Bitcoin Trends – W4.2 March 2025

Stock market turbulence in the US, inflation, and Bitcoin at a crossroads – where will BTC head in Q2 2025?

TL;DR:

US stock markets are falling again amid rising inflation and trade tensions, investors are fleeing risk, and the crypto market has stalled in consolidation. Institutional players continue accumulating Bitcoin, but short-term investor activity is declining. Learn which levels BTC is preparing to test over the next 90 days.

Macro Economy Over the Past Week

Priority: High

1. Rising Inflationary Pressure in the US

PCE Index: The core Personal Consumption Expenditures (PCE) price index increased by 0.4% in February 2025, the strongest rise since January 2024:

Surpassing analyst forecasts (expected 0.3%).

On an annual basis, core PCE climbed to 2.8%, above the previous figure and forecasts of 2.7%.

Price Pressure:

Commodity prices rose by 0.2% (lower than January’s 0.5%).

Service prices increased by 0.4% (higher than January’s 0.2%).

Long-term inflation expectations reached their highest level since 1993, according to the University of Michigan survey.

2. Decline in US Stock Markets

Index Declines:

The S&P 500 dropped by 2%.

The Dow Jones lost 715 points.

The Nasdaq 100 fell by 2.7%.

Downfall Leaders: Tech giants – Alphabet, Amazon, and Meta lost over 4%, while Microsoft declined by 3%.

Weekly Results: Both the S&P 500 and Nasdaq recorded their fifth weekly drop in six weeks, losing over 1% and 2% respectively.

Priority: Medium

1. Decline in US Government Bond Yields

Market Movement: The yield on 10-year US Treasury bonds fell by roughly 8 basis points to a level below 4.29%, retreating from monthly highs.

Reasons:

Growing concerns over the US economic outlook.

Worries about the impact of the trade war.

Mixed economic data: weak spending growth amid rising core inflation.

Fed Expectations: Traders continue to forecast a 25 basis point rate cut in July.

2. Deteriorating Economic Sentiment in the Eurozone

Indicator Decline: The economic sentiment indicator in the Eurozone dropped to 95.2 in March, the lowest level in three months (previous: 96.3, forecast: 97).

Sectoral Changes:

A significant drop in confidence in the services sector (2.4 versus 5.1).

Declines in retail (-6.8 versus -5.1) and among consumers (-14.5 versus -13.6).

Relative stability in manufacturing and construction.

Regional Differences: Marked declines in France (-2.1) and Italy (-2.0), improvements in Spain (+1.1) and a slight increase in Germany (+0.3).

Conclusions on the Impact of Macro Events on Bitcoin

Rising Inflationary Pressure:

The core PCE index rising above expectations and the increase in long-term inflation expectations create a dual scenario for Bitcoin. On one hand, these factors strengthen the narrative of Bitcoin as an inflation hedge. On the other hand, they force the Fed to refrain from cutting rates, which puts pressure on all risky asset classes, including cryptocurrencies. Overall, under current conditions, the inflation factor has a more negative than positive effect due to the dominant tightening of credit conditions.Decline in Stock Markets:

The drop in US indices, particularly in the tech sector, could lead to increased correlation between Bitcoin and risky assets. In the short term, this increases the risk of Bitcoin’s price falling due to the overall retreat from risk.Trade Wars and Global Uncertainty:

The upcoming implementation of new tariffs on April 2 and fears of possible retaliatory measures from trading partners are heightening geopolitical tensions, which could boost demand for alternative assets, including Bitcoin.Overall Summary:

The combination of rising inflationary pressure, stock market declines, and escalating trade conflicts creates a volatile environment for Bitcoin in the short term. Despite its potential as an inflation hedge in times of trade wars, in the near term, negative factors are more likely to prevail due to investors fleeing risk and tighter monetary conditions.

Upcoming Events

Next week, investors should pay attention to the implementation of reciprocal tariffs on April 2, including a 25% duty on automobiles. Key data will include the US employment report (expected to add 128K jobs versus 151K in February) and an increase in unemployment to 4.2%. The focus will also be on ISM business activity indices, which will indicate the state of the private sector. Special attention should be given to speeches from Fed representatives, including Chair Jerome Powell, for signals on future monetary policy. From international data, important indicators will include PMI indices for China, Japan’s Tankan business survey, and preliminary inflation data for the Eurozone.

Key News of the Past Week

Priority: High

FDIC Allows Banks to Work with Cryptocurrency Without Prior Approval

Conclusion: The reversal of the previous policy and the promise to provide additional guidance signal a significant easing of the regulatory approach to the interaction of traditional financial institutions with cryptocurrencies, potentially accelerating institutional integration.

Bitcoin Dominance Rises to 58%, the Highest Since May 2021

Conclusion: The halt in altcoin rotation despite favorable conditions and an inflow into ETFs indicates the strengthening of Bitcoin’s position as the primary crypto asset and market consolidation around it.

GameStop Raises $1.3 Billion for Bitcoin Purchases

Conclusion: The decision by a major public company to raise substantial funds through convertible bonds and adopt BTC as a treasury reserve asset demonstrates a growing trend of corporate accumulation of Bitcoin as a strategic asset. Investors from the Reddit community have yet to fully appreciate the potential of this strategy, and the company’s shares fell by 12.2%.

SEC’s Crypto Task Force to Hold Four Roundtables

Conclusion: The initiative to discuss issues related to DeFi, custody, and tokenization from April to June shows the regulator’s intent to develop clearer crypto regulations, which may reduce uncertainty for market participants.

Crypto.com Reports SEC Investigation Closed Without Charges

Conclusion: The exoneration of yet another crypto firm under the new administration signals a softening of the regulator’s stance and the formation of a more favorable environment for crypto businesses.

BlackRock Launches iShares Bitcoin ETP in Europe

Conclusion: The entry of the world’s largest asset manager into the European market with a low-fee (0.15%) Bitcoin product confirms the global trend towards integrating cryptocurrencies into traditional investment instruments.

Strategy Acquired 6,911 BTC for $584 Million

Conclusion: The increase in total assets to 506,137 BTC confirms Strategy’s consistent approach in executing its Bitcoin accumulation strategy and may encourage other companies to follow suit.

North Carolina Proposes Allocating Up to 5% of Pension Funds to Cryptocurrency

Conclusion: Legislative initiatives to include cryptocurrencies in state pension funds reflect the growing recognition of crypto assets as a legitimate class of institutional investments.

BlackRock’s Tokenized BUIDL Fund Triples to $1.87 Billion

Conclusion: The significant short-term growth reflects investors’ trend toward shifting to safer tokenized real-world assets (RWAs) amid a slowdown in Bitcoin’s growth.

Tokenized Real-World Assets (RWAs) are digital tokens backed by traditional assets such as Treasury bonds, real estate, or commodities. They combine the safety of traditional assets with the efficiency and liquidity of blockchain technologies, making them attractive to investors seeking stability in the crypto space.

Priority: Moderate

UAE Plans to Launch a Digital Dirham in Q4 2025

Conclusion: Plans to launch a national digital currency aimed at enhancing financial stability and combating crime reflect the global trend towards the adoption of state-backed digital currencies and modernization of financial infrastructure.

Terraform Labs Opens a Crypto-Creditors Claims Portal

Conclusion: Allowing users to submit claims in the bankruptcy proceedings until April 30 sets an important precedent in addressing insolvency issues within the crypto industry.

Ripple Signs Partnership Agreement with Chipper Cash

Conclusion: The collaboration to enable faster and cheaper cryptocurrency transfers across Africa demonstrates the growing importance of blockchain technology in emerging markets and its potential for financial inclusion.

Wyoming to Launch State-Backed Stable Token WYST in July

Conclusion: The creation of a stable token, backed by cash and US Treasury bonds, reflects an innovative approach by the state to financial technology and could serve as a model for other jurisdictions.

KULR Buys $5 Million Worth of BTC

Conclusion: The increase in crypto assets to 668.3 BTC valued at $59 million, following a treasury strategy similar to MicroStrategy, confirms the spread of the corporate Bitcoin accumulation model among public companies of various sizes.

eToro Files for IPO on Nasdaq

Conclusion: Plans to raise up to $400 million at a valuation of $4.5 billion after the platform increased its revenue indicate the growing interest of traditional investors in digital asset-related businesses.

CME Group Partners with Google Cloud to Test Tokenization

Conclusion: The partnership aimed at enabling faster, lower-cost settlements and 24/7 trading by 2026 demonstrates how blockchain technologies are penetrating the infrastructure of traditional financial markets.

Standard Chartered Proposes Replacing Tesla with Bitcoin in the “Mag 7” Index

Conclusion: The assertion by a major bank that such a replacement would boost yields and reduce volatility, along with classifying BTC as a tech asset, reflects the changing institutional perception of Bitcoin.

Fidelity Files to Launch a US Treasury Tokenized Fund

Conclusion: Joining the market for tokenized Treasury bonds worth $4.8 billion demonstrates the growing interest of traditional financial giants in blockchain technology to modernize fixed-income asset management.

Tether CEO Prioritizes a Full Audit

Conclusion: The push for a full audit by one of the Big Four firms following the appointment of a new CFO and delisting in the EU shows the largest stablecoin issuer’s move towards greater transparency and regulatory compliance.

Conclusions

The past week was marked by high activity in both the corporate and regulatory spheres. There is a significant strengthening of the trend of corporate Bitcoin accumulation, evidenced by the actions of companies such as Strategy and GameStop. At the same time, institutional integration is increasing through the launch of new investment products by BlackRock in Europe and considerations to include cryptocurrencies in state pension funds in North Carolina.

A notable trend has been the easing of regulatory pressure, reflected in the FDIC allowing banks to work with cryptocurrency without prior approval and the SEC closing its investigation into Crypto.com without charges. Simultaneously, moves towards greater regulatory clarity are underway through the planned SEC roundtables.

There is also a significant growth in interest in tokenized real-world assets, as seen by the threefold increase of BlackRock’s BUIDL fund and Fidelity’s filing to launch a tokenized US Treasury fund. This points to the formation of a new market segment that bridges traditional finance with blockchain technologies.

The rise in Bitcoin dominance to 58.8%, along with declining altcoin activity, indicates a possible market consolidation around the primary cryptocurrency under current macroeconomic conditions. Bitcoin continues to strengthen its position as a strategic reserve asset for corporations and institutional investors.

Bitcoin Trading Week Macro Analysis

1. Analysis of the BTC/USD Pair

Current Price: ~$83.2K

Local Low: $81.6K

Local High: $88.7K

Trend: After reaching the $88.7K level, a correction occurred, and the price dropped to a local low of $81.6K. The current price has recovered to $83.2K, which may indicate the beginning of a new upward movement. The market is showing low volatility with signs of consolidation.

Volumes: Trading activity remains relatively low, with no significant volume surges. This indicates market participants’ indecision and a potential accumulation phase before the next significant move.

Conclusions:

The $88.7K level acts as a key resistance.

$81.6K serves as the local support level.

$76.7K remains a strong base support level for the current correction phase.

Consolidation in the $82K–$84K range may precede a new price movement.

2. Options Analysis

Max Pain Price: $86,000

Expiration Date: April 4, 2025

Market Structure:

Call Options Prevalence: There is a moderate increase in the aggregate intrinsic value of call options (green bars) above the $90,000 level, with a peak concentration around $100,000–$110,000. This indicates bullish sentiment among traders expecting a price rise in the near future.

Put Options: Concentrated mainly in the $65,000–$80,000 range (red bars), with a peak around $65,000–$70,000. This suggests that traders do not expect the price to fall below $65,000, and the current level of $83.2K is perceived as relatively stable.

3. Comparative Analysis with the Previous Week

Price Change: Over the week, the price fell from $84.3K to $83.2K, a correction of approximately 1.3%.

Max Pain Change: The Max Pain level dropped from $90,000 to $86,000, which may indicate a slight decrease in bullish expectations.

Volume Dynamics: There is a continued trend of declining volumes, consistent with a market consolidation phase.

4. Forecast

In the short term, continued consolidation in the $81.6K–$88.7K range is likely, with a possible test of the $86,000 (Max Pain) level closer to the April 4 expiration.

The current structure of the options market shows significant dominance of call options above $90,000, indicating sustained bullish sentiment among traders.

Relatively low trading volumes suggest accumulation ahead of a potential impulsive move. A break above the consolidation range could trigger a rapid move towards $90,000–$95,000.

Key support levels ($81.6K and $76.7K) should hold the price in case of a downward impulse; however, a break could lead to a deeper correction towards the $70,000–$75,000 range, where significant put option volume is concentrated.

The decline in Max Pain from $90,000 to $86,000 compared to the previous week reflects a slight adjustment in market expectations but does not change the overall bullish character of the options market.

Analysis of Bitcoin Market Data

1. Number of Active Wallets (7d):

Previous Week: 8,749,366

Current Week: 8,335,384

Change: 🔴 -4.73%

Commentary: The decrease in the number of active wallets indicates a slight reduction in user activity, suggesting that Bitcoin users are moving into a holding mode as the market consolidates.

2. Network Hashrate:

Previous Week: 836,247,313,820 EH/s

Current Week: 797,343,217,389 EH/s

Change: 🔴 -4.65%

Commentary: The drop in hashrate suggests that some miners may temporarily scale back operations, possibly due to profitability calculations following the recent price movement.

3. BTC Reserves on Exchanges:

Previous Week: 2,450,777 BTC

Current Week: 2,420,848 BTC

Change: 🔴 -1.22%

Commentary: The slight decrease in exchange reserves indicates a modest outflow of Bitcoin from exchanges, potentially pointing to a preference for long-term holding over immediate trading.

4. Transfer Volume (7d):

Previous Week: 3,216,554 BTC

Current Week: 3,579,881 BTC

Change: 🟢 +11.30%

Commentary: A substantial increase in transfer volume, despite fewer active wallets, suggests larger transactions are being made, indicating institutional activity or “whale” movements.

5. Market Capitalization:

Previous Week: $1,663,494,995,578

Current Week: $1,639,846,870,807

Change: 🔴 -1.42%

Commentary: A moderate decrease in market capitalization reflects a slight drop in Bitcoin’s price, but it remains within a consolidation range, indicating market stability.

6. Market Price:

Previous Week: $84,791.23

Current Week: $83,212.13

Change: 🔴 -1.86%

Commentary: Bitcoin’s price experienced a minor correction but remains within the $80,000–$85,000 range, suggesting a phase of consolidation after recent historic highs.

Conclusions:

Institutional Activity: The combination of fewer active wallets but higher transfer volumes suggests that larger players are moving funds, while retail activity has somewhat diminished.

Consolidation Phase: Bitcoin remains in a phase of consolidation with moderate price movement, indicating that the market is digesting recent purchases before determining its next directional move.

Supply Dynamics: The ongoing slight outflow from exchanges supports the view of long-term accumulation despite the minor price correction.

On-Chain Metrics

Bitcoin: Growth Rate 365DMA

The chart shows the relationship between Bitcoin’s market capitalization and its realized capitalization using the 365-day moving average of their difference (delta).

A negative delta (orange areas) indicates periods when Bitcoin’s market price fell below what investors, on average, paid for their coins (realized price). This occurs during market corrections or bear markets when sentiment turns negative and selling pressure intensifies. The current negative delta zone (circled in blue) is less extreme than previous bear market cycles (as in 2018-2019 and 2022-2023), suggesting a milder cooling phase rather than a severe capitulation.

Essentially, the metric shows the ratio between the current market valuation and the actual cost basis of Bitcoin holders. The current moderately negative delta suggests that we are experiencing a correction within a larger uptrend, rather than the start of a prolonged bear market.

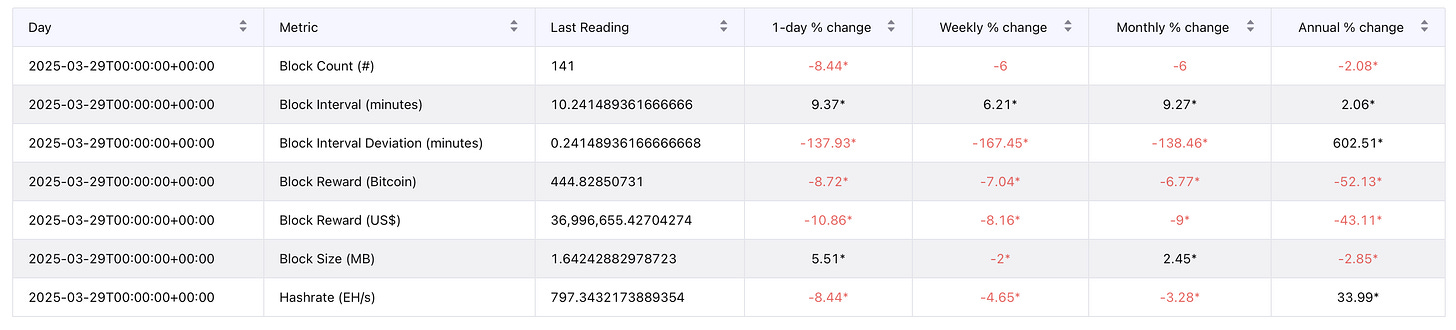

Bitcoin: Block Statistics

Key Metrics and Their Dynamics:

Number of Blocks: Decreased by 6% over the week

Block Interval: Increased by 6.21%, indicating a slowdown in the creation of new blocks

Block Interval Deviation: A sharp drop of 167.45% indicates much more stability between blocks

Block Reward: Decreased by 7.04% in BTC and by 8.16% in USD

Block Size: Decreased by 2%

Hashrate: Dropped by 4.65%

Conclusions:

The data shows a decline in mining activity on the Bitcoin network. The increase in block intervals coupled with the fall in hashrate indicates that some miners have turned off their equipment. This may be due to reduced mining profitability, as evidenced by the drop in the block reward in USD terms by 8.16%.

The significant reduction in block interval deviation indicates network stabilization, despite the overall power decline. This may suggest that the network is adapting to new conditions after less efficient miners have shut down.

The overall trend points to a period of consolidation in the Bitcoin mining ecosystem.

Bitcoin: Fee Statistics

Key Metrics and Their Dynamics:

Average Block Fee: Decreased by 54.41% in BTC and by 54.97% in USD

Fee as a Percentage of the Reward: Dropped by 53.89%

Total Fees Collected: Decreased by 57.14% in BTC and by 57.67% in USD

Average Transaction Fee: Fell by 38.88% in BTC and by 39.62% in USD

Conclusions:

The data shows a sharp decline in network fees over the past week. The drop in the average block fee by more than 50% indicates significantly reduced competition for transaction inclusion in blocks. The decrease in the fee percentage from the block reward to below 1% (0.944973%) suggests that miners are now earning primarily from the base block reward rather than user fees. Overall, this decline signals a reduction in network activity.

Bitcoin: Short-Term Holders Supply

An increasing supply from short-term holders (STH) indicates that there is demand for Bitcoin among investors despite all the negative factors discussed in today’s report.

Bitcoin: Short-Term Holder Realized Profit and Loss

The volume of realized losses by short-term holders (STH) shows that the current correction phase is proceeding under normal, healthy market conditions. The profit/loss margin is at -8.3%, which is relatively moderate compared to the previous correction. Historically, during severe bear markets (for example, from January to September 2022), this metric reached around -40%, indicating massive capitulation by short-term investors.

The current loss level is comparable to corrections observed during bull cycles (as indicated by the marked points in 2023-2024), after which the market usually recovered and continued to rise. Such indicators are characteristic of healthy corrections within a long-term uptrend, rather than the onset of a bear market.

Conclusion

The past week highlighted an intensification of macroeconomic risks, including rising US inflation, falling US stock markets, and renewed trade wars, which create tension and uncertainty in the global market. Despite this, Bitcoin demonstrated resilience by remaining in a consolidation phase within the $81.6K–$88.7K range. The observed moderate correction appears more like a healthy pause before a new phase of growth rather than the beginning of a prolonged downturn. The rise in Bitcoin dominance to 58%, corporate purchases, and the launch of new investment instruments confirm its appeal as a strategic asset in times of uncertainty.

On-chain metrics indicate moderately positive investor expectations. Meanwhile, localized miner issues, reflected in declining fees and hashrate, suggest temporary network cooling but without signs of participant capitulation. These factors indicate a likely continuation of consolidation and localized volatility.

Thus, although short-term market risks remain, the overall picture appears positive for medium- and long-term investors. Upcoming macroeconomic events, especially reactions to new tariffs and US employment data, will be key factors in determining volatility. Nonetheless, today’s correction serves more as a confirmation of a healthy pause within a bull cycle rather than a signal of a trend reversal.

Forecast

Target Price: $115,000 (90-day period)

Projected Total Return: 38.2%

Investment Recommendation: 🟢 OUTPERFORM (Moderate Buy)

For more details on the rating, please refer to this link: https://adlerinsight.com/Adler_Insight_Rating.pdf

Good luck in the upcoming trading week!

AAJ

Disclaimer:

This material has been prepared solely for informational purposes and does not constitute an offer, recommendation, or solicitation to buy or sell any securities, digital assets, or other financial instruments. The information presented in this report is considered reliable; however, its accuracy or completeness is not guaranteed. Past performance is not indicative of future results. Any investment decisions are made by the investor independently, taking into account personal financial circumstances and, if necessary, after consultation with a qualified professional. The author and affiliated parties may hold positions in the assets mentioned in this report. The author and publisher accept no responsibility for any direct or indirect losses arising from the use of this information.

Risks:

High volatility may lead to sharp fluctuations in value, adversely affecting investors' portfolios. Significant price swings may reduce the attractiveness of BTC to institutional investors, especially in the derivatives segment (futures, options). Potential tightening of regulatory requirements by governments and central banks may restrict access to BTC markets and reduce liquidity. Issues with custodial services, centralized exchanges, and hacking incidents could undermine confidence in the asset and negatively impact liquidity.