Insight #20

In today’s edition: institutional BTC purchases, rising bullish sentiment among short-term holders, declining selling pressure, and market resilience amid a local correction.

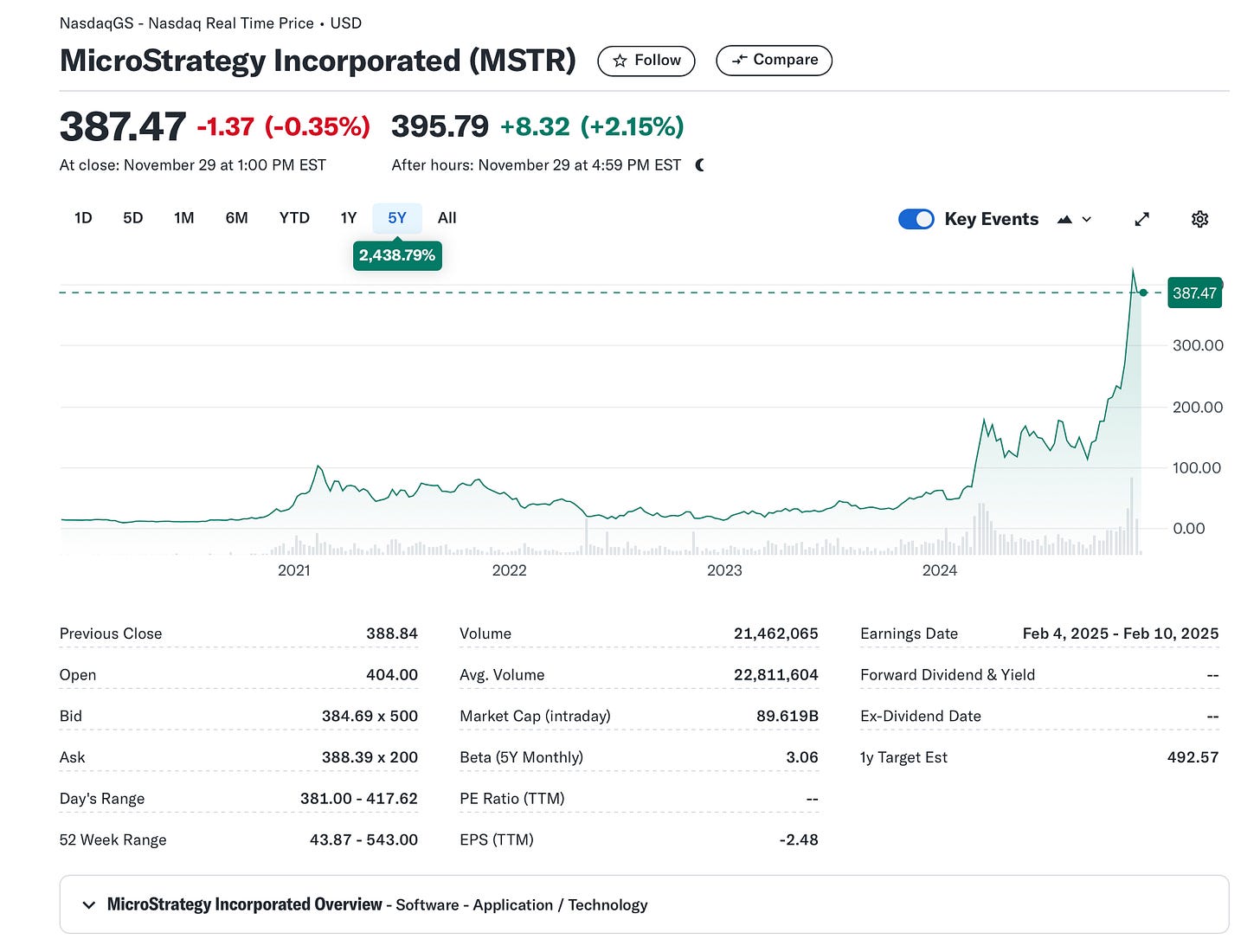

MicroStrategy (NASDAQ:MSTR) purchases Bitcoin worth $5.4 billion, adding 55,500 BTC to its reserves, bringing the total to 386,700 BTC.

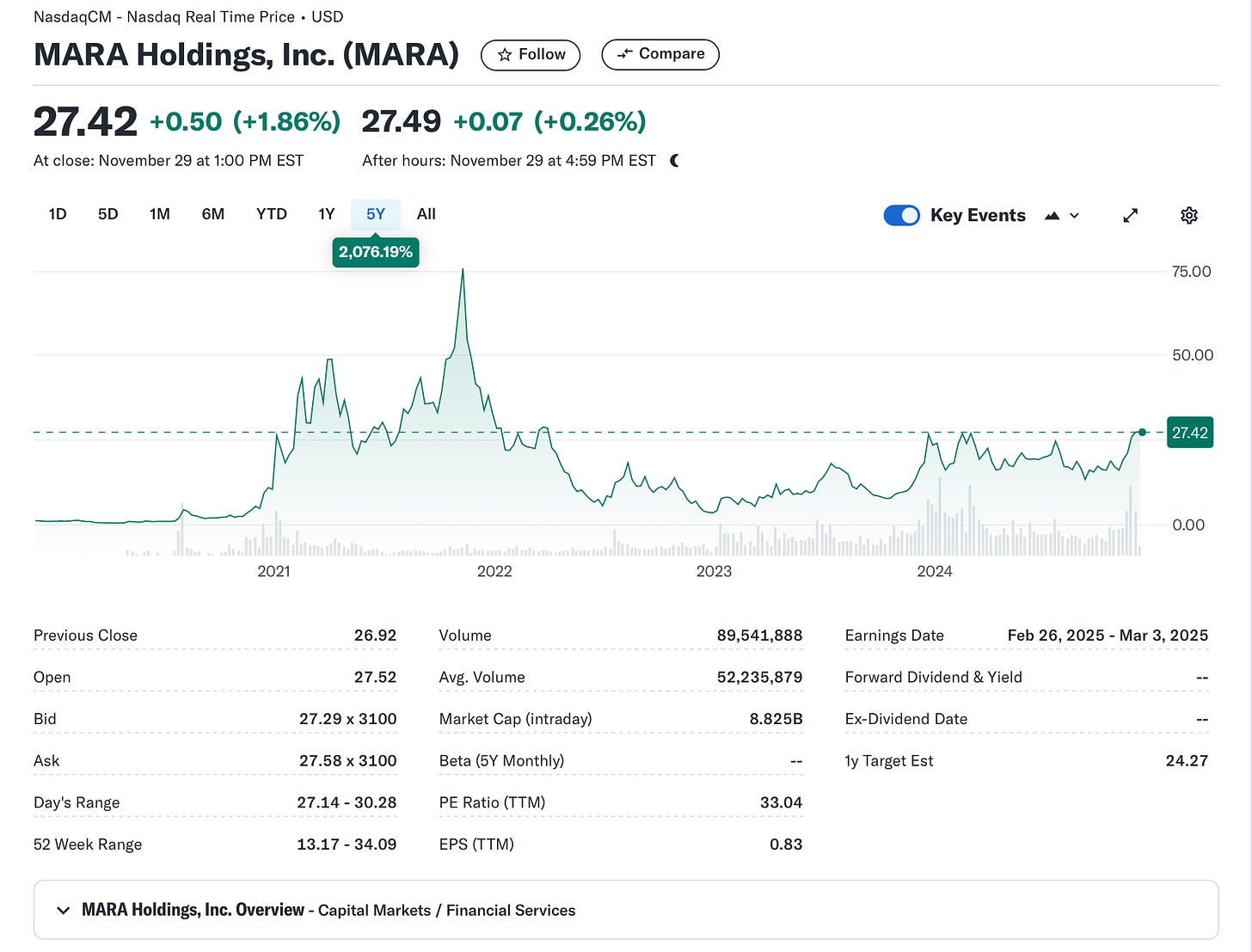

The mining company Marathon Digital (NASDAQ:MARA) acquires 5,771 BTC for $572 million at a rate of $95,554 per BTC, increasing its holdings to 33,875 BTC worth $3.4 billion, backed by 0% convertible bonds.

Metaplanet plans to raise $62 million to purchase an additional 652 Bitcoins, increasing its holdings from 1,142 BTC, citing Bitcoin’s growth and the depreciation of the yen.

Rumble Inc. allocates up to $20 million for Bitcoin following MicroStrategy’s strategy, citing Bitcoin as an inflation hedge and a store of long-term value.

Bitwise files for a 10-token crypto index ETF offering diversified exposure to leading cryptocurrencies, primarily Bitcoin and Ethereum, via NYSE Arca.

MIAX joins Nasdaq and NYSE in listing Bitcoin ETF options, expanding institutional access to crypto markets and driving adoption opportunities.

Hashdex updates its S-1 filing for the Nasdaq Crypto Index US ETF, focusing on Bitcoin and Ethereum, signaling progress amid SEC regulatory changes.

Hong Kong introduces tax breaks on crypto income for hedge funds and investors to attract global liquidity and compete with Singapore and Switzerland.

Vancouver Mayor Ken Sim proposes adopting Bitcoin as a reserve asset to preserve purchasing power and position Vancouver as a "Bitcoin-friendly city."

This week, the cryptocurrency market reflects active institutional adoption: MicroStrategy and Marathon Digital continue increasing their BTC reserves, emphasizing long-term capital preservation strategies. Companies like Rumble Inc. and Metaplanet follow suit, allocating funds for Bitcoin purchases, strengthening trust in the asset as an inflation hedge. Bitwise and Hashdex advance Bitcoin and crypto ETFs, broadening institutional access, while MIAX adds Bitcoin ETF options, increasing market liquidity. On the international stage, Hong Kong incentivizes tax breaks, and Vancouver considers Bitcoin as a reserve asset, reflecting growing global competition for crypto capital.

Weekly Summary

Bitcoin’s price fluctuated between $90.74K and $98.27K, with the current price at $96.5K. The support level at $90.74K was tested but quickly recovered, indicating strong demand at this level. Since November 5, the market has demonstrated a strong bullish trend despite the current local correction due to selling pressure following a new ATH.

Holding the $90K level reinforces the likelihood of testing $100K in the near future.

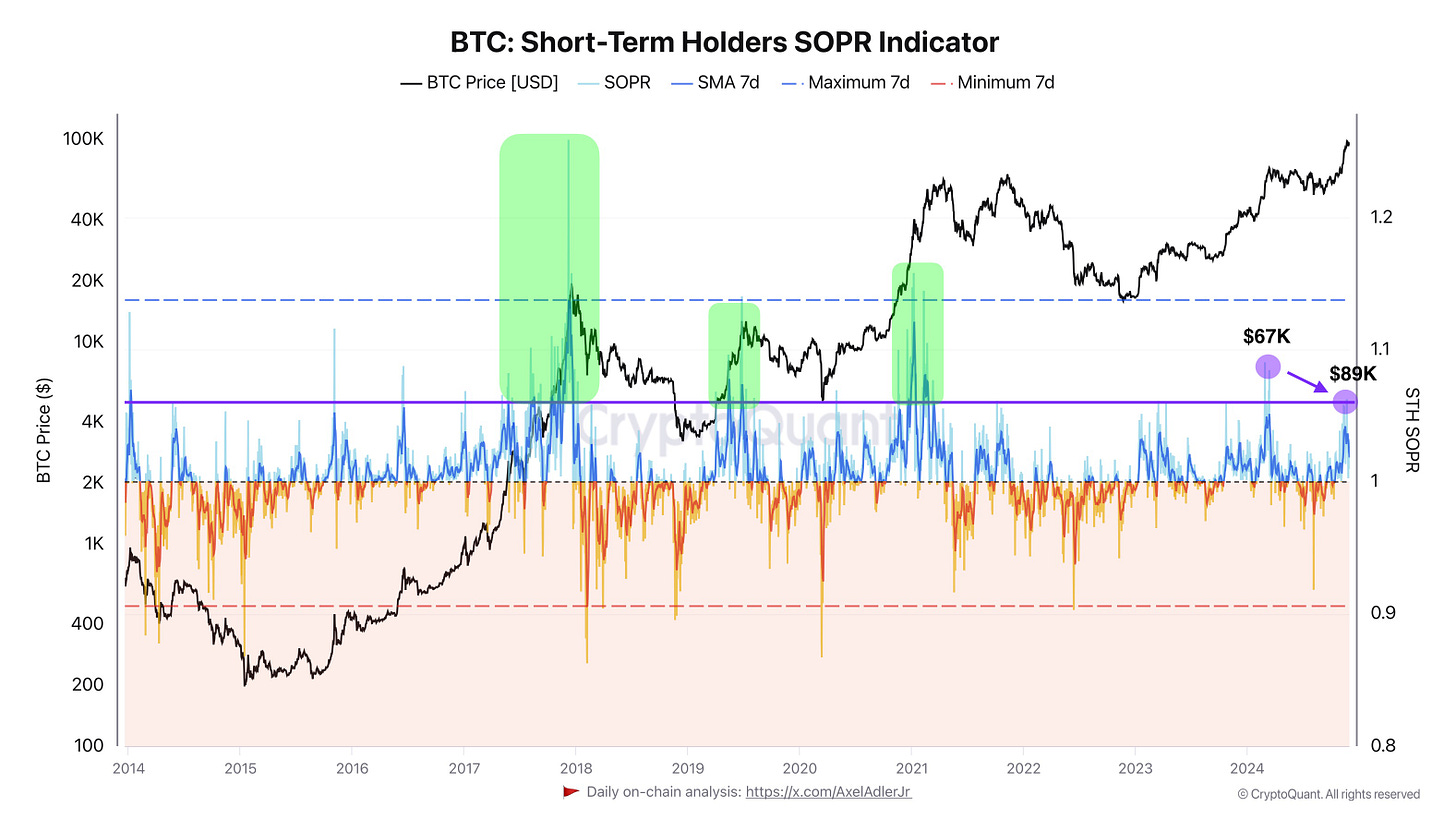

Bitcoin Short-Term Holders SOPR Indicator

Current STH SOPR values above 1 indicate short-term holders are selling coins at a profit. A rise in STH SOPR above 1.30 would signal a significant proportion of profitable sales. Comparing the selling peaks at $67K and the current sales at $89K (purple dots), we see fewer sales now than in March. Sales at $67K preceded subsequent recovery and new highs. This pattern could repeat at $89K if market demand persists.

Green clusters on the chart show how short-term sellers behaved in previous cycles. The current STH SOPR value suggests short-term holders are less active than in March. SOPR = 1 acts as a critical support level. If the indicator stays above this level, it confirms buyer dominance.

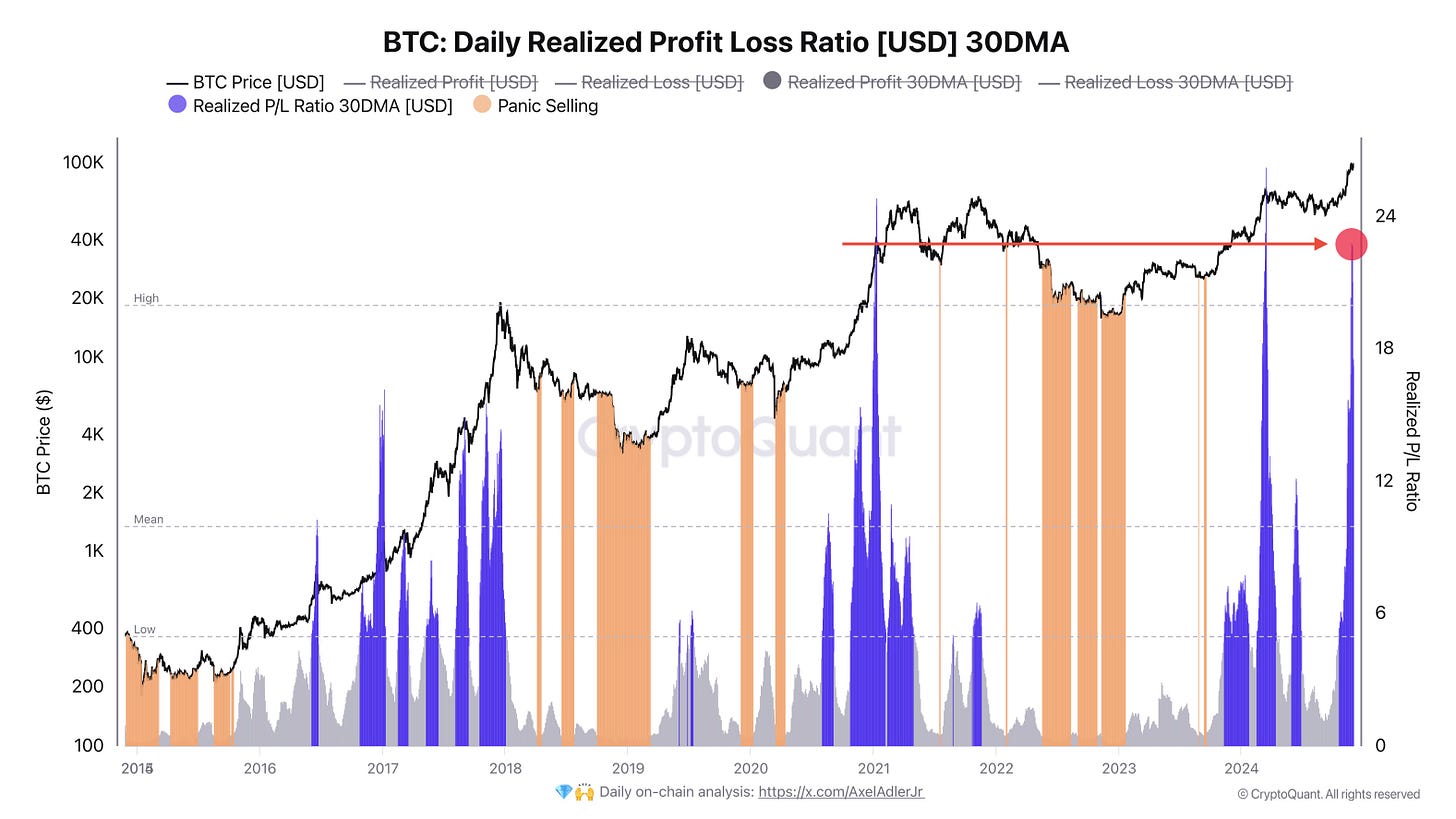

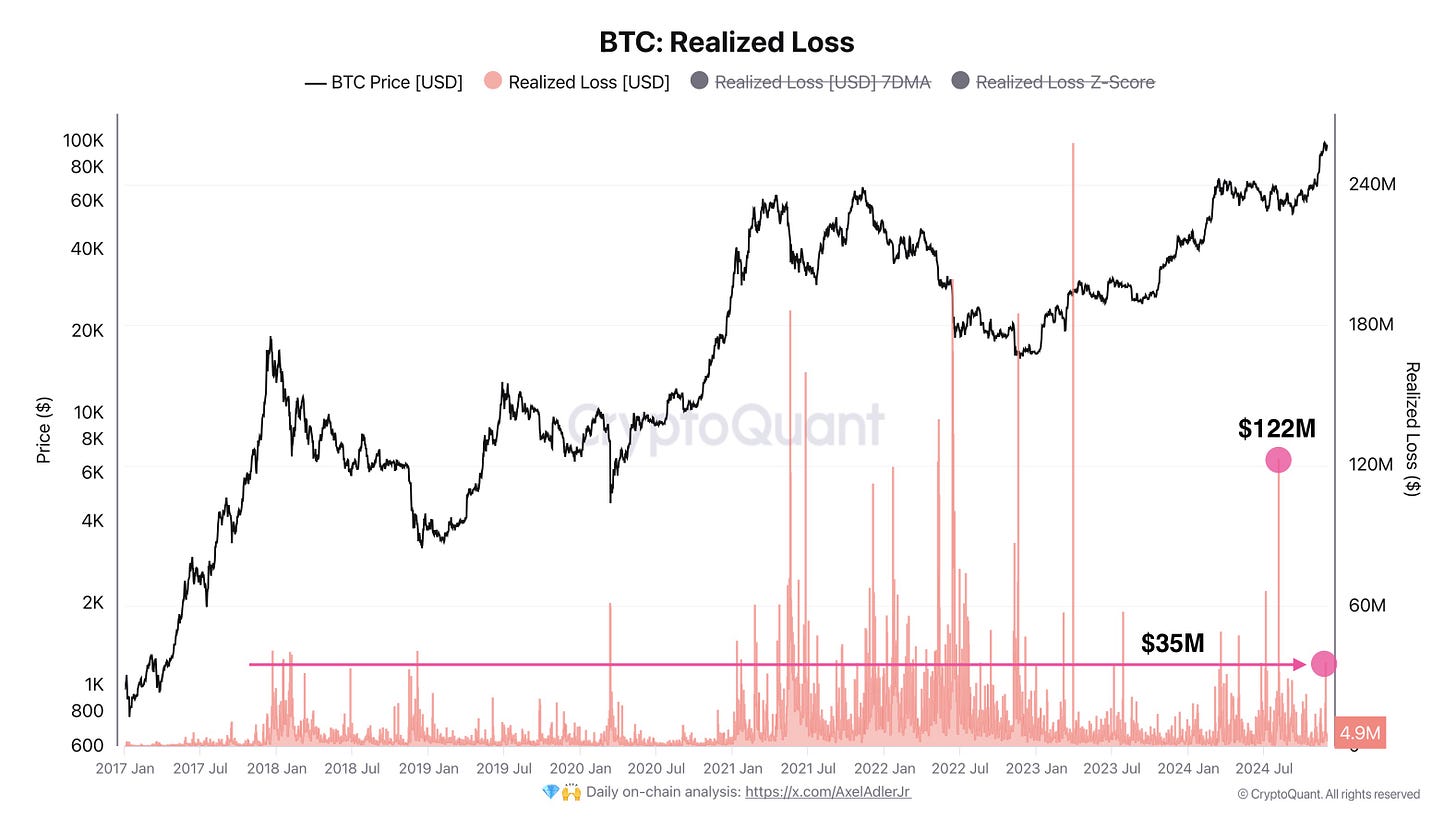

Bitcoin Realized Loss

Let’s examine the realized losses incurred during the current macro correction. The Bitcoin Realized Loss chart shows daily realized losses of $35M during the correction, significantly lower than the $122M peak on August 5, 2024. Historically, spikes in realized losses occurred during significant market corrections or panic. In this situation, no panic is observed, indicating a more stable market.

The current macro correction is characterized by restrained selling volumes at a loss, reflecting increased confidence in long-term growth.

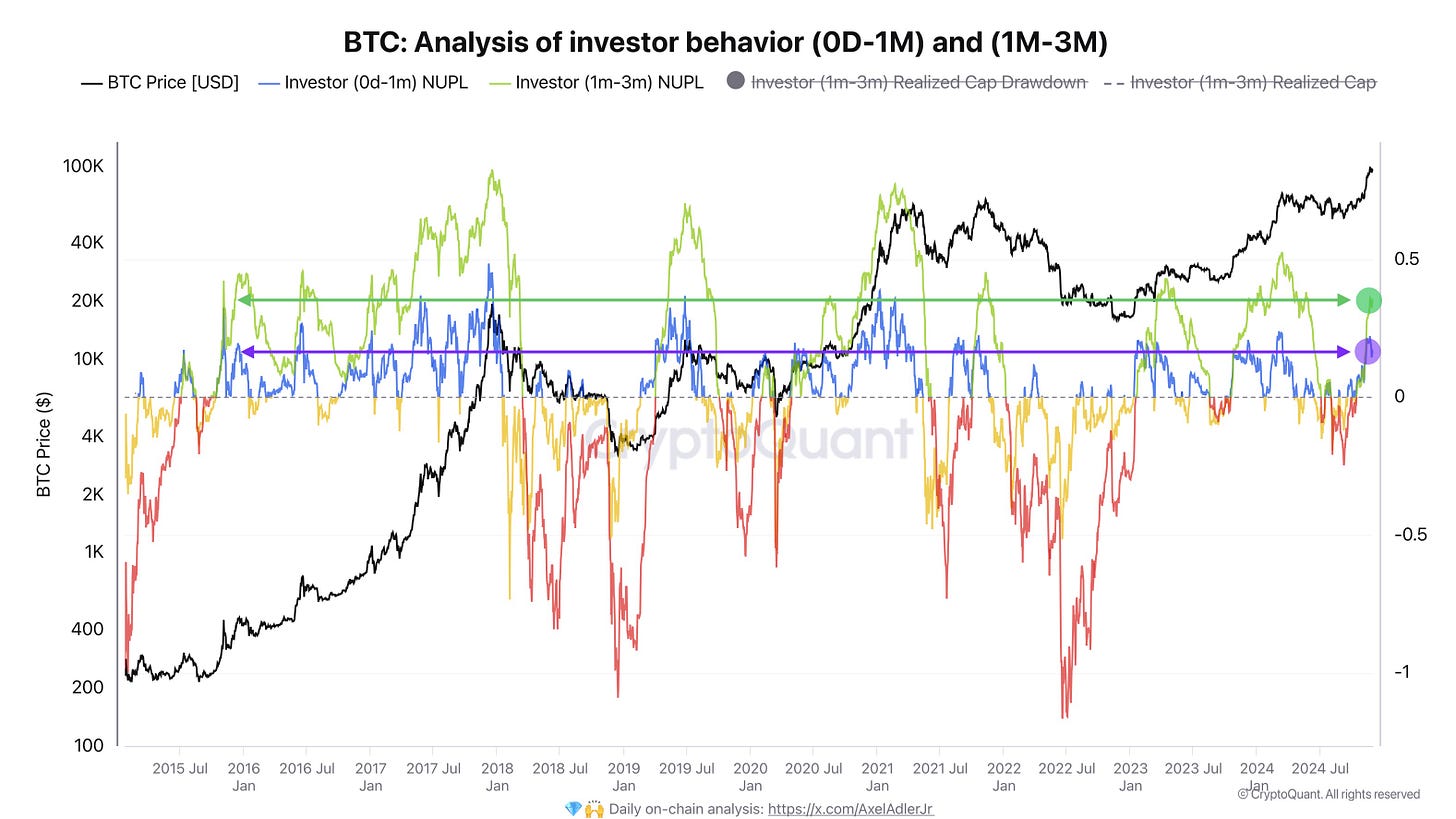

Bitcoin Analysis of Investor Behavior (0D-1M) and (1M-3M)

Let’s examine investor behavior for coins held for up to one month and between one to three months. The chart shows two Net Unrealized Profit/Loss (NUPL) metrics split by cohort—both groups show increasing unrealized profits, signaling bullish sentiment among new market participants. This indicates that new coins are finding buyers even at current price levels, supporting the upward trend. Rising NUPL for (1M-3M) investors shows a transition to holding, crucial for long-term growth.

Despite the local correction, the current market structure appears resilient.

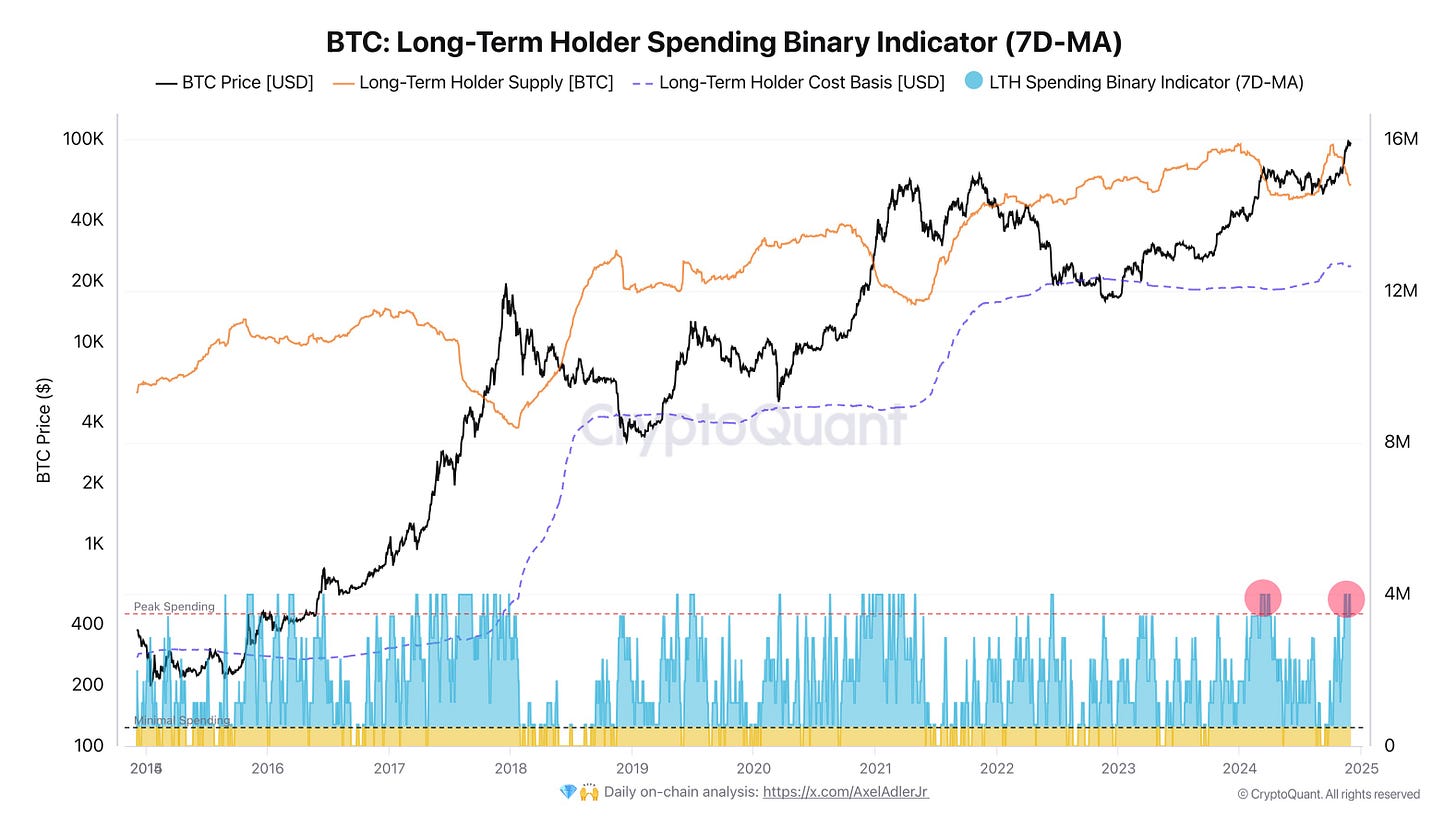

Bitcoin Long-Term Holder Spending Binary Indicator (7D-MA)

Next, we review the behavior of long-term holders. The blue bars on the chart represent LTH actions—selling or moving coins. Currently, active selling is observed, suggesting that the pressure in the market largely originates from this cohort.

The overall reserves of long-term holders remain high (~14.7M BTC), highlighting the dominance of the HODL segment. However, recent activity points to redistribution of some reserves back to the market. The recent redistribution of 1M BTC has been well absorbed, with the price rising from $90K to $96K, inspiring optimism.

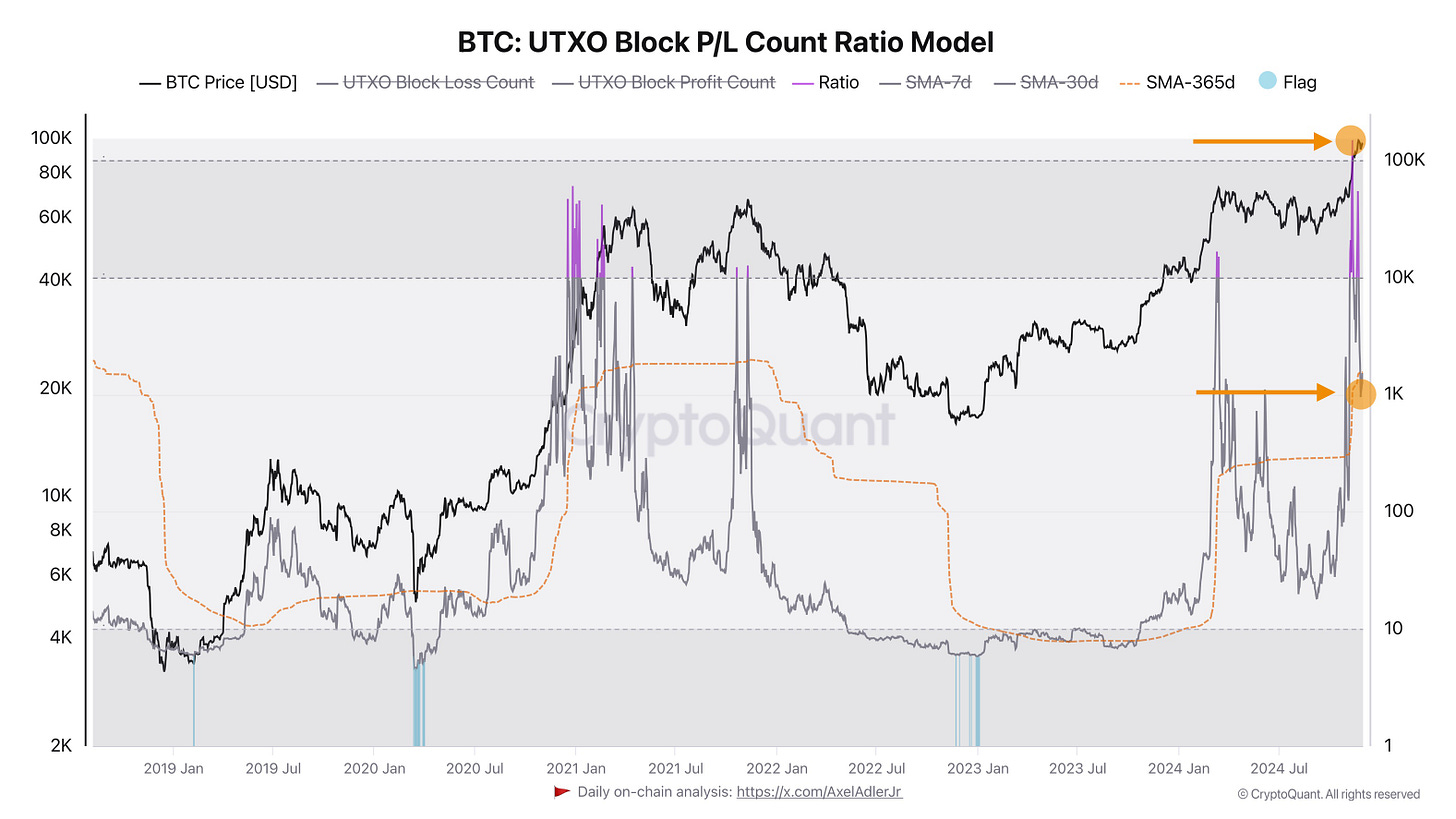

Bitcoin UTXO Block P/L Count Ratio Model

Finally, let’s assess the overall market picture using the UTXO Block P/L Count Ratio Model. The chart shows a 100x reduction in selling pressure per block from 100K to 1K, indicating robust support from participants and laying the foundation for further growth.

Conclusions

At this stage, the market demonstrates resilience and participant confidence. Institutional players continue to actively increase their Bitcoin positions, strengthening long-term bullish sentiment. The local correction has not caused panic, and the market successfully absorbed loss-driven sales and pressure from long-term holders. New and medium-term investors maintain confidence in growth, actively accumulating coins. The upward trend persists, and the market is ready to test new highs despite potential LTH-driven pressure at key levels.

Thank you for reading to the end. My analysis is not financial advice but rather a subjective market opinion.

Good luck in the upcoming trading week!

AAJ

Insightful as always. You can read also my latest issue :)