Insight #29

Bitcoin pullback: STH accumulating, exchange activity declining, MicroStrategy buying— what’s next for the price?

Macroeconomics

1. U.S. 10-Year Treasury Yield Drops to 4.5%

Key Takeaway: The yield has fallen to a six-week low, reflecting market expectations of further Fed rate cuts.

Why It Matters: Lower government bond yields often indicate that alternative assets, including riskier instruments like Bitcoin, become more attractive to investors seeking higher returns.

Potential Impact on Bitcoin: A decline in yields could lead to capital shifting toward risk assets, including cryptocurrencies, potentially supporting Bitcoin's growth.

2. Inflation Data (PCE Price Index)

Key Takeaway:

- The overall PCE index rose in December, aligning with analyst forecasts.

- Core inflation (excluding volatile components like food and energy) also increased, staying within expectations.

- Notably, energy prices saw a sharp increase (+2.7%).

Why It Matters: Rising inflation, even if in line with expectations, reinforces the outlook for monetary policy easing (e.g., rate cuts), which could reduce the appeal of traditional assets.

Potential Impact on Bitcoin: If inflation is perceived as a signal for future Fed easing, this could positively impact Bitcoin as investors turn to assets seen as hedges against inflation or alternatives to traditional investments.

3. U.S. GDP Growth for Q4

Key Takeaway: U.S. GDP grew by 2.3% year-over-year, slightly below the consensus forecast but in line with expectations given high import levels.

Why It Matters: A slightly slower GDP growth rate could create uncertainty about economic activity, potentially increasing the appeal of alternative assets, especially if traditional markets become less attractive.

Potential Impact on Bitcoin: If economic growth slows and is perceived as a sign of potential challenges, investors may seek refuge in assets not directly tied to traditional financial markets, which could boost Bitcoin demand.

Conclusion: How Could This Affect Bitcoin?

Growth Catalysts:

- Falling Treasury yields and expectations of further Fed rate cuts create a favorable environment for risk assets, including Bitcoin.

- Inflation levels in line with forecasts support expectations of monetary policy easing, which could drive capital into the crypto market.

Potential Uncertainties:

- A slight slowdown in GDP growth could add uncertainty to the broader economic outlook. However, for risk-oriented investors, this may serve as a reason to diversify into assets that are less dependent on traditional financial indicators.

Overall Outlook: Given these factors, the macroeconomic landscape signals easing monetary policy and declining returns on traditional assets, which may push investors toward alternative assets like Bitcoin. In the short to medium term, this could lead to increased interest in Bitcoin as a risk asset and an inflation hedge, potentially supporting its price.

Key News from the Past Week

1. Government and Institutional Initiatives

These developments reflect regulatory trends, government support, and new financial products that could significantly impact the crypto market.

Strategic Forecasts & Assessments:

- Standard Chartered: Bitcoin forecasted to reach $130K by March, driven by institutional inflows and macroeconomic stability.

- Czech National Bank: Considering adding Bitcoin to reserves (up to 5% of its $146 billion reserves).

Institutional-Level Launches & Initiatives:

- CME Group: Launch of Bitcoin Friday options (daily expirations) and expanded access to crypto futures through Robinhood.

U.S. State-Level Bitcoin Initiatives:

- Texas Lt. Governor Dan Patrick proposed a state Bitcoin reserve for 2025.

- Nearly one-third of U.S. states are working on Bitcoin reserve funds (Arizona and Utah already approved).

Regulatory & Political Measures:

- Crypto.com: Delisting of USDT and nine other tokens in Europe in compliance with MiCA, with a conversion deadline of March 31.

- Trump Executive Orders: Pro-crypto stance led to a surge in global crypto fund inflows ($1.9 billion, with $1.7 billion from U.S. funds).

Regulatory Statements:

- Fed Chair Jerome Powell: Banks can serve crypto clients with proper risk management.

- ECB President: Bitcoin will not be included in EU central bank reserves due to reserve requirements.

2. Major Corporate Transactions and Investments

Priority: Medium

These reports highlight major players actively accumulating and managing Bitcoin, as well as financial performance indicators of leading firms, showcasing sector resilience and growth.

MicroStrategy:

- Raised $563.4 million from preferred stock sales to buy more Bitcoin.

- Purchased 10,107 BTC for $1.1 billion, increasing its total holdings to 471,107 BTC (worth $46 billion, or over 2.2% of supply).

Government & Institutional Investors:

- Norwegian Sovereign Wealth Fund: Indirectly holds $356.7 million worth of Bitcoin (up 153% YoY, via stakes in MicroStrategy, Coinbase, and Metaplanet).

Key Corporate Metrics:

- Tether: Reported $13 billion in profits for 2024, with $113 billion invested in U.S. Treasuries.

3. Market Dynamics and Investor Activity

Priority: Moderate

These updates highlight changes in retail and institutional investor behavior, ETF fund flows, and rising user engagement, potentially signaling further market expansion.

Investor Activity:

- The number of Bitcoin wallets with over $100 is nearing 30 million, up 25% YoY, driven by institutional adoption and ETF-related optimism.

Fund Flows:

- The total net asset value of U.S. spot Bitcoin ETFs reached $123 billion after a seven-day inflow streak, with cumulative inflows totaling $40 billion.

Macro Analysis of Bitcoin's Trading Week

Sharp BTC Drop: Bitcoin fell from a local high of $106.4K to its current level of $99.5K. The primary trigger – the introduction of trade tariffs:

- Mexico/Canada – 25%

- China – 10%

This has heightened concerns over global trade and led to a short-term decline in risk assets.

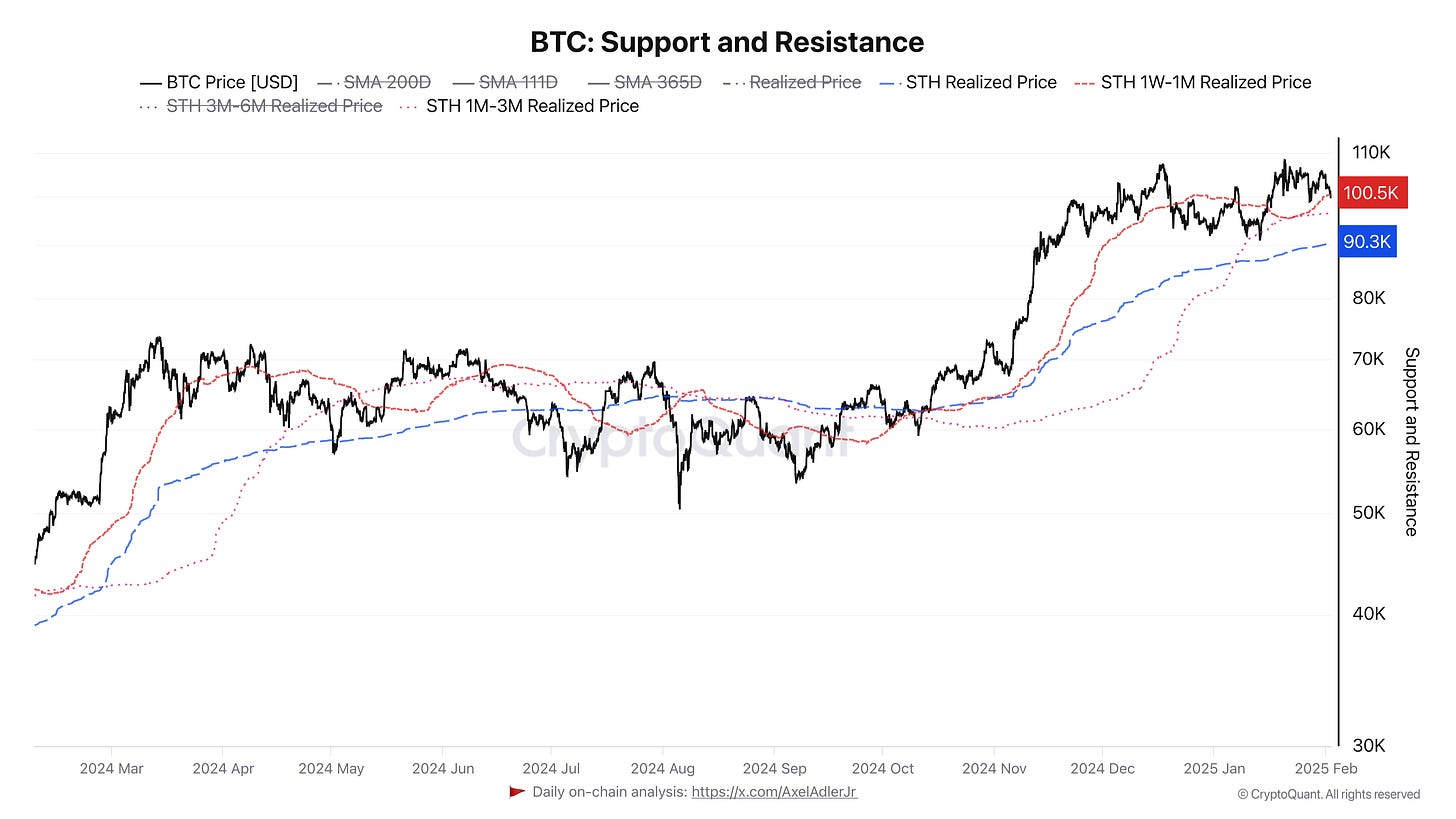

Key Support and Resistance Levels

The global support level is currently STH Realized Price ($90.3K). A breakdown of this level could intensify downward pressure, potentially leading to a test of the previous low at $89.2K, especially if bearish pressure increases.

The key resistance level is at STH 1W-1M Realized Price ($100.5K). A breakout above this level could open the path for a retest of previous highs in the $106K zone.

ETF Factor and Long-Term Holders

The key question: Will institutional and retail investors use this correction as an opportunity to accumulate?

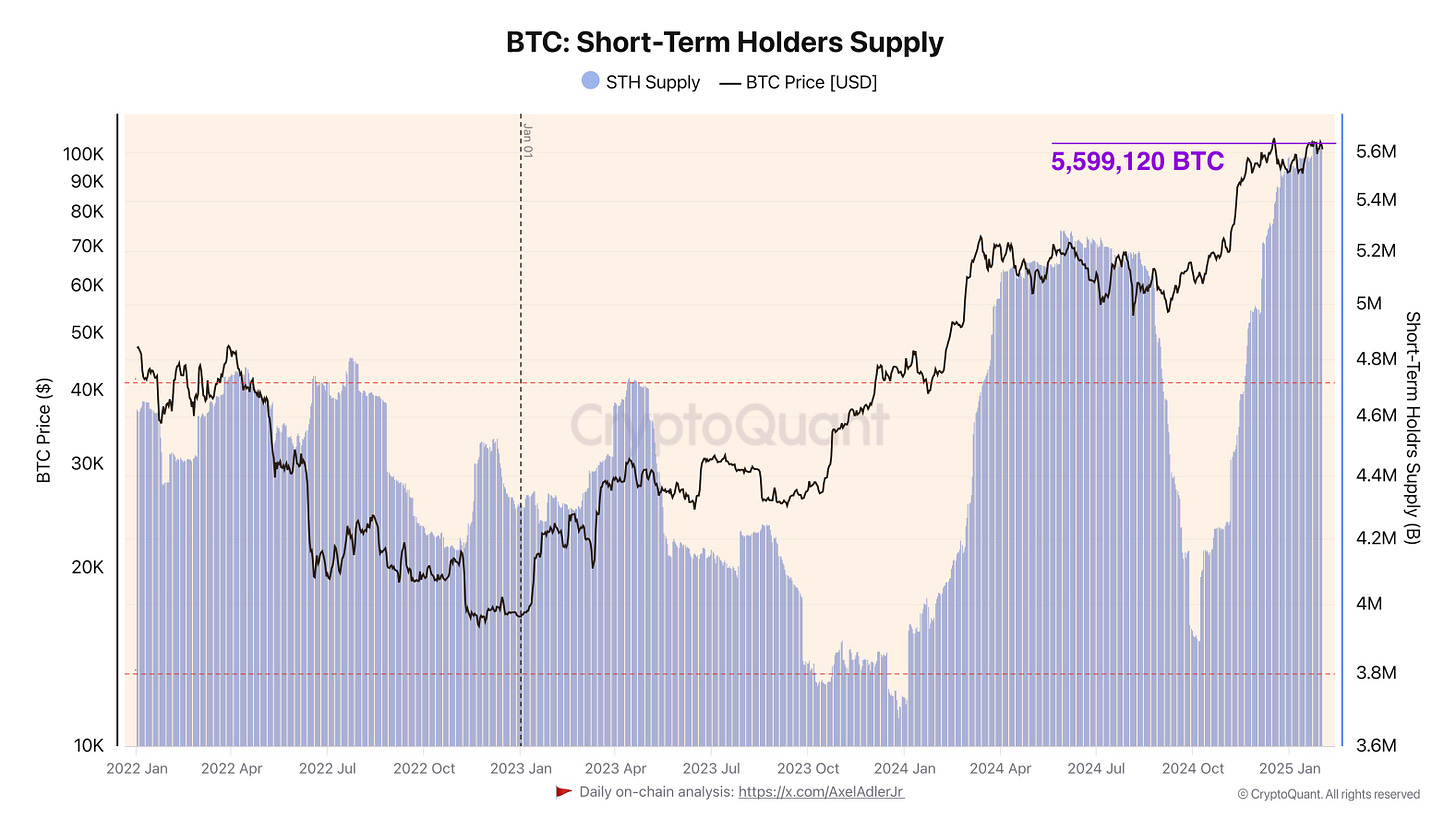

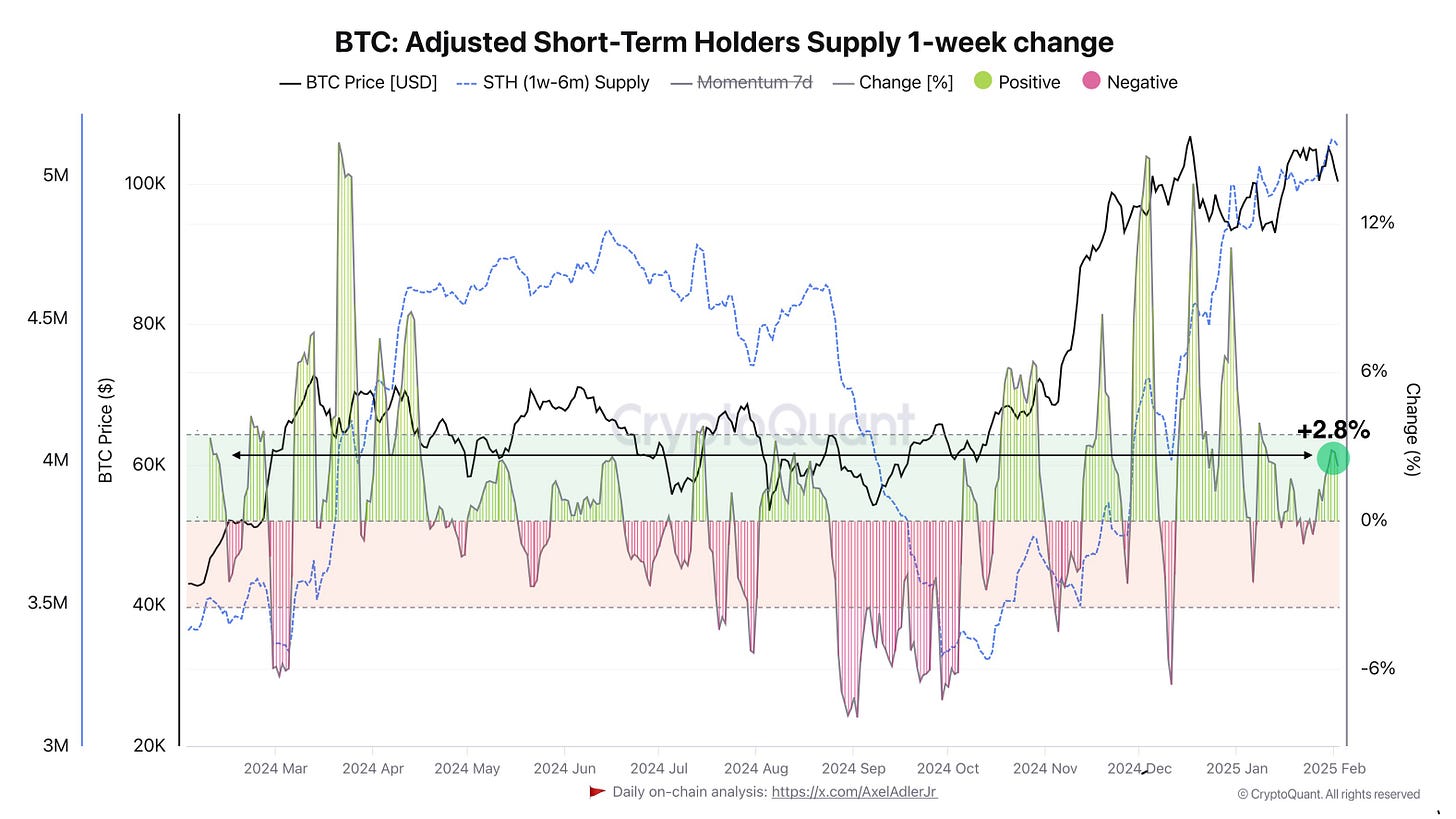

Bitcoin: Short-Term Holders Supply and Price

According to Bitcoin Short-Term Holders Supply, the total BTC accumulation by short-term holders over the past 24 hours amounted to 25,521 BTC, equivalent to $2.5B at an exchange rate of $100K per Bitcoin.

The Adjusted Short-Term Holders Supply 1-week change chart (which excludes short-term speculators holding coins for less than a week) shows that over the past week, adjusted STH supply increased by +2.8%. The introduction of trade tariffs in the U.S. has influenced the local macro trend, adjusting market dynamics.

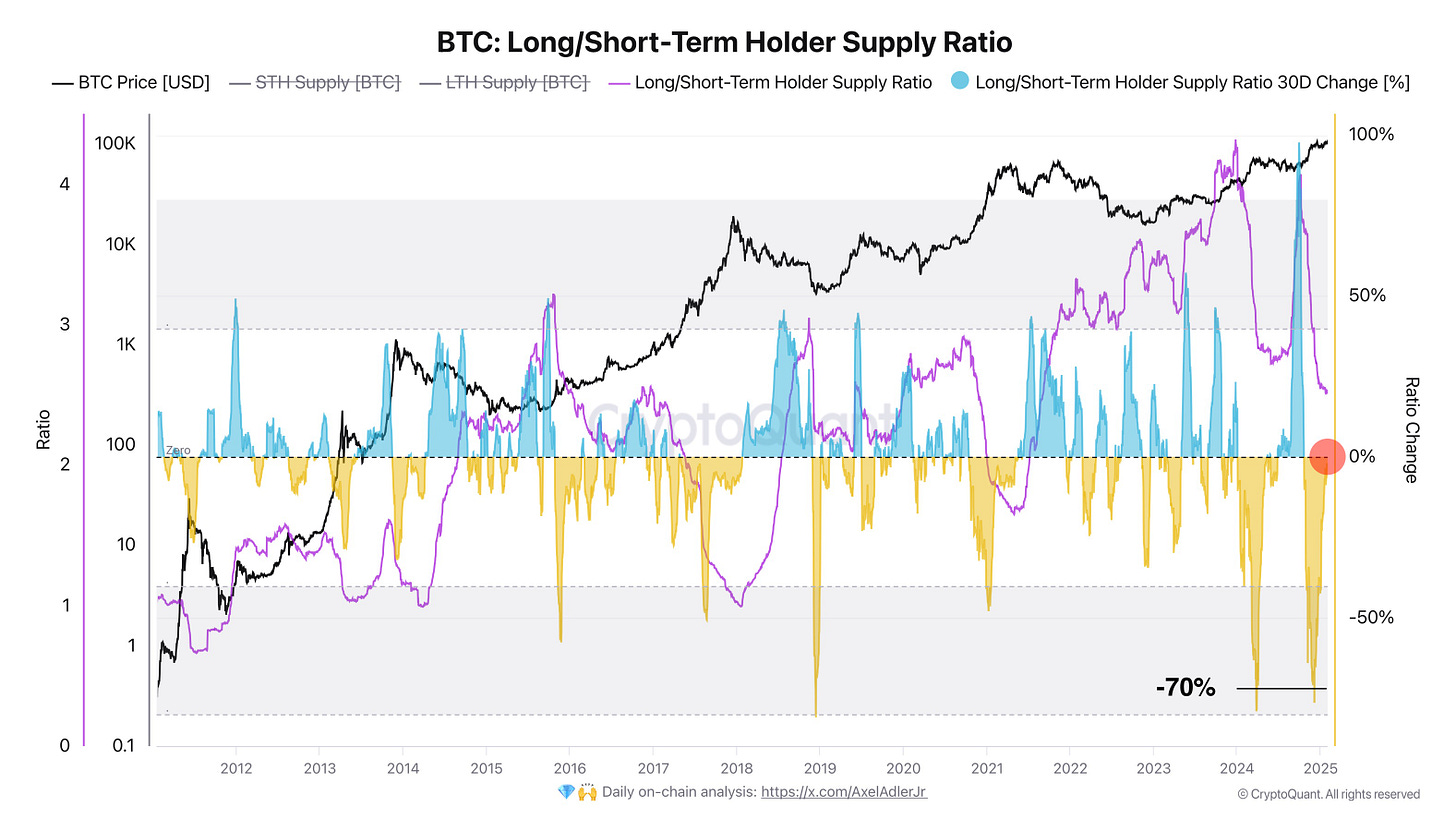

Bitcoin: Long/Short-Term Holder Supply Ratio

The current Long/Short-Term Holder Supply Ratio 30-day Change remains at zero, indicating no significant redistribution of BTC between Short-Term Holders (STH) and Long-Term Holders (LTH) in recent weeks. In other words, the balance between short-term and long-term holders has remained stable.

This suggests that the market is searching for direction: while STH continue to increase their holdings and LTH maintain their positions, near-zero changes in this ratio have historically preceded transition phases. Let’s analyze the next chart to examine potential market impulses.

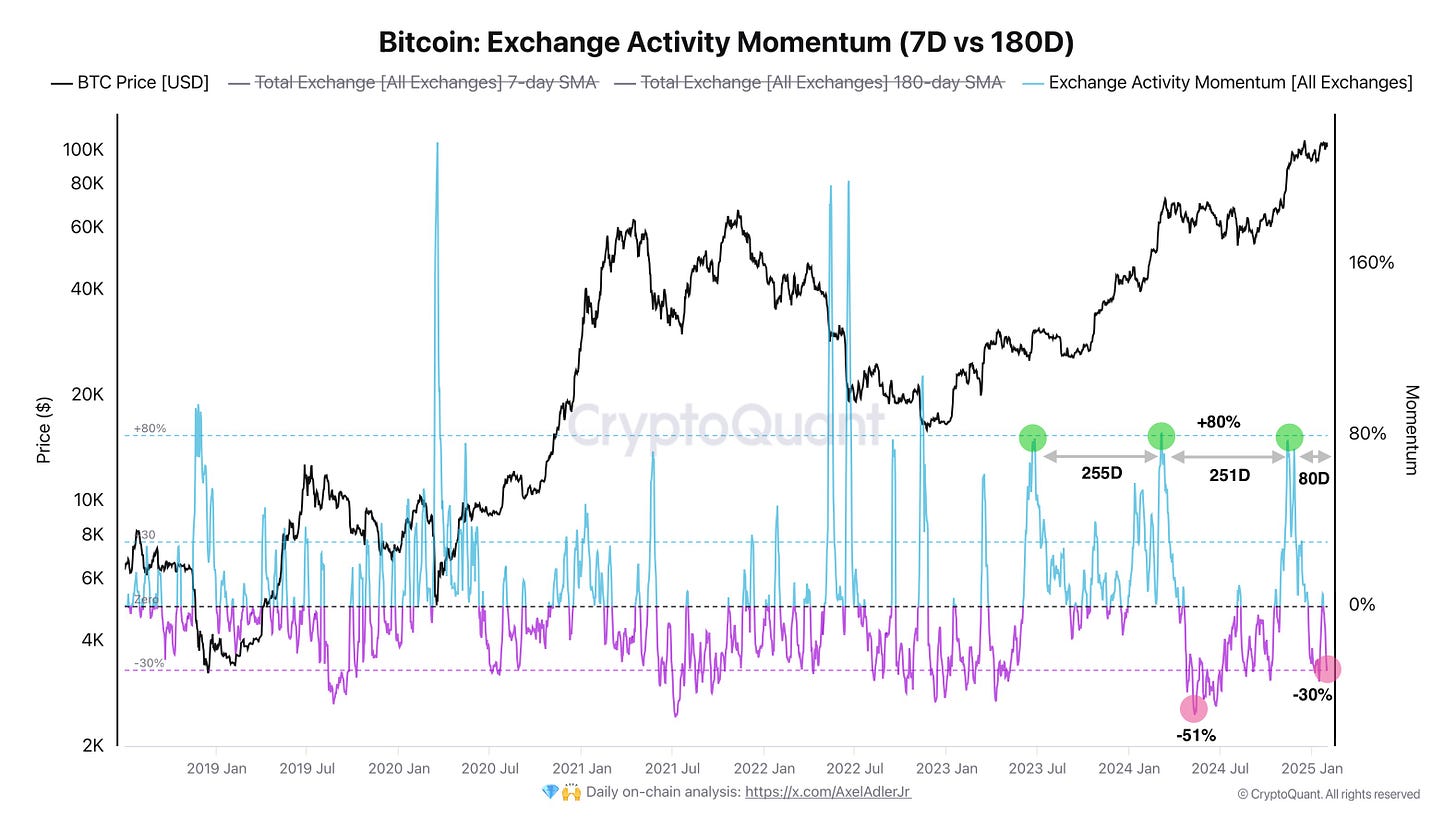

Bitcoin: Exchange Activity Momentum (7D vs. 180D)

1. Cyclical Momentum Patterns

The chart reveals periodic shifts between phases of rising and declining exchange activity, occurring approximately every 250 days between peaks (e.g., spikes in June 2023, March 2024, and November 2024). These phases coincided with significant BTC price surges.

2. Indicator Readings

- When momentum increases to +80%, the market typically enters an overheated price phase.

- When momentum declines to -30% or lower, cooling-off or correction phases are observed. These downturns (especially below -30%) have often led to consolidation or significant pullbacks.

3. Current Market Condition (February 2025)

- Momentum has dropped to a critical level (-30%), a level that has previously preceded correction and consolidation periods.

- Meanwhile, BTC price remains high at around $100K without strong pullbacks.

If the indicator recovers above zero, it could signal the beginning of another bullish impulse. However, if exchange activity reaches the upper threshold (+80%), the probability of another correction phase increases.

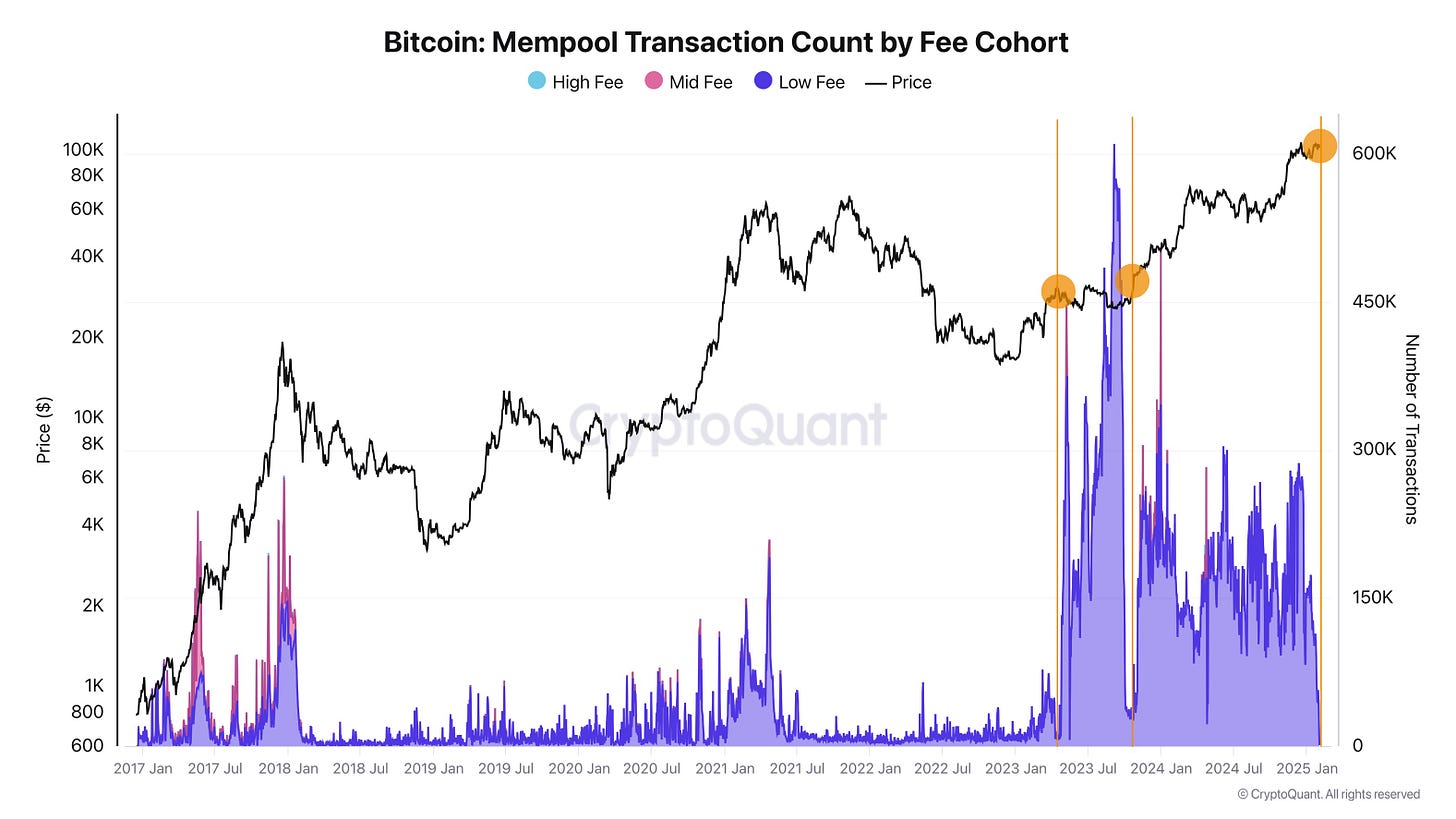

Bitcoin: Mempool Transaction Count by Fee Cohort

This chart was created by Julian, Head of Research at CryptoQuant.

Another key aspect of the current consolidation phase is a temporary decline in on-chain activity within the Bitcoin mempool. During bull trends, low mempool activity and transaction fees have been observed before—sometimes preceding corrections, but other times leading to price surges.

Essentially, low short-term activity suggests that most holders are not moving their coins. One possible scenario is that this "quiet period" is setting the stage for an upcoming spike in activity, similar to what occurred in October 2023.

A bearish scenario would unfold if the mempool does not recover soon. In this case, market focus may shift toward the derivatives market, meaning price movement would be driven more by speculative positions than actual demand-an inherently risky situation.

Weekly Poll

Trading Week Summary

This trading week was characterized by a contrast between favorable macroeconomic signals and short-term volatility in the crypto market.

- The decline in U.S. 10-year Treasury yields to a six-week low reflects a shift in investor sentiment away from traditional assets toward riskier instruments like Bitcoin.

- At the same time, inflation expectations were confirmed, and moderate U.S. GDP growth created a mixed outlook. While expectations of monetary easing could drive capital into alternative assets, economic growth concerns remain.

Crypto Market Overview

Bitcoin saw a significant correction, driven by new trade tariffs and increased short-term pressure. However:

- Institutional players continue to accumulate BTC, signaling long-term confidence.

- On-chain indicators suggest a consolidation phase, with STH steadily increasing their holdings.

Q1 2025 Forecast

My forecast for Q1 2025 remains unchanged at $130K per Bitcoin.

Good luck in the upcoming trading week!

AAJ

🤝