Bitcoin Trends – W4.2 June 2025

Whales are aggressively moving large volumes onto CEX exchanges, preparing for distribution.

TL;DR:

Supply deficit, growing whale dominance on CEX exchanges and bullish options shift outweigh macro uncertainty. As long as BTC holds $108K, the base scenario is upward movement with targets at $112K.

Macroeconomics for the past week

Priority: High

US Personal Spending (May 2025): –0.1% m/m

Conclusion: The first decline since January indicates a restraining effect of tariffs and general uncertainty on consumer demand. The drop in goods spending (–0.1%) combined with slower growth in services (+0.1%) may slow GDP and increase household caution.

PCE Price Index (May 2025): +0.1% m/m; core +0.2%

Conclusion: Acceleration of core inflation to +0.2% (exceeding expectations) signals persistent pressure on service prices and may delay the start of Fed monetary policy easing, despite moderate overall inflation slowdown to 2.3% y/y.

US Current Account Deficit (Q1 2025): –$450.2 billion

Conclusion: The 44% quarterly expansion of the deficit, mainly due to increased imports of oil and pharmaceuticals, increases pressure on the dollar and questions the sustainability of external economic balance amid slowing export growth.

Eurozone Economic Sentiment Indicator (ESI) (June 2025): 94.0

Conclusion: The fall to a six-month low, driven by weak confidence in industry and retail, reduces hopes for accelerating economic activity in the eurozone and increases risks of further growth weakening.

Priority: Moderate

US Dollar Index (DXY): 97.2

Conclusion: The halt of the decline at a three-year low reflects a balance between expectations of Fed rate cuts and geopolitical risks; staying near the support level may limit further strengthening of other currencies.

US Goods Trade Deficit (May 2025): –$96.6 billion

Conclusion: The 11% expansion of the deficit due to declining exports of industrial materials and food, while imports stabilized under tariff policy pressure, exacerbates the burden on the foreign trade balance.

US Durable Goods Orders (May 2025): +16.4% m/m

Conclusion: Record growth since 2014 is largely due to "forward" demand for transportation equipment ahead of expected tariff increases, creating a temporary buffer for the manufacturing sector.

US GDP (Q1 2025): –0.5% annualized

Conclusion: The larger-than-expected GDP contraction (revised down from –0.2%) underscores weakness in consumption and exports, despite sustained investment growth, and strengthens arguments for further Fed policy easing.

The combination of falling consumer spending and tighter Fed signals on inflation creates short-term pressure on risk assets: stocks may remain under pressure due to weak GDP and expanding trade deficit, while the dollar will likely maintain support due to forecasts of prolonged monetary policy "tightness." Nevertheless, the record surge in durable goods orders and expectations of two Fed rate cuts later this year, along with escalating geopolitics, will push some capital into more speculative instruments, including bitcoin, which in such an environment may show high volatility, reacting to the balance between investor risk appetite and the search for a "safe haven."

Stock market for the past week

Priority: High

S&P 500 and Nasdaq 100 closed at historic highs

Conclusion: The S&P 500 index gained 0.5% on Friday, breaking through the February peak, while the Nasdaq 100 rose 0.5%. Markets were supported by optimism around framework trade agreements with China and growing expectations of Fed rate cuts, despite Trump's unexpected announcement about suspending negotiations with Canada.

European stocks rose sharply

Conclusion: STOXX 50 closed with a 1.5% gain, STOXX 600 +1.1% on the wave of positive expectations regarding softer US tariff policy and progress in negotiations. Growth leaders were industrial companies (Siemens +6.5%, Schneider +3.6%, automakers +4–5%).

Priority: Moderate

Corporate drivers: Nike, Amazon, Nvidia and Microsoft

Conclusion: Nike soared 13% after a strong report, Amazon rose to +1.1% on a rating upgrade, Nvidia (+1.7%) and Microsoft set new highs, highlighting the continued strength of the technology sector amid easing inflation concerns.

Ignoring geopolitical "noise" and fiscal rhetoric

Conclusion: While Trump mentioned suspending negotiations with Canada and tensions over tariffs persist, investors focused on the broader "bullish" momentum, ignoring individual political statements in favor of global macrotrends.

Week results

S&P 500 +0.8%

Nasdaq 100 +1.0%

Dow Jones +0.9%

Markets ended the week with gains: optimism about trade agreements and prospects for Fed rate cuts compensated for individual political risks.

Next week

Trade negotiations: end of the 90-day US tariff moratorium (July 9) and dialogue development with key partners.

ECB Forum and J. Powell testimony: leaders will discuss economic prospects and monetary policy.

Key US data: employment reports, PCE, industrial goods orders, goods balance, ISM PMI (manufacturing/services).

Global indicators: flash PMI for US, eurozone, Japan and India, eurozone inflation, Tankan in Japan, Australia trade data.

Given the continuing uncertainty over Fed monetary policy and the revival of trade negotiations, bitcoin will likely continue to show increased volatility, reacting to every signal about potential easing or tightening of monetary policy. On one hand, expectations of two rate cuts by year-end and capital flight to alternative assets amid geopolitical risks will support BTC, on the other hand - strengthening stock indices amid optimism about trade agreements may pull some speculative funds back into stocks. As a result, we may see short-term corrections at the beginning of next week, followed by attempts to break new local highs, especially if Powell's speech confirms a more "benevolent" Fed mood.

Important news of the past week

Priority: High

Ripple withdraws cross-appeal and pays $125 million fine, ending nearly five years of litigation with the SEC after the court refused to reconsider the settlement.

Fed stops supervision of "reputational risk", easing requirements for crypto banking and paving the way for broader institutional adoption of digital assets.

Coinbase announced BTC and ETH nano futures with five-year terms and 24/7 trading - the first perpetual contracts in regulated US jurisdiction.

Kraken received MiCA license in Ireland, allowing it to offer fully regulated crypto services in 30 European Economic Area countries.

Texas signed SB 21 law and became the third US state with an official bitcoin reserve, investing state budget funds in BTC.

Priority: Moderate

Gemini launched tokenized stocks on Arbitrum for EU users and plans to expand support for new assets and networks.

Metaplanet acquired 1,234 BTC for $133 million, bringing total reserves to 12,345 BTC and surpassing Tesla's reserves (11,509 BTC).

Anthony Pompliano's ProCap BTC bought another 1,208 BTC, increasing balance to 4,932 BTC before going public through a $1 billion SPAC.

Arizona House of Representatives passed HB 2324 to create a reserve crypto fund based on seized digital assets, the law awaits governor's signature.

Priority: Low

World Liberty (backed by Trump) sold $100 million WLFI tokens to UAE's Aqua1, strengthening Middle East ties.

Conclusions

Regulatory shift is gaining momentum: after the Ripple settlement and removal of Fed "reputational" requirements, clarity emerges for banks and issuers, while the MiCA license and Coinbase perpetual futures launch give a "green light" to new products.

States continued experiments with BTC reserves - Texas has already invested in bitcoin, Arizona is preparing its own confiscated asset fund, demonstrating growing interest in "treasury" use of cryptocurrencies at the government level.

In the corporate sector, diversification is happening: from Gemini stock tokenization and active purchases by Metaplanet and ProCap to World Liberty regional deals in the UAE. These steps confirm the preservation of the trend at institutional levels.

Bitcoin trading week macro analysis

1. BTC/USD pair analysis

Key indicators for the week

Current price: $108.1K

Local maximum: $108.3K

Local minimum: $99.6K

Trend

This week BTC bounced from the $98.2K low, then smoothly climbed to the $108.3K level. In recent days, narrow consolidation is observed in the $107K–$108K range with declining volumes - this is a sign of profit-taking and position accumulation before the next move.

Conclusions

Key resistance: $108.3K

Breaking this level on increased volumes could open the way to new highs around $112–$115K.Local support: $104K

Holding this boundary will maintain growth momentum and reduce the risk of sharp pullback.Strong base support: $100K

Psychologically important level.

2. Bitcoin Price Momentum (30-day)

Analysis for this week

This week, Bitcoin's 30-day momentum recovered from negative territory and consolidated at 0%. After falling to –7.8%, we saw gradual smoothing of bearish pressure and momentum's return to the neutral mark.

Conclusions

Momentum at zero (0%) indicates balance between buyers and sellers: bearish reversal has stopped, but bullish momentum is not yet sufficient for confident growth.

Neutral zone usually precedes either continued consolidation or a breakout in either direction when a new catalyst appears.

For resuming sustainable growth bulls need to raise momentum above 10% and consolidate in positive territory, which will require significant inflow of new bullish volumes.

3. Options analysis

Max Pain Price: $106,000

Expiration date: July 4, 2025

Market structure

Predominance of Call options (green bars):

Demand is concentrated above the Max Pain level ($106K):$130K (~11M)

$127.5K (~8.5M)

$125K (~7M)

$122.5K (~6M)

$120K (~5M)

Put options (red bars):

Main protection - in the $85K–$95K range:$85K (~15M)

$87.5K (~10M)

$90K (~8M)

$92.5K (~7M)

$95K (~6M)

Above $97.5K, Put volumes drop sharply (< 1M), indicating weak bearish protection closer to current price.

Comparative analysis with previous week

Max Pain change:

Rose from $100K to $106K, reflecting a shift in interests toward higher strikes.Volume dynamics:

Call: peak strikes $125K–$130K added about +3M each, middle range ($120K–$122.5K) - about +1–2M.

Put: volumes in the $85K–$90K zone decreased by –2–3M, and closer to $95K–$100K decreased by –1–2M.

Forecast

Bullish scenario:

Holding the $106K level with further growth in Call volumes may lead to testing the $110K zone.Bearish scenario:

Breaking $106K and building Put volumes (> 1M) in the $102K–$104K range could return price to the $100K–$102K area, where the main "bear" protection is concentrated.

Bitcoin network data analysis for this week

1. Transfer Volume (7d):

Previous Week: 3,449,012 BTC

This Week: 3,956,500 BTC

Change: 🟢 +14.71%

Comment: Significant growth in transfer volumes (+14.7%) indicates revival of on-chain activity, due to institutional and large retail transactions.

2. Network Hashrate:

Previous Week: 886,036,476,241 EH/s

This Week: 911,172,262,801 EH/s

Change: 🟢 +2.84%

Comment: Moderate increase in hashrate (+2.8%) reflects an influx of computing power to the network, strengthening its security.

3. Number of Active Wallets (7d):

Previous Week: 7,890,742

This Week: 7,409,477

Change: 🔴 −6.10%

Comment: The 6.1% decrease in address activity indicates a continuing consolidation phase: most participants have switched to long-term holding and make transfers less frequently.

4. Market Price:

Previous Week: $103,353.84

This Week: $107,108.71

Change: 🟢 +3.63%

Comment: Price grew by 3.6%, updating local highs: the market is experiencing slight bullish momentum.

5. BTC Exchange Reserves:

Previous Week: 2,348,403 BTC

This Week: 2,318,815 BTC

Change: 🔴 −1.26%

Comment: Continuing outflow from exchanges (−1.3%) strengthens long-term accumulation and reduces the volume of liquid reserves.

6. Market Capitalization:

Previous Week: $2,031,074,893,266

This Week: $2,134,657,250,024

Change: 🟢 +5.10%

Comment: The 5.1% growth in capitalization confirms bullish sentiment.

Conclusions

Revival of on-chain activity: +14.7% in transfer volumes while simultaneously reducing the number of active wallets (−6.1%) indicates consolidation of large participants and institutional demand.

Network strengthening: hashrate growth (+2.8%) increases network security and stability.

Bullish momentum returns: price (+3.6%) and capitalization (+5.1%) update levels, supporting investor optimism.

Long-term accumulation continues: outflow from exchanges (−1.3%) reduces supply for sale and creates a foundation for further growth.

On-chain metrics

Difference Liquidity: Bitcoin Inflow - Stablecoin Inflow 30DMA

Currently, the 30-day MA of the metric has gone into negative value, reflecting "Demand Generation" (blue zones on the chart). In its amplitude and character, this shift almost exactly repeats the market reaction after the Terra/LUNA collapse in May 2022 (first green circle) - when participants, frightened by the algorithmic stablecoin crash, bought Bitcoin. Before this, the only similar case throughout the entire bear cycle was the demand growth after the FTX collapse in November 2022 (lower green circle) - the moment when the sell-off phase ended and a turn toward a new bull wave began.

Therefore, the current dynamics of the metric are particularly important: if the inflow of stablecoins to exchanges continues at the level or exceeds what we observed after LUNA and FTX, this will be a strong signal for launching the next Bitcoin rally.

Bitcoin New UTXO

Previously, when Bitcoin was trading in the $60–70K range, the 30-day SMA of new UTXOs confidently grew to ~1M+ outputs per day (green rectangle on the chart). This indicated an influx of fresh participants and high network activity. At the peak of the last rally, at a price of $90–100K, there was a second spike in New UTXO – SMA reached ~850–900K, confirming sustained demand from new and existing addresses (second green rectangle).

Now, despite the price being around $100K again, New UTXO SMA has fallen to ~570K - this is almost half the level during the first rise to $60–70K and more than a quarter below the peaks at $90–100K. Such divergence between price and network activity indicates a strong HODL mode, which is confirmed by the previous metric.

Before the finale of a limited but sustained network rise, it would be enough to see New UTXO growth to the 700,000 level (plus ~23% from current). If there's a stronger bull rally, as happened in spring 2024 (plus ~54–75%), SMA should return to the 875,000–1,000,000 outputs zone.

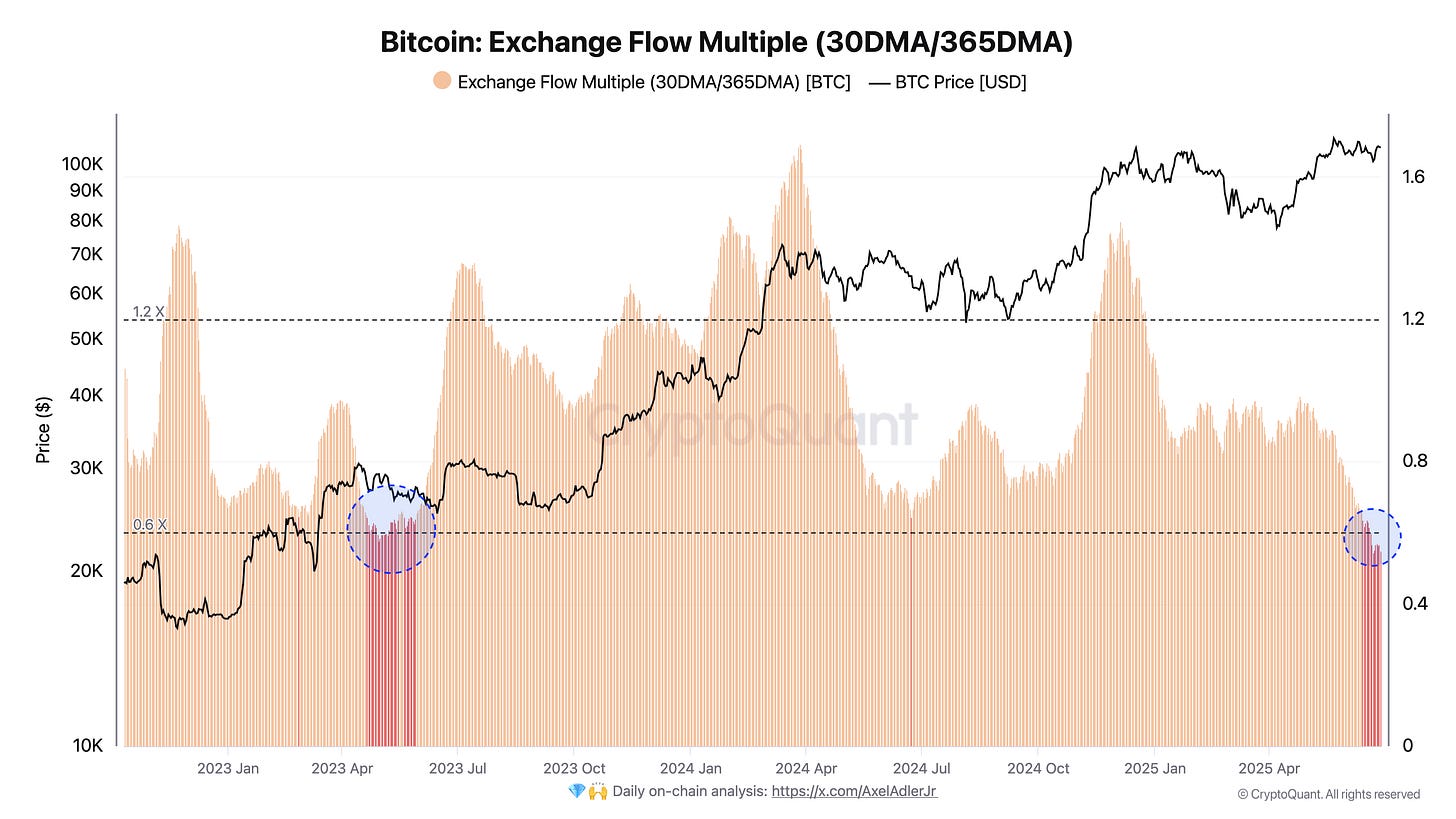

Bitcoin: Exchange Flow Multiple (30DMA/365DMA)

Over the last 15 days, the Exchange Flow Multiple value (30-day MA of BTC inflow to exchanges to 365-day MA) fell from marks close to 1.0× to current ~0.6×. In other words, on average 40% fewer coins are flowing to exchanges than was characteristic over the past year. This is a sustained decrease in short-term inflows over the past year and a half – similar minimums we saw only in April 2023. Extreme weakening of coin inflow traditionally signals exhaustion of active sellers. Historically, it was precisely after such Exchange Flow Multiple collapses that price reversals and transitions to new bull rallies were observed. Low BTC inflow creates a deficit of liquidity for sale and becomes the foundation for further price strengthening.

Bitcoin Top 10 Exchange Large Transaction Dominance

Against the backdrop of general weakness in exchange inflows (Exchange Flow Multiple) and New UTXO minimums, the share of large transactions to exchanges is growing back to historical maximums of ~96% (currently marked by the blue rectangle). This means that despite the absence of massive inflow from small holders, "whales" are still loading coins onto platforms - they concentrate almost the entire volume of incoming flow to CEX exchanges.

Similar spikes in large transaction dominance we saw in mid-2023 and January–March 2024, each time before strong price movements: first to $30–32K, then to $65–70K. High concentration of "whales" on exchanges with general liquidity deficit indicates preparation for distribution. Essentially, large players are currently preparing for the next phase of a bull rally.

Conclusion.

At the intersection of macro factors and on-chain signals, a setup has formed. On one hand, the foundation for growth is strengthening: liquidity deficit is intensifying (Exchange Flow Multiple fell to ≈0.6х), exchange reserves continue to decline, and the negative difference between BTC and stablecoin inflows has historically preceded volatility. Meanwhile, large transaction dominance on CEX is approaching 96% - meaning whales, not the crowd, are forming the coin flow. Usually they "flood" volumes onto exchanges in advance to have the ability to distribute at higher prices, so breaking the $109K zone on increased volumes could quickly pull price to $112–115K, where peak call strikes of options are concentrated.

On the other hand, the macroeconomic picture doesn't yet give a clear signal. The fall in personal spending and unexpected Q1 GDP minus increase the risk of risk-asset correction, but accelerating core inflation keeps the Fed from quick action. The market is betting on two rate cuts by year-end; any "dovish" remark by Powell at the ECB forum or soft data block - especially on ISM and employment - will become a breakthrough catalyst. Conversely, a tough tone (amid expanding trade deficit) could provoke whale profit-taking and a pullback to $104K, and with increased put volume flow - to psychological $100K.

As a result, the coming week will likely pass under the sign of increased volatility within the $104K–$112K range. Watch for (1) stablecoin inflow dynamics: maintaining "Demand Generation" will confirm the market's readiness to absorb distribution volumes, (2) New UTXO growth above ~700K: this will signal fresh inflow of new players; (3) DXY index reaction - a weak dollar traditionally strengthens interest in BTC. While structural supply deficit and whale speculative appetite outweigh macro uncertainty, the base scenario remains testing the upper range boundary of $112K with favorable news.

Forecast for next week

Investment recommendations: 🟢 OUTPERFORM (Accumulate)

More details about the rating can be found at this link: https://adlerinsight.com/Adler_Insight_Rating.pdf

Good luck in the upcoming trading week!

AAJ

Disclaimer:

This material has been prepared solely for informational purposes and does not constitute an offer, recommendation, or solicitation to buy or sell any securities, digital assets, or other financial instruments. The information presented in this report is considered reliable; however, its accuracy or completeness is not guaranteed. Past performance is not indicative of future results. Any investment decisions are made by the investor independently, taking into account personal financial circumstances and, if necessary, after consultation with a qualified professional. The author and affiliated parties may hold positions in the assets mentioned in this report. The author and publisher accept no responsibility for any direct or indirect losses arising from the use of this information.

Risks:

High volatility may lead to sharp fluctuations in value, adversely affecting investors' portfolios. Significant price swings may reduce the attractiveness of BTC to institutional investors, especially in the derivatives segment (futures, options). Potential tightening of regulatory requirements by governments and central banks may restrict access to BTC markets and reduce liquidity. Issues with custodial services, centralized exchanges, and hacking incidents could undermine confidence in the asset and negatively impact liquidity.