Insight #21

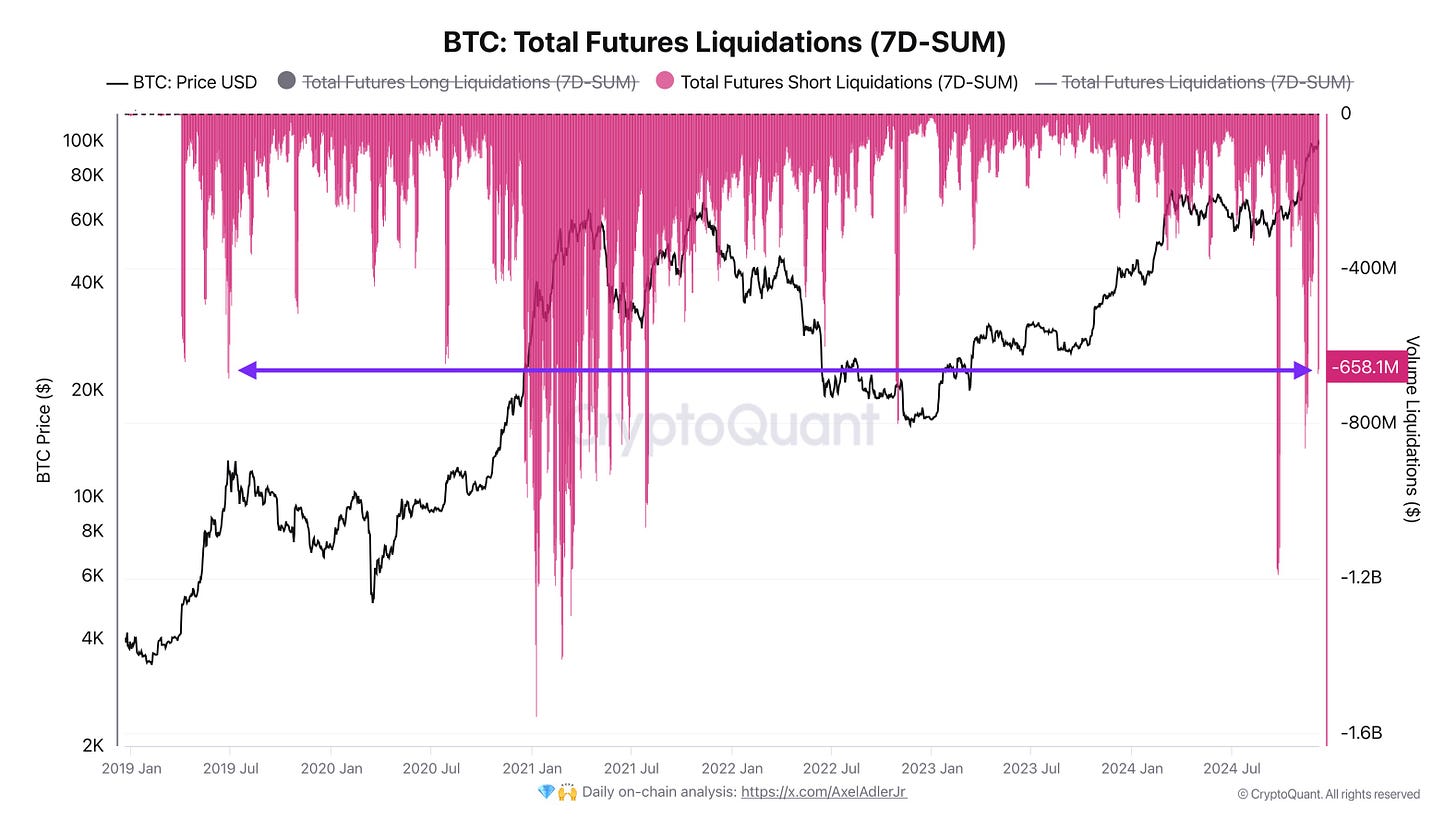

This week, Bitcoin set a new ATH at $104K, but euphoria quickly gave way to tension on the futures market, overloaded with high-leverage long positions. What will drive growth next week?

Key Events of the Past Week

The U.S. President-elect, Donald Trump, officially nominated Paul Atkins as the Chairman of the Securities and Exchange Commission (SEC). Atkins, known for his pro-crypto stance and support of financial sector innovation, previously served as an SEC commissioner from 2002 to 2008. His nomination signals a potential softening of regulatory policy toward digital assets. However, Atkins must still undergo confirmation by the Senate.

Fed Chair Jerome Powell compared Bitcoin to digital gold, emphasizing its volatility and speculative nature, stating, “It’s not a competitor to the dollar but a competitor to gold.”

El Salvador’s President Nayib Bukele presented data on the country’s national Bitcoin portfolio:

- Total balance: $603,340,991

- Unrealized profit: $333,597,190 (+123.67%)

- Total investment: $269,743,800

This marks the first instance in history where Bitcoin holdings directly led to an increase in El Salvador’s sovereign bond value on traditional financial markets. The results demonstrate the success of integrating Bitcoin into the country’s economy, strengthening state assets and boosting global investor confidence. This precedent may serve as a model for other nations considering Bitcoin as a tool to fortify their economies and financial resilience.

MicroStrategy, led by Michael Saylor, purchased Bitcoin worth $1.5 billion, adding 15,400 BTC at $95,976 each, increasing their total holdings to 402,000 BTC, valued at $23.4 billion.

MicroStrategy’s $23 billion investment since 2020 has generated $17 billion in unrealized profit, with their Bitcoin now valued at over $40 billion.

Additionally, Michael Saylor urges Microsoft to adopt Bitcoin on its balance sheet, claiming it could add $584 per share and increase enterprise value by $4.9 trillion by 2034. The shareholder vote will take place live on December 10, 2024, at 8:30 AM PT. I discussed the importance of this event in Insight #15.

BlackRock, MARA Holdings, and major players acquired nearly 10K BTC as the price dropped to $92K. Market panic followed South Korea’s president’s announcement of martial law. However, lawmakers swiftly convened in the National Assembly and unanimously passed a resolution to repeal it. As a result, the Bitcoin Korea Premium Index hit a historic low.

Bitcoin, while sensitive to global political events, generally recovers quickly, as demonstrated this week.

Weekly Highlights

Bitcoin surpassed the $100K psychological level this week, establishing a new ATH at $104K. The Korean crisis triggered a wave of long-position liquidations on the futures market. Total liquidation volume reached $668M, exceeding the monthly average by 36.2%. Support at $90K remains strong, with players actively buying the dip and reopening long positions, pushing the price back to $100K.

The formation of a $90K–$104K range signals potential price consolidation in the short term. Volatility within 15% remains typical for Bitcoin. My bullish outlook remains intact, with the Microsoft board vote next week serving as a potential growth driver and signal for institutional investors.

---

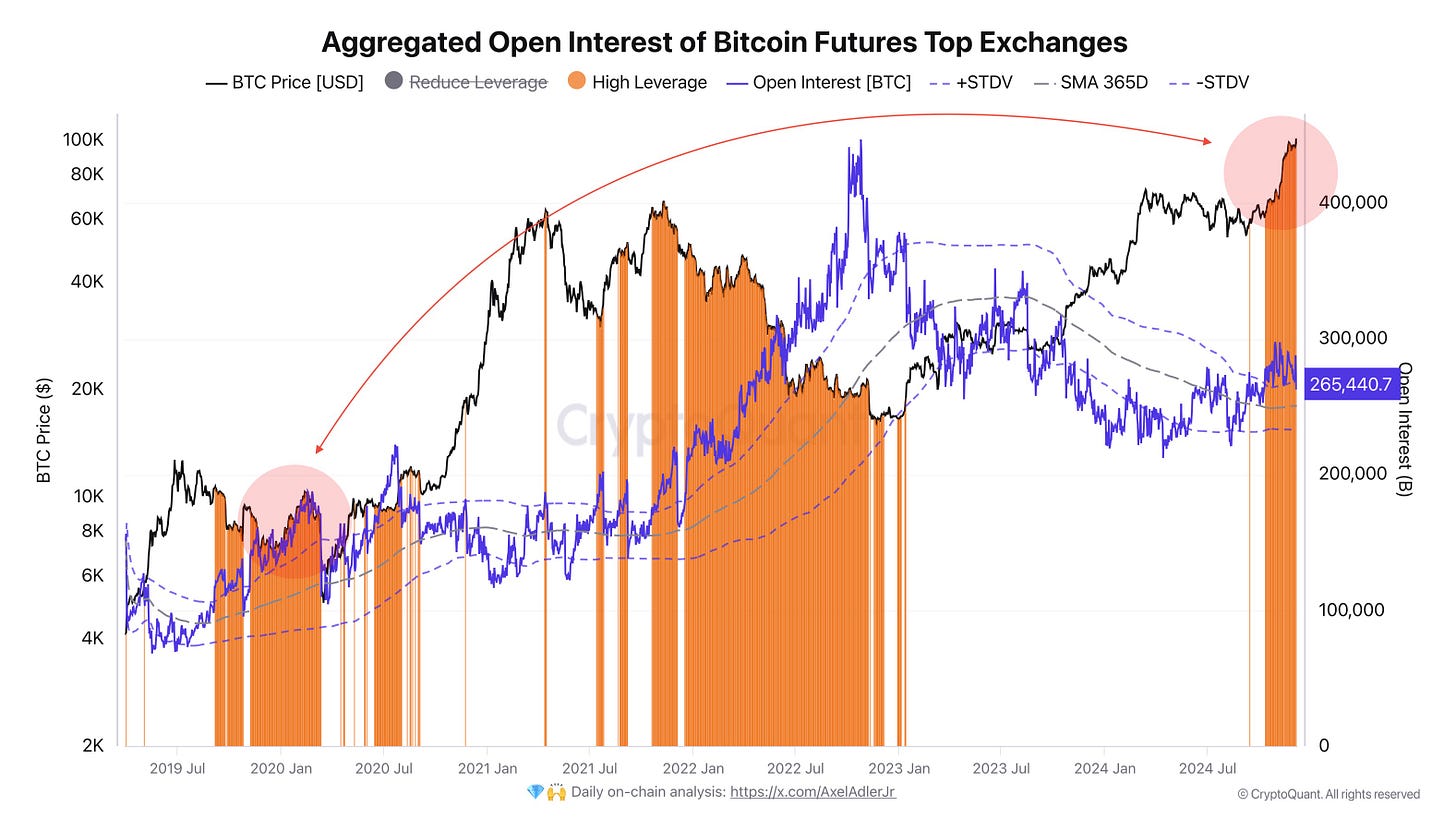

Aggregated Open Interest of Bitcoin Futures Top Exchanges

Starting from October 12, when Bitcoin’s price was at $62K, open interest on the futures market surged significantly. Current levels exceed the yearly average by +1 standard deviation (STDDEV), highlighting market overload. Historically, similar spikes—such as in January 2020—preceded strong bull rallies, though events like the COVID crisis disrupted momentum.

The unusual factor here is that positions are increasing during a bull market, not during corrections when shorts typically accumulate. This imbalance increases liquidation risk, as we saw earlier this week with price declines.

Bitcoin Futures Perpetual Funding Rate (7D-SMA)

The current average Funding Rate across three top exchanges is 0.023%, indicating a dominance of long positions. Historically, spikes in Funding Rate (marked by purple points) often preceded local corrections due to market overleveraging.

For example, similar trends occurred at $50K in 2021 and $60K in early 2024, when holding long positions became costly, leaving the market vulnerable to liquidations triggered by even minor price drops.

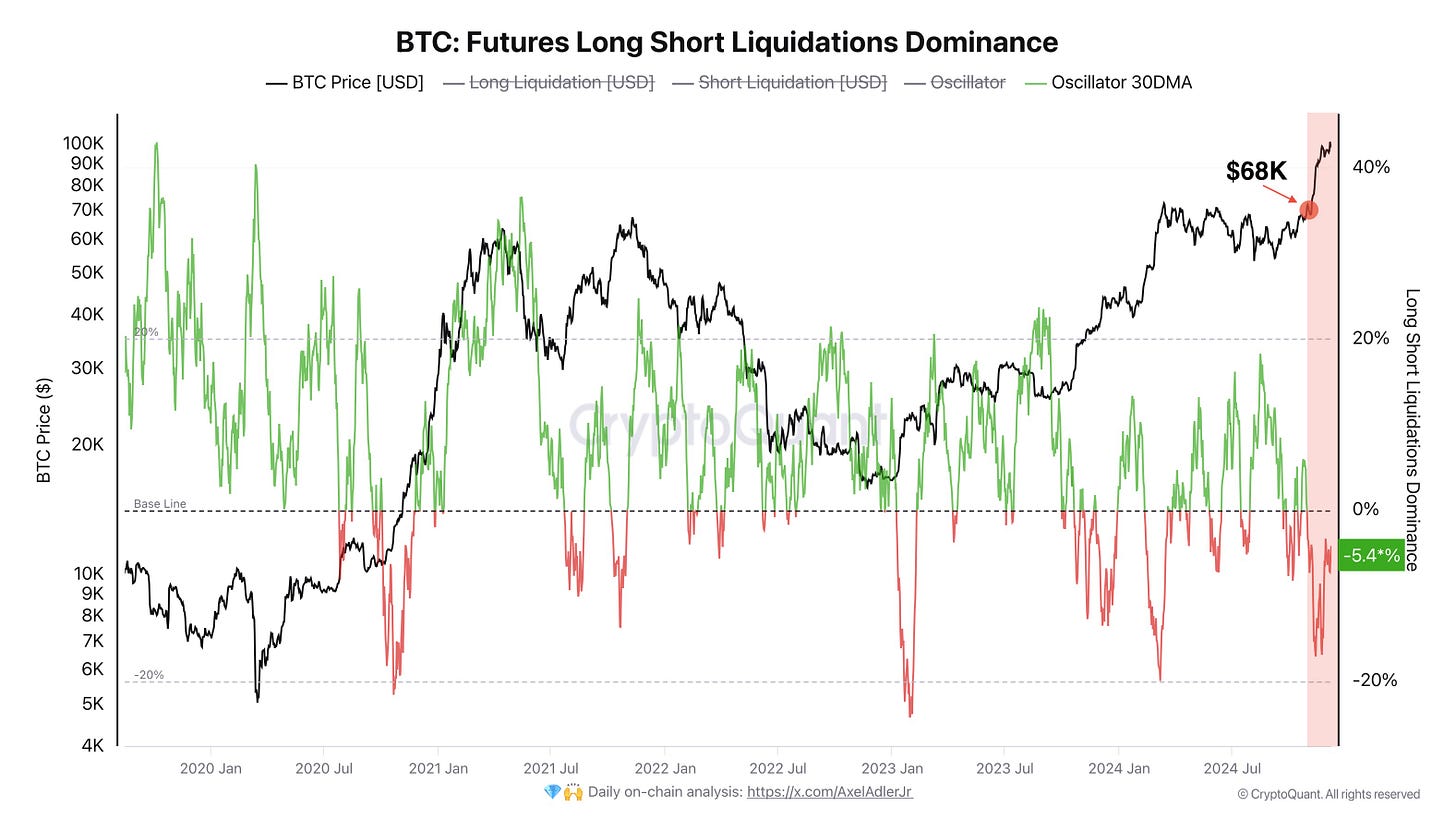

Bitcoin Futures Long Short Liquidations Dominance

Since the $68K level, short-position liquidations have dominated, fueling Bitcoin’s upward momentum. However, the dominance of long liquidations is now increasing, signaling growing bearish pressure. Historically, this shift often correlated with short-term price pullbacks.

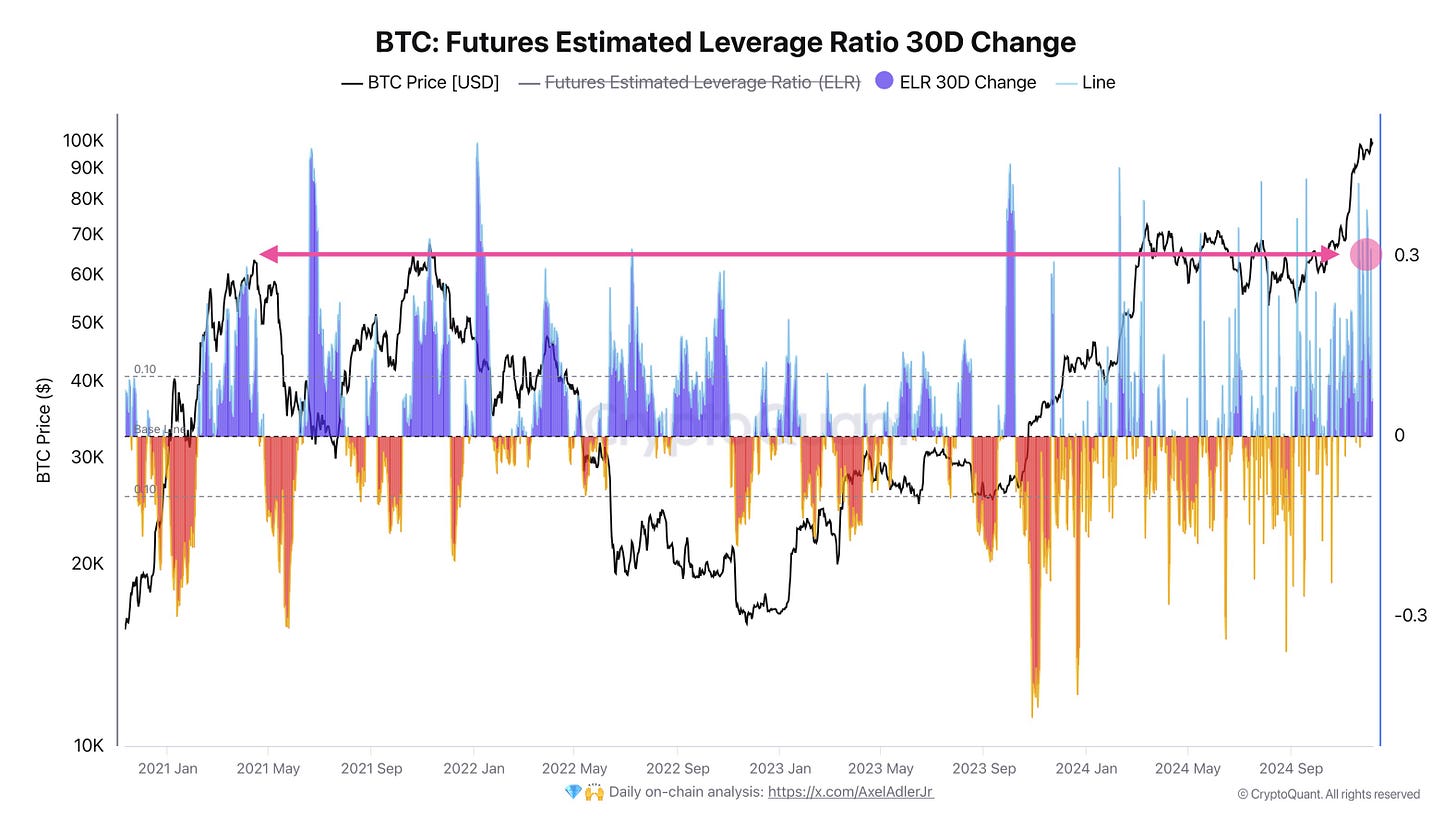

Bitcoin Futures Estimated Leverage Ratio 30D Change

The Estimated Leverage Ratio (ELR) has surpassed 0.3 points, reflecting significant market exposure to high-leverage positions. Such elevated levels often precede volatility spikes and mass liquidations, as participants with insufficient margin get wiped out.

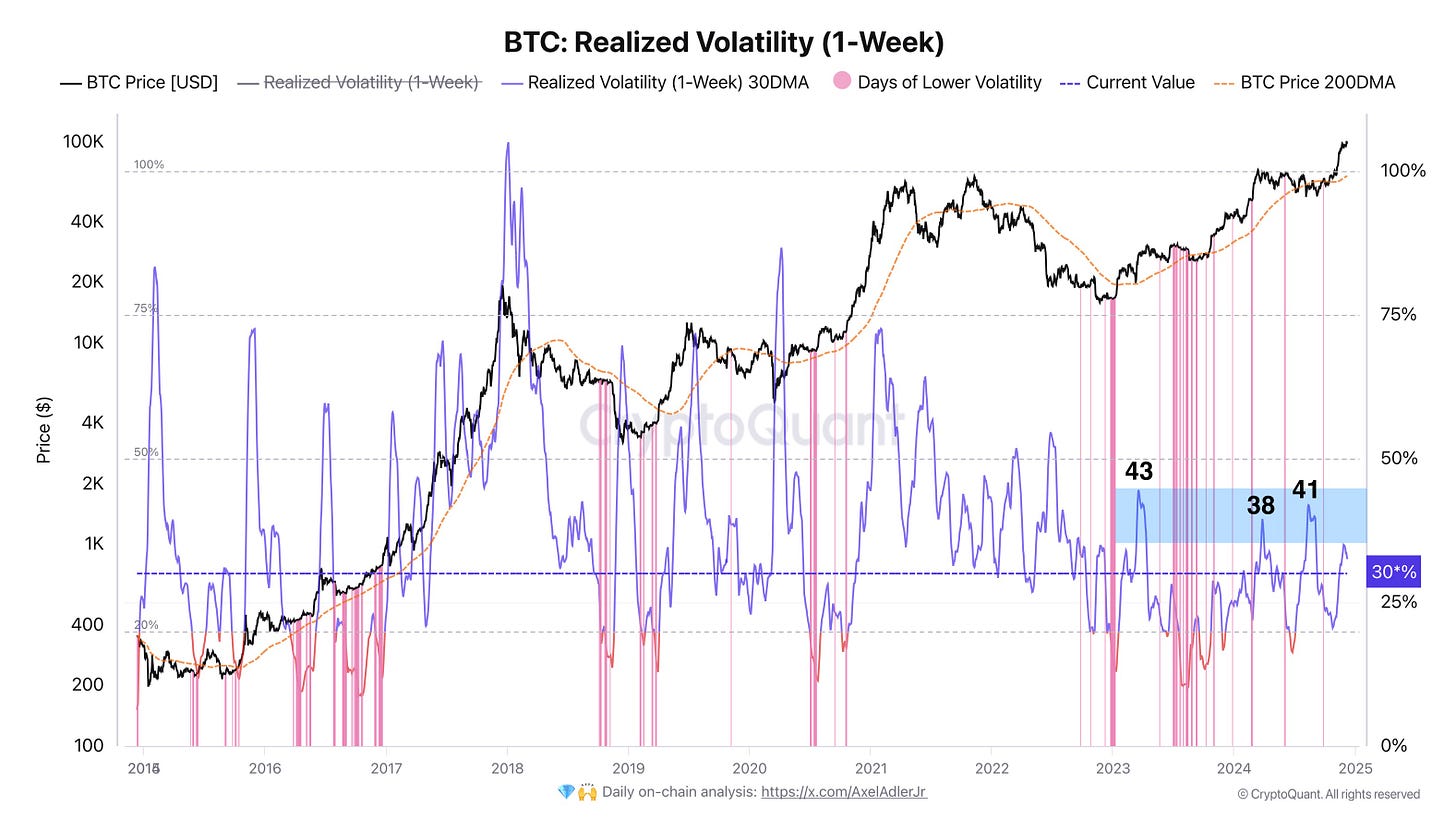

Bitcoin Realized Volatility (1-Week)

Current weekly volatility stands at 30%, a relatively high level that indicates market uncertainty and increased risk for leveraged traders. Historically, this level of volatility often precedes either significant rallies or sharp corrections.

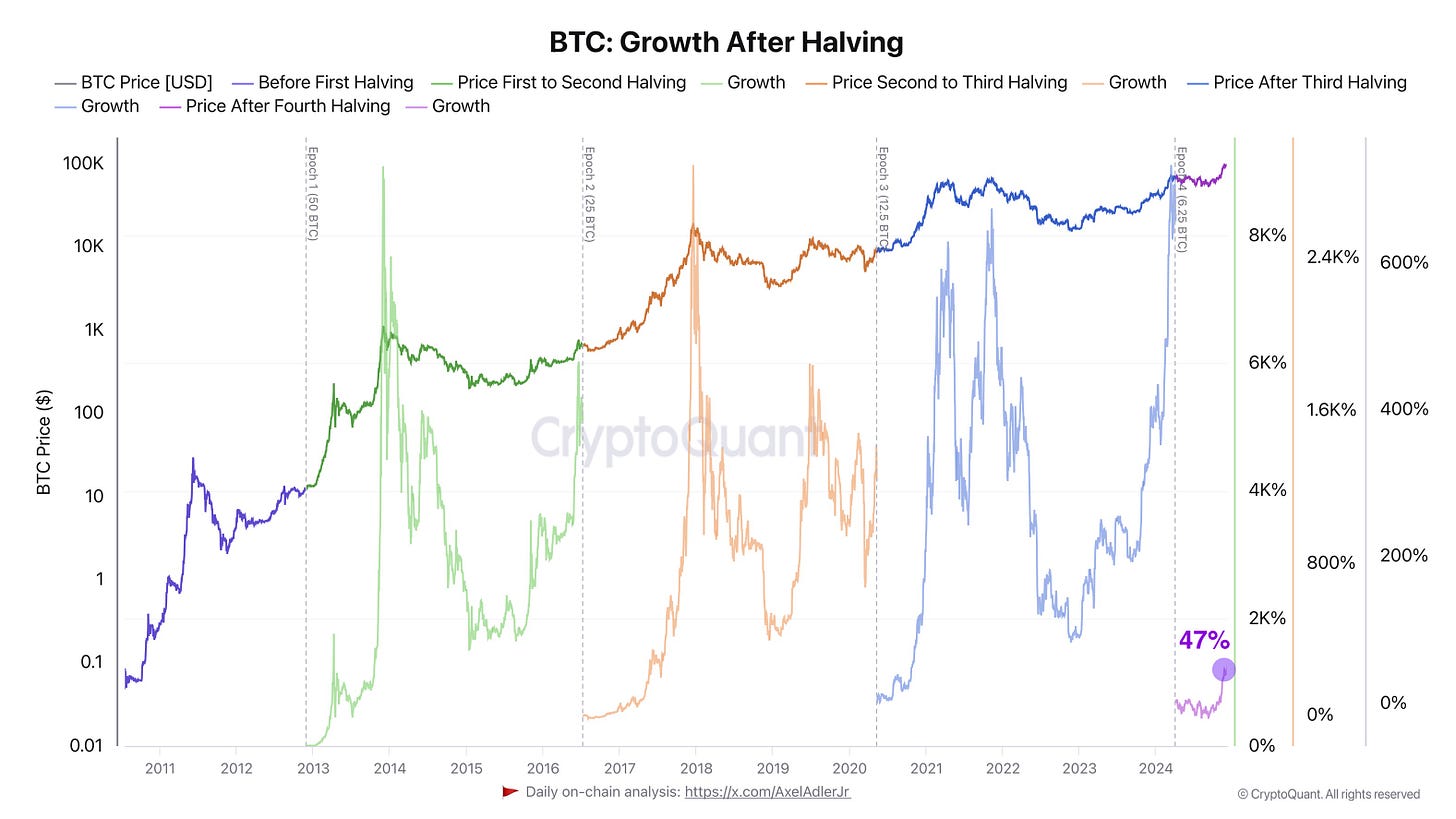

Bitcoin Growth After Halving

The April 2024 halving reduced block rewards from 6.25 BTC to 3.125 BTC. Historically, halvings coincide with bull market phases. However, this cycle has seen slower growth—47% since April—compared to previous cycles, likely due to institutional investor influence and reduced volatility.

Conclusions

The fading euphoria from Donald Trump’s victory and a lack of positive catalysts are weighing on market sentiment. The futures market remains overloaded with high-leverage long positions, creating significant risks:

1. Estimated Leverage Ratio (ELR) > 0.3, increasing liquidation probabilities.

2. Funding Rate at 0.023%, signaling long dominance.

3. Weekly volatility at 30%, reflecting uncertainty and price sensitivity to news.

Support at $90K remains critical. A breakdown of this level could lead to significant corrections. However, the Microsoft board vote on December 10 serves as a key event, with the potential to ignite further institutional demand and support a continuation of the bull trend.

Good luck in the upcoming trading week!

AAJ