Insight #27

In today's issue, we assess the impact of declining inflation, rising institutional activity, state Bitcoin reserves, and the launch of $TRUMP memecoin.

U.S. Macroeconomics:

The U.S. budget deficit grew by 40% year over year, reaching $710.9 billion for the fiscal quarter. The increase in debt servicing costs, higher government spending, and reduced tax revenues led to the national debt surpassing $36 trillion.

Consumer inflation in December rose to 2.9%, mainly due to higher gasoline prices, while core inflation slowed to 3.2%, which was below forecasts. The markets reacted positively, as slowing inflation reinforced investor optimism.

U.S. retail sales increased significantly in December, concluding a strong holiday shopping season. Sales rose by 0.4%, particularly in the categories of automobiles, furniture, and sporting goods.

Wholesale inflation slowed in December: the Producer Price Index increased by only 0.2%, lower than the expected 0.4%. The core PPI remained unchanged, indicating a reduction in inflationary pressure.

Important Events of the Past Week:

Donald Trump plans to make cryptocurrency a “national priority” and, on the first day of his presidency, issue executive orders on crypto policy, including measures for debanking, liability regulations, and a national Bitcoin reserve.

Trump’s memecoin $TRUMP reached a market capitalization of $3.5 billion within 3.5 hours of launch, supported by CIC Digital LLC, with 80% of tokens reserved for the creators.

CIC Digital LLC is a company fully owned by The Donald J. Trump Revocable Trust, which receives licensing fees for the use of Donald Trump’s name, image, and likeness on non-fungible tokens (NFTs).

Wyoming is introducing legislation to allow permanent funds to be diversified into Bitcoin, joining other states in the effort to create a strategic Bitcoin reserve.

Oklahoma is proposing the “Bitcoin Strategic Reserve Act,” aiming to use Bitcoin as a hedge against inflation and to ensure financial freedom.

Arizona State Senator Wendy Rogers has introduced a “Bitcoin Strategic Reserve” bill, making Arizona the 10th state to join the movement.

Investment firm VanEck has filed an application with the U.S. Securities and Exchange Commission (SEC) to launch an exchange-traded fund (ETF) called “Onchain Economics.” The proposed ETF intends to invest at least 80% of its assets in companies that operate within the digital asset ecosystem, known as “digital transformation companies.”

BlackRock has launched its iShares Spot Bitcoin ETF on Cboe Canada under the symbol IBIT, thereby expanding access for Canadian investors to Bitcoin investments. In a new report, BlackRock highlights the rapid growth of cryptocurrency, which attracted 300 million users in 12 years—faster than mobile phones (21 years) and the Internet (15 years). In fact, there are now more than 500 million cryptocurrency users worldwide, so it is unclear where BlackRock got the figure of 300 million.

Coinbase allows U.S. users to borrow up to $100,000 in USDC using Bitcoin as collateral—no fees, no credit checks, and flexible terms. Coinbase CEO Brian Armstrong published an essay “Economic freedom creates prosperity for all”, stating that cryptocurrencies, including Bitcoin, could become the foundation of a new economic era, contributing to global progress and prosperity if governments and society adopt them as a means of increasing economic freedom. He calls for the adoption of progressive laws to support the crypto industry, the creation of strategic reserves in Bitcoin as a high-yield asset, the development of special economic zones for innovation, and the enhancement of government efficiency.

Weekly Results

Bitcoin showed a confident rise from $89.2K to $105.9K, with the main movement beginning at the start of the week. Trading volumes remained stable, but near the peak of the price increase, there was a surge in market participant activity. The $100K level was successfully overcome, attracting additional attention from investors and speculators and reinforcing the overall bullish sentiment.

Over the weekend, the crypto community’s attention was drawn to the launch of the $TRUMP memecoin, which reached a market capitalization of $3.5 billion in just 3.5 hours. In today’s “Insight,” we will discuss how the launch of $TRUMP and the upcoming inauguration of Donald Trump may affect the cryptocurrency market. We will evaluate the impact of these factors on speculative activity, short-term expectations, and potential regulatory changes that could affect the entire market.

$TRUMP

Three days before the inauguration, Trump launched a memecoin that is currently the most popular digital meme on the planet. He did so after inviting representatives of the crypto industry to a celebratory event in Washington.

The crypto industry is urgently in need of change. Companies donated large sums to Trump’s election campaign. In fact, this year, the crypto industry is investing more money into election campaigns than any other sector in the United States. Hence, it is logical that there could be a crypto party accessible only by invitation. Precisely at the moment when the party was in full swing, with everyone from Trump’s circle in attendance, the CIC Digital LLC team launched the $TRUMP memecoin.

As you probably already know, it grew extremely quickly; let’s take a look at Donald Trump’s wallet. With a current project capitalization of $14B, Donald J. Trump’s fortune has grown to $11.2 billion. Forbes estimated the net worth of the president-elect at $5.6 billion as of November 2024. If these data are accurate, adding a share in memecoins could triple the president’s assets.

From the start of his presidency, Trump plans to make cryptocurrencies one of the priority areas of his policy. Launching a memecoin bearing his name only amplifies the effect of his public statements, attracting even more attention to the crypto industry. Observing this, we can see how the government’s attitude toward cryptocurrencies is changing. I am convinced that this trend will continue to gain momentum and accelerate legislative initiatives that will finally be aimed at stimulating economic growth through innovation in the financial sector. You know, I still can’t get Trump’s statement on Fox Business out of my head: “Who knows, maybe we’ll pay off our $35 trillion debt, give them some Bitcoin, and get rid of our debt.”

What is Happening in the Market?

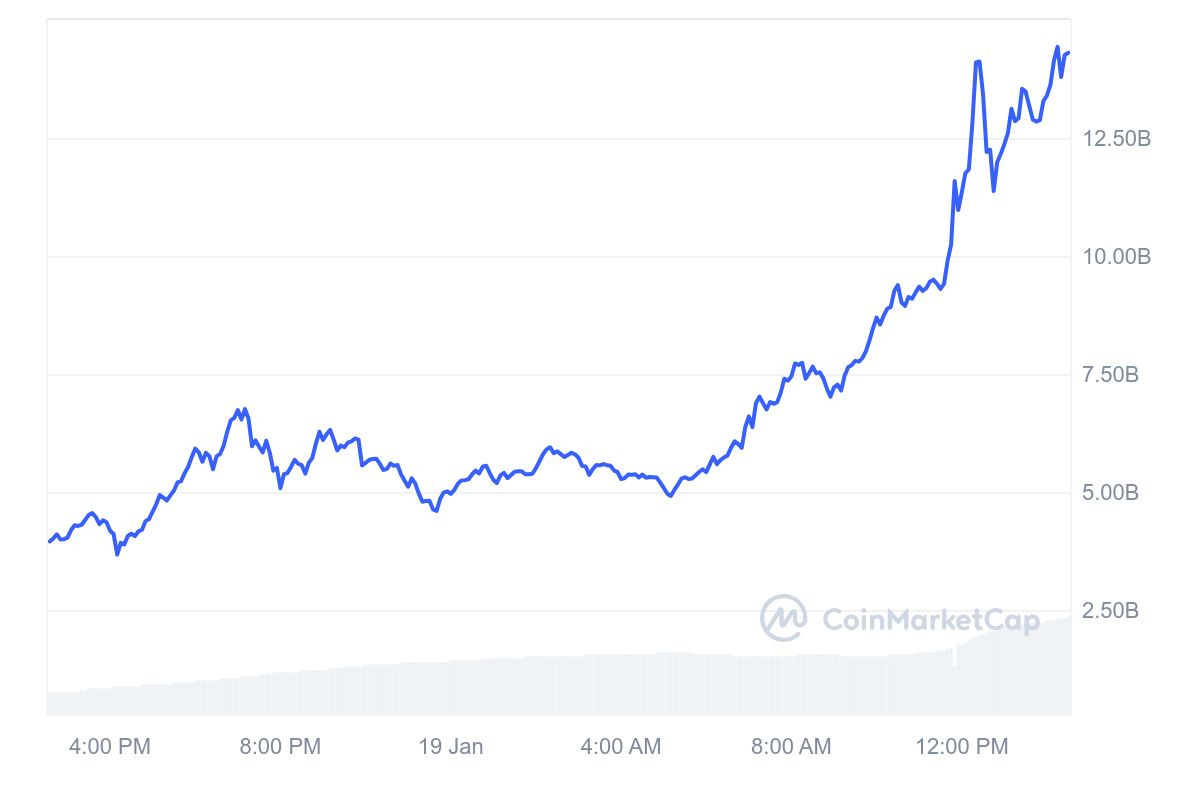

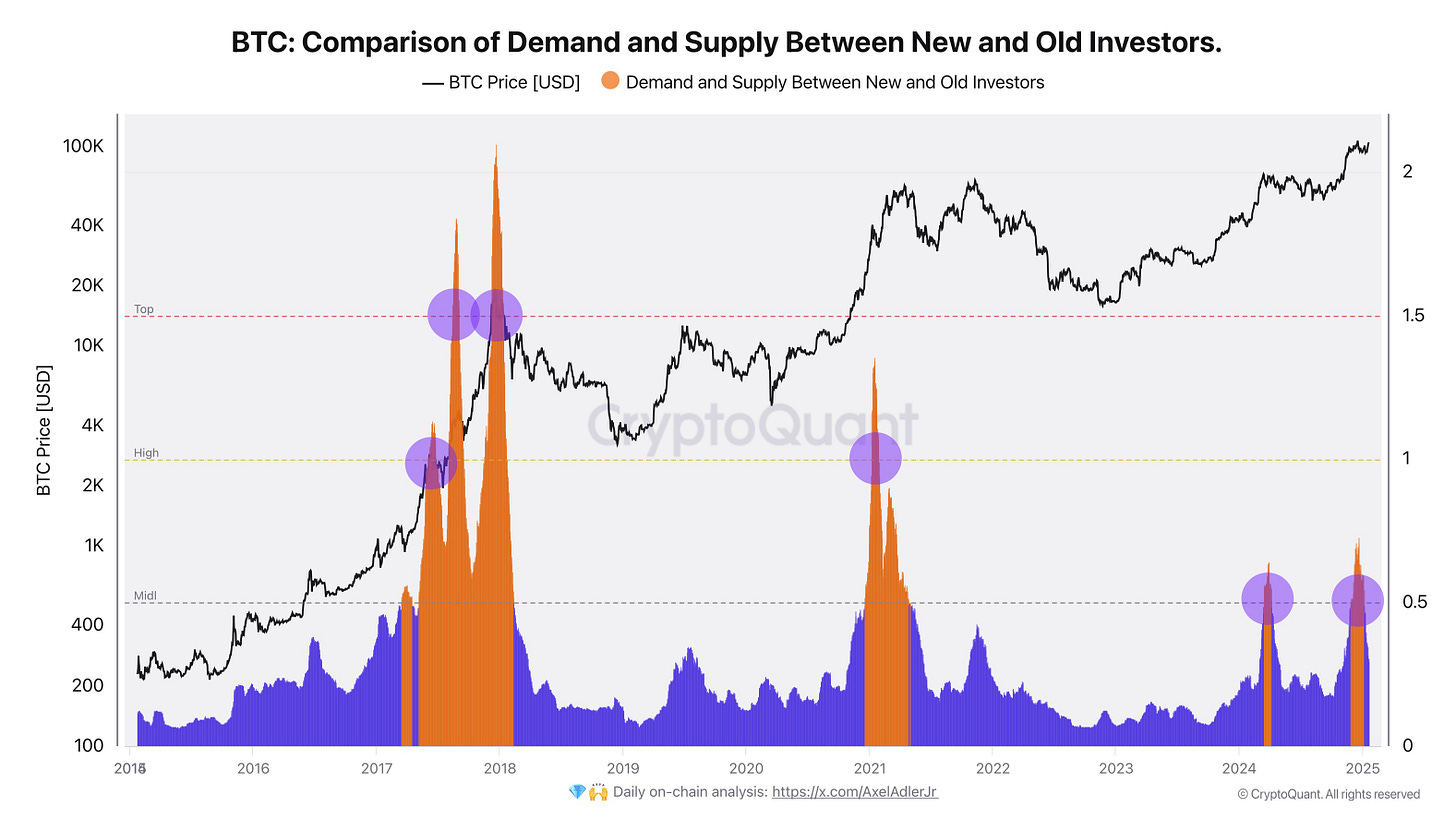

Bitcoin Comparison of Demand and Supply Between New and Old Investors.

The chart shows an analysis of the ratio of demand and supply between new and old Bitcoin investors in comparison with the asset’s price dynamics over the last 10 years. It is evident that peaks in demand from new investors (orange area) coincide with sharp price highs, as seen in 2017 and 2021. In the current situation at the $100K level, we are seeing a renewed rise in the supply-demand metric, indicating that the activity of new investors is increasing, although it still remains far from the extreme values of past bull cycles.

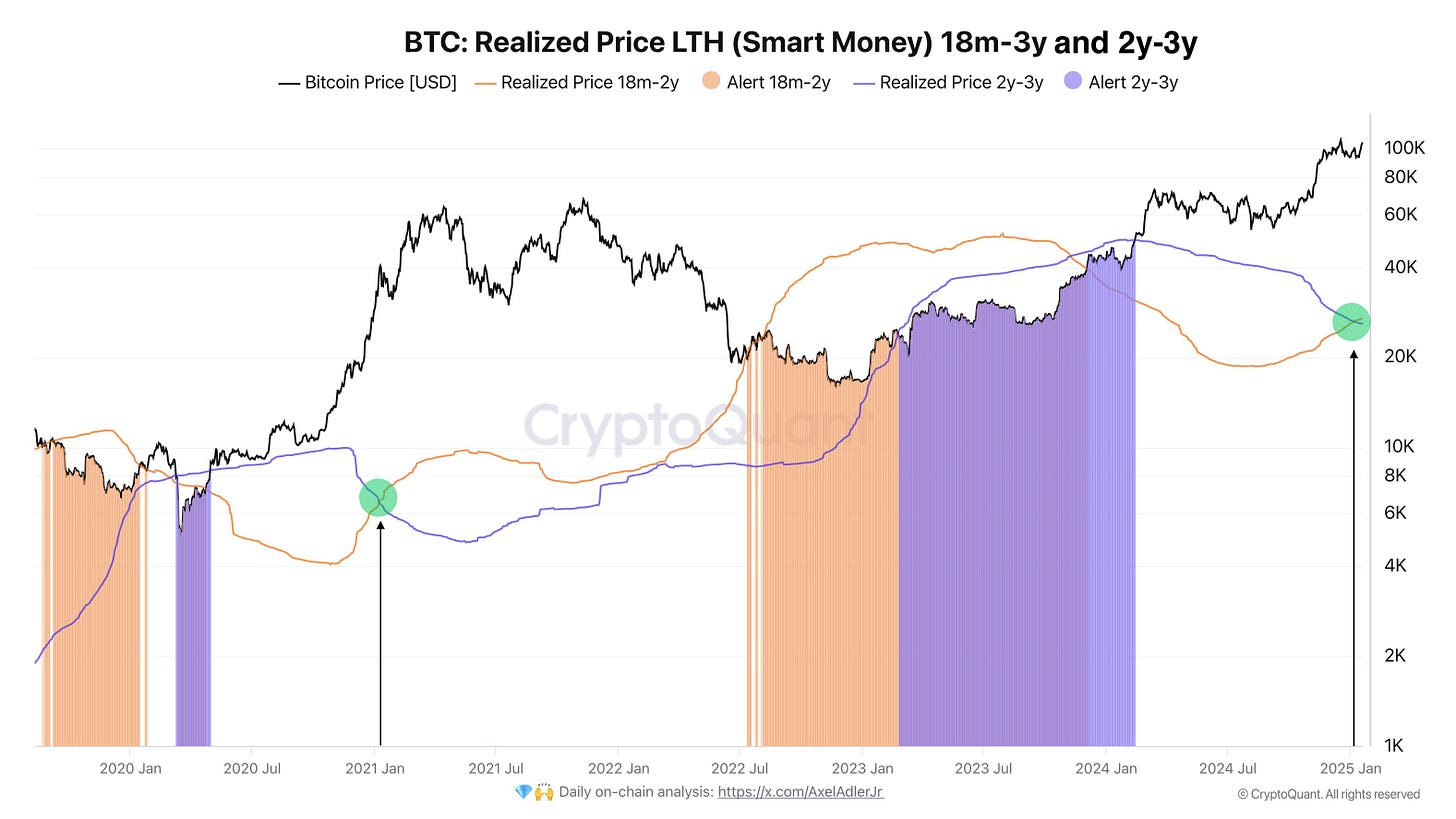

Bitcoin Realized Price LTH (Smart Money) 18m–3y and 2y-3y

Let’s also look at the (Smart Money) chart. Such charts can help identify key points (the end of accumulation, the beginning of distribution, and the formation of local tops) characteristic of so-called Bitcoin “supercycles.” However, it is important to understand that the realized prices of long-term holders (especially in the 18m–2y and 2y–3y ranges) are more indicators of market sentiment and positioning of major players, rather than absolute triggers of trend reversals. Nevertheless, there are several noteworthy points:

Significant Lag of LTH Realized Prices Behind the Market

When the market price moves significantly above the realized price of older coins (for instance, those held 2–3 years), we often witness a late stage of a bull cycle. During a bull phase, the price moves substantially ahead, and holders of older coins enter a phase of high profit.

Convergence/Intersection of the Market Price and LTH Realized Price

In a bear phase, when the market price approaches the realized price of two- or three-year-old coins, capitulation often occurs: weak hands sell, and strong players start buying. Once the price stabilizes near or slightly above the realized price of “smart money,” it may indicate that the market has found a “bottom” or is at least in an accumulation zone.

Essentially, the realized LTH price of these cohorts is just one indicator, and all of this must be supplemented by other metrics. When relying on “smart money,” one should bear in mind that these holders themselves can change their strategies over time, and trading decisions should only be made in conjunction with other indicators and with an understanding of the market’s overall context.

Let’s also consider the moment when the two lines intersect (the realized price of coins aged 18m–2y and the realized price of coins aged 2–3y). In essence, this indicates a change in the “hierarchy” of the average entry prices of different groups of long-term holders. In simple terms:

- Before the Intersection:

One line is above the other, reflecting that the “average purchase price” of one group is higher than that of another.

- Intersection Moment:

The average price at which the “younger” coins (18m–2y) are held lines up with and then crosses the average price of the “older” coins (2–3y).

What Could This Mean in the Context of the Cycle?

A New Wave of Purchases at Higher Prices

If the realized price of “younger” coins (18m–2y) surpasses that of “older” coins (2–3y), it indicates that a notable wave of purchases took place 1.5 to 2 years ago at prices higher than those at which 2–3-year-old coins were acquired. This scenario usually occurs during bullish phases when many “new” holders enter the market, ready to buy at higher prices than the veterans did in previous cycle stages.

Key Cycle Periods

Intersections often happen during “phase changes” in the market—when one major wave of the trend comes to an end and a new one begins. The chart shows an intersection around early 2021 (when BTC moved into an active bullish phase). A current or upcoming intersection may indicate that the market is once again entering a new phase.

Weekly Poll

Conclusions

Against the backdrop of moderate inflation deceleration and the rising U.S. national debt, interest in risky assets, including cryptocurrencies, is strengthening. Positive economic indicators (growth in retail sales, declining PPI), combined with major initiatives and crypto-fund launches (ETFs from VanEck and BlackRock), are contributing to the formation of bullish sentiment, supported by Bitcoin crossing the psychologically significant $100K level.

At the same time, the launch of a politically charged memecoin is intensifying speculative activity, and the interest of several states (Wyoming, Oklahoma, Arizona) in creating Bitcoin reserves suggests a potential shift in the government’s acceptance of cryptocurrencies. On-chain metrics analysis, including the Realized Price LTH, confirms that long-term holders remain comfortably in profit, and the intersection of the two metrics may signify a “phase change” in the market-when one major trend wave ends and a new one forms.

Next week, the key event will be the inauguration of the U.S. president and the market’s anticipation of the first executive orders regarding the “national priority” in the cryptocurrency domain, which, in turn, could create new FOMO in the Bitcoin market.

Good luck in the upcoming trading week!

AAJ

Great job

Great summary Axel! I personally was really disappointed with Trump, as I felt he was making a mockery of crypto with hiw fraudulent memecoins. Hopefully, he will do something serious for BTC and the entire crypto industry as well. Interesting times...