce the attractiveness of BTC to institutional investors, especially in the derivatives segment (futures, options). Potential tightening of regulatory requirements by governments and central banks may restrict access to BTC markets and reduce liquidity. Issues with custodial services, centralized exchanges, and hacking incidents could undermine confidence in the asset and negatively impact liquidity.