Insight #24

In today's issue, I summarize the year and analyze the key events that had the most significant impact on Bitcoin's price growth over the past year, while also providing a forecast for 2025.

Key Events of the Past Week:

Bitwise and Strive have filed applications to create new Exchange-Traded Funds (ETFs) focusing on companies with substantial Bitcoin reserves. What are these funds, and why are they important for the market?

Bitwise plans to launch the "Bitcoin Standard Corporations ETF," which will invest in companies holding at least 1,000 Bitcoins in their corporate reserves. To be included in the ETF, companies must meet the following criteria:

- A market capitalization of at least $100 million,

- An average daily trading volume of at least $1 million,

- A free float of less than 10%.

Unlike traditional ETFs, where a company's weight is determined by its market capitalization, this ETF will weigh companies based on the value of their Bitcoin reserves, with a cap of 25% per company.

Strive, founded by Vivek Ramaswamy, proposed the "Bitcoin Bond ETF," which will focus on convertible bonds issued by companies like MicroStrategy that use the proceeds to purchase Bitcoin. This actively managed fund will invest at least 80% of its assets in "Bitcoin bonds" and related instruments, including options and swaps. The fund will trade on the New York Stock Exchange (NYSE), allowing investors to gain indirect exposure to Bitcoin through the debt obligations of companies actively investing in cryptocurrency.

The Tether FUD

The main news of the past week revolved around yet another wave of FUD (Fear, Uncertainty, and Doubt) regarding Tether (USDT). Every market cycle seems to include speculation about Tether's collapse. Statements like "USDT is a ticking time bomb," "Tether is a scam," and similar criticisms resurface repeatedly. Frankly, it feels unusual if a cycle doesn’t include FUD targeting USDT.

So, what’s the issue this time?

According to the Markets in Crypto-Assets (MiCA) regulations, stablecoins like USDT are classified as Electronic Money Tokens (EMTs) or Asset-Referenced Tokens (ARTs). These rules came into effect on June 30, 2024, requiring stablecoin issuers to meet strict requirements to operate legally within the European Union (EU).

If Tether, the issuer of USDT, fails to comply with MiCA, the token will be deemed non-compliant rather than entirely "illegal." This means exchanges and financial services operating in the EU must assess their risks and compliance. Many may preemptively delist USDT to avoid regulatory fines or licensing issues under MiCA.

The Shift to USDC

This explains why some EU exchanges are shifting their focus to stablecoins like USDC, which are actively working toward MiCA compliance. For users, this could mean reduced access to USDT in the region unless Tether achieves compliance or adjusts its operations to align with MiCA standards.

Clarification: USDT will not become illegal in Europe on December 30, 2024. MiCA regulations require compliance, but there is a transition period of 6 to 18 months for providers.

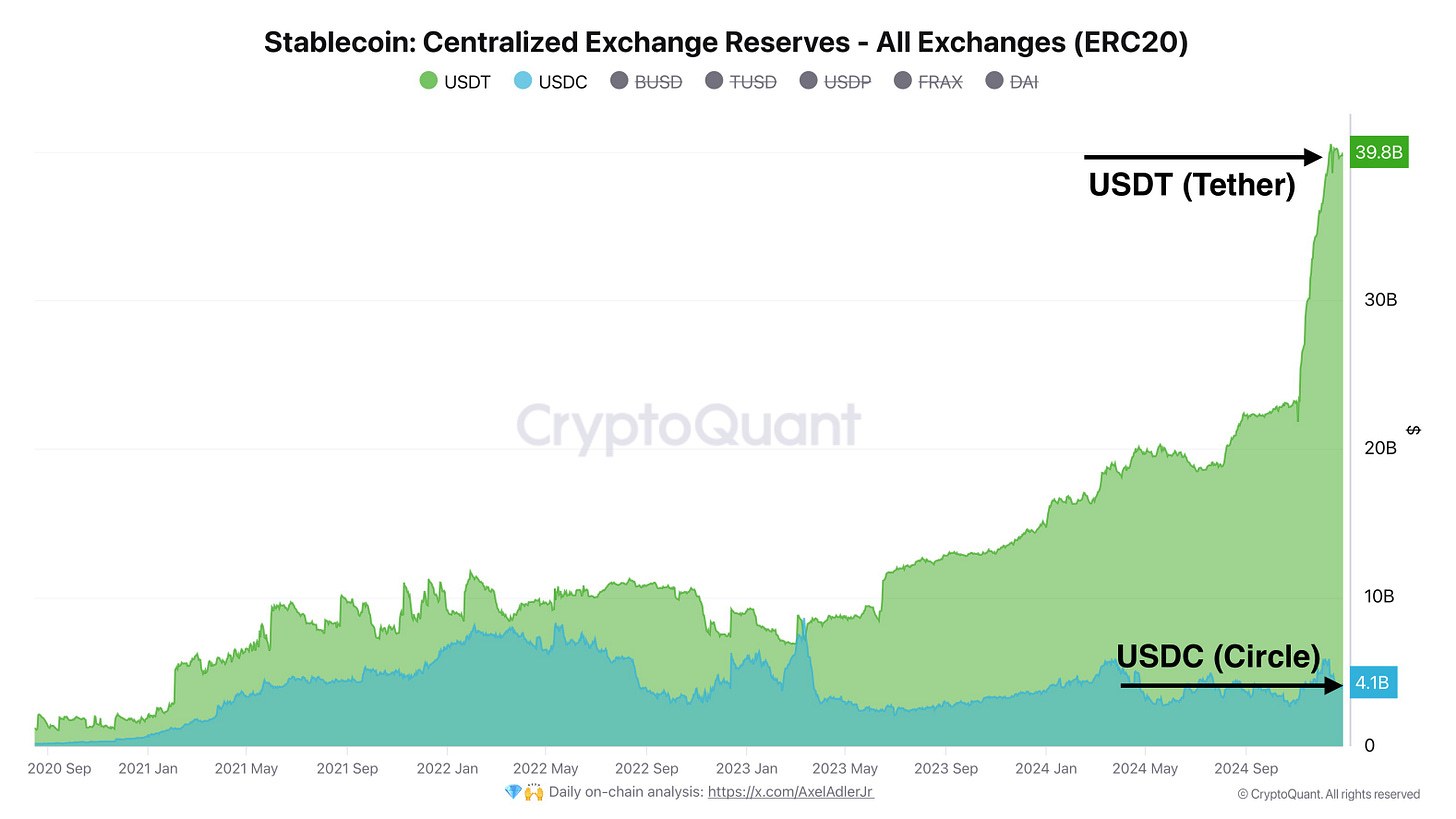

Let’s clarify further: Circle, the company behind USDC, competes in the stablecoin market with Tether, the issuer of USDT. Tether clearly leads the market, especially judging by reserves on centralized exchanges (CEXs) and in the Ethereum network, where USDT outpaces USDC by a factor of ten.

Starting today, Coinbase will delist non-compliant stablecoins, particularly USDT, in Europe. Let’s not forget that Coinbase and Circle collaborate under the Centre Consortium, which sets standards for USDC.

The Issue with USDC Awareness

The problem with Circle is not whether USDC is a good or bad stablecoin, but rather that people are simply unaware of its existence, particularly in the retail market. When someone asks about stablecoin transfers, they typically say: "I can send you USDT, just let me know if it’s on Ethereum or Tron," but nobody mentions USDC.

USDC is widely used by institutional players, enjoys a solid reputation among traditional financial companies, and Circle actively engages with banks and financial institutions. However, in practical everyday use (P2P transfers, retail traders), USDT dominates the market.

What should Circle do? Circle’s founders need to invest more in branding and marketing targeted at the retail segment to increase product awareness. Right now, it feels like there’s a deliberate effort to spread FUD about Tether to gain a competitive advantage in the market.

Weekly Summary

Last week, from December 23 to December 29, the Bitcoin market exhibited moderate volatility, with a price range of $92.4K to $99.9K. The period began with a price decline to the week’s low of $92.4K. This was followed by a rebound to the weekly high of $99.9K, though the price failed to sustain these levels due to selling pressure. The week ended with consolidation around $93K, indicating a temporary equilibrium between buyers and sellers, with bears holding the upper hand.

Trading volume was most significant during sharp price movements but declined toward the end of the week, suggesting reduced market participant activity. Support at $92.4K and resistance at $99.9K defined the current range. The market remains in a phase of uncertainty, and in the near future, we can expect either continued consolidation or a breakout of key levels that could set the direction for further price movement.

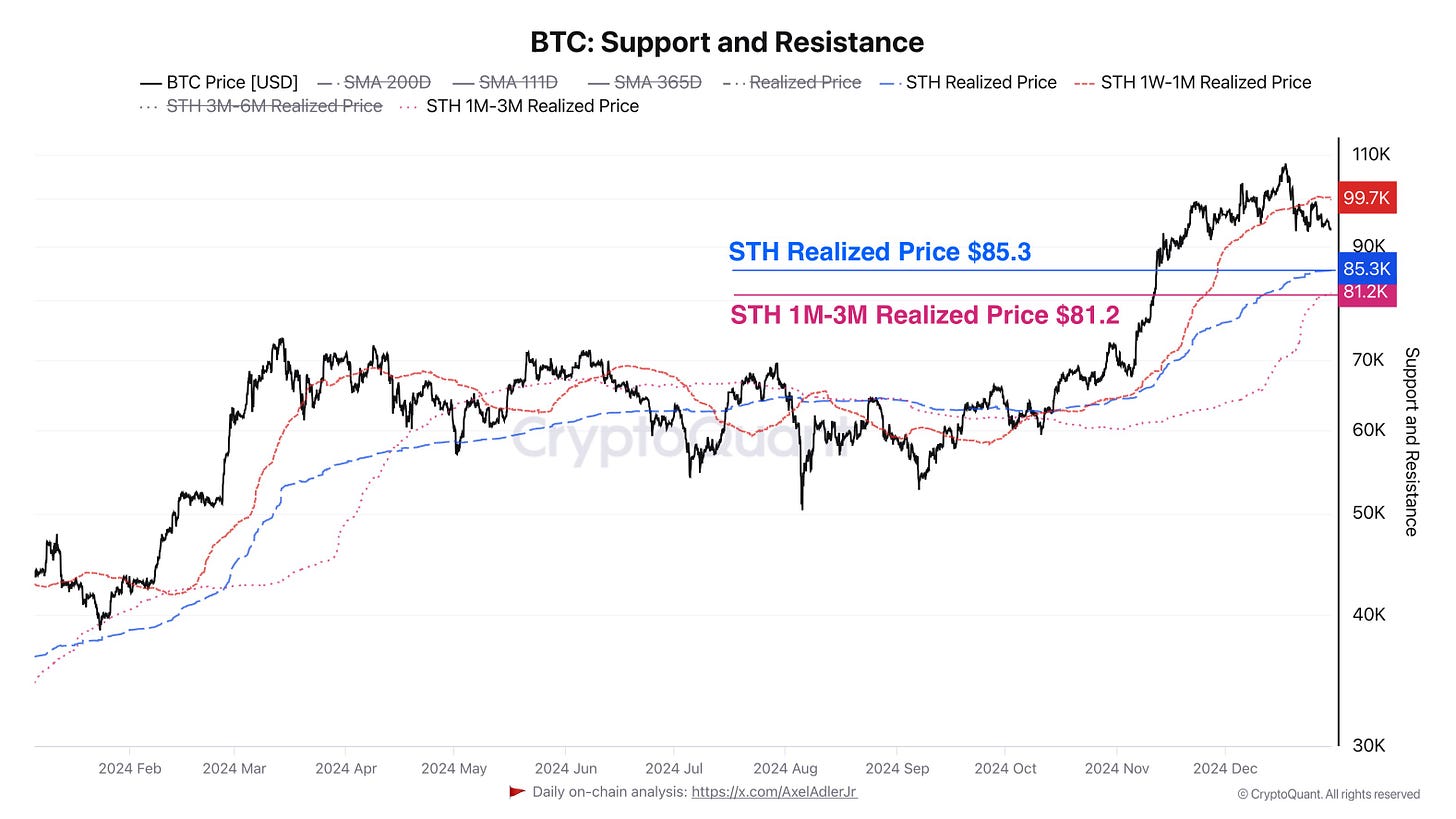

Let’s examine the STH cohorts and their average purchase price. The first cohort of short-term holders (STHs), holding coins for 1 week to 1 month, is currently at a loss, as their average purchase price is $99.7K—the current local resistance level.

The support level is currently at $85.3K, which aligns with the realized price of all short-term holders. Additionally, the $81.2K level, reflecting the average acquisition price of coins held by STHs for 1–3 months, serves as a crucial lower barrier.

The main question at this stage is whether buyers can overcome resistance, or if reduced activity due to the holiday season will lead to a test of support levels.

2024 Year-End Summary

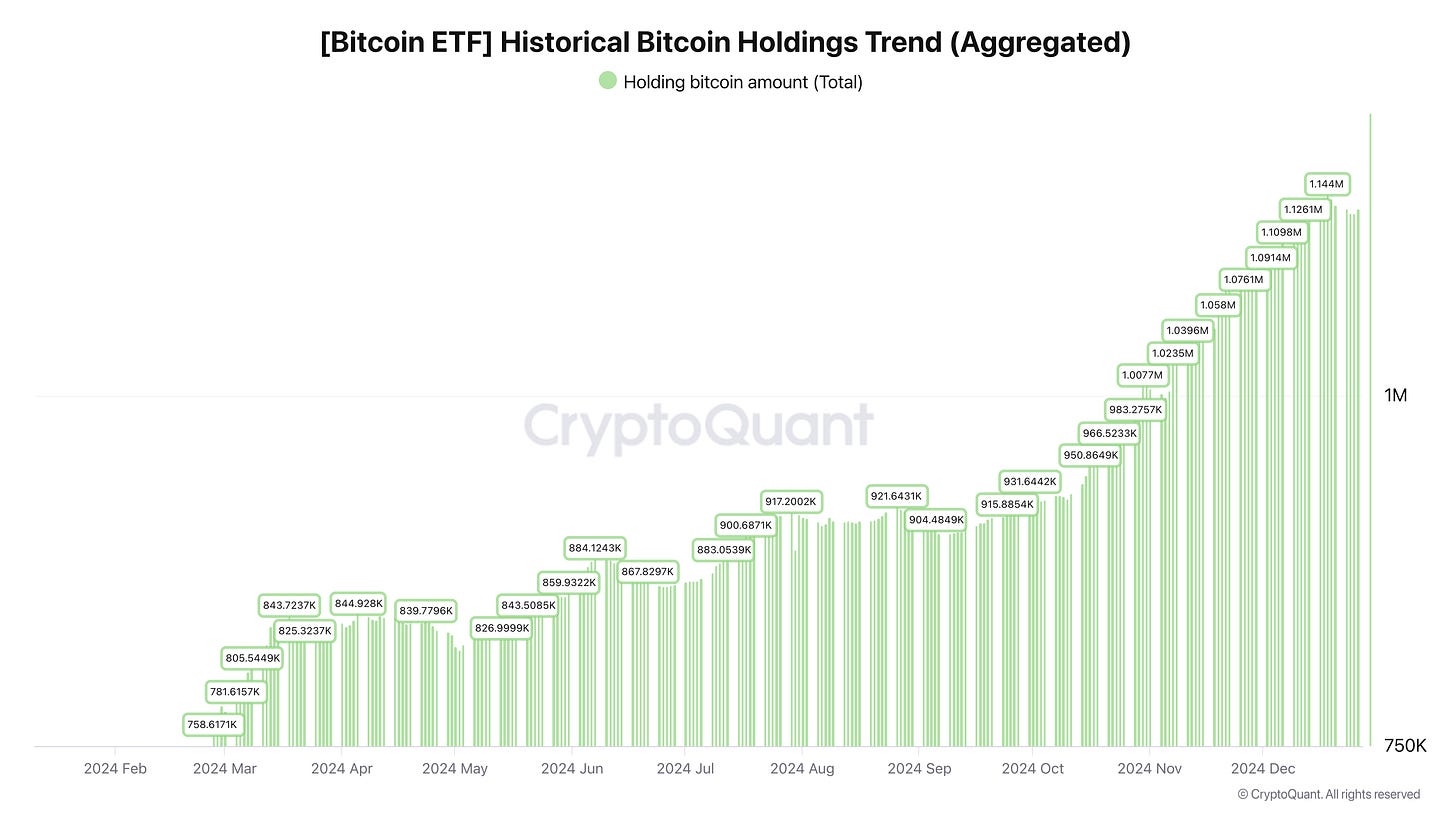

The Approval of Bitcoin ETFs Was the Strongest Driver of Growth for the Leading Cryptocurrency

The first Bitcoin ETFs approved in the United States were not based on physical Bitcoin but on CME futures contracts. Their approval paved the way for more active engagement of institutional investors and regulators with the crypto-assets industry. For a long time, the U.S. Securities and Exchange Commission (SEC) had rejected applications for spot Bitcoin ETFs, citing concerns over market manipulation. However, in 2024, regulators approved several applications from major companies such as BlackRock, Fidelity, Ark Invest, and others. This event became a crucial catalyst for Bitcoin’s price growth as it lowered barriers to mass retail and institutional investments.

The Role of BlackRock and Other Financial Giants

BlackRock, the world’s largest asset manager with over $10 trillion in assets under management, played a pivotal role. The approval of a Bitcoin ETF by such a major player sent a positive signal to the market, boosting confidence in this new investment opportunity. Following BlackRock, other traditional institutions like Fidelity, Valkyrie, WisdomTree, and Invesco also submitted their applications for spot Bitcoin ETFs.

$35.66 Billion Inflows into U.S. Spot Bitcoin ETFs

By the end of 2024, U.S. spot Bitcoin ETFs recorded $35.66 billion in new capital inflows. This includes BlackRock’s ETF, which attracted the lion’s share due to its strong brand recognition and extensive client base. The remaining funds were distributed among other ETFs, such as those managed by Fidelity and Ark Invest.

Demand Structure: The Role of Retail and Institutional Investors

80% (Retail Trading): Approximately four-fifths of the total demand for Bitcoin ETFs in 2024 came from retail investors. Key drivers included the simplified process of purchasing cryptocurrency through familiar brokerage platforms, reduced risks associated with custody, and the "trust effect" attributed to major financial institutions. Retail activity surged in a bullish trend fueled by positive news.

20% (Institutional and Professional Players): Although the institutional share was relatively low in 2024, interest from hedge funds, pension funds, and insurance companies increased toward the end of the year. According to forecasts, in 2025, the institutional segment (pension funds, insurance firms, and large banks) is expected to expand its share of Bitcoin purchases, both through ETFs and directly on the spot market.

A significant influx of "long-term" money could act as a stabilizing cushion for volatility and support asset growth.

Who Is Making These Predictions?

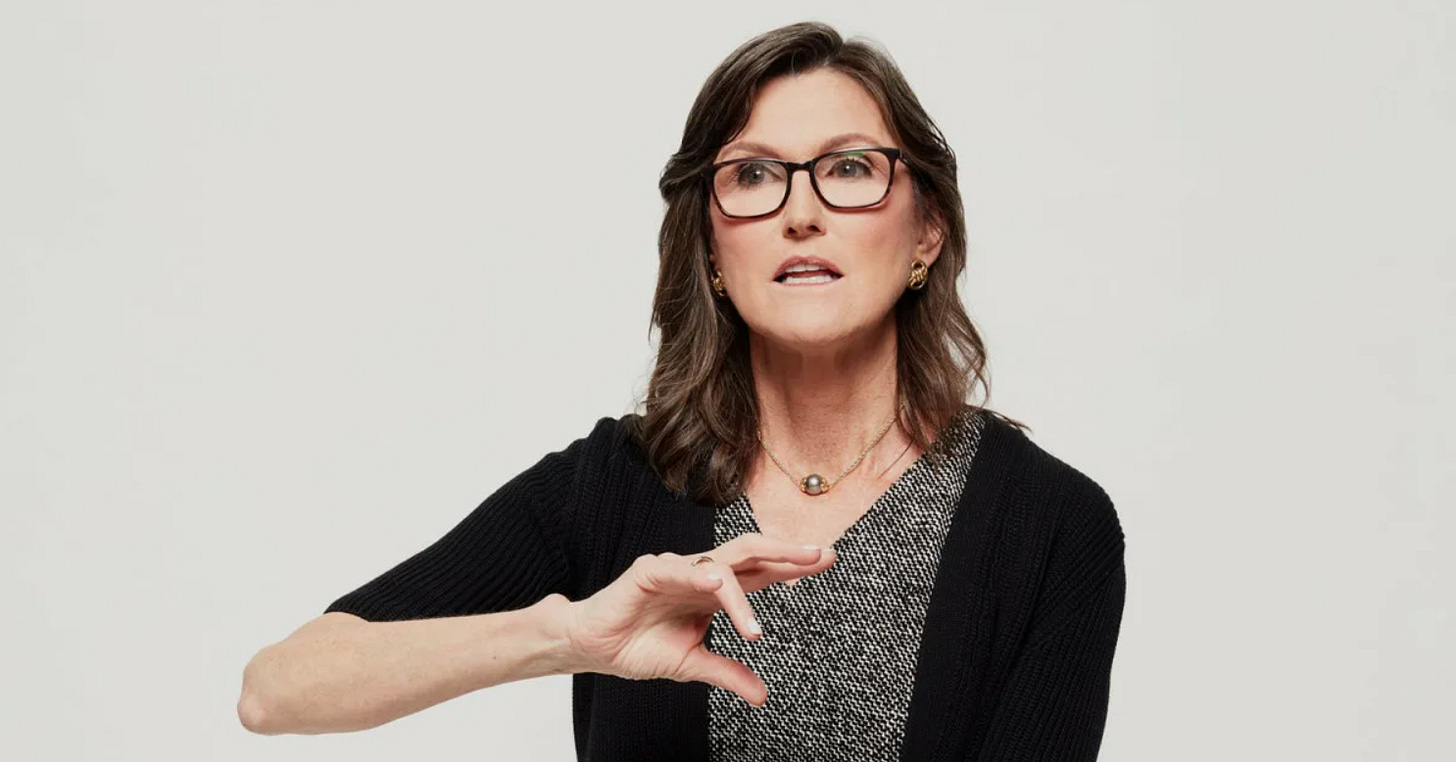

Cathie Wood, CEO and founder of ARK Invest, has repeatedly highlighted the potential for widespread institutional adoption of Bitcoin in interviews and blog posts. ARK predicts the emergence of a class of "long-term institutional money" (pension funds, insurance companies, and sovereign wealth funds) that views Bitcoin as a hedging tool or a digital gold equivalent. Their reports suggest that growing institutional interest could significantly boost Bitcoin’s market capitalization while simultaneously reducing volatility due to the long-term positions of major players.

Fidelity Digital Assets, a subsidiary of one of the world’s largest asset managers, conducts annual research on institutional interest in cryptocurrencies. According to their "Institutional Investor Digital Assets Study," the share of institutions (including pension funds and family offices) with a "positive" outlook on cryptocurrencies continues to grow.

Bloomberg Intelligence forecasts that with the expansion of regulated products (including spot ETFs), major financial companies will gain easy infrastructure for entering Bitcoin. Mike McGlone has frequently mentioned that capital inflows from "long-term" players will increase, especially if macroeconomic conditions (interest rates, inflation, and stock market behavior) push them to seek alternatives.

Additional Insights from Market Leaders

Bitcoin May Be a Top Commodity Indicator in 2025. Bitcoin on the top of our macroeconomic annual performance dashboard and US Treasury bonds on the bottom may suggest it's about as good as it gets for risk assets. That gold has outperformed the AI-driven S&P 500, despite competition from the rapidly rising crypto, could show lofty limits favoring the store of value.

While BlackRock has not released detailed medium-term crypto forecasts (at least not publicly), its CEO, Larry Fink, has commented: "Cryptocurrencies can play a role in portfolio diversification."

Institutionalization and the Path Forward

Deloitte, PwC, and other consulting firms have published reports on blockchain and cryptocurrencies, emphasizing that market institutionalization heavily depends on the availability of convenient and regulated tools, which are gaining momentum toward the middle of the decade.

The thesis that "institutions will significantly increase their Bitcoin positions in 2025" reflects a general trend and consensus among industry analysts (ARK Invest, Fidelity, Bloomberg Intelligence, etc.) rather than a specific forecast. Analysts frequently note that the accessibility of regulated instruments (such as spot ETFs) and the resolution of legal issues (custody, storage, and reporting) will play a critical role. As a result, the mass entry of "long-term" money is expected not in 2024 but closer to 2025–2026, when the market undergoes its first phase of "adoption" of spot Bitcoin ETFs by major participants.

Conclusion

Spot Bitcoin ETFs have not only attracted massive volumes of retail investment but also significantly increased trust in Bitcoin among traditional financial institutions. If favorable regulatory and macroeconomic conditions persist, 2025 may witness an even larger influx of institutional money, which would have a long-term positive effect on the cryptocurrency market as a whole.

How U.S. Elections Impact Bitcoin

Important Note:

1) At the time of writing this review, there is no direct official evidence to suggest that "support for Bitcoin" itself became a decisive factor in any U.S. election victory.

2) Historically, Donald Trump's public statements about Bitcoin have generally been skeptical. However, more recent rhetoric has included moderately positive signals in favor of innovation, including blockchain and cryptocurrencies.

Background: Bitcoin in U.S. Politics

Initial Skepticism from Regulators and Politicians (2013–2017): During Bitcoin’s rapid growth from 2013 to 2017, U.S. authorities and politicians were largely cautious about cryptocurrencies. Agencies like the SEC, FinCEN, and others issued warnings highlighting risks such as money laundering, fraud, and regulatory violations. The vast majority of traditional political figures did not see Bitcoin as a mainstream phenomenon capable of influencing the political landscape.

Shift Toward Crypto Exchange and Regulation Discussions (2018–2021): As major exchanges like Coinbase, Kraken, and Gemini developed and Bitcoin futures ETFs emerged, regulatory interest grew. Politicians began recognizing crypto as a legitimate economic sector capable of generating tax revenue and creating jobs. Some lawmakers began lobbying for "pro-crypto" legislation, including simplified tax regimes and clearer regulations.

2021–2023: Cryptocurrencies Become a Campaign Topic: Between the 2020 and potential 2024 elections, several high-profile events occurred: the DeFi and NFT boom, and the collapse of major projects like Terra and FTX.

These events prompted both Republicans and Democrats to express positions on cryptocurrencies, recognizing that the topic resonates with millions of retail investors and active users.

Donald Trump: Evolving Views on Cryptocurrencies

Early Public Statements (2019–2020): Donald Trump repeatedly tweeted (now on X) that he was "not a fan of Bitcoin" and that "cryptocurrencies are not real money." These statements were broadly negative or skeptical.

Potential Shift in Rhetoric (2023–2024): As more political figures (primarily in the Republican Party) began advocating for citizens’ rights to hold Bitcoin and protect innovation, Trump may have adjusted his stance. While there are few direct statements where Trump explicitly says, "I support Bitcoin," he has made comments like, "The U.S. must lead in technology, not lag behind."

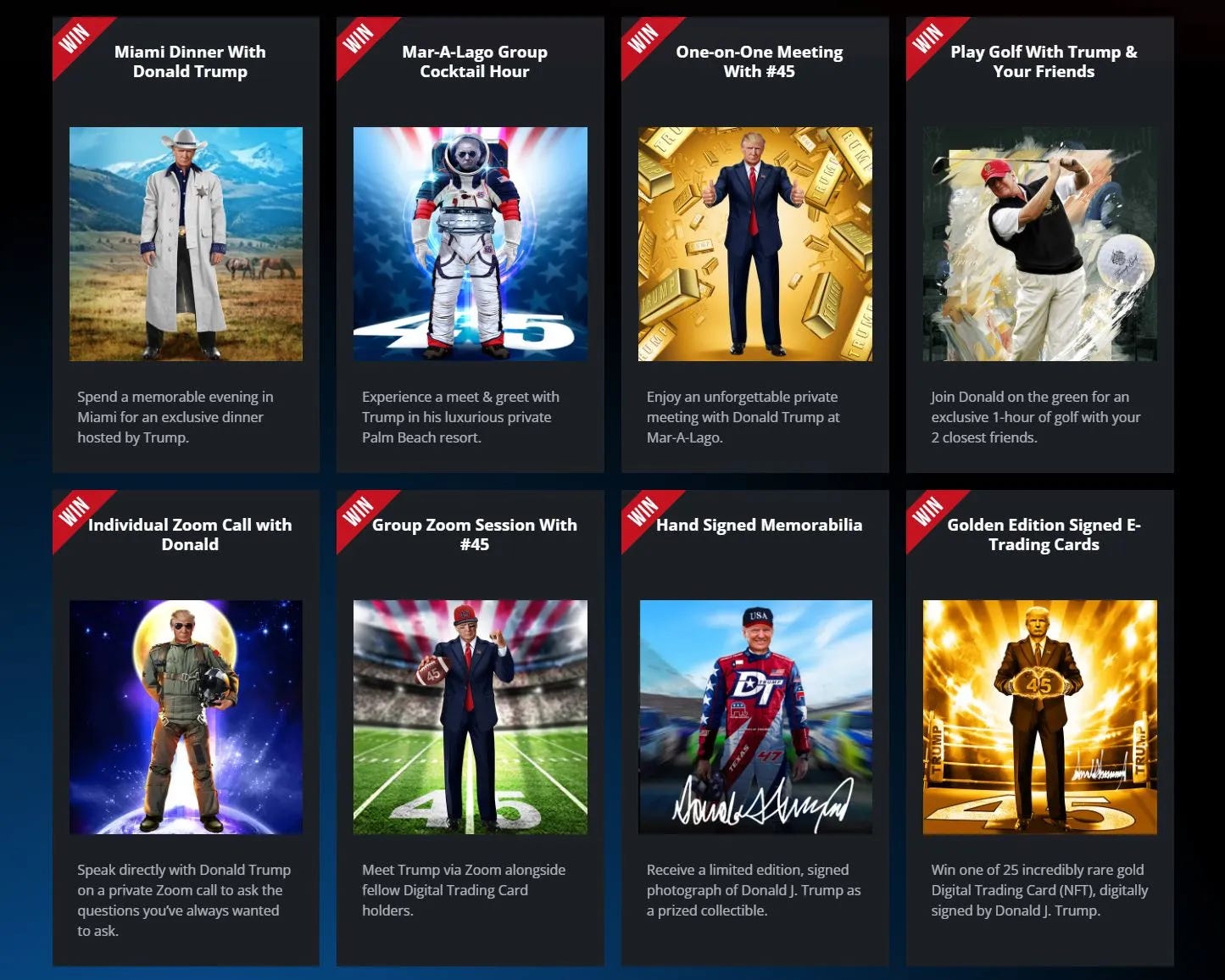

Role of Trump’s NFT Projects: Donald Trump launched an NFT collection (Trump Digital Trading Cards) that generated significant interest and sold out quickly. This move likely reflects an effort to capitalize on trendy technology and monetize his brand, rather than full-fledged support for the idea of "Bitcoin as the future of finance." Nonetheless, his entry into the NFT space indicates that Trump (and his team) see potential in cryptocurrencies and digital tokens to attract new audiences.

Other Candidates and the Republican Agenda

Ron DeSantis: The former governor of Florida has repeatedly stated that "Florida is a state open to innovation" and signed legislation favorable to blockchain companies. His 2023–2024 campaign included mentions of supporting "fintech startups" and opposing "oppressive regulation" in the cryptocurrency space.

Rand Paul and Other Libertarians in the Republican Party: Some Republican senators and congressmen see Bitcoin as a continuation of libertarian ideas: monetary freedom, reduced Federal Reserve oversight, and more. For them, cryptocurrencies align with a broader fight against "excessive government regulation."

Democrats and Progressive Ideas: Some Democrats also maintain positive positions on cryptocurrencies. For example, Andrew Yang, during the 2020 primaries, advocated for "embracing Bitcoin" and fostering fintech. However, the left wing of the Democratic Party often criticizes the crypto industry for its speculative nature and consumer risks, leading to a lack of consensus within the party.

Lobbying from the Crypto Industry

Growth of the Crypto Lobby: The number of lobbyists and political action committees (PACs) associated with exchanges and blockchain companies continues to grow annually. Coinbase, Gemini, FTX (before its collapse) and other firms actively fund political campaigns to create a "crypto-friendly" regulatory environment. Regardless of the candidate, the crypto industry aims to establish allies in both parties.

Impact on Voters: Millions of Americans own cryptocurrencies, making them an active and engaged demographic. Some voters consider the "Bitcoin factor" when deciding how to vote. However, for most Americans, cryptocurrencies rank far below traditional campaign issues such as the economy, healthcare, and public safety.

Was "Bitcoin Support" a Decisive Election Factor?

Key Factors in Election Outcomes: U.S. elections are determined by a complex mix of factors, including the state of the economy, unemployment rates, partisan dynamics, candidate charisma, debate performance, and support in key swing states. For the vast majority of voters, Bitcoin and innovation rarely serve as decisive criteria.

Can Pro-Crypto Rhetoric Sway Some Voters?

Yes, absolutely. Bitcoin holders and supporters of decentralized technologies form a highly active community. In tight elections where candidates receive similar levels of support, a pro-crypto stance could become an additional "plus" for undecided voters. This is particularly true among younger voters in tech hubs like San Francisco, New York, and Miami, as well as the blockchain business community.

Examples of Crypto Funding in Politics: There are documented cases of candidates receiving significant donations from crypto investors. However, these contributions pale compared to traditional financial structures (banks, hedge funds, and large corporations), whose lobbying budgets are orders of magnitude larger.

U.S. Presidential Elections as the "Second Most Important Event for Bitcoin"

Why Are Elections Important for Bitcoin? U.S. regulatory policy largely shapes global rules for crypto exchanges, stablecoins, and blockchain projects. The adoption of either restrictive laws or liberal norms can affect Bitcoin prices and the industry’s development. The U.S. is home to many major Bitcoin-related companies, as well as a significant share of mining operations. Therefore, presidential administrations have both direct and indirect influence on the industry.

Was Trump’s Stance Decisive? Historically, Trump’s position on Bitcoin has been somewhat contradictory. However, the broader Republican environment has recently leaned more favorably toward reducing regulations and supporting innovation, including blockchain. A candidate running on a platform of "We will not stifle Bitcoin" could gain additional votes from the crypto community. That said, labeling this as the "decisive factor" would be an oversimplification. In practice, the economy, political alliances, and swing-state preferences play a much greater role.

Does Bitcoin Influence Elections?

The Crypto Factor Exists, But It’s Not Dominant. In U.S. politics, cryptocurrencies and blockchain are gaining prominence but still lag behind traditional socio-economic topics in importance. However, a flourishing lobbying scene and a growing crypto-holder community make a pro-crypto stance potentially advantageous.

Trump and Republicans Can Leverage Innovation Themes. Despite early skepticism, Trump’s team recognizes the value of appealing to younger, tech-savvy voters and entrepreneurs. As a political message, this could resonate well, especially if opponents are seen as more "overregulated."

Presidential Elections Are Not Determined Solely by Bitcoin. Election outcomes are shaped by a complex geopolitical, economic, and social mosaic. While the victory of a particular candidate can influence Bitcoin’s volatility and regulation, it’s incorrect to claim that the sole reason for victory is support for the innovation sector.

Bitcoin Is Now Part of the Political Agenda: More U.S. politicians from both parties are compelled to articulate their positions on cryptocurrencies and blockchain.

Final Thoughts

While Bitcoin’s role in elections may not yet be decisive, its influence is growing. Spot Bitcoin ETFs, lobbying efforts, and the rapid expansion of the crypto audience make the question "What is the president’s stance on Bitcoin?" increasingly relevant.

If a candidate (whether Trump or another) openly supports the industry, it could be an additional incentive for proponents of decentralized technologies. However, calling this a decisive factor requires more concrete evidence.

U.S. presidential elections undoubtedly hold a special place in Bitcoin’s world, as American policies and regulations directly impact global crypto markets. Still, turning pro-crypto rhetoric into the sole determining reason for an election victory oversimplifies the political process. Looking ahead to 2028 and beyond, as the "digital native" generation becomes more active in voting, the impact of crypto themes on election outcomes could grow significantly.

The Role of Michael Saylor and MicroStrategy in Bitcoin Market Development

Michael Saylor is an American entrepreneur, co-founder, and chairman of the board (formerly CEO) of MicroStrategy. He is renowned as a visionary in data analytics and enterprise software. Since 2020, Saylor has become one of the most vocal Bitcoin advocates on traditional financial platforms. He regularly participates in conferences, podcasts, and interviews, emphasizing that BTC is "the best store of value" in an era of rising inflation and fiat currency instability.

MicroStrategy: Company Profile and Bitcoin Acquisition Strategy

MicroStrategy is a corporation specializing in business intelligence (BI) software and cloud solutions. Founded in 1989, it is headquartered in the United States and publicly traded under the icker MSTR.

Transition to Bitcoin Investment:

In August 2020, MicroStrategy announced its first Bitcoin purchase as part of its treasury strategy.

Objective:

To hedge against inflation risks and reduce dependence on the U.S. dollar.

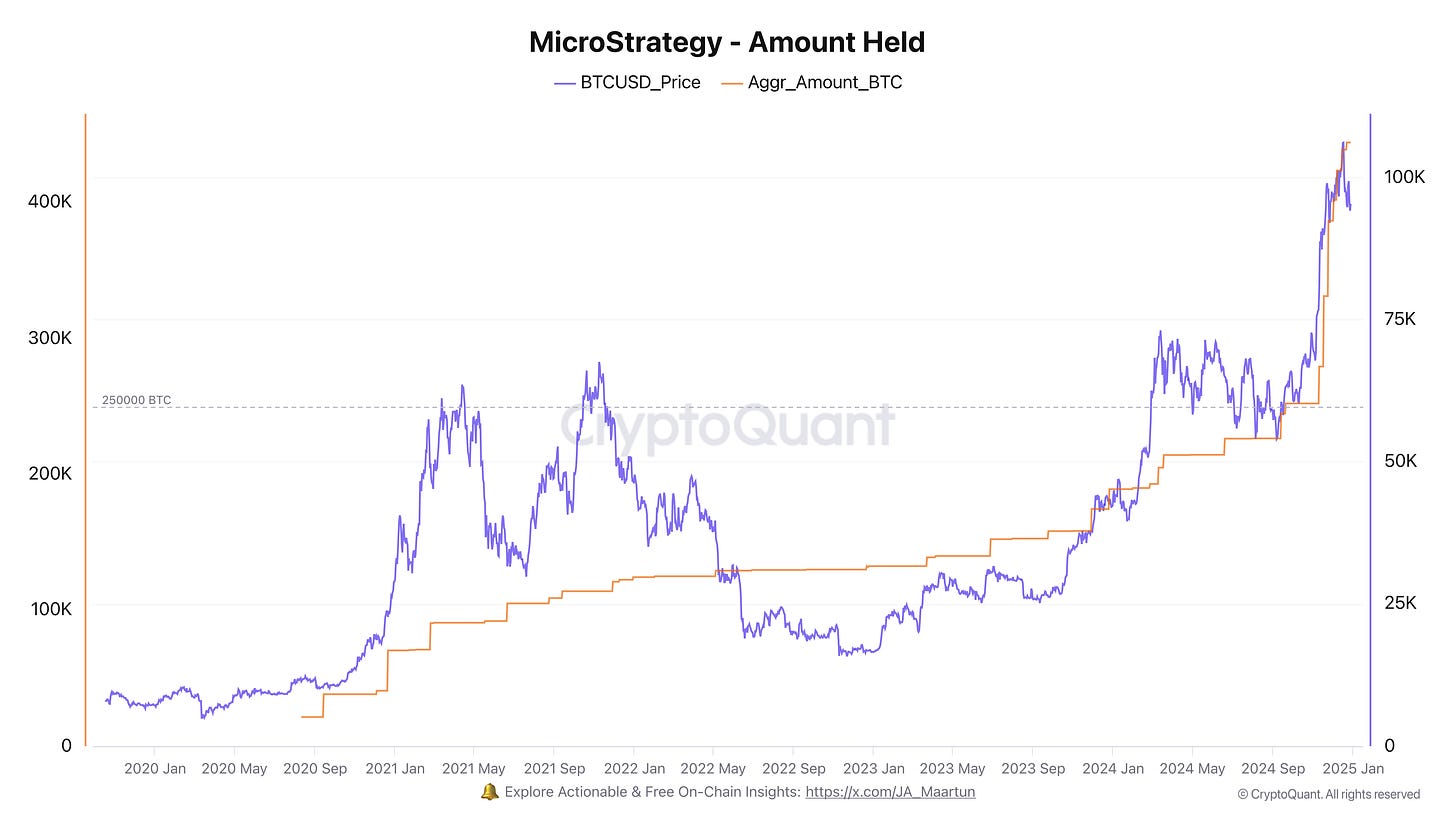

Since then, the company has continued to accumulate Bitcoin, leveraging convertible bonds and additional stock offerings. By 2024, MSTR had amassed several hundred thousand BTC, effectively transforming into a "corporate Bitcoin fund."

The company has also become a proxy for investors seeking indirect exposure to Bitcoin through MSTR shares. Thanks to Saylor's active advocacy and MicroStrategy's transparent reporting, the company has become a symbol of corporate Bitcoin adoption, inspiring other firms to consider allocating a portion of their reserves to BTC.

A Key Driver of Bitcoin Growth in 2024: MicroStrategy’s Role

Why 2024?

The approval of spot Bitcoin ETFs in the U.S. (including those from BlackRock, Fidelity, and others) positively impacted the broader market. However, MicroStrategy remained one of the pioneers with a significant Bitcoin balance. In 2024, amid bullish market sentiment, MSTR continued to publicly announce plans to acquire more Bitcoin. Each press release about additional purchases sparked waves of interest.

Two Waves of Purchases:

1) First Wave: Early in the year, MicroStrategy announced a major BTC purchase (several thousand Bitcoin) after prices spiked following ETF-related news.

2) Second Wave: Mid-2024, MicroStrategy issued convertible bonds to raise funds for another significant Bitcoin purchase.

Each transaction announcement often triggered a short-term price spike in BTC, as the market perceived it as a sign of confidence from major players in Bitcoin's long-term growth.

Marketing and Information Effect:

1) Extensive PR: Each of Saylor's public appearances—whether on YouTube, podcasts, or conferences—was widely covered by industry media (e.g., CoinDesk, The Block, Bloomberg Crypto).

2) The “Follow-the-Leader” Effect: Institutional investors and private individuals, previously skeptical of BTC, saw MicroStrategy’s example and began to view Bitcoin as a reliable investment. This mirrored the sentiment of "If a major public company does this, it must be justifiable."

Financial Results and MSTR Stock Performance

Additional charts on MicroStrategy can be found on Maarten's dashboard at CryptoQuant.

Correlation Between MSTR Shares and Bitcoin:*

Since 2020–2021, MSTR’s stock performance has closely correlated with BTC’s price. When Bitcoin rises, MSTR shares often climb even higher. Conversely, when Bitcoin prices fall, MSTR shares tend to drop more sharply.

In 2024, as Bitcoin reached new local highs, MSTR shares demonstrated significant growth, buoyed by positive reports.

Strengthened Financial Position:

As Bitcoin’s balance sheet value increased, it positively impacted MicroStrategy's financial reports (though BTC is formally considered an intangible asset under US GAAP, which involves nuanced revaluation practices).

This positive asset revaluation helped MicroStrategy avoid losses it had previously reported during significant Bitcoin downturns (e.g., in 2022).

Improved Ratings: Analysts who once criticized MicroStrategy's "excessive" reliance on Bitcoin began revising their views in 2024, raising target prices for MSTR shares.

Criticism and Risks

High Leverage and Volatility:

The strategy of raising debt to purchase Bitcoin could result in substantial losses if BTC prices drop sharply. While the company has risk policies in place, the market still views its approach as highly aggressive.

Bitcoin’s volatility remains high; in the event of a severe price decline, MSTR shares could face significant losses, posing a risk to long-term shareholders.

Regulatory Uncertainty:

Despite the approval of several spot Bitcoin ETFs, the SEC and other U.S. regulators continue to scrutinize the crypto market (e.g., actions against Coinbase and Binance). Any strict regulatory measures could negatively impact MicroStrategy. However, as a publicly traded company, MSTR benefits from some protection due to its adherence to financial reporting standards and its operation within U.S. legal frameworks.

Reputation Tied to Saylor:

Michael Saylor has become the face of MicroStrategy and corporate Bitcoin holdings. If negative information about Saylor emerges, it could impact MSTR shares directly.

Outlook for Late 2024 – Early 2025

Continuation of the Bullish Trend:

If Bitcoin's bull market persists, MicroStrategy could continue its BTC accumulation strategy. Proponents believe Bitcoin prices will rise as new institutional tools (e.g., spot ETFs, custody infrastructure) are introduced.

Possible Diversification:

Some analysts anticipate that MicroStrategy might partially shift to a "diversified" strategy, such as acquiring Ethereum (ETH) or other highly liquid digital assets. However, Saylor has remained conservative in his choice: "Only Bitcoin."

Potential Impact of the Bitcoin Halving (2024–2025):

Historically, after Bitcoin’s block reward halving, the market enters a new growth phase. If this trend continues in 2025, MicroStrategy, as the largest corporate holder, stands to benefit significantly. This could further solidify its position and serve as an example for other public companies.

Conclusion

n 2024, Michael Saylor and MicroStrategy continued to play a pivotal role as one of the primary catalysts for Bitcoin’s growth. Their aggressive Bitcoin accumulation strategy—supported by Saylor’s high-profile statements and positive market news (such as the launch of spot ETFs)—contributed significantly to Bitcoin’s bullish trend. However, this ambitious model carries substantial risks associated with market volatility. The next 1–2 years will determine whether MicroStrategy solidifies its status as a "long-term winner" and corporate "Bitcoin holding company" or faces new challenges amid future market fluctuations.

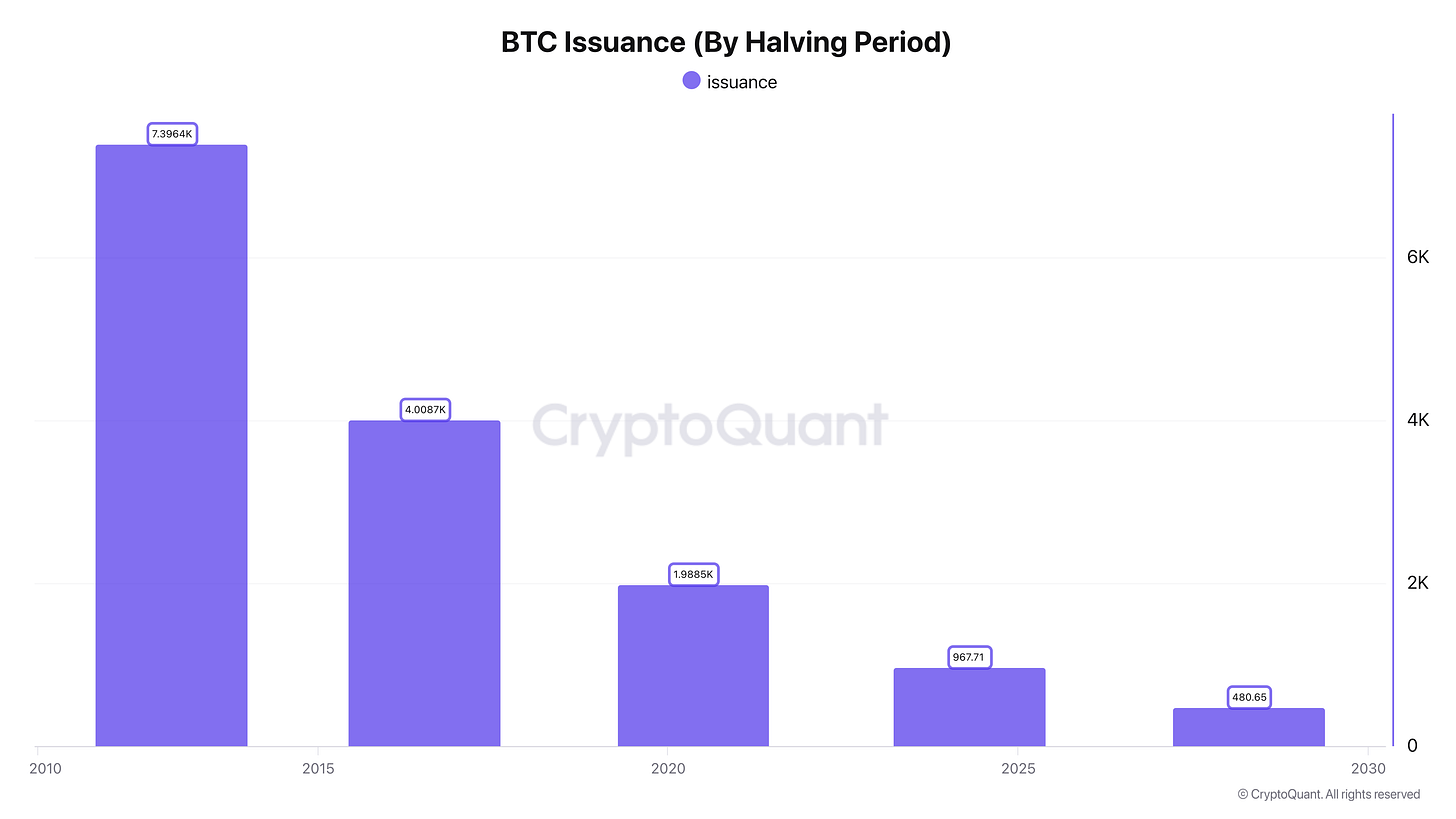

The Role of Bitcoin Halving in Price Dynamics for 2024

The Bitcoin halving is a protocol-scheduled event where the reward for mining a block is reduced by half. It occurs approximately every 210,000 blocks, or roughly every four years.

Purpose: Halving reduces the issuance rate of new Bitcoins, making it a "deflationary" asset. Market logic suggests that with stable or increasing demand, decreasing supply can lead to price growth.

Historical Context of Halving

To understand potential scenarios for 2024, it’s useful to analyze the price dynamics following previous halving events.

First Halving (November 28, 2012):

The reward decreased from 50 BTC to 25 BTC.

Before the halving, Bitcoin traded at approximately $10–$12. Over the next year, the price surged to several hundred dollars, ending the bull cycle near $1,000 by late 2013.

Second Halving (July 9, 2016):

The reward decreased from 25 BTC to 12.5 BTC.

Bitcoin gradually rose over the next year, entering a major bull cycle that peaked near $20,000 by December 2017.

Third Halving (May 11, 2020):

The reward decreased from 12.5 BTC to 6.25 BTC.

After a brief consolidation, BTC began a significant rally in late 2020, eventually exceeding $60,000 in 2021.

Fourth Halving (April 20, 2024):

The reward decreased from 6.25 BTC to 3.125 BTC.

The halving’s impact, amplified by institutional interest and macroeconomic factors, creates the potential for price growth over the next 12–18 months, similar to prior cycles.

General Pattern:

Following each halving, Bitcoin typically enters a significant price growth phase over the subsequent 12–18 months. While this is not a "guarantee" of future performance, historical data supports expectations of a bullish trend.

How Halving Affects Price

Supply Shock:

Post-halving in 2024, the mining reward decreases from 6.25 BTC to 3.125 BTC per block. Approximately 144 blocks are mined daily, reducing daily issuance from ~900 BTC to ~450 BTC. With constant or increasing demand, this supply reduction creates a gradual shortage of new coins in the market.

Inflation Hedge and Perceived Scarcity:

In times of high inflation (or inflation fears), Bitcoin is viewed by some investors as "digital gold" and a hedge.

The reduction in issuance reinforces this narrative, enhancing its perceived scarcity.

Psychological Factor:

Halving is widely discussed in the crypto community and media, generating "FOMO" (Fear Of Missing Out) among both small and large investors. This interest often increases months before the event.

Unique Factors for the 2024 Halving

Spot Bitcoin ETFs:

The approval of several spot BTC ETFs in the U.S. (from providers like BlackRock, Fidelity, and others) was one of the most significant events of 2024. Regulated instruments can attract new, large-scale investors (both retail and institutional), complementing the supply reduction effect.

Active Corporate Adoption (e.g., MicroStrategy):

Large public companies (such as MicroStrategy) continue to acquire BTC. Corporate interest, combined with the halving, serves as an additional bullish signal for the market.

Broader Macroeconomic Environment:

If central banks (notably the U.S. Federal Reserve) ease monetary policy, demand for "safe-haven" assets (like gold and Bitcoin) could rise. Volatility in global equity markets may also drive investors toward alternatives like cryptocurrency.

Potential Price Scenarios for 2025

Classic Bull-Run:

Historically, Bitcoin often begins a steady rise months before the halving, with momentum accelerating after the event. This pattern was evident in 2024.

Negative Macro Backdrop:

If the global economy faces a severe crisis or tighter monetary conditions (e.g., rate hikes, restrictive policies for crypto exchanges, or geopolitical conflicts), some investors may exit riskier assets like Bitcoin. In such cases, the halving’s impact could be muted or delayed.

Risks

Overheated Market and Speculation:

During periods of high enthusiasm, BTC prices can become overinflated in a short time. Sharp corrections often follow such spikes. New investors must understand market volatility risks and avoid relying solely on historical charts.

Regulatory Actions:

New regulations for crypto exchanges, mining, and taxation could emerge in the U.S. and other countries. Strict measures could temporarily "cool" the market and reduce the halving’s impact.

Conclusion

The 2024 Bitcoin halving, based on previous experience, has been one of the key catalysts for a bull market. Additional factors—spot BTC ETFs, corporate purchases, and macroeconomic conditions—further strengthen the case for potential price growth. If demand for Bitcoin continues to increase and institutional investors leverage regulated entry points into the crypto market, BTC prices are well-positioned for growth in 2025.

Key Takeaways for Bitcoin in 2024:

1. Spot Bitcoin ETFs were a major growth driver, attracting $35.66 billion in new capital, primarily from retail investors.

2. Role of BlackRock and Other Major Players: The approval of ETFs from giants like BlackRock, Fidelity, and Ark Invest boosted investor confidence in Bitcoin.

3. Retail Activity Dominated: Around 80% of ETF demand came from retail investors, with institutional interest rising toward the year’s end.

4. Corporate Interest: Companies like MicroStrategy continued to accumulate BTC, reinforcing the bullish trend.

5. Bitcoin Halving: The reduction in mining rewards created conditions for further price growth by amplifying the supply shock.

6. Market Volatility: BTC ended the year with a price range between $42K and $108K.

7. Macroeconomic Context: Regulatory liberalization and high inflation solidified Bitcoin’s positioning as digital gold.

8. Risks: High volatility, regulatory uncertainty, and market pressures remain factors that demand investor attention.

Outlook:

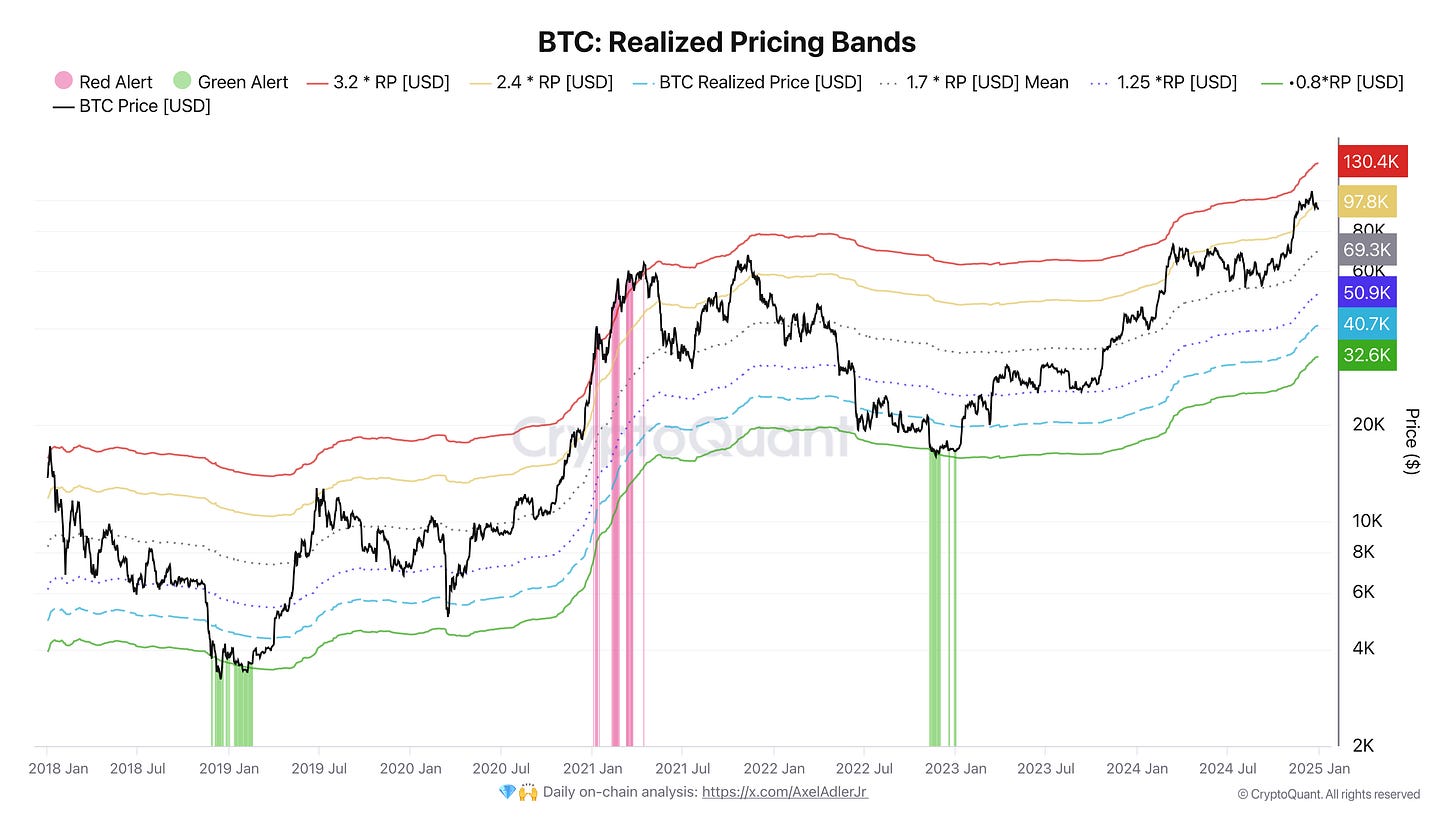

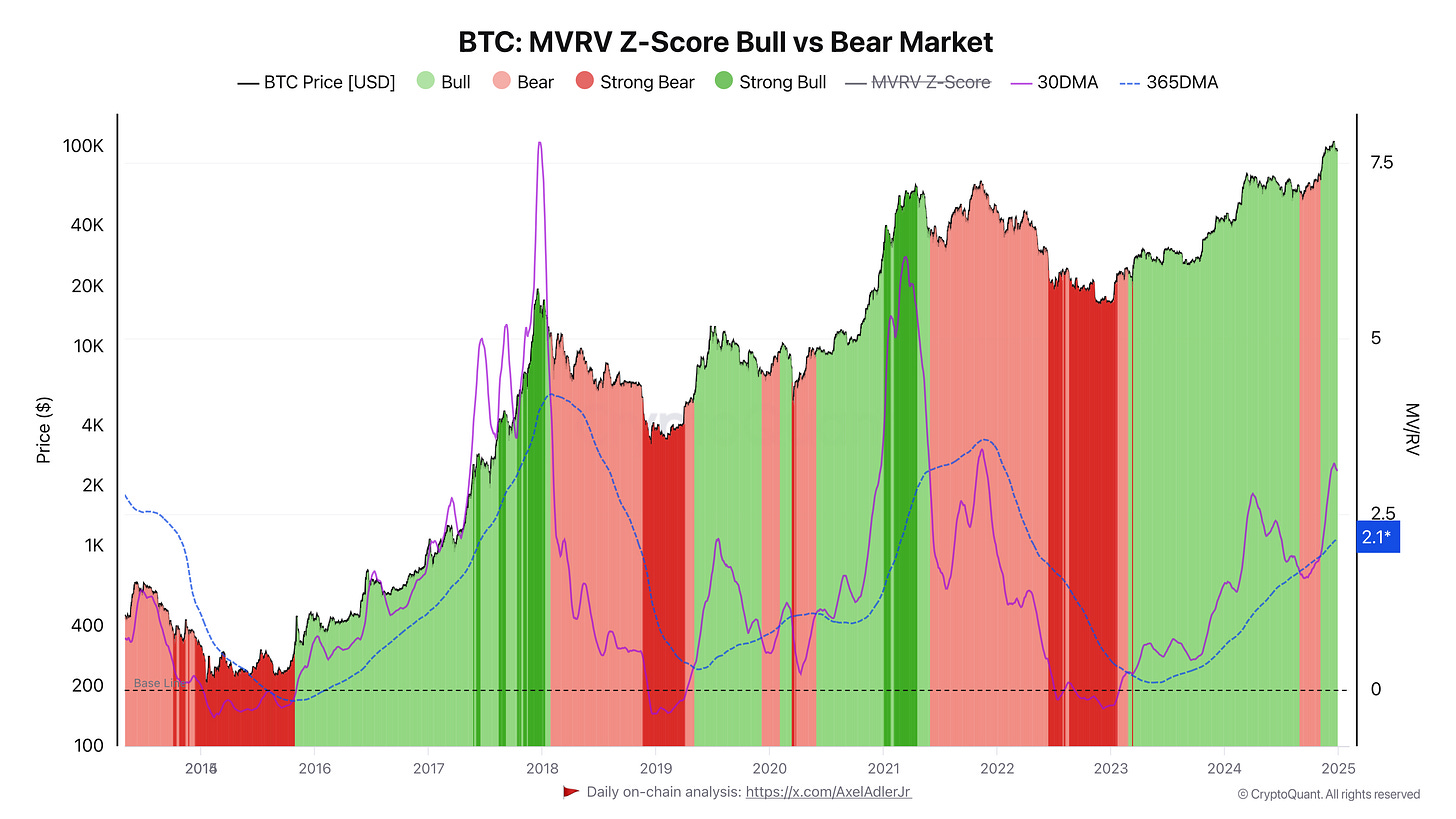

Amid growing institutional interest, spot BTC ETFs, and the halving’s effects, the bullish trend is expected to continue in 2025. Investors should remain mindful of volatility and global economic influences on growth rates. The next resistance level at $130K will be a critical point where major players may start selling Bitcoin. On the macro level, $90K remains a strong support zone. In case of a negative macro scenario early in the year, the range of $85K–$82K will act as a key support level.

Thank you for your attention this year! Wishing you a wonderful holiday season, successful investments, and encouraging you to view Bitcoin as a long-term tool for preserving and growing capital.

Happy New Year,

AAJ

Massive work 🙏

In an ETF, it's very easy to cash out - literally just one click. I think that once investors realize a bear market has set in, many of them will start selling so they can buy at lower prices toward the end of the cycle.