Insight #23

Will $90K Support Hold? We Explore Macro Backdrop, On-Chain Metrics, and Volatility to Identify Overheating Risks and Predict the Next Bull Market Phase.

Key Events of the Past Week:

The Bitcoin Policy Institute has drafted an Executive Order to "Designate Bitcoin as a Strategic Reserve Asset." It just needs Trump’s signature on day one.

Ohio proposes a Bitcoin reserve law, joining Texas and Pennsylvania. The bill allows the state treasurer to purchase BTC to safeguard tax dollars.

A former German finance minister declared in a Bundestag speech: "It's time to recognize Bitcoin's opportunities in Germany."

A European MP calls for a Strategic Bitcoin Reserve.

The Dutch government, in an open letter, called for the creation of a National Bitcoin Reserve. The proposal suggests acquiring Bitcoin via the Ministry of Finance by selling part of its current gold reserves.

The Federal Reserve reduces interest rates by 25 basis points to 4.25%, marking the third consecutive cut as inflation stabilizes. Further reductions are expected in 2025.

The SEC approves Bitcoin-Ether index ETFs by Hashdex and Franklin Templeton, marking a milestone for spot crypto ETFs on Nasdaq and Cboe.

French Groupe BPCE, the second-largest bank, received AMF approval to launch Bitcoin investment services for 35 million users by 2025.

MARA acquires 15,574 BTC for $1.53 billion, bringing its total holdings to 44,394 BTC.

MicroStrategy acquires 15,350 BTC for $1.5 billion, increasing its assets to 439,000 BTC worth $45 billion, averaging $61,725/BTC. The company now holds over 2% of Bitcoin's total supply.

This week, Michael Saylor proposed a "Digital Asset Framework," advocating for a U.S. Bitcoin reserve to lead the global crypto economy and reduce debt.

Metaplanet accelerates Bitcoin purchases for 2024, now holding 1,142 BTC (~$110.3M), in line with its treasury reserve strategy.

El Salvador acquired 11 BTC worth $1M following a $1.4B IMF deal, reaffirming its Bitcoin strategy despite IMF conditions restricting public Bitcoin activities.

Weekly Highlights

During the past trading week, Bitcoin exhibited significant volatility, trading between $108.3K and $92.1K. The weekly high was recorded early in the week, reflecting the continuation of the bullish trend formed earlier and strong buyer activity.

A sharp BTC price decline began after U.S. Federal Reserve Chairman Jerome Powell's December 18, 2024, statement. Powell emphasized that the Fed lacks authority to hold cryptocurrencies and does not plan to seek legislative changes. These comments triggered a negative market reaction, driving Bitcoin below the $100K mark, with a local low of $98.8K.

Further declines were accompanied by increased trading volumes and long position liquidations, confirming weakening bullish sentiment. The weekly low of $92.1K became a key support zone from which recovery began, supported by moderate buyer interest.

The recovery by week's end allowed Bitcoin to close at $96.4K. The current dynamics indicate persistent market uncertainty, potentially pressuring prices short term, primarily through futures market liquidations.

I think the Axios journalist who asked Powell about creating a national Bitcoin reserve underestimated the market impact. Nonetheless, the market correction doesn't appear severe. The $90K level remains a strong support, indicating consistent market interest despite regulatory negativity. The journalist’s question may have sought clarification on the Fed's crypto policy, but its market impact was larger than anticipated.

Despite the decline, the BTC correction seems more like a short-term reaction to external factors than the start of a prolonged bear trend. The $90K level continues to validate its role as a key demand zone, potentially serving as a base for future recovery. A fall below $90K could alarm holders, prompting sales at a loss and amplifying the correction risk.

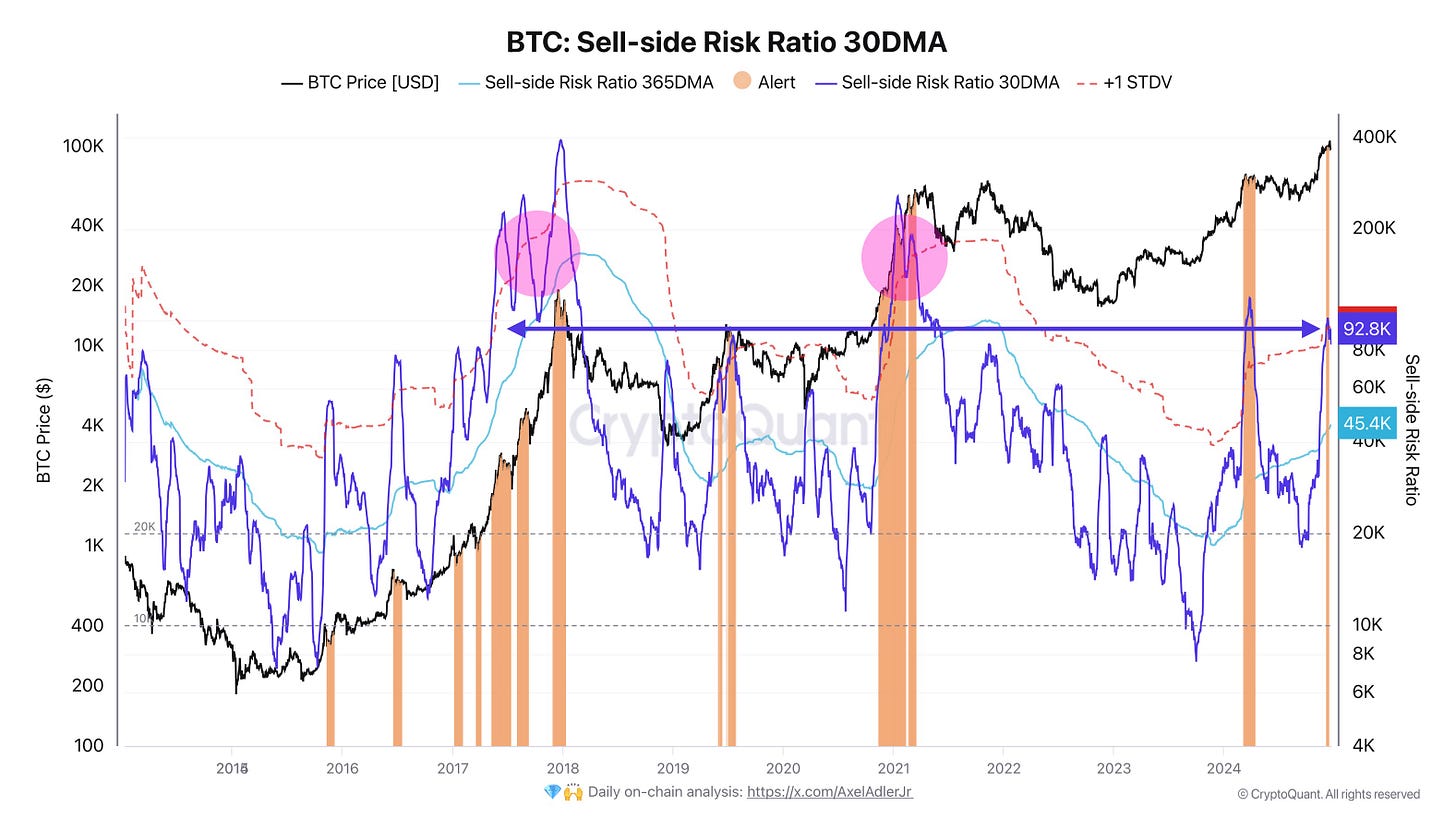

BTC: Sell-side Risk Ratio 30DMA

The first chart focuses on the Sell-side Risk Ratio smoothed by a 30-day moving average (30DMA). Current values (blue line and orange bars) highlight a high risk of coin sales at these levels, reflecting notable seller activity. This metric measures profits or losses realized relative to the average purchase price of coins.

The current situation doesn't resemble previous cycles where high Sell-side Risk Ratio levels coincided with mass profit-taking phases, leading to market cycle transitions. Historical peaks (pink zones) mark periods when holders sold en masse, increasing volatility and correcting the market.

Current deviations of the 30DMA Sell-side Risk Ratio from the long-term average (365DMA) + 1 standard deviation (STDV) at $96.2K help identify local levels where sales may intensify. These levels are traditionally linked to heightened volatility due to active selling. However, despite high Sell-side Risk Ratio (30DMA) values, they remain below critical levels seen during bull market peaks in 2018 and 2021.

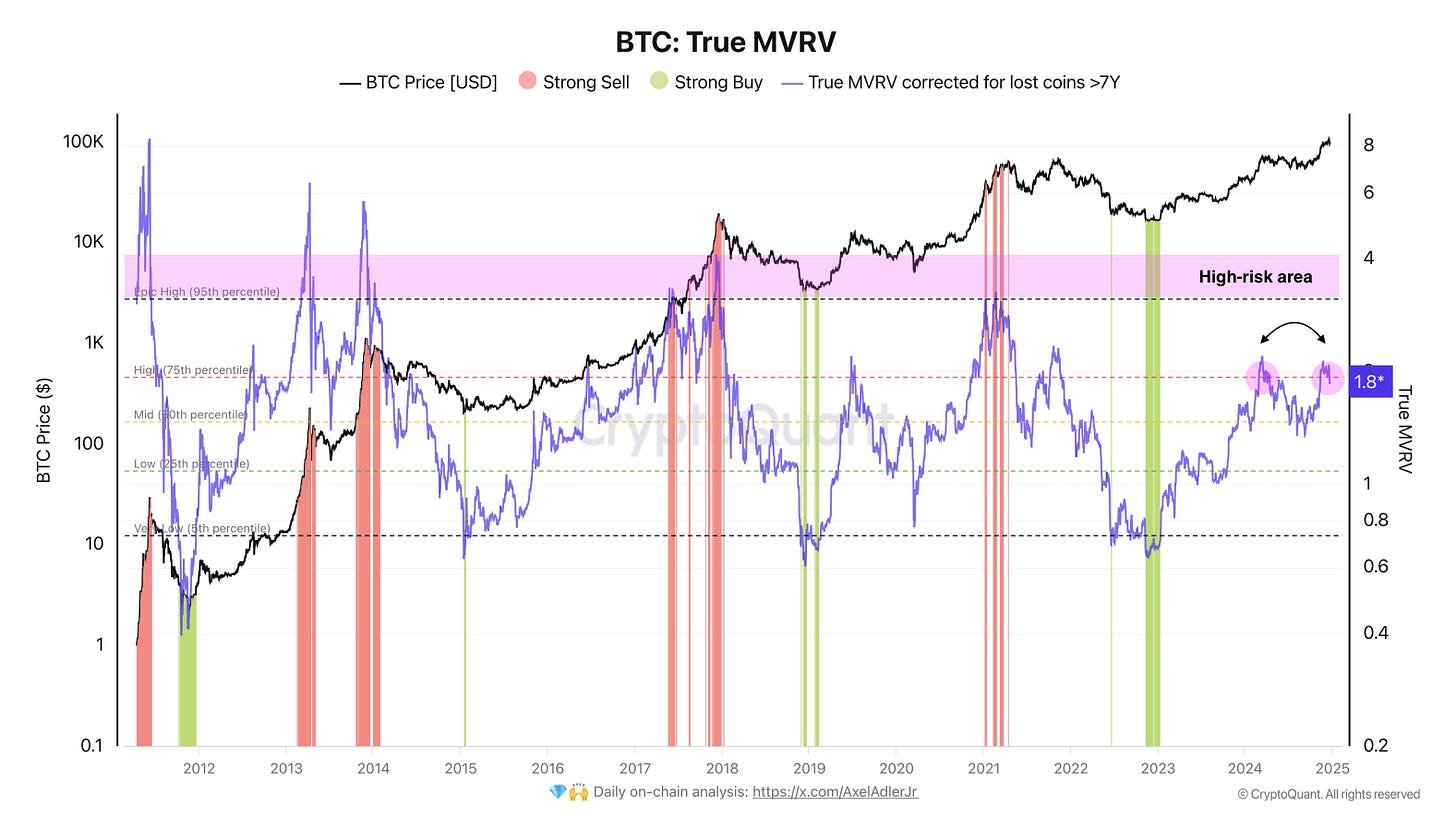

BTC: True MVRV

To confirm the previous analysis, we examined the True MVRV chart, adjusted for lost coins older than seven years. This metric reflects the ratio of market cap to realized cap, assessing market overheating or undervaluation.

Currently, True MVRV is at 1.8, above the average zone but not yet reaching critical high-risk areas. This indicates the market is nearing overheated levels but remains in a moderately stable phase.

Historical True MVRV peaks (red bars) coincided with active selling periods and the end of bull cycles. Green zones mark significant undervaluation levels, offering long-term buying opportunities.

Current data indicates moderate market overheating, aligning with the Sell-side Risk Ratio analysis. However, the absence of critical level breaches suggests potential for further growth, provided seller activity doesn't spike.

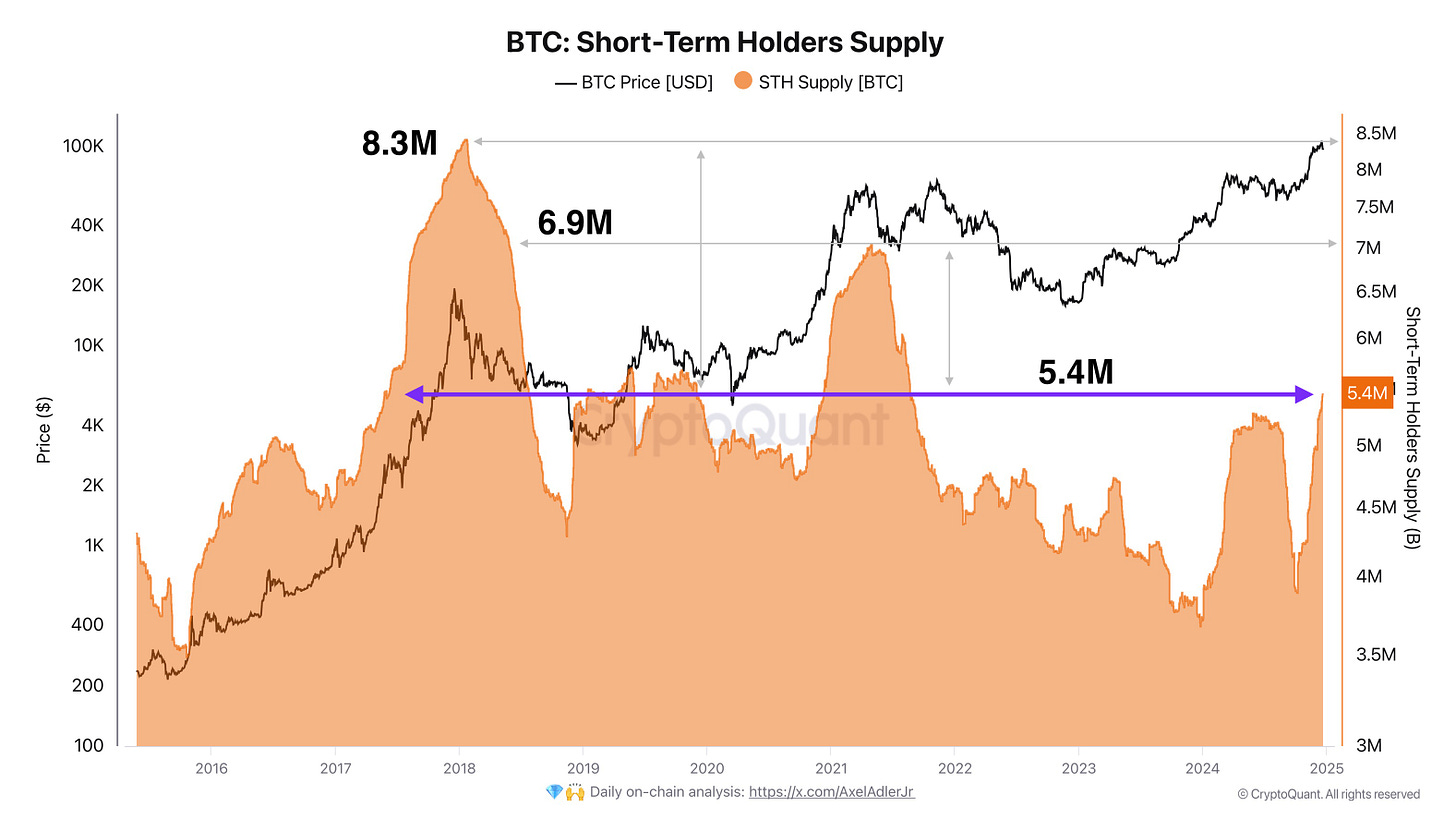

BTC: Short-Term Holders Supply

Let's examine spot market buying behavior. The current volume of coins held by short-term holders (STH Supply) is 5.4M BTC, a historically high level. While below peaks from 2018 and 2021 bull cycles (8.3M BTC and 6.9M BTC, respectively), it signifies active spot market participation and new short-term investor groups.

STH Supply dynamics now indicate active market entry by new players. Continued growth nearing previous cycle peaks could signal market overheating.

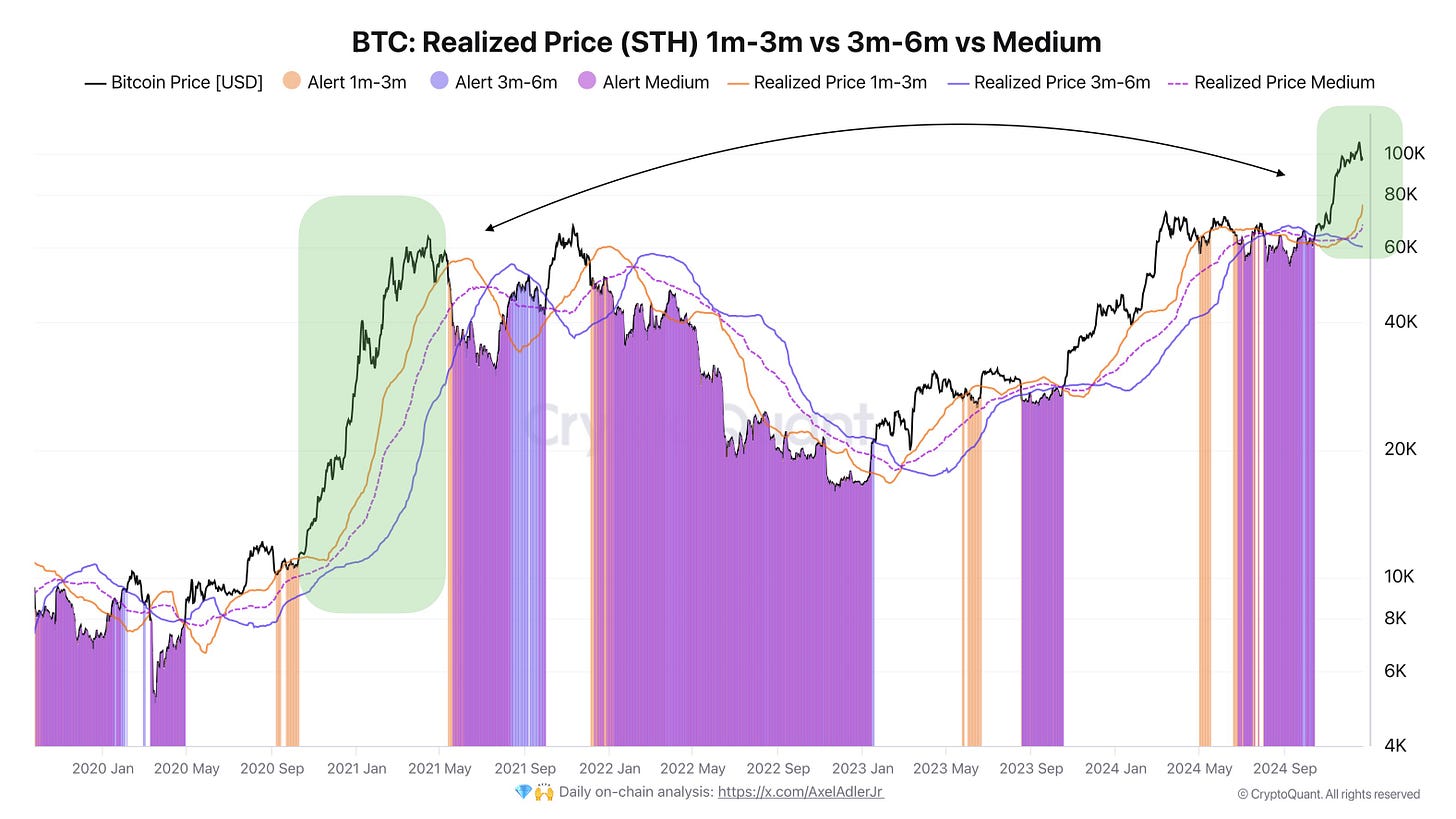

BTC: Realized Price (STH) 1m-3m vs 3m-6m vs Medium

Let's examine market structure through short-term holders' average purchase prices, focusing on the 1–3 month holding range. The market is in a strong bull phase, with this cohort’s average purchase price at $76K. This level serves as a strong support zone against potential negative "Black Swan" events. The average purchase price of two cohorts is $68.2K.

Historical realized price growth for STH signaled higher asset price levels. Current dynamics mirror this trend, confirming strong fundamental interest and market participants' willingness to hold coins even at elevated levels.

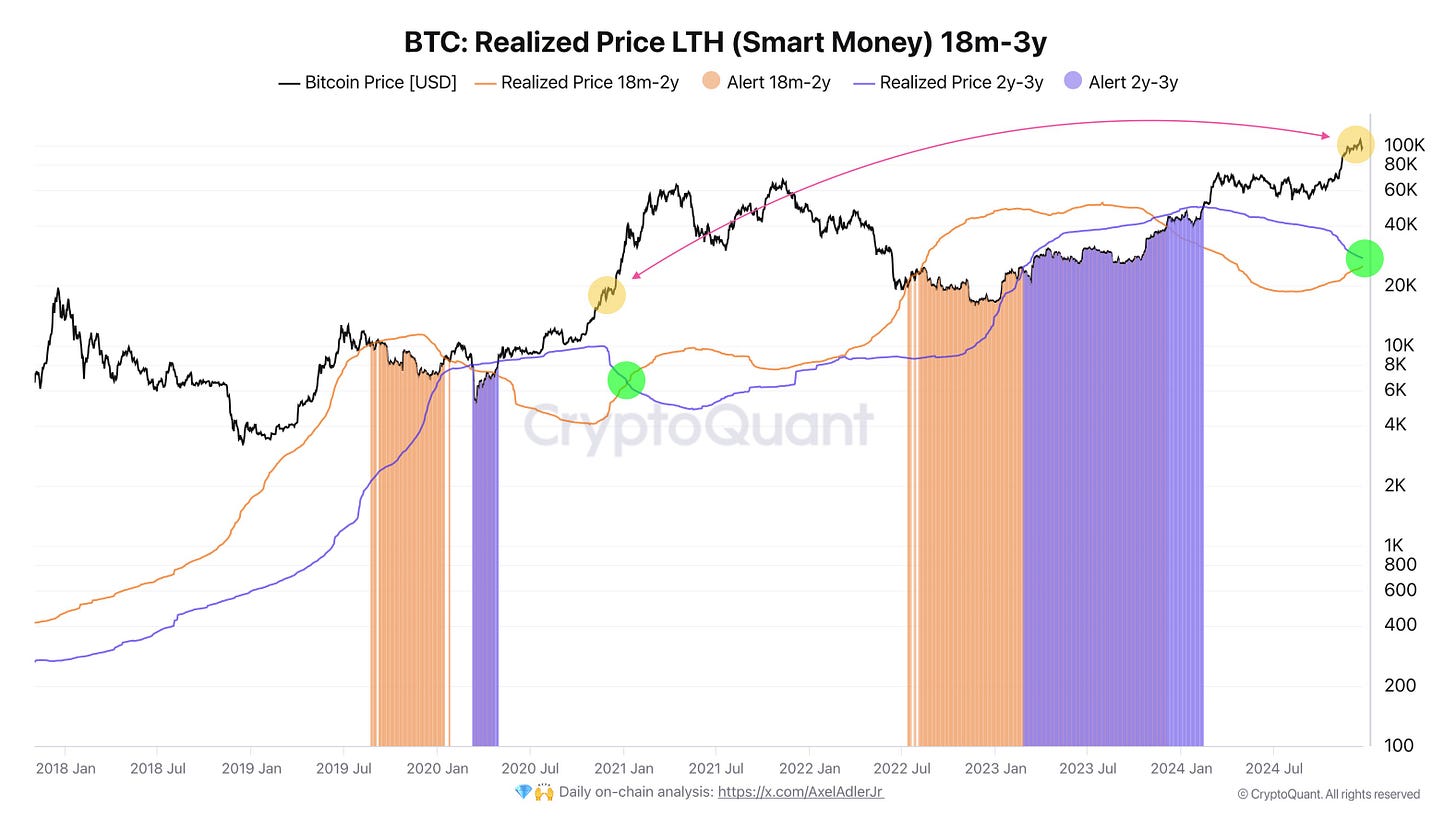

BTC: Realized Price LTH (Smart Money) 18m-3y

Finally, let's analyze Smart Money behavior—holders retaining coins for 18 months to 3 years.

Major sales for this cohort began at $48K and intensified at $68K. To grasp the sales scale, we can revisit BTC: Short-Term Holders Supply, noting 1.6M BTC absorbed by new players from $60K onwards.

The yellow mark on the chart indicates the market's current position compared to previous cycles. Last time, this point coincided with a stabilization phase before transitioning to later growth stages. Reduced "Smart Money" activity compared to 2021 sales peaks suggests their expectation of further price growth and a more conservative strategy.

The green mark corresponds to the potential final phase of the current bull cycle, characterized by reduced buying activity, accelerated profit-taking, and heightened volatility.

Conclusions:

1. Ongoing Trend of Strategic Bitcoin Reserves

USA: The proposed Executive Order for Trump to recognize Bitcoin as a strategic reserve asset highlights growing government interest in BTC.

States and Nations: Ohio, Texas, Pennsylvania, Germany, Netherlands, and the European Parliament increasingly discuss including BTC in national reserves.

Corporations: MARA and MicroStrategy continue accumulating Bitcoin (MARA: 44,394 BTC, MicroStrategy: 439,000 BTC).

Institutional interest and state initiatives for "strategic BTC reserves" signal Bitcoin’s strengthening role in the global economy.

2. Regulators' Actions and Macro Backdrop

The U.S. Fed cut interest rates for the third time (to 4.25%) and hinted at further 2025 reductions.

SEC-approved Bitcoin-Ether ETFs (Hashdex and Franklin Templeton) on Nasdaq and Cboe may invite new investors.

Negative Fed rhetoric (Powell publicly ruled out Fed ownership of crypto) triggered Bitcoin's short-term correction.

Regulatory decisions support the market (rate cuts, new ETF approvals), but official comments can negatively affect prices. Nonetheless, Bitcoin's long-term institutional adoption trend persists.

3. Bitcoin Price Dynamics and Market Sentiment

Weekly range: $108.3K to $92.1K. The sharp drop below $100K followed negative Fed statements.

Correction: Price declined to $92.1K before recovering. Week closed at $96.4K.

Key support: The $90–92K zone remains a strong demand level.

Market not panicked: Despite price drops, no mass sell-off occurred; the correction appears healthy.

Short-term negative rhetoric may cause price volatility, but buyers continue to support the $90K zone. Overall sentiment remains bullish unless major support breaks.

4. On-Chain Metrics and Indicators

Most on-chain metrics show Bitcoin isn't excessively overheated. Short-term holder activity is high, while "Smart Money" sales are reduced compared to past cycles, signaling growth expectations.

5. Overall Market Picture and Prospects

Short-term uncertainty from Fed comments and regulators persists, posing correction risks. However, institutional purchases, government adoption, and rate cuts create a supportive backdrop for further growth.

$90K Level: Key support indicating buyer interest remains intact.

Good luck in the upcoming trading week!

AAJ

Thank you 😊