Insight #28

Decelerating inflation, SEC reforms, and rising bond yields: how do these factors impact the market? A detailed analysis of stablecoin inflows, liquidity dynamics, and the outlook for Bitcoin.

Macroeconomics

Key events of the past week:

1. USA: Slowing inflation and a strong labor market

- Headline inflation (CPI) in December rose by 2.9% YoY, but core inflation dropped to 3.2%, the lowest level since August 2024. Slowing inflation in the services (+4.4%) and housing (+4.6%) sectors provided a positive signal for markets.

- The U.S. added 256,000 jobs in December, and the unemployment rate declined to 4.1%. However, strong employment paired with slower wage growth (+3.9% YoY) creates mixed expectations for inflationary pressures.

2. Rate divergence and U.S. budget deficit

- The yield on 10-year Treasury bonds rose to 4.8%, reflecting expectations of persistent inflation and an increasing budget deficit (6% of GDP). This highlights investor uncertainty about the economy's long-term stability.

- The strengthening U.S. dollar has put pressure on global currencies, reducing their competitiveness.

3. China: Exports offset weak domestic demand

- China's GDP grew by 5% in 2024, driven mainly by exports (+10.7% YoY in December) and government-supported manufacturing.

- Domestic demand remains sluggish, with retail sales up just 3.7% in December and real estate investments down 10.6%. U.S. protectionist policies may limit China’s export potential.

4. Sanctions and the energy market

- New U.S. sanctions targeting the Russian oil sector pushed crude prices higher (WTI hit its highest level since August 2024). This has created challenges for major importers like China and India, exacerbating global energy instability.

Conclusions

This week’s events confirmed the resilience of the U.S. economy, supporting an appetite for risk assets like Bitcoin. Decelerating inflation and a strong labor market create an optimistic backdrop for investors. However, rising bond yields and a growing budget deficit signal long-term macroeconomic risks. For Bitcoin, this presents a dual narrative: on one hand, a stronger dollar and rising yields may create downward pressure, while persistent inflation bolsters Bitcoin’s appeal as a hedge.

In China, slowing domestic demand and rising protectionism add to global economic uncertainty, potentially increasing interest in Bitcoin as a non-correlated asset. Widening global imbalances, including higher oil prices and sanctions on Russia, could further boost demand for decentralized assets amid geopolitical instability.

For investors, Bitcoin remains an attractive tool in uncertain macroeconomic conditions, offering hedges against inflation, trade risks, and potential fiat currency volatility.

Key news of the week:

President Donald Trump signed an executive order establishing a U.S. digital asset reserve, banning CBDCs while positioning the country as a leader in global crypto innovation.

Senator Cynthia Lummis was officially appointed chair of the Senate Banking Subcommittee on Digital Assets.

President Trump appointed crypto-friendly Mark Uyeda as acting chair of the Securities and Exchange Commission (SEC) following Gary Gensler’s departure. In its early days, the SEC repealed SAB 121, which had prohibited U.S. banks from holding Bitcoin.

A U.S. court overturned sanctions against Tornado Cash, ruling that OFAC exceeded its authority. This decision is seen as a victory for crypto privacy technologies.

MicroStrategy purchased 11,000 BTC for $1.1 billion, bringing its total holdings to 461,000 BTC valued at $48 billion. The company continues acquisitions via equity and debt financing.

BlackRock CEO Larry Fink forecasted Bitcoin reaching $700,000 if investors allocate 2–5% of portfolios to it, citing its appeal for global stability.

Bank of America CEO Brian Moynihan stated that banks will "actively embrace cryptocurrency" if regulators permit, highlighting blockchain patents and readiness to adopt.

Meme tokens $TRUMP and $MELANIA dropped 62% and 81%, respectively, due to profit-taking and a lack of crypto-positive policies in Trump’s speech. A reminder: meme tokens are highly speculative and volatile assets.

Bitcoin Market Week Macroanalysis

Over the past week, Bitcoin exhibited sideways movement within the $99.4K–$109.4K range, influenced by key macroeconomic events:

1. Macroeconomic Impact

The slowdown in U.S. inflation (CPI at 2.9%, Core CPI at 3.2%) provided a positive signal for risk appetite, including Bitcoin. However, the rise in 10-year U.S. Treasury yields to 4.8% and the strengthening dollar exerted pressure on the markets. This limits upward momentum for cryptocurrency as institutional investors balance between traditional and digital assets.

2. Crypto Industry Support News

- The appointment of crypto-friendly policymakers in the U.S., including SEC reforms and the removal of restrictions on BTC custody by banks, brought optimism to the market.

- MicroStrategy continues its strategic BTC purchases, underscoring sustained institutional interest despite volatility.

3. Meme Token Market and Rising Geopolitical Risks

Speculative assets like meme tokens ($TRUMP, $MELANIA) highlight high risks. At the same time, U.S. sanctions targeting the Russian oil sector and China's economic weakness enhance Bitcoin's appeal as a hedge asset.

Conclusions

Bitcoin remains in a consolidation zone at higher levels, supported by institutional news and the deceleration of U.S. inflation. However, the stronger dollar and rising bond yields temporarily limit its growth potential.

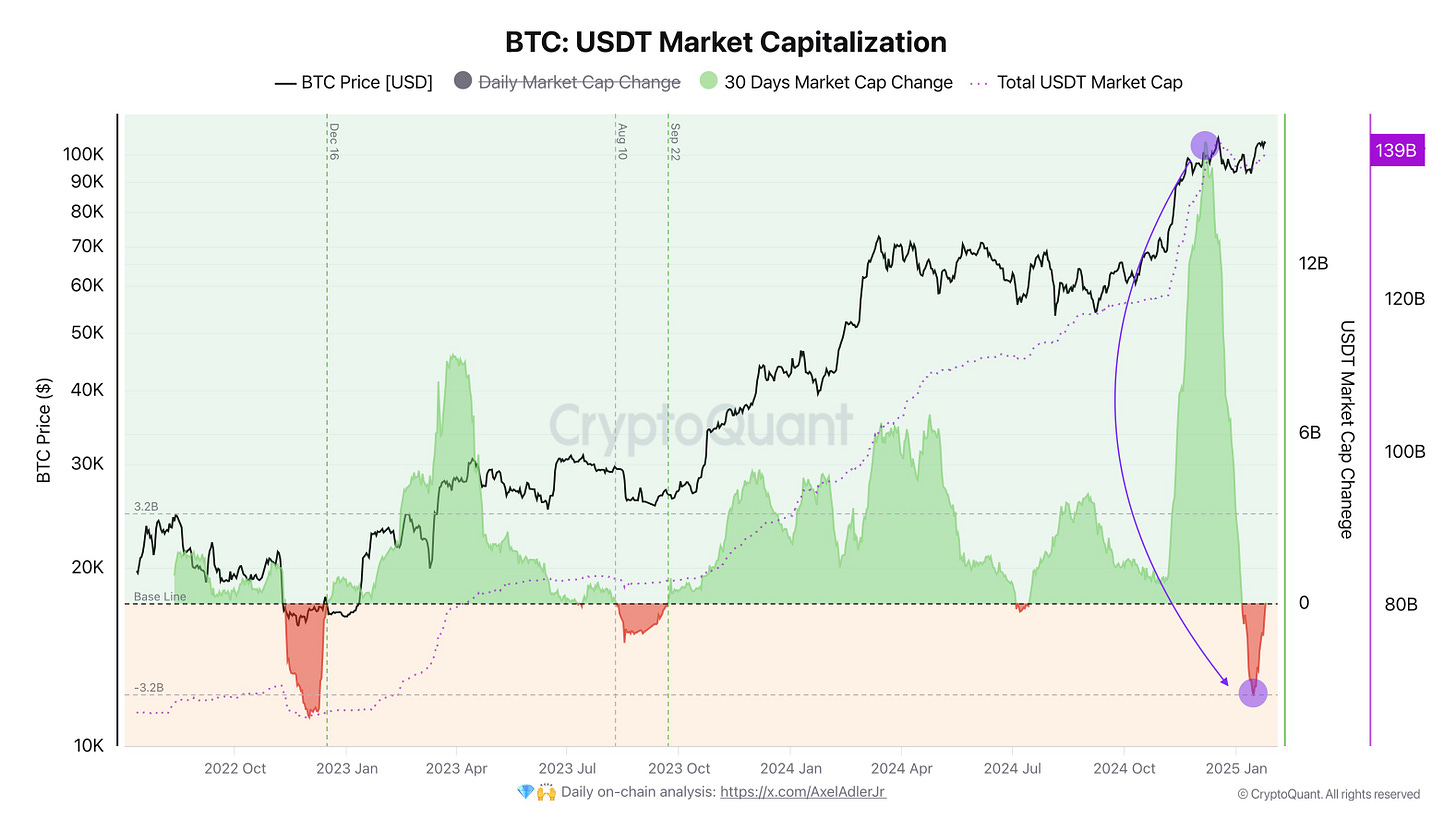

Bitcoin: USDT Market Capitalization

Since December 6, 2024 (at the $99K level), USDT market capitalization has shown a sharp decline. By January 15, 2025, the 30-day change turned negative, reaching -$3.2B. This indicates a drop in new liquidity inflows into the crypto market.

Weaker buyer activity and reduced investments in USDT reflect declining demand for risk assets from December to mid-January. However, the situation stabilized in mid-January, with metrics improving, possibly signaling renewed interest in cryptocurrencies. Similar cycles have been observed previously, particularly at the beginning of the current bull trend, suggesting market readiness for the next growth phase if liquidity inflows continue to rise.

USDC and USDT All Exchange Inflow [USD] ERC-20

Let’s compare the slowdown in USDT market capitalization growth with the absolute average inflow of USDT and USDC stablecoins on Ethereum to top crypto exchanges. The chart shows that the inflow of USDT and USDC stablecoins peaked in early December 2024, when Bitcoin was around $99K, reaching an average daily value of $131B. Subsequently, inflows dropped to $76B, but they have since recovered to $88B daily. Notably, even during the decline, inflows remained above the annual average of $64B daily, indicating resilient demand.

The recovery in stablecoin inflows reflects renewed investor interest in the cryptocurrency market.

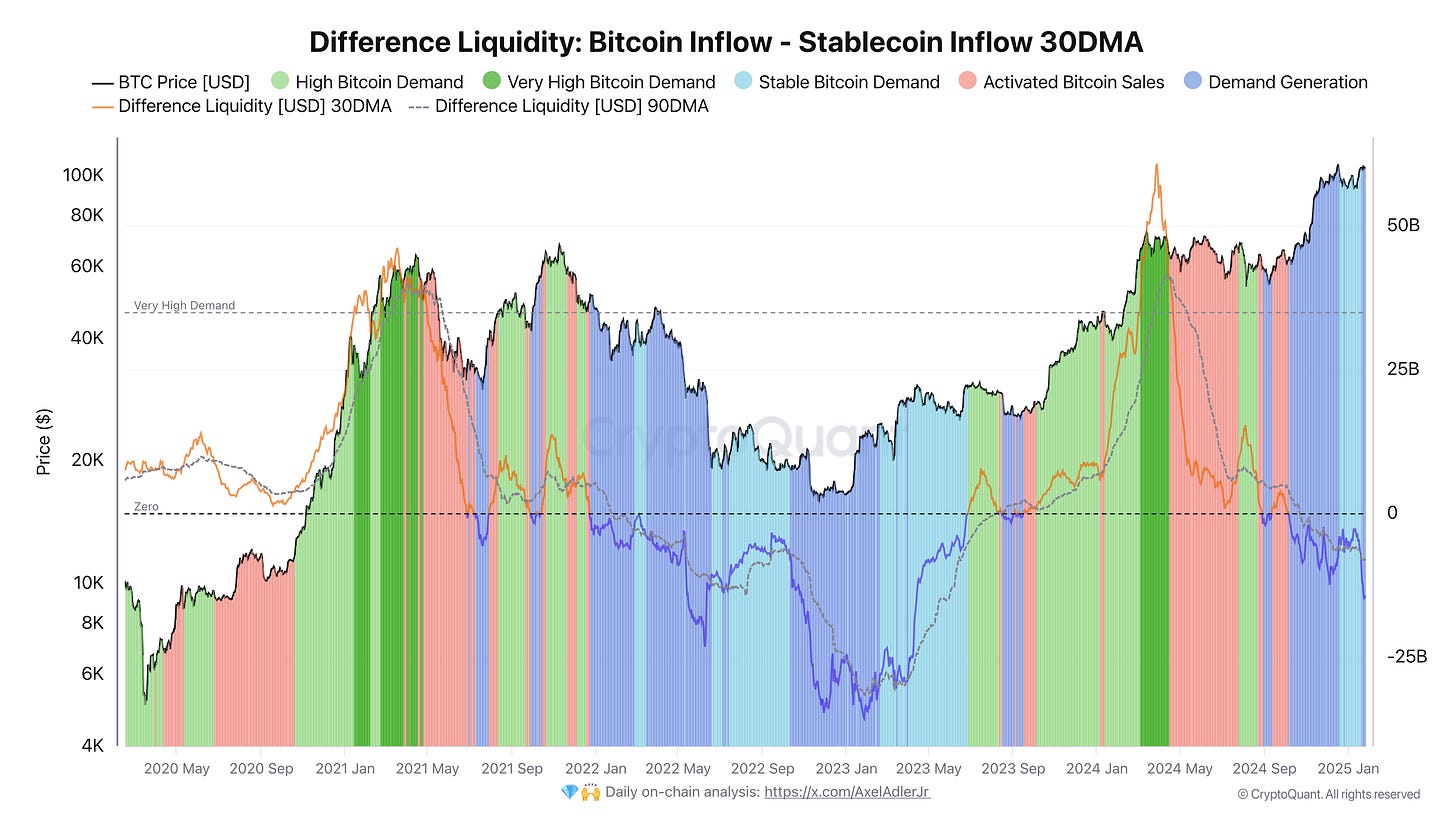

Difference Liquidity: Bitcoin Inflow - Stablecoin Inflow (30DMA)

Let’s evaluate how stablecoin inflows impact Bitcoin demand. This model analyzes the liquidity difference between BTC inflows and stablecoin inflows to exchanges to assess current BTC demand. It calculates the net difference between BTC inflows (USD equivalent) and all stablecoin inflows.

The model identifies several key zones:

Green: High BTC demand

Dark green: Very high BTC demand

Red: Active BTC selling

Light blue: Moderate BTC demand

Dark blue: Demand generation for BTC

The dark blue (demand generation) zone indicates liquidity accumulation without significant capital flowing into BTC. Currently, stablecoin inflows are not equivalent to direct BTC demand. These funds may remain on exchanges, awaiting more favorable conditions or being allocated to other purposes (e.g., altcoins). This pattern resembles the early phase of the current bull cycle. The demand generation (blue) zone reflects a period where capital flows to exchanges (in the form of stablecoins) but has yet to convert into BTC demand.

This demand generation zone represents liquidity accumulation, which could potentially transition into high demand if investors begin actively buying BTC. A shift into the "green" zone would signal accumulated liquidity turning into active BTC purchases.

During the early phase of the current cycle, a similar situation occurred where BTC prices continued rising despite a negative liquidity difference. The price recovery after the 2022 bottom (~$15-16K) was supported by stablecoin accumulation on exchanges, indicating readiness to buy BTC as prices rose. Key growth drivers included expectations of dovish Fed policy, institutional interest, ETF approvals, and large-scale purchases that provided fundamental growth support.

Conclusions

1. Sufficient Liquidity Accumulation on Exchanges:

- High stablecoin inflows to exchanges (demand generation, dark blue zone) indicate significant capital accumulation, ready for deployment.

- These funds may be used to purchase BTC under favorable conditions.

2. BTC Support in Case of Correction:

- In the event of a correction, accumulated liquidity could act as buying support.

- Investors waiting for lower prices may deploy stablecoins to acquire BTC, limiting downside potential.

3. FOMO in Case of Growth:

- If BTC price begins to rise sharply (e.g., on positive news or breaking key resistance levels), accumulated stablecoins could quickly convert into BTC.

- This would trigger FOMO (Fear of Missing Out), where investors rush to buy, fearing they might miss the beginning of a new bullish impulse.

Similarities to the Start of the Cycle

- We have observed similar dynamics at the beginning of the current cycle (2022-2023):

- Despite a negative liquidity difference, stablecoin accumulation provided fundamental support for BTC growth.

- Recovery from crisis events (e.g., FTX) was accompanied by expectations of dovish Fed policy and institutional buying.

Thus, the current situation is favorable for BTC, as high liquidity levels reduce the risk of deep pullbacks and increase the likelihood of sustained growth under the right conditions.

Weekly Poll

Weekly Trading Summary

Bitcoin remains in a consolidation zone at higher levels ($99.4K–$109.4K), influenced by key macroeconomic factors. The slowdown in U.S. inflation and optimism around SEC reforms support risk asset appetite. However, rising U.S. bond yields and a stronger dollar constrain further price growth.

High stablecoin inflows to exchanges indicate significant liquidity accumulation, which could play a critical role during corrections (acting as price support) or in driving market growth (triggering FOMO). Investors should continue monitoring the news flow, especially official statements from the Senate Banking Subcommittee on Digital Assets.

Good luck in the upcoming trading week!

AAJ

Nice job bro

Insightful as always 🫡