Insight #26

Fears over 69,370 BTC sale shake the market, inflation risks, futures pressure – what’s next for Bitcoin?

Bitcoin Network Milestones in 2024 🎉

In 2024, the Bitcoin network processed transactions totaling over $19 trillion, more than double the $8.7 trillion figure recorded in 2023. Bitcoin’s market capitalization reached $1.9 trillion in December 2024, while the network’s hash rate hit a new record of 1,000 exahashes per second (EH/s) in January 2025.

Significant Events of the Past Week:

The U.S. government has received approval to sell $6.5 billion worth of Bitcoin seized from Silk Road in 2020, totaling 69,370 BTC.

An amount of 69,370 BTC is significant even for the global cryptocurrency market. Currently, the average daily inflow to all exchanges is approximately 25,000 BTC. If the U.S. government decides to sell all these Bitcoins at once on the open market, it could potentially trigger:

A sharp price decline (a "dump" effect) due to the sudden influx of supply.

Increased volatility, as large traders may begin opening short positions in anticipation of mass sales, leading to a cascade of long liquidations.

How feasible is this from a legal standpoint?

Following the court’s satisfaction of the claims in this civil case, the assets came under U.S. government control, which may dispose of them through U.S. Marshals Service auctions or other mechanisms.

If the new administration considers such actions "controversial," a temporary moratorium (executive order) on large-scale state transactions may be imposed. Essentially, the new administration could initiate further investigations, audits, or new court hearings regarding the legality and advisability of rapidly liquidating the asset before the transfer of power. Considering the U.S. presidential inauguration, a decision without the new administration’s consent is unlikely, as it could exacerbate instability and provoke negative reactions from investors in the cryptocurrency market. Notably, President Trump would likely avoid such negativity before taking office.

For now, this news is primarily FUD but is expected to exert negative market pressure throughout the week.

Circle has donated $1 million in USDC to President-elect Trump’s inaugural fund, highlighting the committee’s openness to stablecoin contributions. While $1 million is the minimum donation for Trump’s inauguration, it is intriguing to observe how other company leaders have directly or indirectly commented on Trump before his recent election victory:

Sam Altman (OpenAI) called Trump an "unacceptable threat to America" in 2016 but now says, "We should all wish the President success."

Sergey Brin (Google) stated he was "deeply offended" by the 2016 election results but has now dined with Trump at Mar-a-Lago.

Tim Cook (Apple) declared that those who led the "shameful" Capitol insurrection on January 6, 2021 (fueled by Trump), "must be held accountable."

It’s interesting to see how Silicon Valley’s top figures have shifted their opinions.

Corporate Developments:

MicroStrategy: Michael Saylor’s company purchased 1,070 BTC worth $101 million, increasing its holdings to 447,470 BTC as it continues its aggressive accumulation strategy.

CleanSpark: Joining MARA, Riot, and Hut 8, CleanSpark became the fourth publicly traded Bitcoin miner with assets exceeding 10,000 BTC. Its BTC holdings grew by 236% year-over-year, solidifying its position as a top-five corporate Bitcoin holder.

Standard Chartered: The multinational financial services corporation has established a company in Luxembourg to provide Bitcoin and cryptocurrency custody services in the EU, expanding its presence in the digital assets space. This is notable because secure custody remains a real challenge for many investors.

Weekly Summary

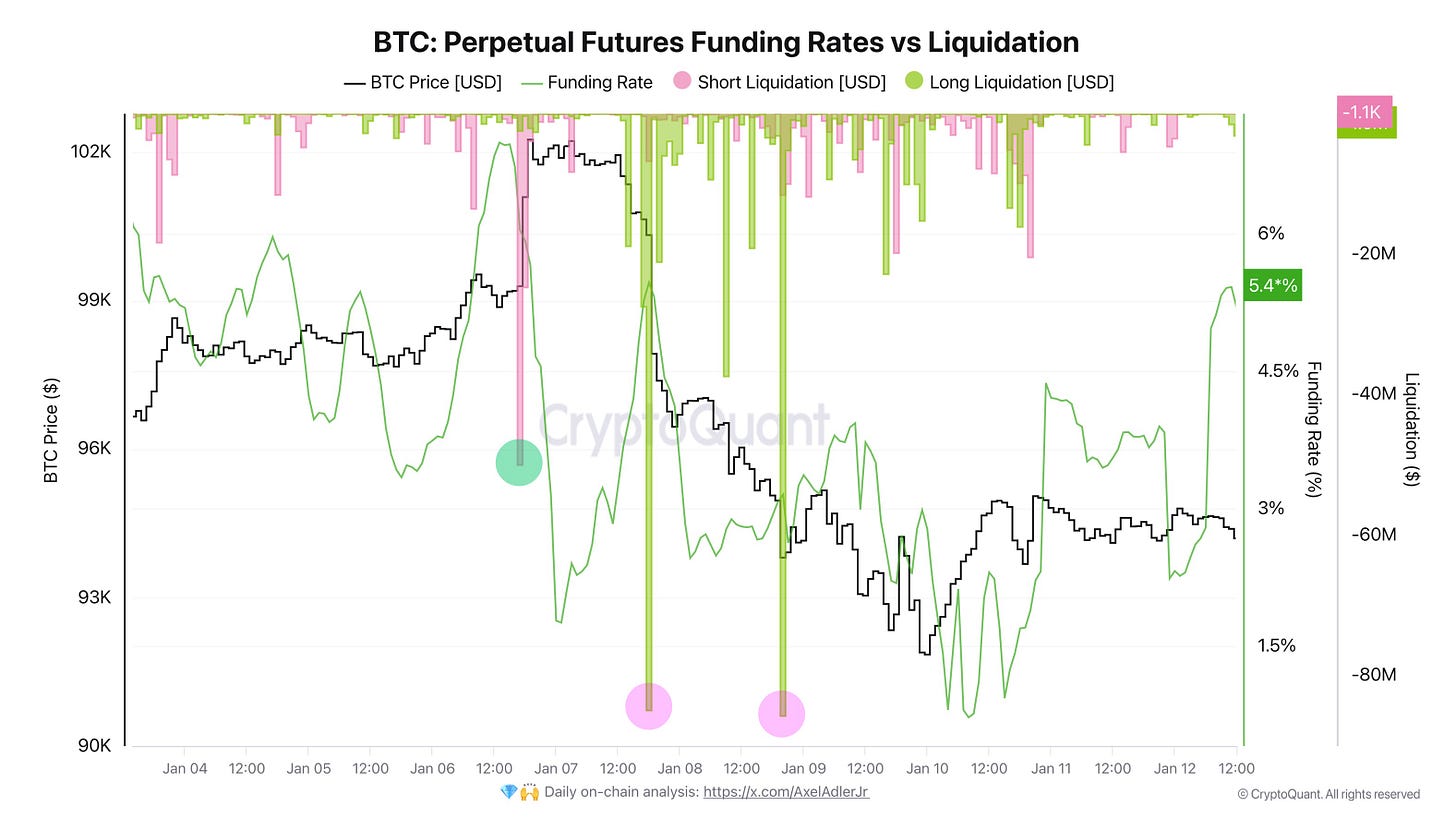

At the beginning of the week, Bitcoin reached $102,700, marking a local peak.

For the first time since December, Bitcoin surpassed the $100,000 mark, driven by rising funding rates for perpetual futures and bullish taker order volumes. This, in turn, triggered a cascade of short liquidations.

Amid concerns about inflation due to strong U.S. economic data, Bitcoin dropped to $91,000, causing market volatility. Trading volumes remained high during the decline but began to decrease during stabilization, potentially signaling a weakening momentum.

How did strong U.S. economic data spark inflation concerns?

The Dollar Index Reaches a 26-Month High

The Dollar Index has reached its highest level in 26 months. This indicates sustained demand for dollar-denominated assets and confirms that the U.S. appears more of a “safe haven” compared to other markets. A stronger dollar makes imports cheaper but may weaken exports. Combined with changes to the Federal Reserve's interest rate policy, this could lead to certain fluctuations in the USD pair with other major currencies.

Forecasts from Leading Banks on Fed Interest Rates

Goldman Sachs: Now expects two rate cuts this year (June and December) instead of three (March cut removed).

JP Morgan: Also removed the March rate cut, predicting reductions in June and September.

Bank of America: Believes the rate-cutting cycle is already over. The next phase will be an extended pause, with the next move possibly being a rate hike rather than a cut.

Thus, major banks are generally shifting toward more cautious rate forecasts. Many no longer anticipate a March cut and suggest the Fed will act more conservatively until inflation approaches the 2% target.

The Fed’s Position: A "Pause" on Rate Cuts

The Federal Reserve is maintaining a "pause" on rate cuts until disinflationary trends resume. According to analysts, the Fed is currently at the “right point” with rates at 4.25–4.50%, and further substantial cuts are unjustified until inflation gets closer to the target. This means rates are unlikely to fall below 4% in the short term unless price and economic activity data significantly underperform current forecasts. Additionally, comments from Fed officials reflect this stance:

Susan Collins, President of the Boston Fed, stated she expects less decisive monetary easing this year than anticipated a few months ago. Her outlook on the pace of disinflation has become more conservative, emphasizing the need for patience and a comprehensive evaluation of economic data.

Key Takeaways:

Most major banks no longer expect a quick resumption of rate cuts. On the contrary, if inflation does not continue to decline steadily, the Fed may keep rates elevated for longer.

A key risk for 2025 is a resurgence of inflation (“inflation risk 2.0”), potentially delaying further monetary easing or even prompting new tightening measures.

If the economy strengthens (GDP growth) and inflation risks persist, yields on long-term bonds are likely to rise further.

A Fed pause on rate cuts, coupled with a strong dollar, could temporarily suppress gold and Bitcoin prices in absolute terms. However, gold remains favored among precious metals, especially if inflation or geopolitical risks continue to rise.

Four Key Insights from Last Week:

1. Bitcoin reached a “psychological” round-number level before dropping under macroeconomic pressure.

2. Macroeconomic factors (Fed policy, dollar strength, forecasts) are pulling risk assets down amid inflation concerns.

3. Banks are adjusting their rate expectations in line with broader market sentiment.

4. FUD related to the sale of 69K BTC is likely to weigh negatively on the market.

Market Outlook for Next Week

The "Inflow/Outflow Ratio 30DMA" metric (orange and green lines) remains stable below the 1.0 level. This indicates that outflows from exchanges are exceeding inflows. Such a balance reflects demand for BTC, as users actively withdraw coins from exchanges after purchases.

The price continues consolidating near current levels, showing resilience despite negative news. The $90K level is holding as a potentially significant resistance zone. Investors view current levels as consolidation territory. Now let’s turn to futures.

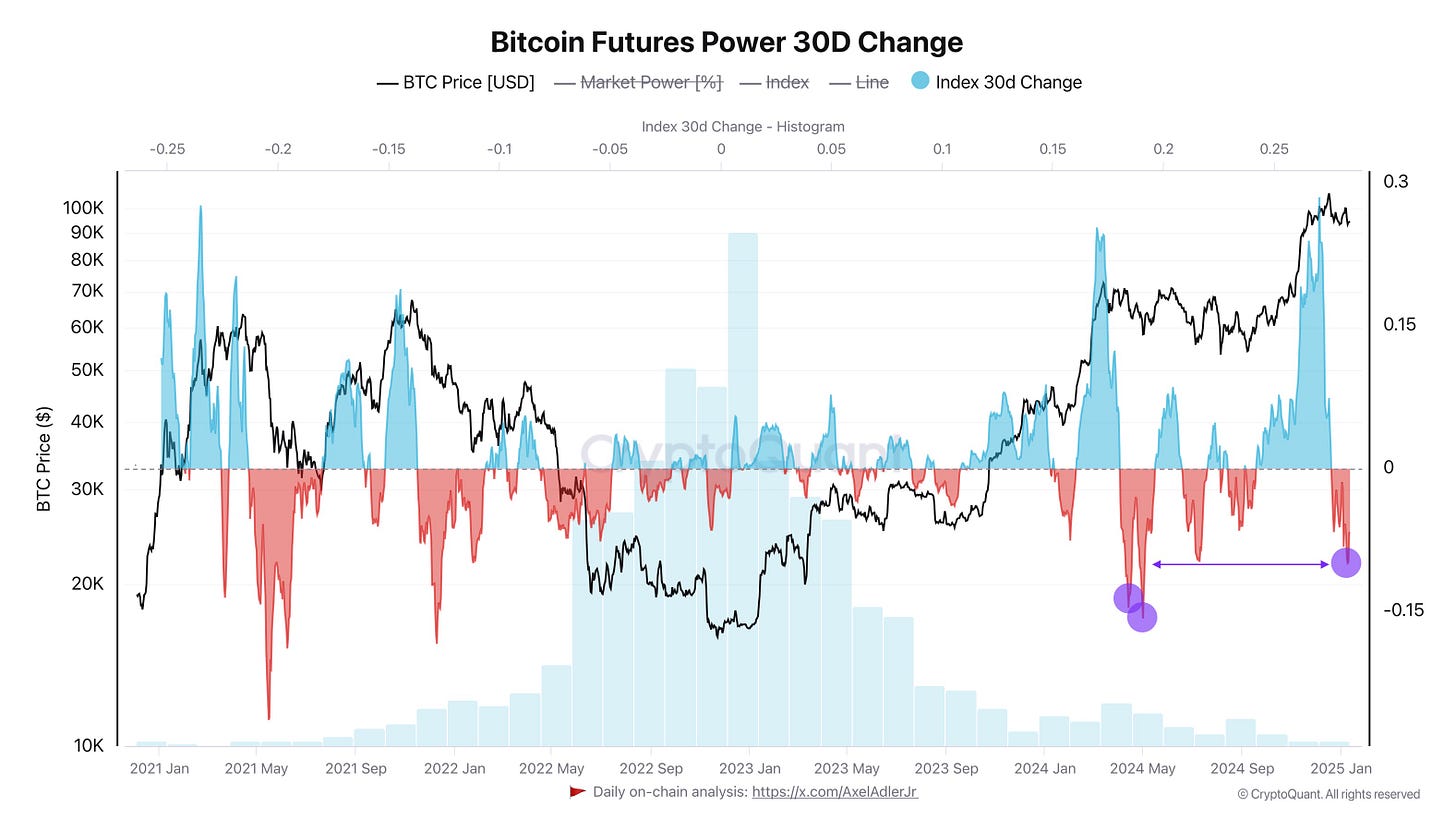

Bitcoin Futures Power 30D Change

Since December 20, the red zone on the chart indicates that the futures market is under bearish pressure. Sellers are actively driving down prices, amplified by negative news. The last similar situation with negative "Futures Power" was observed in late April 2024, which was followed by a short-term price dip and subsequent recovery. Given the current pressure, the market could test key support at $90K. If selling volumes continue to rise, a temporary break of the support level to $87K is possible, though this is unlikely to trigger a significant trend reversal.

Conclusion: The upcoming week is likely to be neutral-to-negative, with potential testing of the $90K level. However, long-term trends remain stable.

When to Buy Bitcoin?

The realized price for short-term holders (STH) is currently at $86.9K. This is the average price at which short-term holders acquired BTC. Buying near the realized price (or below), especially when the STH MVRV falls below 1.0, represents a favorable entry point in a bull market. In other words, when STHs are at a loss, it may be an opportune time to buy.

Conclusions

Over the past week, the Bitcoin market showed modest growth at the start, followed by a correction driven by strong U.S. economic data, which heightened inflation concerns and influenced Fed monetary policy expectations. Key factors included news of potential large Bitcoin sales by the U.S. government and continued spot market buying activity. Despite the negative news, significant outflows from exchanges indicate ongoing demand for Bitcoin.

In the short term, the market may test levels around $90K–$87K. However, the current cycle appears robust, and long-term trends remain bullish. Investors might consider entry points where short-term holders are at a loss, i.e., near the realized price of approximately $86–87K.

Good luck in the upcoming trading week!

AAJ

Nice review!

The new On-chain GOAT <3