Insight #15

We cover Microsoft’s potential Bitcoin investment, its impact on institutional interest, and analyze STH/LTH NAV Premiums. Plus, BTC price trends with key support/resistance levels.

Key Events of the Past Week:

Microsoft shareholders will vote in December on a proposal to invest 1% in Bitcoin. The board opposes it, citing volatility, while NCPPR claims it serves as an inflation hedge.

Tether's CEO stated there are "no signs" of a U.S. investigation, dismissing reports of potential sanctions and anti-money laundering probes.

MicroStrategy shares hit a 25-year high, and I believe it’s "extremely unlikely" the company will need to sell its Bitcoin despite its debt structure. I tweeted more about this on X.

A bill protecting Bitcoin holders’ self-custody rights and authorizing BTC as a payment method was passed in Pennsylvania.

The SEC has listed crypto as a priority for 2025 inspections, focusing on Bitcoin and Ethereum exchange-traded products and blockchain-related risks.

Optimism over a potential Republican win drove $2.2B into crypto products, with $2.13B flowing into Bitcoin.

Stripe acquired the stablecoin platform Bridge for $1.1B, marking the largest crypto acquisition in history and expanding Stripe’s crypto utility.

Tether's market cap in USDT hit a record $120B, signaling potential growth for Bitcoin and Ether as stablecoin inflows indicate buying pressure.

Let’s discuss the week’s main story: Microsoft voting on adding Bitcoin to its balance sheet.

The National Center for Public Policy Research (NCPPR) proposed that Microsoft evaluate Bitcoin as an inflation hedge to protect its assets, given U.S. inflation and risks with traditional bonds.

Bitcoin's advantages over corporate bonds underscore its potential as an inflation-resistant asset.

With institutional investors like BlackRock, State Street, and Fidelity supporting Bitcoin, and only a simple majority needed to pass the proposal, strong shareholder backing could push it through during the vote on December 10. This marks a shift in traditional treasury strategies, where corporations need not only to generate profits but to maintain the purchasing power of those profits. Looking at Bitcoin, with its four-year CAGR never dropping below 25%, this inflation hedge strategy provides a competitive edge despite BTC’s volatility. In essence, investing in Bitcoin and HODLing for four years yields a positive profit. It shows Bitcoin’s resilience as a value-preserving asset, especially when traditional assets falter.

Comparing U.S. inflation: The average rate over the last four years was 5.03%, peaking at 9.1% in June 2022, the highest in 40 years. Actual inflation may far exceed reported levels, implying traditional assets like U.S. treasuries and corporate bonds may fail to keep pace, potentially eroding Microsoft’s asset value.

As the Fed lowers rates, eventually dropping below inflation to ease the federal government's real debt burden, treasuries are unlikely to be effective inflation hedges. Without diversifying into Bitcoin, Microsoft's balance sheet remains vulnerable during both rate hikes and cuts.

Given Bitcoin’s historical outperformance over bonds, allocating even 1% of Microsoft's assets to Bitcoin could provide inflation protection without sacrificing liquidity. Essentially, if Microsoft allocates 1% of its $484B assets, that equates to $4.84B. Microsoft could purchase around 71,000 Bitcoins at the current price.

A successful case can be seen in MicroStrategy, which added Bitcoin to its balance sheet 4 years ago, and its stock outperformed Microsoft by 313% this year.

Now, let’s delve deeper into corporate finance.

The largest institutional investors in Microsoft are Vanguard with 9.09%, BlackRock with 7.82%, State Street with 4.04%, Capital Group with 3.14%, Fidelity with 2.91%, and Geode Capital Management with 2.18%. Vanguard opposes Bitcoin and doesn’t offer a Bitcoin ETF, whereas BlackRock, State Street, Fidelity, and Geode offer or hold Bitcoin and/or ETFs in various forms. Additionally, Capital Group is the largest institutional shareholder in MicroStrategy, holding 9.9% of the outstanding shares, so they are clearly interested in allocations to public companies with substantial Bitcoin holdings and are likely to vote "yes."

It's evident that institutional investors who earn brokerage commissions from buying ETFs and direct MicroStrategy shareholders who benefit from Bitcoin's growth share a dependency. The fact that this is happening within the corporate finance world shifts the paradigm of risk hedging.

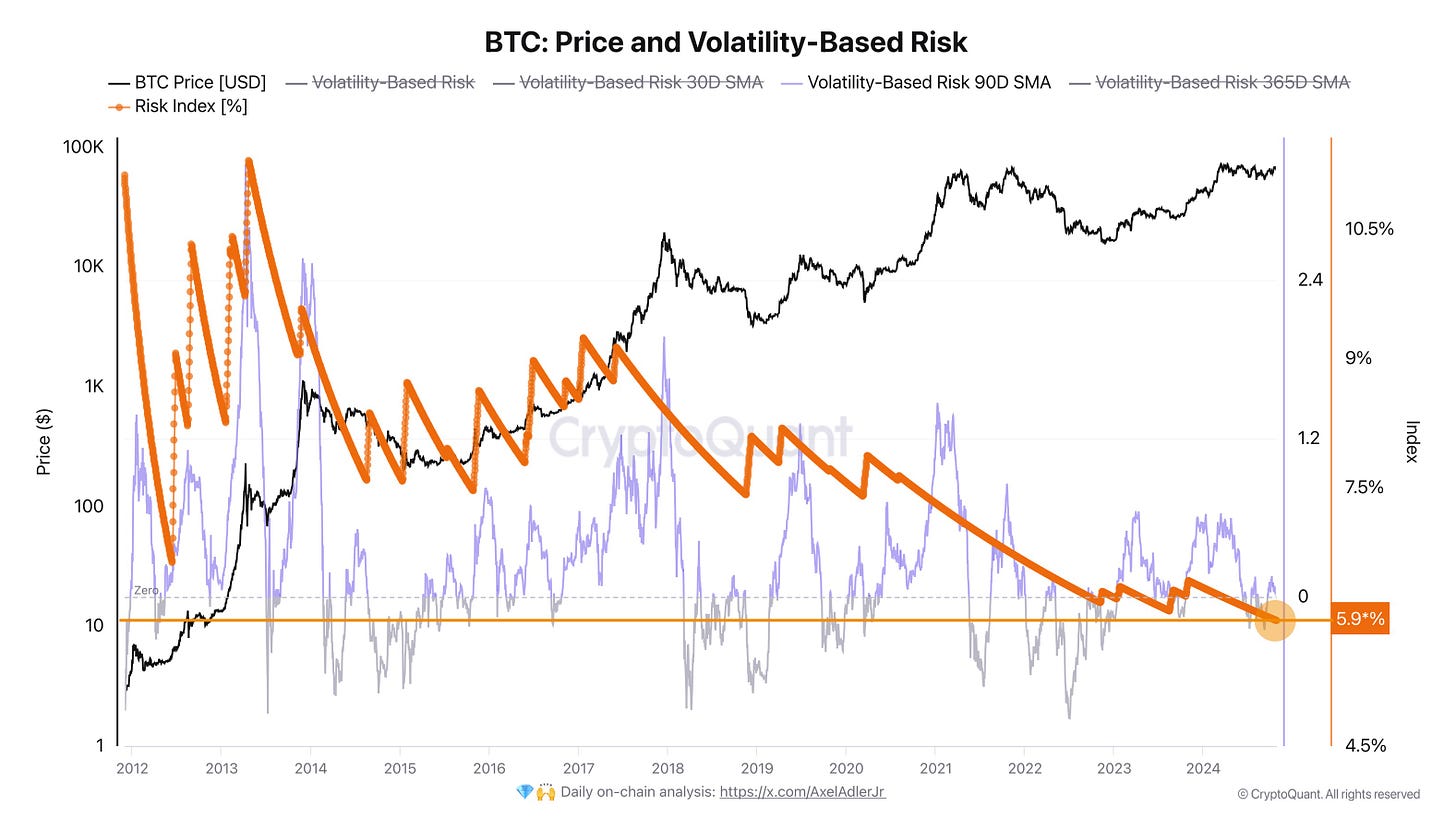

The graph shows how Bitcoin's volatility is declining, setting risk based on a dynamic volatility threshold. This trend could prompt major players to consider Bitcoin as a hedge against inflation and a source of additional profits, unlike risk-free bonds.

Approximately 20% of MSFT shareholders are highly likely to vote for Microsoft’s investment in Bitcoin. With a simple majority of 30% needed to pass, the proposal is likely to succeed. Should this happen, other major companies may adopt this strategy, further accelerating Bitcoin adoption and price growth, guaranteeing shareholders inflation protection and higher returns compared to traditional instruments.

This will be the second most important vote in Q4 this year, after the U.S. elections.

The original post on this topic was shared on X by Joe Consorti. I added my thoughts to provide a more unbiased view of what’s happening in the corporate finance sector and how it could affect the future of Bitcoin.

Weekly Wrap-Up

Earlier this week, Bitcoin reached a local high of $69,500, followed by a macro correction. The minimum was hit at $63,800, marking a short-term drop of over 8% from the peak. Subsequent recovery and consolidation around $67K could signal strengthening support at $65,500.

Bitcoin NAV Premium Analysis

This week, I’ve added two analytical models I wanted to share.

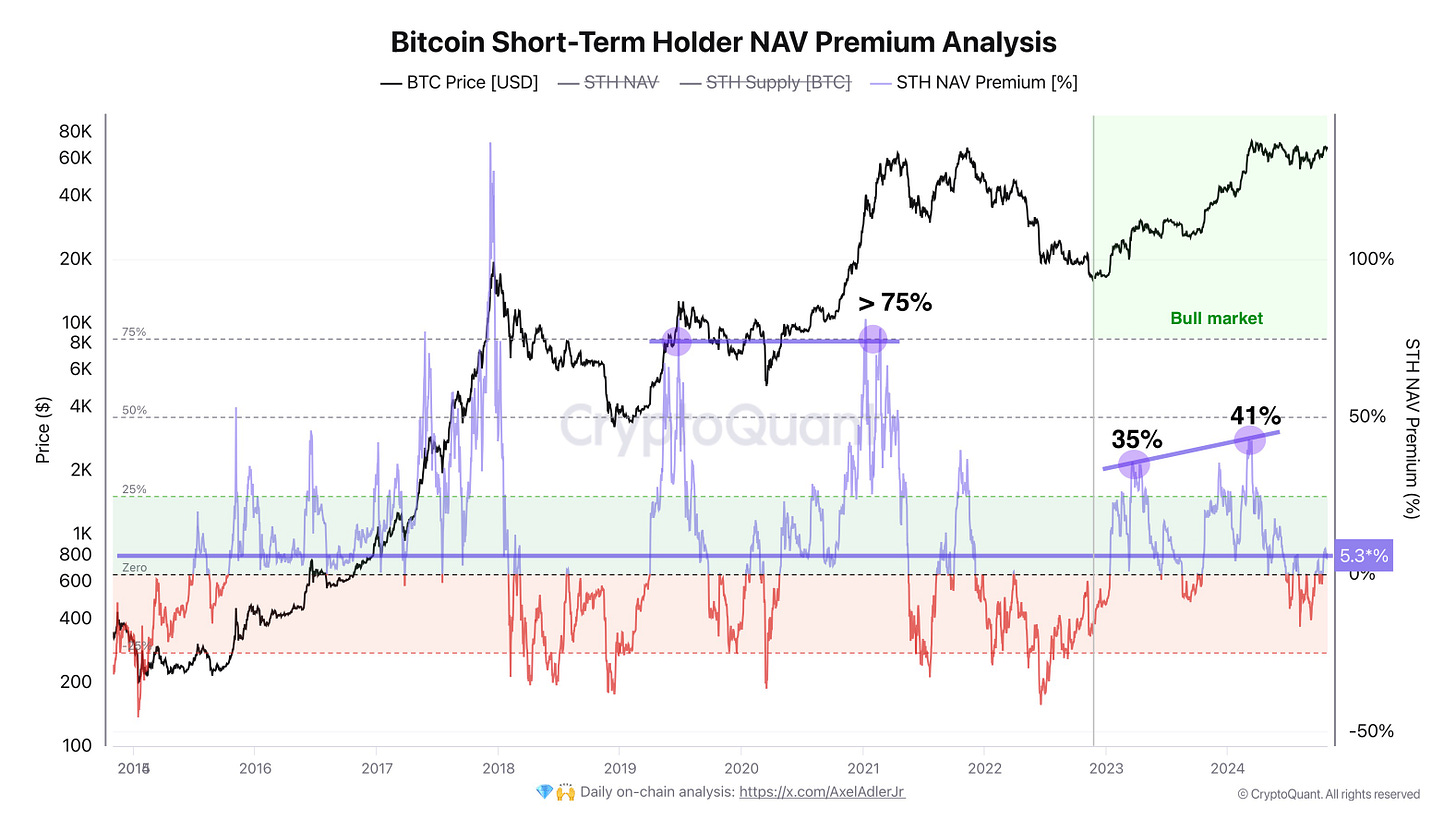

The graph shows the change in Short-Term Holder (STH) NAV Premium relative to Bitcoin's price (BTC). NAV Premium highlights the difference between the current market price of assets held by short-term holders and their realized value.

Current STH NAV Premium:

The current NAV premium for STH is 5.3%, indicating that the market value of BTC held by short-term holders slightly exceeds their realized value by 5.3%.

Historical Dynamics and Interpretation:

In the past, positive NAV premium values (green zone) often coincided with BTC price growth phases, where short-term holders kept their coins, anticipating further price increases. Conversely, negative premiums (red zone) indicated that STH were at a loss, typically occurring during bearish periods when BTC prices fell.

A 5.3% premium signals a modest positive return for short-term holders, suggesting local optimism. In this market cycle, pressure from STH intensified at a 35% and 41% premium, leading to corrections and the current consolidation phase.

However, the current premium is still far from the extreme levels of past bull cycles, where it exceeded 50-75%. This may indicate that the market is still in a preparatory phase for more significant moves. Essentially, the minimal premium suggests the current price is attractive, and we should not expect significant selling pressure from short-term holders at this moment.

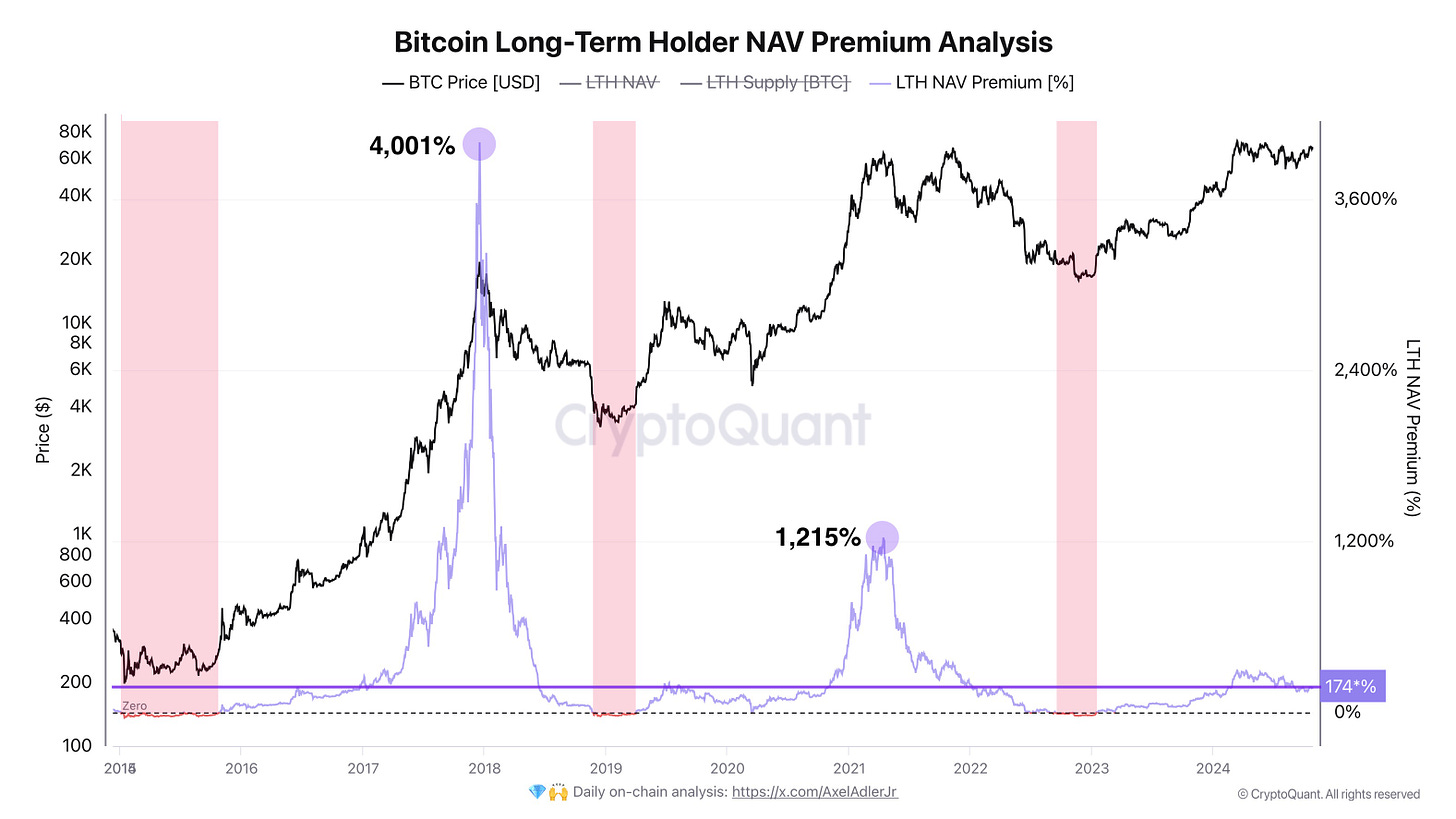

The second graph shows the change in Long-Term Holder (LTH) NAV Premium compared to BTC price. Again, the NAV premium reflects the difference between the current market price of assets held by long-term holders and their realized value.

Current Situation and Key Takeaways:

The current LTH NAV premium stands at 174%, indicating that BTC held by long-term holders trades significantly above their average realized value. Historically, extreme premium levels, such as 4001% in 2017 and 1215% in 2021, marked market cycle peaks. Significant premium declines after these levels were accompanied by market corrections, highlighting the connection between high LTH NAV premiums and overheating phases.

Currently, the 174% premium is far from historical peaks, which may indicate market stability and the continuation of a bullish phase. However, reaching a 300% premium could be an indicator of potential overheating, after which increased selling pressure from long-term holders and subsequent corrections may follow.

Weekly Analysis Summary:

News on Microsoft’s Potential Bitcoin Investment:

The most significant event was the announcement of Microsoft shareholders voting in December on a proposal to invest 1% of the company’s assets in Bitcoin. This decision could be a game-changer for the corporate world, given the involvement of major institutional players like BlackRock, State Street, and Fidelity, who actively support Bitcoin.

If the proposal is approved, Microsoft could acquire around 71,000 BTC, not only solidifying Bitcoin’s position as an inflation hedge but also triggering a chain reaction among other major corporations that may follow suit. This could become a new driver for BTC price growth and institutional recognition.

NCPPR’s stance that Bitcoin can protect assets from inflation better than traditional bonds confirms a global shift in the perception of cryptocurrencies as a store of value.

STH NAV Premium Analysis:

The current 5.3% premium reflects a modest positive return for short-term holders, suggesting local optimism. The lack of significant selling pressure indicates possible continued consolidation and preparation for the next growth phase.

Historically, surges above 35% and 41% led to corrections, so keeping a close eye on the premium level is essential. The current moderate level suggests stable price movements.

LTH NAV Premium Analysis:

The 174% premium for long-term holders indicates stability and confidence among investors, supporting a bullish scenario.

A 300% premium level could indicate possible overheating, and if this indicator rises, we should expect increased selling pressure. Overall, current premium values indicate favorable conditions for the continuation of a bullish phase.

Macro BTC Market Situation:

Throughout the week, BTC reached a local high of $69,500, followed by a correction to $63,800. The current price around $67,100 and consolidation near $65,500 suggest possible strengthening of support. A breakout above $67,400 could revive the bullish macro trend.

The Bitcoin market continues to show resilience and optimism among different groups of holders, from short-term to long-term investors. News of Microsoft’s potential investment in BTC could be a pivotal moment, increasing interest in cryptocurrencies at the corporate level and initiating a new stage of institutional adoption.

Good luck in the upcoming trading week!

AAJ

Great insights.

Question: as you describe the different cohorts and their premium to NAV, MVRV kept coming to mind. What, if any, difference are there between NAV Premiums and MVRV?

Thank you.

Thanks, Axel, for this analysis, and particularly the relevant institutional holdings. In your estimation, how important to the November-December BTC price evolution is the election outcome compared to the MSFT vote? If, for example, Trump lost, might that trigger significant selling before we get to the December corporate vote??